nro,fcnr,nre account scheme and foreign investment

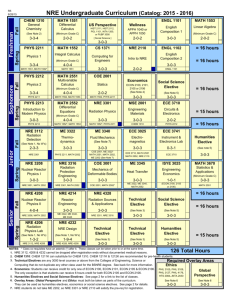

advertisement

NRO,FCNR,NRE ACCOUNT SCHEME AND FOREIGN INVESTMENT NRO –ACCOUNT • Ordinary none-resident account in rupees. • The existing accounts of any Indian National can be designated as Ordinary Non-Resident Accounts, upon your NRI status. • these accounts can also be opened with initial deposits paid into any bank or post office (saving a/c) authorized to open Non-Resident accounts. • NRO account can be of any type: saving, current or Fixed Deposit. • Interest payable on NRO accounts is the same as on resident accounts. They vary from bank to bank as they have been freed from RBI regulation. You can also have a joint account with residents in India. • NRO accounts may be re-designated as resident accounts when the account holder becomes a resident in India. DISADVANTAGES OF NRO: • Interest earned on balances in NRO Accounts is not exempted from Indian Income tax. Instead income tax is deducted at source (TDS) i.e. at the time of payment of interest by the bank. • Balance held in NRO account can neither be repatriated. No remittance in foreign currency is allowed without prior approval of Reserve Bank as well. So overall, the money stays 'as is' in India. FCNR ACCOUNT: • Foreign Currency (Non Resident) Account (FCNR A/C) • FCNR A/C is maintained only in term deposit. The account can be maintained only in Pound, Sterling, U.S. dollar, Deutsche Mark and Japanese Yen. • The interest and the repayment of the deposit is also made in the same foreign currency in which the account is maintained. • The depositor may at his own will, obtain repayment in Indian rupees, converted at the buying rate on the date of repayment. • Deposits under this scheme are held for the following period: 6 months and above, but less than 1 yr-1 yr and above but less than 2 yrs-2 yrs and above but less than 3 yrs-3 yrs only. • Premature withdrawal is allowed, but there will be a penalty. • Non-Resident Account holders can grant power of attorney or such other authority to residents in India for operating their FCNR(B) accounts in India. NRE ACCOUNT • Persons of Indian nationality or origin resident abroad may open, with authorized banks in India, Non-resident (External) Accounts (NRE Accounts), designated in rupees. • These accounts can be maintained in the form of savings, current or term deposit accounts. • Opening of NRE Accounts jointly in the names of two or more non residents is permitted provided all the account holders are persons of Indian nationality or origin. • For opening these accounts, the funds are required to be remitted to India through a). proceeds of foreign exchange remittances from abroad through banking channels in an approved manner. b).proceeds of foreign currency notes and traveler cheques brought into India by the non-resident while on a temporary visit to India. C).Transfer from an existing Non-Resident (External) FCNR account of the same person. – Proceeds of remittance arranged by the account holder through banking channels from any country can be credited to this account. – Similarly, income from the account holder’s investment from the funds in the account can be credited to it, except in cases where the investments are permitted on non-repatriable basis. – Remittances from the account to the country of residence of the account holder or any other country are freely allowed. – Authorized dealers may allow operations on NRE Accounts by persons resident in India in terms of Powers of Attorney (Annexure 14.5) or other appropriate authority granted in their favor of non-resident account holders, provided the powers are restricted to withdrawals for local payments. – The resident power of attorney holder cannot repatriate funds held in accounts outside India under any circumstances or make payment of gifts on behalf of the account holder. – Immediately upon return of the account holder to India and on his becoming resident in India, NR (E) account will be redisignated as resident rupees account or converted to RFC account as per the option of the account holder. – However, if the account holder is only on a short visit to India, the account will continue to be treated as NR (E) account even during his stay in India. – In respect of funds held in fixed deposits in NR(E) Accounts, interest will be payable at the rate originally fixed, provided the deposit is held for the full even after conversions into resident account. – The NRO account can't be converted into NRE. Also funds can't be transferred from NRO to NRE account without a special permission from RBI and proof of all existing funds required, which is a complex procedure than opening a new NRE account. ADVANTAGES OF NRE ACCOUNT 1. 2. 3. 4. 5. 