Seminar Slides

advertisement

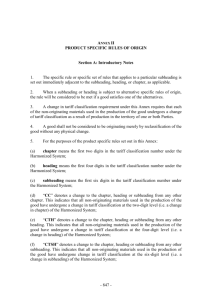

Government funding post Williams - why it is still at risk Your speakers: Alison O’Brien Laura Vickers Introduction • Constitution establishes financial relationships between the Parliament and the Executive – (so too does that of the State) • It also creates a financial relationship between the Commonwealth and the States • The principles underlying these relationships are given context by legal history…. • …but that is not as important as the text and structure of the Constitution – (where it is there) Expense governs everything All state action costs money, directly or indirectly, and questions of finance must sooner or later affect all public policy and business as weighty, if not determining, factors. 'Expense governs everything'. Finance may therefore be said with truth to be the foundation of government, in the sense that ways and means must be found for everything which a government desires to do. A good system of finance and good government are interdependent. Durrell, The Principles and Practice of the System of Control over Parliamentary Grants (1917) Parliament/ Executive financial relationship - principles • Bedrock of financial system is maintenance by Parliament of control over grants it makes • 3 fundamental principles (French CJ in Pape): – Parliament must authorise any taxes – All Crown revenue forms part of the Consolidated Revenue Fund – Only Parliament can authorise the appropriation of any money from the Consolidated Revenue Fund Parliament/Executive financial relationship - practice • The Executive has the initiative in taxation and appropriation • Control is (principally) with the Assembly • 3 stages of finance affecting Assembly: estimates, expenditure, accounting • Until appropriation, monies are administered at the direction of Parliament Parliament/Executive financial relationship - process • See notes What does an appropriation do? • Financial, not regulative. Does not create rights • Legally segregates monies – merely earmarking • Not a source of spending power – “necessary but not sufficient” What does an appropriation do? • Other restrictions – Limited to specified purpose – Imposes a maximum sum – $ only available for specified period • Conditions the lawfulness of Executive expenditure • Standing appropriations are different Commonwealth/State financial relationship • What does the Constitution say? – Section 94: After five years from the imposition of uniform duties of customs, the Parliament may provide, on such basis as it deems fair, for the monthly payment to the several States of all surplus revenue of the Commonwealth. – BUT: Surplus Revenue Case (1908) – Section 96: During a period of ten years after the establishment of the Commonwealth and thereafter until the Parliament otherwise provides, the Parliament may grant financial assistance to any State on such terms and conditions as the Parliament thinks fit. Commonwealth/State financial relationship • What does the Constitution mean? – First uniform tax case (1942) – Second uniform tax case (1957) – BUT “Obamacare” decision Legal history vs text and structure • The principles underlying these relationships are given context by legal history…. • …but that is not as important as the text and structure of the Constitution – (where it is there) Outline - Laura • • • • • Facts and issues of Williams Scope of Cth spending power before and after Cth response Relevance of the financial relationship principles Risks for existing and new funding arrangements Facts of the case • The school • The program (via funding agreements, rather than legislation) • The agreement • The payments Questions asked of the Court 1. Did Mr Williams have standing to challenge the Agreement, the appropriations, and the payments? 2. Is the Agreement invalid because it is: • beyond the executive power of the Cth, or • prohibited by s 116 of the Constitution (freedom of religion)? 3. Was the drawing of money from Consolidated Revenue to make payments under the Agreement authorised by the relevant Appropriation Acts? 4. Were the payments made by the Cth to SUQ pursuant to the Funding Agreement: • beyond the executive power of the Cth, or • prohibited by s 116 of the Constitution? Questions asked of the Court 1. Did Mr Williams have standing to challenge the Agreement, the appropriations, and the payments? 