Day-5 outline

advertisement

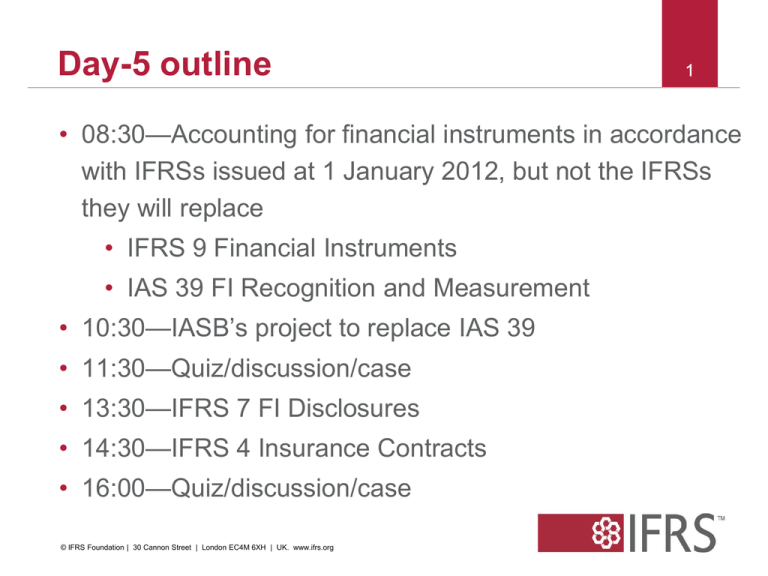

Day-5 outline 1 • 08:30—Accounting for financial instruments in accordance with IFRSs issued at 1 January 2012, but not the IFRSs they will replace • IFRS 9 Financial Instruments • IAS 39 FI Recognition and Measurement • 10:30—IASB’s project to replace IAS 39 • 11:30—Quiz/discussion/case • 13:30—IFRS 7 FI Disclosures • 14:30—IFRS 4 Insurance Contracts • 16:00—Quiz/discussion/case © IFRS Foundation | 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org 2011 October IFRS Conference | Financial Instruments | C&M and Impairment International Financial Reporting Standards Accounting for financial instruments— IFRS 9 and IAS 39 at 1 January 2012 Joint World Bank and IFRS Foundation ‘train the trainers’ workshop hosted by the ECCB 30 April to 4 May 2012 The views expressed in this presentation are those of the presenter, not necessarily those of the IASB or IFRS Foundation. © IFRS Foundation | 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org Introduction 3 • Replace IAS 39 Recognition and Measurement with IFRS 9 Financial Instruments in phases • Phase I: Classification and measurement (completed) • Phase II: Impairment (in progress) • Phase III: Hedge accounting (in progress) • Offsetting financial assets and financial liabilities (completed) © IFRS Foundation | 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org 2011 October IFRS Conference | Financial Instruments | C&M and Impairment IFRS 9 Effective date and transition • IFRS 9 effective 1 January 2015 – early application permitted • Restatement of comparative financial statements not required – modified disclosures on transition © IFRS Foundation | 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org 4 IFRS 9 Main changes from IAS 39 5 • Reduces complexity – only two classification categories – single impairment model (only FI’s at amortised cost) – embedded derivatives no longer separated from financial asset host contracts • Aligns measurement of financial assets with entity’s ‘business model’ and contractual cash flow characteristics of instruments • ‘Own credit’ risk issue addressed • Elimination of ‘tainting rules’ – that caused bonds to be measured at fair value even if the business model was to hold © IFRS Foundation | 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org 2011 October IFRS Conference | Financial Instruments | C&M and Impairment Classification and measurement Financial assets 6 Business model test Amortised cost (one impairment method) Contractual cash flow characteristics FVO for accounting mismatch (option) Reclassification required when business model changes All other Instruments: • Equities • Derivatives • Some hybrid contracts Fair Value (No impairment) © IFRS Foundation | 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org 2011 October IFRS Conference | Financial Instruments | C&M and Impairment Equities: OCI presentation available (alternative) Financial Assets At amortised cost 7 Business model: • objective of holding instruments is to collect contractual cash flows rather than to sell prior to contractual maturity to realise fair value changes • not an instrument by instrument approach to classification • assess contractual terms of instruments within such a business model © IFRS Foundation | 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org 2011 October IFRS Conference | Financial Instruments | C&M and Impairment Financial Assets At amortised cost continued Contractual cash flow characteristics • Payments represent solely principal and interest • Interest is consideration for time value of money and credit risk • Prepayment/extension options may qualify No ‘tainting’ rules for assets at amortised cost • gains or losses from derecognising such items to be presented separately with additional disclosures © IFRS Foundation | 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org 2011 October IFRS Conference | Financial Instruments | C&M and Impairment 8 Financial Assets Equity investments: OCI alternative Alternative presentation of fair value changes in other comprehensive income (OCI) Scope • investments in equity instruments not held for trading Features • alternative available instrument by instrument • dividends recognised in P&L • no recycling, impairment or change in presentation © IFRS Foundation | 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org 2011 October IFRS Conference | Financial Instruments | C&M and Impairment 9 Financial Assets Embedded derivatives 