6. Term deposits for one year and above made by nonresidents carry interest at rates higher than those available to residents in India. The interest on deposits and any other income accruing on the balance in the accounts are free of Indian Incometax. The balances in the accounts are free of Wealth-tax. The entire credit balance (inclusive of interest earned thereon) can be repatriated outside India at any time without reference to the Reserve Bank. Local disbursement from the accounts can be made freely. Purchases of Units of Unit Trust of India (UTI), Central and State Government Securities and National Plan/Savings Certificates can be made freely from the balances in these accounts. 7. Sale proceeds/maturity proceeds/repurchase price of Units of UTI, securities or certificates originally purchased out of the funds in the account can be freely credited to these accounts by banks, without reference to the Reserve Bank. 8. Account holders are supplied special series of cheques forms for operations on these accounts. 9. Account holders can avail of loans/overdrafts from banks against security of fixed deposits in their NRE accounts. 10. No need to joint account with an Indian resident. DISADVANTAGES OF NR(E) ACCOUNTS 1. 2. NR (E) accounts are opened in Indian rupees and all foreign exchange remittances received for credit of those accounts are first converted to Indian rupees at the buying rates by the banks. Any withdrawal in foreign currency will be permitted by the bank by converting Indian rupees in the account to foreign currency at the selling rate. This conversion loss is to be borne by the account holder. Exchange rates are subject to fluctuation on day to day basis and Indian rupee has depreciated against all major foreign currencies in recent past. Balances held in Indian rupees in NR (E) accounts are thus exposed to exchange fluctuation risk Comparison of three account scheme Particulars Non-Resident Ordinary Rupee Account Scheme [NRO Account ] Non-Resident (External) Rupee Account Scheme [NRE Account Who can open an account Any person resident outside India (other than a person resident in Nepal and Bhutan). Individuals / entities of Bangladesh / Pakistan nationality / ownership as well as erstwhile Overseas Corporate Bodies require prior approval of the Reserve Bank. NRIs (individuals / entities of Bangladesh / Pakistan nationality/ownership require prior approval of RBI) Foreign Currency (NonResident) Account (Banks) Scheme [FCNR (B) Account] NRIs (individuals / entities of Bangladesh/ Pakistan nationality/ ownership require prior approval of RBI) Joint account May be held jointly with residents In the names of two or more nonresident individuals provided all the account holders are persons of Indian nationality or origin. In the names of two or more non-resident individuals provided all the account holders are persons of Indian nationality or origin. Nomination Permitted Permitted Permitted Currency in which account is denominated Indian Rupees Indian Rupees Pound Sterling, US Dollar, Japanese Yen, Euro, Canadian Dollar and Australian Dollar Repatriablity Not repatriable except for the following: i) current income ii) up to USD 1 (one) million per financial year (April-March), for any bonafide purpose, out of the balances in the account, e.g., sale proceeds of assets in India acquired by way of purchase/ inheritance / legacy inclusive of assets acquired out of settlement subject to certain Repatriable Repatriable conditions. Type of Account Savings, Current, Recurring, Fixed Deposit Savings, Current, Recurring, Fixed Deposit Term Deposit only Period for fixed deposits As applicable to resident accounts At the discretion of the For terms not less than 1 year and not more than 5 years. bank OTHER IMPORTANT QUESTIONS AND ANSWERS. 1. How do NRE and NRO accounts differ? Funds remitted from overseas sources or local funds that would otherwise have been sent to the accountholder abroad can instead be transferred to NRE Accounts. On the other hand, local funds that aren’t eligible to be remitted abroad must be credited to an NRO account. 2. Can you transfer funds from an NRE to an NRO account and vice versa? It’s easy to transfer funds from an NRE to an NRO account. But it’s not possible to transfer funds from an NRO account to an NRE account. Once you transfer funds from an NRE to an NRO account, the amount is non-repairable. Consequently, you cannot transfer it back. 3. What’s the difference in the tax treatment for interest earned on an NRE and an NRO account? The interest earned on any type of NRO bank as well as the credit balances in this kind of account are taxed under the account holder’s tax bracket. On the other hand, interest earned on the NRE account is totally exempted from income tax, and the credit balances in the account don’t attract any wealth tax. Any gift given to a close relative doesn’t attract gift tax. NRE and NRO accounts are two different types of rupee accounts permitted by the Government of India for NRIs. Have you tried opening either of these accounts? With which bank did you open your account? How did you decide which one to go for? SOME IMPORTANT QUESTIONS ABOUT FOREIGN INVESTMENT. 