Front Office/Maintain Financial Records

advertisement

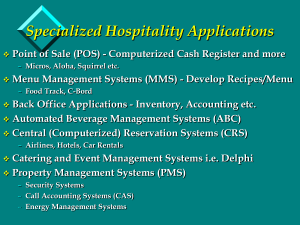

Maintain Financial Record SITXFIN002A Lecture notes Financial Transactions Management Sub-Title Introduction of billing system Payments Processing payment documents Financial transactions TAFE Introduction Every hospitality establishment has a billing system to deal with customer transactions. Billing systems may be manual, electronic, computerized or Point of Sale (POS). Point of sale or point of service (POS) is a location where a transaction occurs. It is the equivalent of an electronic cash register. Point of sale systems are used in supermarket, restaurant, hotels, and casinos, as well as almost any type of retail establishment Fundamental to any billing system is the ability to calculate and total a customer account and then calculate and issue change to the customer. Local bar Advantages of the POS System Orders print automatically in kitchen/bar therefore fewer trips to the kitchen/bar and more time with customers. Order is legible for chefs/bar attendants Ordering with the system automatically opens a bill for the table, which is updated automatically when new orders are placed Waiters have their own key or pin number – check waiter averages and only the waiter can make entries into the system Accurate and up to date management reports Links up to other systems i.e. reception, housekeeping Disadvantages of the POS System Initial costs can be expensive Training/retraining of staff Malfunctions: Paper Out – printers Error message – terminal System down – power failure User error Payments Accepting payments These days, customers expect a range of options when conducting financial transactions. As a tourism industry employee, you need to know all forms of payment that are appropriate for your business and customers. Forms of payment accepted by your business may include one or more of the following: cash cheques: personal, bank or business credit card or cash card EFTPOS travellers cheques foreign currency invoice. continued Cash To process cash payments, your business may use a manual approach with a cash drawer or in larger businesses some type of register (manual, electronic, computerised or point of sale system). Ensure that your calculations are accurate and use a calculator or register, if available. When accepting cash, ensure that it is legal tender and that the notes are not seriously damaged. Change should be provided using the largest denominations available, and counted out to the customer as a way of ensuring errors are not made. Business Cheque Personal Cheque continued Cheques Cheques may be written against a personal account, issued by a bank, or written against a company account. Policies regarding personal cheques vary from business to business. Commonly, personal cheques are not accepted unless a prior arrangement has been made or unless there is sufficient clearance time between the date of payment and the date of travel. Usually seven to ten working days are allowed. continued Procedures for accepting a cheque: ensure that the cheque is a valid form of payment as per the business' policy Ensure that the cheque is dated and signed Ensure that the word and number value correspond and are correct Verify that the signature matches the name on the cheque Every cheque accepted should be marked 'Not Negotiable' to protect the drawer and payee in case the cheque is lost or misplaced continued Ensure the cheque is completed in blue or black pen Ensure that any alterations made on the cheque are initialled Cross check the name and signature with the appropriate ID (eg driver's licence) Note the name, address and identification details (eg driver's licence number) on the back of the cheque issue a receipt either manually or via a cash register.. continued Credit cards and EFTPOS Major credit or charge cards include Bankcard (Australia), MasterCard, Visa and American Express. Acceptance of credit cards will depend on the type of system used by a business. If EFTPOS (Electronic Funds Transfer Point of Sale) machines are used, expiry date, credit limit, and whether the card is stolen are checked by the system automatically. The only items to be checked by the staff member are the customer's signature and that the total is filled out. The EFTPOS device requires the person providing the services for sale to enter the amount. The customer's card can be swiped or the card number may be manually entered via a numeric keyboard and the customer may need to enter their PIN (personal identification number). EFTPOS Machines continued When a customer wishes to pay in this manner, these are the steps to follow: Enter the amount of the purchase. The card must be swiped or the card number and expiry date embossed on the front of the card are entered manually. Also check the expiry date on the card.. The customer may need to enter their PIN, depending on the account type selected. The EFTPOS machine will then send a message to the card issuer to check that the card and account selected are valid, there are sufficient funds to make the purchase and the PIN entered is correct. The card issuer will send a response to the EFTPOS device indicating whether the transaction has been approved or declined. If it is declined, it will usually display a reason for the decline. continued Retain the customer's card until authorisation has been granted or declined. For approved transactions, the card issuer may debit the customer's account as the transaction takes place or they may debit the account within the next few days. A receipt will be printed, indicating the purchase amount, date, time and other transaction details. A copy of this receipt should be given to the customer as proof of payment. If