Chapter 8 Powerpoint

advertisement

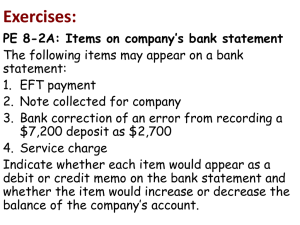

8 Sarbanes-Oxley, Internal Control, and Cash 8-1 Sarbanes-Oxley, Internal Control, and Cash After studying this chapter, you should be able to: 8-2 1 Describe the Sarbanes-Oxley Act of 2002 and the impact on internal controls and financial reporting. 2 Describe and illustrate the objectives and elements of internal control. 3 Describe and illustrate the application of internal controls to cash. Sarbanes-Oxley, Internal Control, and Cash (continued) 8-3 4 Describe the nature of a bank account and its use in controlling cash. 5 Describe and illustrate the use of a bank reconciliation in controlling cash. 6 Describe the accounting for specialpurpose cash funds. 7 Describe and illustrate the reporting of cash and cash equivalents in the financial statements. 1 Describe the SarbanesOxley Act of 2002 and its impact on internal controls and financial reporting. 8-4 9-4 1 The Sarbanes-Oxley Act of 2002 (referred to simply as SarbanesOxley) applies only to companies whose stock is traded on public exchanges. Its purpose is to restore public confidence and trust in the financial statements of companies. 8-5 1 Sarbanes-Oxley requires companies to maintain strong and effective internal control. 8-6 1 Internal control is broadly defined as the procedures and processes used by a company to: 1. Safeguard its assets. 2. Process information accurately. 3. Ensure compliance with laws and regulations. 8-7 1 8-8 1 Exhibit 1 8-9 Sarbanes-Oxley Report of Nike 2 Describe and illustrate the objectives and elements of internal control. 8-10 2 8-11 2 Employee fraud is the intentional act of deceiving an employer for personal gain. 8-12 2 Five Elements of Internal Control Management is responsible for designing and applying five elements of internal control to meet the three internal control objectives. These elements are as follows: 1. Control environment 2. Risk assessment 3. Control procedures 4. Monitoring 5. Information and communication 8-13 2 Exhibit 2 8-14 Elements of Internal Control 2 Control Environment The control environment is the overall attitude of management and employees about the importance of controls. 8-15 2 Factors That Influence the Control Environment 1. Management’s philosophy and operating style 2. The company’s organizational structure 3. The company’s personnel policies 8-16 2 8-17 2 Control Procedures 1. Competent personnel, rotating, duties, and mandatory vacations. 2. Separating responsibilities for related operations. 3. Separating operations, custody of assets, and accounting. 4. Proofs and security measures. 8-18 2 Exhibit 3 8-19 Internal Control Procedures 2 Monitoring Monitoring the internal control system is used to locate weaknesses and improve controls. 8-20 2 Monitoring Monitoring often includes observing employee behavior and the accounting system for indicators of control problems. 8-21 2 Exhibit 4 Warning Signs of Internal Control Problems Edwin C. Bliss , “Employee Theft,” Boardroom Reports, July 15, 1994, pp. 5–6 8-22 (continued) 2 Exhibit 4 Warning Signs of Internal Control Problems (continued) 8-23 1. Missing documents or gaps in transaction numbers (could mean documents are being used for fraudulent transactions). 2. An unusual increase in customer refunds (refunds may be phony). 3. Differences between daily cash receipts and bank deposits (could mean receipts are being pocketed before deposited). 4. Sudden increase in slow payments (employee may be pocketing the payment). 5. Backlog in recording transactions (possibly an attempt to delay detection of fraud). Edwin C. Bliss , “Employee Theft,” Boardroom Reports, July 15, 1994, pp. 5–6 2 Limitations of Internal Control 1. The human element of control 2. Cost-benefit considerations 8-24 2 Example Exercise 8-1 Internal Control Elements Identify each of the following as relating to (a) the control environment, (b) risk assessment, or (c) control procedures. 1. Mandatory vacations 2. Personnel policies 3. Report of outside consultants on future market changes Follow My Example 8-1 1. (c) control procedures 2. (a) the control environment 3. (b) risk assessment 8-25 8-25 For Practice: PE 8-1A, PE8-1B 3 Describe and illustrate the application of internal controls to cash. 8-26 3 Cash includes coins, currency (paper money), checks, and money orders. Cash is the asset most likely to be stolen or used improperly in a business. 8-27 3 Sources of Cash Businesses normally receive cash from two main sources: 1. Customers purchasing products or services. 2. Customers making payments on account. 8-28 3 Control of Cash Receipts One of the most important controls to protect cash received in over-the-counter sales is a cash register. 8-29 3 8-30 Using the Cash Register to Control Cash 3 Control of Cash Receipts A predetermined amount of money that is given to each cash register clerk in a cash drawer is called a change fund. 8-31 3 Cash Short and Over Cash sales for March 19 totaled $35,690 per the cash register tape. After removing the change fund, only $35,668 was on hand. If there had been cash over, Cash Short and Over would have been credited for the overage. 