Collateral Valuations

advertisement

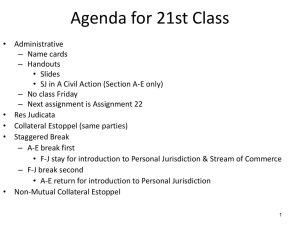

fda OTCLite Webinar EMIR Collateral and Valuation Reporting © DTCC V1.2 updated 31May14 1 Regulatory Overview • • Reporting start date for Collateral and Valuation is August 11th 2014 Derivative contracts still outstanding on 11th August 2014 – must include information pertaining to collateral and valuation as from that date; – need not include information pertaining to collateral and valuation prior to that date. • • • • Contracts that are terminated before 11th August 2014 need not include information pertaining to collateral or valuations. Collateral and valuations must be reported on a daily basis by financial counterparties and non-financial counterparties who exceed their clearing threshold as referred to in Article 10(3). Participants can delegate reporting of collateral and valuation to their counterparties or a third party provider. Collateral and valuation is reported as Counterparty data therefore, counterparties do not need to agree the data reported. © DTCC 2 fda Valuations © DTCC 3 Trade Valuation Reporting • Trade valuations must be submitted to GTR daily. Submissions can be made to GTR intraday or at the end of day. • No calculation will be performed on valuations and the latest report, based on the as of date time, will be considered the current valuation for that day. • Valuation data can be submitted using any of the following messages*: – – Valuation message Position message • With reference to transactions cleared by a CCP, valuations should be reported on a daily basis at position level, as maintained and valued by the CCP. • For Non-Financial counterparties who are below the clearing threshold, there is no obligation to report valuation data. – – Any trade valuations submitted by NFC (minus) parties will be withheld and will not be included on regulatory reports. As a result of the above, all valuations reported by, or on behalf of, NFC (minus) parties will not be populated on regulatory reports. *For submissions to the core applications users can also submit valuations as part of Snapshot messages © DTCC 4 Trade Valuation Reporting • For OTC Core and OTC Lite, users can submit valuations through a different service than the associated trade. – • • • A valuation can be reported through OTC Lite even if the associated trade has been reported through an OTC core asset class. – Valuations cannot be submitted through OTC Core for trades reported through OTC Lite. – Valuations reported through a different service to the associated trade will only be reported on the ESMA OTC Position report and the ESMA OTC Activity report. – Valuation messages submitted through OTC Lite will be included in reports produced from the OTC core asset classes (i.e. the Enhanced Position Reports). Delegated reporting of valuation messages will follow the same rules as delegated reporting of trades but can be applied independently of the reporting of trades. A firm can delegate reporting of their trades but independently report the valuation of those trades or vice versa. The valuation reported will be that with the latest valuation date time reported for that day, regardless of data submitter. It will no longer be the case that any self-submission takes precedence over a delegated submission. There are no jurisdiction or obligation fields on the valuation message – – • Reporting of the valuations will be determined by the reporting obligations specified on the associated trades. The message routing to the correct data center is indicated by providing information in the “sendTo “field on the inbound message For OTCLite submissions you can include both position AND valuation submissions on the same csv spreadsheet upload as each line will indicate what type of message is being used. The csv will still require the use of the footer in order to process. © DTCC 5 Valuation template EXTRACT © DTCC 6 Valuation template EXTRACT © DTCC 7 fda Collateral Valuations © DTCC 8 Collateral Valuation Message • A new collateral valuation message has been created to provide for the reporting of the value of collateral. It is a cross-asset message published on its own template • All collateral valuations, including those applicable to individual transactions, must be reported using this message. Collateral valuations will not be accepted on trade/position messages. • Collateral valuation messages must be submitted daily by the poster of the collateral. If no submissions are received for a particular collateral portfolio code on a given reporting date, none will be reported to the regulators. • The party posting collateral has the obligation to report, therefore the Collateral Value Message will always be provided by, or submitted on behalf of, the party positing the collateral. • Portfolio code, Collateral Value and Collateral Currency are all from the posters perspective. • The Collateral message report the value of the collateral that has currently been posted for that date – not the movement of collateral day on day © DTCC 9 Collateral Valuation Message • Collateral valuations must be reported on behalf of the same entity that is named as the party to the trade (this can be party 1 or party 2 on the trade message). • • Submissions will be made against a new o-code to facilitate a cross asset solution For incorrect submissions, a new (corrected) submission should be made (rather than exit/termination) and if multiple collateral valuation messages are submitted on a given reporting date, the latest valuation date/time is considered the current value. – Where a collateral value message has been reported when collateral does not need to be reported (e.g. the receiver of the