the customer selected 'credit' as account type, they will normally be required to sign a copy of the receipt that will be retained as proof of the purchase. continued Smaller Hospitality businesses may still use an imprinter for credit card transactions. Larger businesses will often still have an imprinter in case the EFTPOS system is offline. The procedure followed when using an imprinter is as follows: check the card is accepted in your business and is signed check the warning bulletin for cancelled or stolen cards after imprinting the card, check the card numbers are legible on the payment slip write the date and amount check the expiry date and circle it continued if the amount is above the 'floor limit', ring for authorisation retain the card until authorisation has been granted or declined check the signature after the customer has signed the payment slip return the card and the customer copy of the payment slip to the customer. Cont. What to do procedures: If the customer accidentally leaves behind the card, it should be kept for 24 hours in a safe place, after which time the card should be cut in half and returned to the card issuer. If it is claimed, ensure that you establish the identity of the card holder before returning the card. The floor limit The floor limit (or merchant limit) is the maximum credit card amount that a business can accept for an individual credit card transaction, above which the business must obtain phone authorisation. continued Floor limits vary for different outlets and different card types. As long as the credit card number is not listed on the cancellation and warning bulletin, the payment of amounts accepted by the merchant below the floor limit is guaranteed by the bank or card company. Hotels, business owners (eg travel agencies) receive regular update lists of cards that are invalid. A reward is offered to anyone who retains a cancelled card and returns it to the credit provider. Traveller Cheque Travellers cheques A travellers cheque is a form of international currency that customers would normally convert at a bank. Travellers cheques are written out in the country of departure and are issued by major banks, Thomas Cook and American Express. Travellers cheques can be issued in many currencies, in a variety of denominations and are treated as 'cash' payments. If your business allows customers to pay by travellers cheque, it is usually only Australian dollar travellers cheques. Some businesses, however, may accept foreign currency travellers cheques. The procedure to follow when accepting travellers cheques for payment is as follows: continued • Ensure the cheque is dated and counter signed in your • • • • • • • presence Verify that the second signature matches the signature on the cheque Cross check the name and signature with appropriate ID (eg a passport) Note identification details on the back of the travellers cheque Provide change in local currency Issue a receipt either manually or electronically. If the cheque is in a foreign currency, and your business will accept these as payment, then you will need to become familiar with rates of exchange. continued Foreign currency Foreign currency is not commonly accepted by Hospitality businesses. If this is the case, you will need to convert this amount to AUD in order for your customer to make a decision about purchasing the service and, indeed, paying your agency. Major banks issue foreign exchange rates daily and these may also be accessed via a computerised reservation system. These are used to calculate the conversion to Australian dollars. The formula to calculate this conversion is: continued $AU1.00 divided by the exchange rate = 1 unit of foreign currency For example: Bank rate of Aus: $ 1= $US 0.86 If I would like to change US $100 The amount divided by exchange rate 100/0.83 = 116 This means that $US100 =$AU116 (rounded) continued To then exchange foreign currency for Australian dollars, the formula is: Number of foreign currency units multiplied by converted exchange rate For example: From the above converted exchange rate, calculate the AUD 200 equivalent of $US? 200 x 0.86 = US$ 172(rounded) This means that $Aus 200 is equivalent to US$172. When dealing with foreign currency, it is important to realise that the bank will also charge a fee to exchange the foreign currency and that rates fluctuate over time. GST Calculating GST The consumer bears the cost of the 10% GST, not the business producing the goods and services. However, the liability to pay GST to the Australian Taxation Office rests on the supplier of the goods and services (ie the tourism business, not on its customer). This is why it is vital that a business reports the GST liability accurately through their payment processing system. continued To manually calculate the GST applicable on goods and services that are not GST free, the total amount payable is multiplied by 10%. If some goods are GST free (eg airfares to international destinations), only the goods subject to GST are to be multiplied by 10%. continued If a customer is given a total amount to be paid and wants to know the GST component, the total is divided by 11 to calculate the GST liability. The federal government has introduced a tourist refund scheme that entitles travellers from overseas to claim the GST if they have purchased goods over the value of $300.00 at one retail outlet and have their receipts. This refund is given at the airport of departure and is carried out by customs officers. Processing & providing receipts for payments There is a variety of ways to process receipts and payments in tourism businesses. Both manual and computerised methods are considered standard. All business documentation must bear the license number of the