2. Is the Agreement invalid because it is: • beyond the executive power of the Cth, or • prohibited by s 116 of the Constitution (freedom of religion)? 3. Was the drawing of money from Consolidated Revenue to make payments under the Agreement authorised by the relevant Appropriation Acts? 4. Were the payments made by the Cth to SUQ pursuant to the Funding Agreement: • beyond the executive power of the Cth, or • prohibited by s 116 of the Constitution? Questions asked of the Court 1. Did Mr Williams have standing to challenge the Agreement, the appropriations, and the payments? 2. Is the Agreement invalid because it is: • beyond the executive power of the Cth, or • prohibited by s 116 of the Constitution (freedom of religion)? 3. Was the drawing of money from Consolidated Revenue to make payments under the Agreement authorised by the relevant Appropriation Acts? 4. Were the payments made by the Cth to SUQ pursuant to the Funding Agreement: • beyond the executive power of the Cth, or • prohibited by s 116 of the Constitution? The Cth’s executive power to spend and contract Section 61 of the Constitution: • The executive power of the Commonwealth is vested in the Queen and is exercisable by the Governor-General as the Queen's representative, and extends to the execution and maintenance of this Constitution, and of the laws of the Commonwealth. The ‘Common Assumption’ Cth legislative power (i) trade and commerce with other countries, and among the States; (ii) taxation; but so as not to discriminate between States or parts of States; (iii) bounties on the production or export of goods, but so that such bounties shall be uniform throughout the Commonwealth; (iv) borrowing money on the public credit of the Commonwealth; (v) postal, telegraphic, telephonic, and other like services… Cth executive power The new requirements for the Cth • statutory authority to enter into any contracts and or spend public money OR • the agreement of the relevant States to accept a s 96 grant with the Cth's preferred conditions. NB: A program only needs to have some basis in statute - the statute itself does not need to authorise each and every contract and payment. Exceptions to the requirement for legislation/ s 96 grant Contracts and payments in respect of – prerogative powers – administration of departments (including possibly any longstanding policies) – possibly, national emergencies or the need for some unique national enterprise How does this case fit with Pape? Pape = – The Commonwealth's power to appropriate money is not sufficient to support its expenditure of that money on any subject it liked. – A separate source of power is required to justify such expenditure. Williams = don’t just need a source of power, need (in most cases) actual legislation. The Cth’s response • Financial Framework Legislation Amendment Act (No 3) 2012 (Cth) • Valid? Not free from doubt. • The Commonwealth must have legislative power to support its spending, else it must a s 96 grant Why did the Court reject the Common Assumption? • • Two reasons: – Federalism – The role of Parliament, particularly the Senate Rationales relevant to risk of ‘trickle down’ of principle to State level – State has plenary legislative power – State Executive power not specified in Constitution (Cth or State) – BUT parliamentary scrutiny relevant Risks for Victoria – are you: • Receiving funding from the Cth does not have a specific legislative basis? • Working with organisations that receive direct Cth funding? • Negotiating with the Cth about a program not directly inside the Cth’s legislative heads of power? • Likely to restructure its funding arrangements with the Cth in the future? • Designing State funding programs? • Delivering State funding programs that do not have an express legislative basis? Which are not for the ordinary services of government? Are existing programs based on s 96 grants OK? Yes. Constitution, s 96 - ‘… the Parliament may grant financial assistance to any State on such terms and conditions as the Parliament thinks fit’. Case references • Auckland Harbour Board v The King [1924] AC 318 • National Federation of Independent Business v Sebelius, Secretary of Health And Human Services (Obamacare decision) 567 US _ (2012) • NSW v Bardolph (1934) 52 CLR 455 • NSW v Cth (Surplus Revenue Case) (1908) 7 CLR 179 • Pape v Commissioner of Taxation (2009) 238 CLR 1 • South Australia v Cth (First Uniform Tax case) (1942) 65 CLR 373 • Victoria v Cth (Second Uniform Tax case) (1957) 99 CLR 575 • Williams v Commonwealth [2012] HCA 23