collateral has reported) a cancel message will be available to remove the collateral valuation. Collateral valuations will only be reported to regulators once successfully linked to a reported trade. There are no jurisdiction or obligation fields on the collateral valuation message • • – Regulatory reporting of collateral valuations will be determined by the reporting obligations specified on the associated trades. – The message routing to the correct data center is indicated by providing information in the “sendTo “field on the inbound message © DTCC 10 Collateral Valuation Message © DTCC 11 Collateral Valuation Message Note: additional clarification from ESMA indicates that collateral is expected in one currency only. DTCC templates in the process of being updated accordingly © DTCC 12 Collateral Valuation Example Day 1 Day 2 Day 3 Day 4 Party 1 Collateral valuation action Scenario Collateral Held Party 1 submits collateral valuation message for Party 1 posts 1000 EUR as Party 2 holds 1000 EUR in collateral to party 2 collateral EUR1000 using their collateral portfolio code Party 1 received 200 EUR from Party 1 submits collateral Party 2 now holds 800 EUR party 2 in collateral margin valuation message for in collateral movement EUR800 Party 1 received 100 EUR form Party 1 submits collateral Party 2 now holds 700 EUR party 2 in collateral margin valuation message for in collateral movement EUR700 Party 1 submits collateral No change in collateral margin Party 2 still holds 700 EUR in valuation message for movement collateral EUR700* Party 1 received 1000 EUR Day 5 form party 2 in collateral margin movement Day 6 Party 1 posted 100 EUR from party 2 Party 1 now holds 300 EUR in collateral Party 1 now holds 200 EUR in collateral No action needed No action needed Party 2 Collateral valuation action No action needed No action needed No action needed No action needed Party 2 submits collateral valuation message for EUR300 using their collateral portfolio code (which can be different to the portfolio code used by Party 1) Party2 submits collateral valuation message for EUR200 * Note that on day 4 even though there is no change in the collateral being held if there is no submission of a collateral valuation message that day then collateral will not be reported to ESMA for that day. Party 1 still needs to submit the collateral valuation even though there has been no movement in © DTCC collateral that day 13 fda Collateral Linking © DTCC 14 Collateral Linking • The GTR provides two methods for linking collateral portfolios to trades. – Using trade messages • – • • Collateral portfolio codes can be specified on trade submissions Using a Collateral Link message The collateral portfolio code and the collateralization type can be submitted on the existing trade messages (position message for OTCLite). A new Collateral Link Message can be submitted to link each trade to be associated with a collateral portfolio. – • • The trade should be identified using a UTI, USI or Trade Party Transaction Id (or any combination thereof). Reporting of collateral will be based upon the open trade population and not the collateral portfolios. If a collateral portfolio code exists on an open trade the information held on the trade will be used to extract collateral valuation data. The collateral value will be identified using: – – – • Trade Party 1 Value / Trade Party 2 Value Execution Agent Party 1 / Execution Agent Party 2 Collateral Portfolio Code Party 1 / Collateral Portfolio Code Party 2 All three fields must match exactly between the trade and the collateral value. © DTCC 15 Collateral Linking • If the collateral portfolio code does not exist on the trade message GTR will look for a collateral link message. The collateral link message will be identified using – A trade identifier • • • – – • If UTI matches the UTI will be used If no match is found on UTI the USI will be used If no match is found using UTI or USI the Trade Party 1 Transaction Id will be used Trade Party 1 Value / Trade Party 2 Value Execution Agent Party 1 / Execution Agent Party 2 Once a collateral link message is identified GTR will look for the collateral value using: – – – Trade Party 1 Value / Trade Party 2 Value Execution Agent Party 1 / Execution Agent Party 2 Collateral Portfolio Code Party 1 / Collateral Portfolio Code Party 2 extracted from the link message • All three fields must match exactly between the trade and the collateral value. • Collateral linking is NOT required to be submitted every day. Only additions to the portfolio need to have a collateral linking message submitted (if the portfolio is not identified on the position message) • You do NOT need to make a new collateral linking submission to remove a trade from a portfolio is it has matured or terminated, but you should submit a cancel to remove a trade from a portfolio if it had been added incorrectly © DTCC 16 Collateral Linking Message © DTCC 17 Collateral Linking Message © DTCC 18 fda Participant Reports © DTCC 19 Participant Reports • MtM Valuations – The reports that will be updated to include valuations are: • Enhanced Position Reports (for each OTC core asset class where the valuation has been submitted through that asset class and not through OTC Lite) • ESMA OTC Position Report (Includes Core and Lite) • ESMA ETD Position Report • ESMA OTC Activity Report (Includes Core and Lite) • ESMA ETD Activity Report • Submission report (excludes Lite) • Warning Report (Includes ETD, Core and Lite) – Valuations submitted through OTC Lite will not appear on OTC core reports, they will only appear on the consolidated ESMA OTC Position and Activity Reports. © DTCC 20 Participant Reports • Collateral Valuations – – – Collateral