business as well as the ABN (Australian Business Number) issued by the Australian Taxation Office. Different kinds of receipts continued The key documents needed when processing financial transactions in your business are receipts, refund notices, invoices and petty cash vouchers. These are described below. Receipts A receipt may be automatically produced by a point of sale system if your business uses a computerised system or electronic register. In many smaller businesses, receipts may need to be completed manually. Receipts are usually prepared in duplicate, with a copy for the customer and a copy retained by the office. continued The receipt shows: business name and ABN date time (automated receipts) your name or initials services supplied subtotal GST inclusive goods and services total method of payment amount tendered (automated receipts) change given (automated receipts) GST. Invoices An invoice is issued to those customers who are account holders and who do not pay for their services as they are supplied, but rather on a regular billing basis (eg once a month). In some tourism businesses, like visitor information offices, invoices are received rather than produced, for services provided to them. The invoice lists: continued the business name and ABN the date the date of supply of services the services provided reference numbers the subtotal GST inclusive goods and services the total GST payment terms. continued Petty cash vouchers Petty cash is the term used for money that is allocated for items that are purchased on short notice and for relatively small amounts, usually less than $100 (eg a taxi fare to a seminar or flowers for the office). A separate float is kept in the safe for petty cash. An authorisation by management and a petty cash voucher are completed before funds are reimbursed to the staff member. The purchase docket or receipt is attached to the petty cash voucher. Procedures for dealing with floats Very rarely will customers have the exact amount of money necessary to pay for their tourism purchase. Setting up a cash float involves deciding on the denominations to start your day or shift with and ensuring that the amount of money that you are provided with is what the float sheet totals. It is no use having two $100 notes as your change, just as it is not suitable to have $200 in 5c coins. Procedures for handling a float: Collect the float from the manager or person responsible. This will vary according to the size and type of the tourism business in which you are employed. Sign for the float. In a large business, you may be required to complete a float logbook with the following details: date and time the float was taken, name and signature, amount of float, time float is returned and amount and a witness. continued Check that the amount of money received is the same as the amount noted on the float sheet. Ensure that the till drawer or cash box in which the float is placed is closed and locked when not in use. This should only be opened when transactions are taking place (eg depositing a customer's payment or giving change to a customer). Close and lock doors when counting money. Balance the float before handover. Do not let other people use the float. Never borrow from the float. continued Reconciliation procedures At the end of the day, there are many things to do. One of them is to reconcile your takings. In order to do this, you will need to follow your organisation's policy on reconciliation. The float not only has to be counted but a reconciliation of the takings must also be carried out. This is to show any variance from the actual takings to the amounts included on the total of all receipts and refunds. It is a good idea to reconcile your cash drawer with someone else so that any problems can be verified immediately. continued Each business will vary but a typical procedure checklist is: Count the float and remove it. Count each of the following: credit cards, vouchers, petty cash dockets, travellers cheques, non-cash refunds. Record each total and then total the non-cash transactions. Count each denomination of cash and cash refunds and record the total cash receipts. Balance against the reading from your register or computer or the manual total calculated using an adding machine to total the value of all receipts and tickets or vouchers. Fill in the reconciliation report. continued In a perfect world, the reconciliation of receipts and payments would not have any discrepancies at any time. If there is any problem in the reconciliation process and the result is that there is a variance between your takings and your tape reading, ensure that you: recount your takings check foreign currency conversions recount your non-cash transactions recheck your readings get someone else to check all of the above. If it still doesn't reconcile, call your supervisor. Maintain Financial Records Sub-Title Definition of accounts and Folio used in Front Office Accounting The procedures for processing and tracking transactions The process of creating and maintaining accurate financial transaction. TAFE Front Office/Maintain Financial Records Prepared by Philip Maw Competencies for Financial Transactions Management 1. Define the types of accounts and folios used in front office accounting. 2. Distinguish between the guest ledger and the city ledger. 3. Describe the process of creating and maintaining front office accounts. Competencies for Front Office Accounting/financial transactions 4. Describe typical procedures for processing and tracking common front office accounting transactions. 