8-32 3 Cash Received in Mail Cash is received in the mail when customers pay their bills. Most companies design their invoices so that customers return a portion of the invoice, called a remittance advice, with their payment. 8-33 3 Cash may be received from customers through electronic funds transfers (EFT). Customers may authorize automatic electronic transfers from their checking accounts to pay monthly bills. 8-34 3 Control of Cash Payments The control of cash payments should provide reasonable assurance that: 1. Payments are made for only authorized transactions. 2. Cash is used effectively and efficiently. 8-35 3 A voucher system is a set of procedures for authorizing and recording liabilities and cash payments. It may be either manual or computerized. 8-36 3 A voucher is any document that serves as proof of authority to pay cash or issue an electronic funds transfer. 8-37 4 Describe the nature of a bank account and its use in controlling cash. 8-38 4 Bank Accounts A major reason that businesses use bank accounts is for internal control. Some of the control advantages of using bank accounts are as follows: 1. Bank accounts reduce the amount of cash on hand. 2. Bank accounts provide an independent recording of cash transactions. 3. Use of bank accounts facilitates the transfer of funds using EFT systems. 8-39 4 A summary received from the bank of all checking account transactions is called a bank statement. 8-40 4 Impact of Debit and Credit Memos 8-41 4 Exhibit 5 8-42 Bank Statement (continued) 4 Exhibit 5 8-43 Bank Statement (continued) 4 Typical credit or debit memorandum entries found on the bank statement: — Error correction to correct bank error. NSF — Not sufficient funds check. SC — Service charge. ACH — Automated Clearing House entry for electronic funds transfer. MS — Miscellaneous items. EC 8-44 4 Example Exercise 8-2 Items on Company’s Bank Statement The following items may appear on a bank statement: (1) NSF check (2) EFT Deposit (3) Service Charge (4) Bank correction of an error from recording a $400 check as $40. Indicate whether the item would appear as a debit or credit memorandum on the bank statement and whether the item would increase or decrease the balance of the company’s account. 8-45 8-45 4 Example Exercise 8-2 (continued) Follow My Example 8-2 Item No. Appears on the Bank Statement as a Debit or Credit Memo Increases or Decreases the Balance of the Company’s Bank Account (1) debit memo decreases (2) credit memo increases (3) debit memo decreases (4) debit memo decreases For Practice: PE 8-2A, PE 8-2B 8-46 8-46 4 Exhibit 6 8-47 Power Networking’s Records and Bank Statement 5 Describe and illustrate the use of a bank reconciliation in controlling cash. 8-48 5 A bank reconciliation is an analysis of the items and amounts that cause the cash balance reported in the bank statement to differ from the balance of the cash account in the ledger in order to determine the adjusted cash balance. 8-49 5 The Adjusted Balance Must be equal 8-50 5 Steps in a Bank Reconciliation 8-51 (continued) 5 Steps in a Bank Reconciliation 8-52 5 Bank’s Records Beginning balance Power Networking’s Records $3,359.78 Beginning balance Step 1 Power Networking prepares to reconcile the monthly bank statement as of July 31. The bank statement shows an ending cash balance of $3,359.78. The company’s Cash account has a July 31 balance of $2,549.99. 8-53 $2,549.99 5 Power Networking’s Records Bank’s Records Beginning balance Add deposit not recorded by bank $3,359.78 Beginning balance 816.20 $4,175.98 Step 2 A deposit of $816.20 did not appear on the bank statement. 8-54 $2,549.99 5 Power Networking’s Records Bank’s Records Beginning balance Add deposit not recorded by bank $3,359.78 Beginning balance $2,549.99 816.20 $4,175.98 Deduct outstanding checks: No. 812 $1,061.00 No. 878 435.39 No. 883 48.60 1,544.99 Step 3 8-55 Three checks that were written during the period did not appear on the bank statement: No. 812, $1,061; No. 878, $435.39, No. 883, $48.60. 5 Power Networking’s Records Bank’s Records Beginning balance Add deposit not recorded by bank $3,359.78 Beginning balance $2,549.99 816.20 Add note and interest collected by bank $4,175.98 Deduct outstanding checks: No. 812 $1,061.00 No. 878 435.39 No. 883 48.60 1,544.99 408.00 $2,957.99 Step 4 The bank collected a note in the amount of $400 and the related interest of $8 for Power Networking 8-56 5 Power Networking’s Records Bank’s Records Beginning balance Add deposit not recorded by bank $3,359.78 Beginning balance $2,549.99 816.20 Add note and interest collected by bank $4,175.98 Deduct outstanding checks: No. 812 $1,061.00 No. 878 435.39 No. 883 48.60 1,544.99 Deduct check NSF $300.00 408.00 $2,957.99 Step 5 The bank returned a check for $300 from customer (Thomas Ivey) because of insufficient funds (NSF). 