valuations will not be populated on the GTR position reports. This exclusion will apply to • Enhanced Position Reports • ESMA OTC Position Report • ESMA ETD Position Report • ESMA OTC Activity Report • ESMA ETD Activity Report The following fields will be added to the above reports but will not be populated: • Collateralisation • Value of the collateral • Currency of the collateral value The following fields will be added to the above reports and will be populated if submitted via trade messages. They will not be populated if submitted on Collateral Link messages. • Collateral Portfolio Indicator • Collateral portfolio code © DTCC 21 Participant Reports • Collateral Submission Report – – – – A new collateral report will be created to indicate collateral posted by the report recipient This will provide participants with a view of the collateral that is reported as being posted by them. The collateral reports will be asset class and service agnostic, meaning all collateral from the OTC Core, Lite and ETD service will appear on the same collateral report. The report will only show data related to the trade party where that party has reported the collateral. The report will include the following fields: • • • • • • • • • • – – Trade Party Prefix Trade Party Value Execution Agent prefix Execution Agent Value Data Submitter prefix Data Submitter value Collateral portfolio code Value of the collateral Currency of the collateral value Send To Users will only be able to access collateral reports where they are posting collateral. This report will be available for download under a new o-code. © DTCC 22 Participant Reports • Counterparty Data Masking – When reporting an allege message on position and activity reports the following fields will be masked: • MTM Value Party 2 • MTM Currency Party 2 • Valuation Datetime Party 2 • Valuation Type Party 2 • Collateral portfolio code • Collateral Portfolio Indicator • Collateralized • Value of the collateral • Currency of the collateral value © DTCC 23 Warning Reports - Collateral warnings will not be produced because given the method proposed for reporting collateral to participants and regulators it will not be possible to provide warnings for those portfolios not linked to trades. - Valuation warning reports will be introduced. Note that valuation warnings are produced in end of day reports, there are no warning messages (WACKs) associated with valuation submissions. Valuation warnings (NFC(minus) excluded from this population) : • Where there is an obligation to ESMA and no valuation has been received. • Where there is an obligation to ESMA and no valuation has been received for the current day. One exceptional scenario exists whereby the data submitter will not receive this warning report. • If a trade is reported through an OTC core asset class and valuation reporting is delegated to a third party who uses OTC Lite, it will be possible to provide warnings to the trade parties but not to the third party data submitter © DTCC 24 Summary Valuation Collateral Valuation Collateral Linking Messages Position Message Valuation Message Collateral Valuation Message Collateral Linking Message Action New only (correction by subsequent New) New and Cancel New and Cancel Who Submits All parties to the trade that have a reporting obligation to ESMA (unless non-financial under the clearing threshold) The poster of collateral The poster of collateral When they submit Every day the position is live, on a T+1 basis Every day that collateral is posted regardless of whether the collateral held changed that day or not Only when the transactions in a given portfolio changes Implication of not submitting Last known (stale) valuation is reported to ESMA No collateral is reported to ESMA Collateral valuation only reported to ESMA if linked to a live position © DTCC 25 OTC Lite Client Support • Dedicated OTCLite webpage • (http://www.dtcc.com/en/data-and-repository-services/global-trade-repository/otc-lite.aspx) • Includes recorded presentations, user guide, connectivity guide, up to date template and a schedule of online demonstrations • Dedicated OTC Lite Support team – Support available in multiple European languages – Email support: otcliteuat@dtcc.com (UAT queries); otclitesupport@dtcc.com (production queries) – Hotline support: • Europe/UK/Asia: +44 (0)207-136-6328 (Options 1,3) – Regular live webinars available in multiple European languages (schedule published on the OTCLite website) © DTCC 26 Disclaimer The content, information and any materials (“data”) provided by DTCC Deriv/SERV LLC (Deriv/SERV) and/or its affiliated companies or subsidiaries in this presentation is on an “as is” basis. Deriv/SERV expressly disclaims all warranties, expressed or implied, as to the accuracy of any data provided, including, without limitation, liability for quality, performance and fitness for a particular purpose arising out of the use of the data. Deriv/SERV shall not have any liability, duty or obligation for or relating to the data contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon. In no event shall Deriv/SERV be liable for damages, including, without limitation, damages resulting from lost data or information or lost profits or revenue, the costs of recovering such data, the costs of substitute data, claims by third parties of for other similar costs, or any special, incidental, or consequential damages, arising out of the use of the data. Any unauthorized use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing herein may violate the intellectual property rights of Deriv/SERV under any intellectual property laws such as copyright laws, trademark laws and communications, regulations and statutes. © DTCC