5. Describe internal control procedures for front office operations. Front Office Accounting/Financial Transaction Management • The front office accounting system is responsible for: • Creating and maintaining an accurate accounting record for each guest or non-guest in the hotel • Tracking all financial transactions throughout the guest cycle • Ensuring internal control over cash and non-cash transactions • Recording settlement for all goods & services provided • The front office accounting system is customized and tailored to track each hotel’s needs. Therefore, no two hotels have exactly the same front office accounting systems. Accounts • An Account is a form on which financial data are accumulated, summarized and brought to its ending balance. • all accounts shall have two entries referred to as Debit (dr) (or charges) versus Credit (cr) (or payments). • The most widely used representation of accounts is the T- Account, which summarizes debit entries on the left-hand side and credit entries on the right-hand side. T Account Debits Charges Credits Payments Front Office Accounting Formula Previous Balance + Debits - Credits = Net Outstanding Balance PB + DR - CR = NOB Two major types of accounts • Guest accounts describe all charges and payments of guests who are already registered at the hotel. • Non-guest (house or city) accounts: describe all charges and payments of non-guests. To illustrate, a potential guest sending a certain deposit to guarantee a reservation is a nonguest. Moreover, charges and payments of guests who checkout with any method of payment other than cash, shall be opened a non-guest account. Lastly, visitors and employees with charge privileges shall be opened non-guest accounts. • Folios A folio is a statement of all transactions (i.e. debits & credits) affecting the balance of a single account. At Checkout, any guest folio should be balanced to 0 through full cash payment, credit card transfer, check transfer, special program transfer, and direct billing transfer… Continued • The correct way of maintaining folios starts with proper posting, which is the process of recording transactions on a folio (i.e. proper folio, proper location and proper amount) • Under the manual, semi automated and fully automated systems, folios are called hand-written folios, machineposted folios, and computer-based electronic folios respectively. Moreover, all folios shall have a unique serial number for internal control and storing purposes. Types of Folios There are basically four common types of folios used in front office accounting: · Guest folios · Master folios · Non-guest folios · Employee folios Four common types of folios Guest folios: accounts assigned to individual persons or guestrooms Master Folios: accounts assigned to more than one person or guest room; usually reserved for guest groups Non-Guest (or semi-permanent) folios: accounts assigned to non-guest businesses or agencies with hotel charge purchase privileges Employee Folios: accounts assigned to employees with charge purchase privileges Guest’s folio/Guest’s transaction Record Master Folio Non Guest Folio Account Vouchers • Vouchers depict the details of the transaction • • • • • • • information gathered at the source of transaction and is, hence, a supporting documents used only for internal control purposes. Below are some of the commonly used vouchers in the hospitality industry: Cash vouchers Credit card vouchers Charge vouchers Transfer vouchers Paid-out vouchers Correction vouchers Allowance vouchers Voucher Sample Points of sale [i.e. POS] • A point of sale is the location at which goods or services • • • • • • are purchased; sometimes called a revenue center When posting charges, the following items shall be considered: Amount of the charge Name of the point of sales outlet Room number & name of the guest Brief description of the charge Guest signature & employee identification Ledgers: Ledger—a summary grouping of accounts Account receivable—money owed to the hotel Guest ledger (transient ledger, front office ledger, rooms ledger) Accounts of registered guests Accounts of advance deposits from future guests (credit balance) City ledger (non-guest ledger)—collection of non-guest Creation and Maintenance of Guest Accounts: All guest folios are created during the pre-arrival or arrival stage of the guest cycle. Moreover, folios might be either placed in front desk folio tray [i.e. posting tray, folio well, or bucket] or stored as an electronic guest folios in fully automated systems. As far as walk-ins are concerned, all their guest folios are created at the arrival stage! Guest charge privileges Potential guests who would like to have guest charge privileges shall present an imprint of an acceptable credit card or direct billing authorization at registration. Failing to do so, guests would have to pay, in full, all their charges through cash, hence called Paid-inAdvance [PIA] guests and have, hence, have no post status. Credit monitoring In order to monitor and control charge privileges, the front office staff should check whether the total net purchases are less than the minimum of floor Limit (i.e.: credit card company's limit) and house limit (i.e. hotel's limit). At least, each day, lists of guests with high risk or high balance accounts shall be communicated to all point of sale outlets. This is vital since, failing to do so, will let point of sales outlets continue giving charge privileges to a point that eventually the credit card company refuses to pay the amount of money exceeding its limit. This will cause very serious financial losses to the hotel. Front office transactions Cash payment Charge purchase Account correction Account allowance Current transfer Cash Advance Transactions (continued) 1. Cash payment: In this very transaction, front office staff posts cash payment as a credit in the guest folio. Moreover, cash vouchers shall be used as a transaction-supporting document. 