Balance Sheet –Schedule VI

advertisement

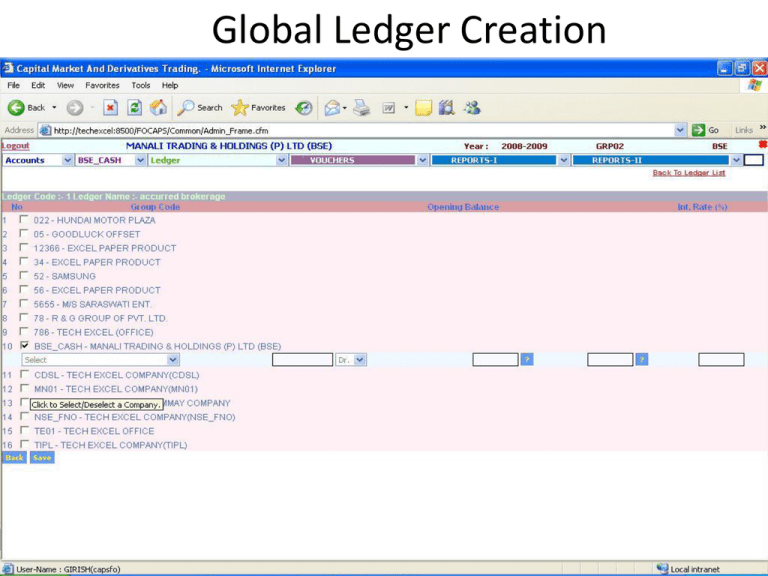

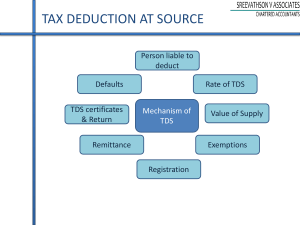

Global Ledger Creation Control A/c & Ledger Grouping Open different telephone a/c’s as sub-ledger a/c’s and map under telephone expenses control a/c . Note : ledgers appearing under any control a/c are termed as sub- ledgers (i.e that is their kind of account is sub-ledger) Ledger Transfer across the Groups Accounts-BSE-Masters-accounts transfer Ledgers can be transferred at any point of time without changing the entries done in it There are three different options in accounts transfer 1. Direct ledger - sub ledger---2. Sub ledger – Direct ledger--- 3. Sub ledger – Sub ledger--The above account transfer is individual segment wise only( i.e. for that respective segment only from which account transfer is done) Schedule VI Balance Sheet & Profit & Loss A/c Balance Sheet Default Group Balance Sheet Group Creation Click Add New Group Map to Main Code Enter New Group Name Schedule Mapping to Groups Balance Sheet Designer Ledger Mapping to Balance Sheet Accounts-Master-Balance Sheet Designer- clicking on undefined option all the ledgers which are not mapped will be displayed through this option we can map ledgers under their respective schedules / groupings- tick on checkbox and select from the help option either from Dr. posting & Cr. posting and on pressing update the respective ledger /ledgers will be mapped Voucher Data Entry Bank Receipt Bank Payment Journal Voucher Debit Note Credit Note Cost Centre Master Creation Bank Receipt Voucher Data Entry At the time of in putting bank receipts we have an option of cost center, through this option we can allocate receipts received on behalf of the respective cost center or sub cat. Note : cost centre / branch related receipts entries if cost centre code not selected will not reflect in the cost center Cost Centre Receipt with JV The Receipt with jv entry inputted as per the screen shown above will display in the Report no 382 with proper information – for eg in the above screen prof fees is received from hiral parekh for rs 10000/- but rs 1000/- deducted as TDS and net amount of rs 9000/- is recd as prof fess Bank Payment Voucher Data Entry At the time of in putting bank payments we have an option of cost center, through this option we can allocate payments incurred on behalf of the respective cost center or sub cat. Note : cost centre / branch related payment entries if cost centre code not selected will not reflect in the cost center Cost Centre JV Creation journal entries can also be allocated in their respective cost center. As shown below Note : cost centre / branch related journal entries if cost centre code not selected will not reflect in the cost center Journal Voucher E.g. Expense TDS Detail report Payment With JV Creation The payment with jv entry inputted as per the screen shown above will display in the Report no 382 with proper information – for eg in the above screen commission is paid to apx for rs 10000/- but rs 1000/- tds is to be deducted as TDS and net amount of rs 9000/- is paid to apx as commission TDS Report Inputting of TDS account code is compulsory : E.g. In our books of account TDS account code is TDS as inputted above Select paid if want to view for TDS paid Accounts-BSE-Reports2-Report no 382- TDS Detail report Trough the above report it can be viewed that in BSE segment on 07/10/2009 – Party APX had been paid gross amount 10000/- and deducted TDS of rs 1000/- and net amount paid to apx is rs 9000/and pan no of apx is also displayed Debit / Credit Note Bank Guarantee & FD Management FD Interest Calculation Report Unconciled Receipt / Payment Reversal Process E-Payment File Interface BRS File Import Trial Balance

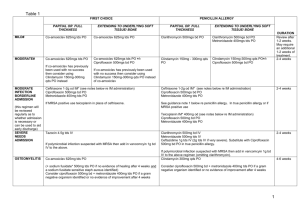

![Antibiotics [pre:Dfreq, post: D dose by 50%]](http://s3.studylib.net/store/data/007446576_1-5f5b3cd9462e3ff75ef61a5b7a0b32d2-300x300.png)

![Antibiotics [pre:Dfreq, post: D dose by 50%]](http://s3.studylib.net/store/data/007691453_2-0141a33ae9700e59544c7b2d9c70f9a5-300x300.png)