1. 2. Are there any provision of repatriating the money held in the bank accounts in India ? Yes, the balances lying in the following accounts can be repatriated anytime outside India: (i) NRE account holders can not only repatriate the account held in this account but also the interest accrued on this account. (ii)Balances in NRO account can be remitted abroad with the permission of RBI. However, only the funds received from abroad can be repatriated. It may be noted that normally this account is used for depositing the local funds/incomes of NRI. Can NRIs invest in the Mutual funds schemes? Yes, NRIs/OCBs can invest in domestic mutual funds on repatriation basis. NRIs/OCBs can also invest in Mutual funds floated by public and private sector mutual funds on non repatriation basis by giving a separate application in RBI. No separate approval for the same is required. Similarly, they can also invest in Money Market Mutual Funds (MMMFs) floated by commercial banks and other financial institutions. No separate permission is required. 3. Can I retain my savings in foreign currency even after return to India? Yes you can. This is usually after a continuous stay abroad for more than a year. You can also keep your foreign currency in Resident Foreign Currency (RFC) account in any nationalized bank in India. These funds can again be transferred to your NRI account, if you go abroad or become an NRI again. 4. Can NRI bring Gold to India? NRIs can bring into India gold up to 10,000 grams, once in six months provided they have stayed abroad for a continuous period of six months. They are required to pay custom duty in at the latest rate according to EXIM Policy in any convertible foreign currency. They can pay per 10 grams of gold brought. Currently the rate is Rs.220/per 10 grams of gold. 5. In what form can gold be brought by NRIs to India? Any form including ornaments (excluding ornaments studded with stones and pearls). 6. I want to sell the gold/silver I take back. How should I do this? Gold/silver brought by NRIs can be sold to residents for Indian rupees. According to the RBI rules, any person in India can buy gold/silver from the NRI by using a crossed cheque in India. Such money is credited to Ordinary Non-resident Rupee (NRO) account of the NRI gold/silver seller. • 7. Can NRIs bring silver to India? Is there a maximum limit? Yes. NRIs are allowed to bring upto 100 kgs of silver as part of personal luggage. This attracts import duty at the rate of Rs. 500 per kg. payable in foreign currency (U.S. dollars if going back from the U.S.) UNDERSTANDING OF SOME IMPORTANT TERMS. • Person origin India: He/she, at any time, held an Indian passport, or Parents or any of his grandparents hold Indian citizenship. Invest on repatriable basis: 1. 2. To invest on a repatriable basis, you must have an NRE or FCNR Bank Account in India. The Reserve Bank of India (RBI) has granted a general permission to Mutual Funds to offer mutual fund schemes on repatriation basis, subject to the following conditions: The amount representing investment should be received by inward remittance through normal banking channels, or by debit to an NRE / FCNR account of the non-resident investor. The net amount representing the dividend / interest and maturity proceeds of units may be remitted through normal banking channels or credited to NRE / FCNR account of the investor, as desired by him subject to payment of applicable tax. N.R.I AS PER FEMA ACT: • An individual shall be deemed to be a non-resident in following cases: • When he stays in India for less than or up to 182 days during the preceding financial year. The period of stay may not be ‘continuous’ and the same shall be calculated by adding up the days of his stay in India during that financial year. Thus a student who goes for studies abroad and his stay in India during a financial year is less than 182 days, then he shall be treated as non-resident Indian for the next financial year. Similarly, tourists and all others who have gone out of India without the purpose of taking up employment or starting any business abroad, shall be treated as non-residents if, their stay in India during the preceding financial year was less than or up to 182 days. • When he goes or stays outside India for any of the following purposes: – For or on taking up employment outside India, or – For carrying on outside India a business or vocation outside India, or – For any other purpose, in such circumstances as would indicate his intention to stay outside India for an uncertain period. • In such cases, the person becomes a ‘non-resident’ irrespective of the period of his stay in India. It is pertinent to note here that while the period of his stay in India shall be reckoned for the preceding financial year, the event of going or staying abroad for any of the aforesaid purposes shall be reckoned for the current financial year. Thank You Udit Patadiya CJ & Associates