2- Charge purchase: Charge purchases represent deferred payment transactions that increase the outstanding balance of a folio account. In this transaction type, front office staff shall use charge vouchers as a transaction-supporting document. Account correction: Account correction is used to resolve a posting error in a folio detected at the day the error is made (i.e. before the closing of the business day). In this transaction, front office staff shall use correction vouchers as a transaction-supporting document. Account allowance • Account allowances occur because of two reasons: • Either as compensation of poor service, or as rebates for coupon discounts. That way, guest outstanding balance decreases. • As to correct a posting error detected after the closing of the business day. • For both reasons, front office staff prepare an allowance voucher as a transaction supporting document. Cash, house banks • Cash Bank is the amount of cash assigned to a cashier so that he/she can handle the various transactions that occur in a particular work shift. • • At the end of each shift, cashiers should watch out for cash discrepancies (i.e. any difference between front office cash sheet and the actual amounts in their cash drawers). Cash discrepancies might have the form of cash overages, shortages, or due backs Continued Audit control: Along with the fact that hotels might employ internal control auditors, at least once in a year, (especially for hotels traded in the stock market) to get use of external certified public accountants responsible for approving hotel's accounts. Settlement of accounts One of the responsibilities of front office receptionists is to settle guest accounts, which means the eventual collection of payment for outstanding account balances (i.e.: bringing account balances to 0]. This is usually ensured either by full cash payment, transfer to an approved credit card, personal check, special program, or direct billing account… Financial Transaction management 2008/2009 Process Financial Transactions Topics Point O f Sale/cashiering systems Processing payments and presentations of accounts Transaction reports The purpose of point of sale/cash register Records sales Store cash Issue reports Types of registers Manual Basic Electronic cash register Computerised cash register Point of sale systems-main frame & computer/terminals Main Components Display panel Keyboard/touch screen/hand held Keys & Switches Printer operation Remote slip printer How to program Program verification Facilities of point of Sale Key pad entry/touch screen End of shift/managers reports Ordering stock in/out Employee time Sign in/out Maintain weekly hours (no need for timesheets) Cashiering Terms X & Z readings Single or multiple items No sale Register tapes Pay out / discounts Void Clear GST Malfunctions - check the following Is machine plugged in Machine is turned on Keys / card / ID Machine is set Cash draw closed Last transaction totalled Paper in printer Power out Handling Customer Enquiries Welcome the enquiry Listen attentively Use empathy Wait for the customers response Remain calm-try not to take it personally Collect the facts and repeat to customer Inform the customer and explain what is/was done Presenting the customers account Prepare the account when required Present the account only when customer asks for it (exceptions may occur) Do not wait around the table (but do not disappear) Thank the customer when returning the balance Thank the customer when and accompany them to the door when possible Procedures and security whilst handling Cash Float sign out Count and place in cash drawer Close cash door when not in use Only open cash draw for transaction CLOSE & LOCK doors when counting money Transfer takings and float to and from office quickly Continued Balance the float before handing over or returning to head cashier Do not let other people use float Never borrow money from the float Types of Transactions Payments of accounts Deposits Refunds Petty cash Methods of Payments Cash Credit cards EFTPOS Personal cheques Company cheques Travellers cheques Vouchers Credit card EFTPOS Most of establishments have EFTPOS machines to accept credit cards If EFTPOS machines are used check Expiry date Credit limit Note: stolen cards are checked automatically Credit Card (manual) Expiry date, signed, warning bulletin Enter the details on voucher Retain credit card whilst guest signs Compare signatures Ensure total is complete Return customers card Place merchant and company copies in cash draw Travelers Checks Calculate currency exchange Ensure cheque is dated and counter signed in your presence Check signatures match Cross check with ID eg passport Vouchers Check with house policy on the procedures for processing vouchers Collect the establishments copy Check the validity, dates and issue of voucher covers Ascertain what is covered by the voucher and what will be paid by the customer Open account as required-part voucher part cash Vouchers Entertainment fundraising booklets Shopper dockets Charge accounts A letter of authorisation has been received The customer is entitled to charge The amounts charged to the company are covered in the authorisation Two accounts can be opened if needed-part charge part cash Incidentals are paid for The bill is signed, correct signature Closing Procedures Check all outstanding accounts are finalised Count float and remove All cash, credit cards, vouchers, petty cash dockets make up the shift takings Count the above and record Balance against X reading/end of shift report Fill in the reconciliation report The need for Forms and Reports A communication link Data provision Operational factors- sales and commodities Operational procedures -staffing