The Classical Gold Standard 4

advertisement

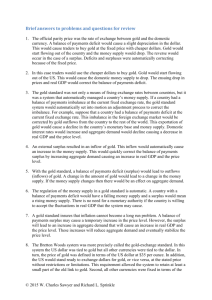

HYSTORY OF EXCHANGE RATE SYSTEMS 1 Lecture 8 LEARNING GOALS Features and Mechanism of Gold Standard Features and Mechanism of Dollar Standard The Credit Money System 2 INTERNATIONAL MONETARY SYSTEMS 3 HISTORY OF THE INTERNATIONAL MONETARY SYSTEM Desirable properties Raire, durable, divisible, fungible New phenomena in crises: speculative! Representative money:Coins, notes represented real commodities strored elsewhere 4 THE USE OF GOLD In short run: High production costs limit short-run changes. In long run: Commodity money insures stability. Silver: the main circulating medium (Gresham) Gold: medium of reserve 5 THE CLASSICAL GOLD STANDARD Major currencies on gold standard. Involved commitment by nations to fix the price of domestic currency in terms of a specific amount of gold. 6 EXCHANGE RATE PARITY The relationship between the value of one currency and another 1 uncia gold = 86,58 RM 1 uncia gold = 20,67 USD 1 USD = ? RM 1 USD = 4,19 RM 7 THE CLASSICAL GOLD STANDARD (1875-1914) 1844 Britain: Bank Charter Act Establishment of Bank of England notes backed by gold 1871 Germany: After unified, and Franco-Prussian war Mark defined its value in gold By 1879 only gold coins were accepted in Latin Monetary Union (France, Italy, Belgium, Switzerland, Greece) 8 ARBITRAGE Attempting to profit by exploiting price differences of identical or similar financial instruments, on different markets or in different forms. The ideal version is riskless arbitrage. A risk-free transaction consisting of purchasing an asset at one price and simultaneously selling that same asset at a higher price, generating a profit on the difference. 9 THE CLASSICAL GOLD STANDARD 2 Maintenance involved: the buying and selling of gold at that price. Besides the free flow of capital free exchange rate market 10 THE CLASSICAL GOLD STANDARD 3 Operating conditions: 1. All national currency is backed by gold, and growth in money supply is linked to gold reserves. Growing world economies Growing money demand Growing gold reserves (colonies) 11 THE CLASSICAL GOLD STANDARD 4 Conditions: 2. Each currency convertible into gold at a fixed price - the exchange rate between the two currencies automatically fixed. 3. No fluctuation in the exchange rate unless either country changes the local price of gold. 12 HOW??? From 4.19 the dollar rises to 5 Mark Over or undervaluation of USD? Cause: arbitrage Example: 1 uncia gold = 86,58 RM 1 uncia gold = 20,67 USD 1 USD = 4,19 RM Buy USD directly from 1000RM or make an arbitrage? 11.55 uncia gold sold at the fixed rate Result: 238.74USD Dollar surplus push down the exchange rate: rise in dollar volume, decrease in mark volume 13 PRICE-SPECIE-FLOW MECHANISM: AUTOMATIC ADJUSTMENTS When a balance of payments surplus led to a gold inflow Gold inflow led to higher prices which reduced surplus Gold outflow led to lower prices and increased surplus. 14 THE GOLD EXCHANGE STANDARD (19251931) Only U.S. and Britain allowed to hold gold reserves Other countries could hold both gold, dollars or pound reserves. 15 BETWEEN WW1 AND WW2 Countries experimented with floating rates in the 1920’s and ’30 “If there is anything that the inter-war experience has clearly demonstrated, it is that currency exchanges cannot be left free to fluctuate from day to-day under the influence of demand and supply. If currencies are left to fluctuate, “speculation” is likely to play havoc with the exchange rate.” Ragnar Nurske (1944) of the League of Nations 16 Currencies devalued in 1931- led to trade wars. 17 Bretton Woods Conference - called in order to avoid future protectionist and destructive economic policies 18 THE BRETTON WOODS SYSTEM The Bretton Woods System (1946-1971) U.S.