8-57 5 Power Networking’s Records Bank’s Records Beginning balance Add deposit not recorded by bank $3,359.78 Beginning balance 816.20 Add note and interest collected by bank $4,175.98 Deduct outstanding checks: No. 812 $1,061.00 No. 878 435.39 No. 883 48.60 1,544.99 Deduct check NSF $300.00 Bank service charges 18.00 Step 6 Bank service charges for the month, $18. 8-58 $2,549.99 408.00 $2,957.99 5 Power Networking’s Records Bank’s Records Beginning balance Add deposit not recorded by bank $3,359.78 Beginning balance 816.20 Add note and interest collected by bank $4,175.98 Deduct outstanding checks: No. 812 $1,061.00 No. 878 435.39 No. 883 48.60 1,544.99 Deduct check NSF $300.00 Bank service charges 18.00 Error recording Chk. No. 879 9.00 $2,549.99 408.00 $2,957.99 Step 7 8-59 Check No. 879 for $732.26 to Taylor Co. on account, erroneously recorded in journal as $723.26. 5 Bank’s Records Beginning balance Add deposit not recorded by bank $3,359.78 Beginning balance 816.20 Add note and interest collected by bank $4,175.98 Deduct outstanding checks: No. 812 $1,061.00 No. 878 435.39 No. 883 48.60 1,544.99 Adjusted balance 8-60 Power Networking’s Records $2,549.99 408.00 $2,957.99 Deduct check NSF $300.00 Bank service charges 18.00 Error recording Chk. No. 879 9.00 327.00 $2,630.99 Adjusted balance $2,630.99 5 Exhibit 7 8-61 Bank Reconciliation for Power Networking 5 The journal entries for Power Networking, based on the bank reconciliation in Slide 61 are as follows: 8-62 5 Example Exercise 8-3 Bank Reconciliation The following data were gathered to use in reconciling the bank account of Photo Op. a. b. 8-63 8-63 Balance per bank............................................. $14,500 Balance per company records………………. 13,875 Bank service charges………………………… 75 Deposit in transit…………………………….. 3,750 NSF check……………………………………. 800 Outstanding checks………………………….. 5,250 What is the adjusted balance on the bank reconciliation? Journalize any necessary entries for Photo OP based upon the bank reconciliation. Example Exercise 8-3 (continued) 5 Follow My Example 8-3 a. $13,000, as shown below. Bank section of reconciliation: $14,500 + $3,750 – $5,250 = $13,000 Company section of reconciliation: $13,875 – $75 – $800 = $13,000 b. Accounts Receivable………………… 800 Miscellaneous Expense……………… 75 Cash………………………………… 875 For Practice: PE 8-3A, PE 8-3B 8-64 8-64 6 Describe the accounting for special-purpose cash funds. 8-65 6 Petty Cash Fund It is usually not practical for a business to write checks to pay small amounts. Thus, it is desirable to control such payments by using a special cash fund, called a petty cash fund. 8-66 6 A petty cash fund of $500 is established on August 1. The entry to record the transaction is as follows: 8-67 6 IMPORTANT! The only time Petty Cash is debited is when the fund is initially established or when the fund is increased. The only time Petty Cash is credited is when the fund is being decreased. 8-68 6 At the end of August, the petty cash receipts indicate expenditures for the following items: Office supplies $380 Postage (debit Office Supplies) 22 Store supplies 35 Misc. administrative expenses 30 Total $467 8-69 6 Example Exercise 8-4 Petty Cash Fund Prepare journal entries for each of the following; a) Issued check to establish a petty cash fund of $500. b) The amount of cash in the petty cash fund is currently $120. Issued a check to replenish the fund, based on the following summary of petty cash receipts: office supplies, $300 and miscellaneous administrative expense, $75. Record any missing funds in the cash short and over account. 8-70 8-70 Example Exercise 8-4 (continued) 6 Follow My Example 8-4 a) Petty Cash………………………........ 500 Cash…………………………........ 500 b) Office Supplies………………………. 300 Miscellaneous Admin. Expense….. 75 Cash Short and Over……………….. 5 Cash……………………………….. 380 For Practice: PE 8-4A, PE 8-4B 8-71 8-71 7 Describe and illustrate the reporting of cash and cash equivalents in the financial statements. 8-72 7 Cash Equivalents A company’s excess cash is normally invested in highly liquid investments. These investments are called cash equivalents. 8-73 7 Companies that have invested excess cash in cash equivalents usually report Cash and cash equivalents as one amount on the balance sheet. 8-74 7 Compensating Balance Banks may require depositors to maintain minimum cash balances in their bank accounts. Such a balance is called a compensating balance. 8-75 7 Monthly Cash Expenses A cash ratio that is especially useful for companies, starting up or in financial distress, is the ratio of cash to monthly cash expenses. First, the monthly cash expenses are determined. Monthly Cash Expenses = 8-76 Negative Cash Flows from Operations 12 7 Ratio of Cash to Monthly Cash Expenses The ratio of cash to monthly cash expenses can then be computed as follows: Ratio of Cash to Monthly = Cash Expenses 8-77 Cash and Cash Equivalent as of Year-End Monthly Cash Expenses 8-78