Cashiering Systems PLU X and Z readings Single or multiple items No Sale Register tapes Pay outs/Discounts Void Clear Price look up screen Register tape Cash draw/cash taking Malfunctions – Check the following Machine plugged in Plug switch turned on Machine is turned on Keys/Card/ID Machine is set Cash draw closed Last transaction totalled Paper in printer Power out Slip is correctly placed in printer Ribbon is in place Safety fuse reset properly Handling Customer Enquiries Welcome the enquiry Listen attentively Use empathy Wait for the customers response Remain calm – try not to take it personally Collect the facts and repeat to the customer Inform the customer and explain what is/was done Presenting the Customer’s Account Prepare the account when required Present the account only when the customer asks for it (exceptions may occur) Do not wait around the table, but do not disappear Thank the customer when returning the balance Thank the customer when leaving and accompany them to the door when possible Procedures and Security Whilst Handling Cash Float sign out Count and place in drawer Close till drawer when not in use Only open till drawer for transactions CLOSE and LOCK doors when counting money Charge Accounts/Direct billing Account Sometimes the company wants to pay on behalf of its employees. Follow these procedures: A letter of authorisation has been received The customer is entitled to charge The amounts charged to the company are covered in the authorisation Two accounts can be opened if needed – part charge part cash Incidentals are paid for The bill is signed, correct signature Terminology of a Cash Register Price Look Up button or PLU Pre programmed with individual prices of food and drink, the price is automatically recorded when the allocated button is pressed. X and Z readings X readings allow a readout of the transactions by department. The supervisor would usually take an X reading at the end of each shift and record the sales at that time. Z readings will give the same information as the X read, but also clears the machine of all totals. This reading is usually taken at the end of the day's trading, bringing the machine back to a nil balance. Register tapes The register tapes record all the information you have entered into the machine. There are two register tapes – the receipt roll for providing receipts to the customers; and a receipt journal roll, for internal auditing purposes. The receipt journal tape needs to be turned on, whereas the customer receipt roll is automatic. When finalising the end of shift report if a discrepancy is found then the register tapes can provide the source of the mistake. continued Pay outs This function allows the operator to account for money paid out from the till for petty cash or payment to suppliers. An invoice or receipt is needed before money can be taken from the till. Discounts The discount button is a quick and easy way to calculate a customer's bill when a discount is offered. Cash handling and security A float is an amount of cash held on the premises to facilitate the issue of change to customers paying bills or requiring a large note to be broken down. It is also drawn from to issue petty cash. Depending on the size of the establishment and the amount of business, the float can be anywhere from $100 – 500. Procedures for handling a float during a shift Collect the float from the manager Sign for the float Check the amount of money received Close till drawer when not in use Only open till drawer for transactions CLOSE and LOCK doors when counting money Balance the float before handover Transfer takings and float to and from office quickly Do not let other people use the float Never borrow from the float continued. Refunds The customer is required to sign for any refund received. Refunds are balanced at the end of the shift and are shown in the banking summary to account for the shortage/s. Cash advances Cash advances are also known as ‘pay outs’. A pay out voucher must accompany the request. Examples may include taxis, cigarettes, flowers etc. This is normally restricted to hotels and ‘in house’ guests. Financial Transactions management 2008/2009 Financial Transactions management Account Settlement at Front Office Front Office Front Office receptionists are cashiers as well. Their responsibilities are not only providing customer services, but they also monitor guest’s financial transactions and settle the guest’s account. The guests use different method of payments for their accounts such as: cash, credit card and direct billing Describe methods of settlement for guest accounts. • Cash payment in full • At check out time some of guests may pay cash for • • • • • payment If Full cash payment is made; the front office receptionist destroy the guest’s credit card voucher. Make guest account to zero balance Credit card transfer Moves account balance from guest ledger to a credit card account in the city (non-guest) ledger the guest only signs a credit card voucher Payment to be received from credit card company Credit card company collects payment from card holder Guest’s Account(sample) Paid by Cash Credit card Payment Method of settlements (continued) Direct billing transfer Moves account balance from guest ledger to the city (nonguest) ledger Hotel is responsible for billing and collection The billing has been arranged and approved by the hotel’s account department The front office receptionist ask the guest to verify the account and sign the folio. Direct billing (City Ledger) Method of settlements (continued) Combined settlement method: A guest may choose to use more than one settlement method to bring the folio balance to zero. (cash payment and credit card payment) Combine settlement by Cash and City ledger