$ was key currency; valued at $1 - 1/35 oz. of gold. All currencies linked to that price in a fixed rate system. 19 A BRIEF HISTORY OF THE INTERNATIONAL MONETARY SYSTEM Exchange rates allowed to fluctuate by 1% above or below initially set rates. Collapse, 1971 Causes: U.S. high inflation rate U.S.$ depreciated sharply. 20 BREAKDOWN OF BRETTON WOODS By late 1960’s: US liabilities abroad exceeded their gold reserves. US: expansionary monetary policy during Vietnam wars Current account and trade balance teriorated. No possibility to back its commitment to its currency with gold. On August 15, 1971, Nixon officially took the US off the gold standard. (see IMF site) www.imf.org/external/about/histend.htm 21 POST-BRETTON WOODS SYSTEM (1971- PRESENT) Smithsonian Agreement, 1971 US$ devalued to 1/38 oz. of gold. By 1973: World on a freely floating exchange rate system. 22 OPEC AND THE OIL CRISIS (1973-1974) 1. 2. 3. 4. OPEC raised oil prices four fold; Exchange rate turmoil resulted; Caused OPEC nations to earn large surplus Surpluses recycled to debtor nations which set up debt crisis of 1980’s. 23 DOLLAR CRISIS (1977-78) 1. 2. 3. U.S. B-O-P difficulties Result of inconsistent monetary policy in U.S. Dollar value falls as confidence shrinks. 24 THE RISING DOLLAR (1980-85) 1. 2. 3. U.S. inflation subsides as the Fed raises interest rates Rising rates attracts global capital to U.S. Result: Dollar value rises. 25 THE SINKING DOLLAR:(1985-87) 1. 2. 3. Dollar revaluated slowly downward; Plaza Agreement (1985) G-5 agree to depress US$ further. Louvre Agreement (1987) G-7 agree to support the falling US$. 26 RECENT HISTORY 1. 2. 3. 4. 1988 US$ stabilized Post-1991 Confidence resulted in stronger dollar 1993-1995 Dollar value falls Now? 27 Thanks for your attention! 28 THE EUROPEAN MONETARY SYSTEM I. INTRODUCTION A. The European Monetary System (EMS) 1. A target-zone method (1979) 2. Close macroeconomic policy coordination required. 29 THE EUROPEAN MONETARY SYSTEM B. EMS Objective: to provide exchange rate stability to all members by holding exchange rates within specified limits. 30 THE EUROPEAN MONETARY SYSTEM C. European Currency Unit (ECU) A “cocktail” of European currencies with specified weights as the unit of account. 1. Exchange rate mechanism (ERM) each member determines mutually agreed upon central cross rate for its currency. 31 THE EUROPEAN MONETARY SYSTEM 2. Member Pledge: To keep within 15% margin above or below the central rate. D. EMS ups and downs 1. Foreign exchange interventions failed due to lack of support by coordinated monetary policies. 32 THE EUROPEAN MONETARY SYSTEM 2. G. Currency Crisis of Sept. 1992 a. System broke down b. Britain and Italy forced to withdraw from EMS. Failure of the EMS members allowed political priorities to dominate exchange rate policies. 33 THE EUROPEAN MONETARY SYSTEM H. Maastricht Treaty 1. Called for Monetary Union by 1999 (moved to 2002). 2. Established a single currency: the euro 3. Calls for creation of a single central EU bank. 4. Adopts tough fiscal standards. 34 THE EUROPEAN MONETARY SYSTEM I. Costs / Benefits of A Single Currency A. Benefits 1. Reduces cost of doing business. 2. Reduces exchange rate risk B. Costs 1. Lack of national monetary flexibility. 35