10 Hybrid contracts Financial host Non-financial host No separation – part of classification IAS 39 guidance retained © IFRS Foundation | 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org 2011 October IFRS Conference | Financial Instruments | C&M and Impairment Financial Assets Fair Value Option (FVO) 11 Fair value option available, if… Accounting mismatch Managed on fair value basis Not managed to collect contractual cash flows = FV Embedded derivative(s) Hybrid contracts with financial host classified in entirety *Circumstances when FVO available is unchanged for financial liabilities © IFRS Foundation | 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org 2011 October IFRS Conference | Financial Instruments | C&M and Impairment Financial Assets Application guidance 12 Unquoted equities and their derivatives • Fair value measurement required • Cost may be an appropriate estimate of fair value – if more recent information not available or a wide range of outcomes • Does not apply to equities held by financial institutions and investment funds Contractually linked and non-recourse instruments • Detailed application guidance • ‘Look through’ approach © IFRS Foundation | 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org 2011 October IFRS Conference | Financial Instruments | C&M and Impairment Financial Assets Summary of Key Changes IAS 39 13 IFRS 9 Classification Many categories each with different measurement Measurement methods Two measurement bases: Amortised cost and Fair Value Impairment Only debt instruments at amortised cost are tested for impairment Different impairment rules depending on category and instrument type © IFRS Foundation | 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org 2011 October IFRS Conference | Financial Instruments | C&M and Impairment Irrevocable option at initial recognition to present fair value changes of some equity investments in OCI Financial Assets Summary of Key Changes IAS 39 continued 14 IFRS 9 Tainting Tainting rules for held No tainting rules to maturity investments Reclassification Some reclassifications permitted/required Embedded derivatives Bifurcation of No separation, same embedded derivatives classification approach required in some cases (for hybrid financial assets with financial hosts) FVO Available if specific criteria are met © IFRS Foundation | 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org 2011 October IFRS Conference | Financial Instruments | C&M and Impairment Reclassifications required if and only if business model changes Available if eliminating or significantly reducing an accounting mismatch Example 1: Equity investment 15 Held for trading Fair value - with changes recognised in profit or loss Not held for trading Fair value – irrevocable choice of recognising changes in profit or loss or OCI © IFRS Foundation | 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org 2011 October IFRS Conference | Financial Instruments | C&M and Impairment Example 2: Debt investment (basic loan features) 16 Amortised cost Held to collect contractual cash flows (FVO available if criteria are met) Not held to collect contractual cash flows Fair value through profit or loss © IFRS Foundation | 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org 2011 October IFRS Conference | Financial Instruments | C&M and Impairment Example 3: Debt investment (embedded derivative) 17 Hybrid contract (as a whole) has basic loan features and is Held to collect contractual CFs Whole instrument at amortised cost All other hybrid contracts with financial hosts Whole instrument at fair value through profit or loss © IFRS Foundation | 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org 2011 October IFRS Conference | Financial Instruments | C&M and Impairment Classification and measurement Financial liabilities All financial liabilities Amortise d cost Except: Held for trading 18 FVO for mismatch, managed on FV basis and hybrids Fair value through P&L • Hybrid financial liabilities are bifurcated • No reclassification permitted © IFRS Foundation | 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org 2011 October IFRS Conference | Financial Instruments | C&M and Impairment Own credit in OCI Financial Liabilities FVO and own credit 19 • What is ‘own credit’? – fair value changes in liability arising from changes in the issuer’s credit quality • How is it measured? – often measured as change in margin over a benchmark interest rate • What is the concern? – Gain when credit quality deteriorates, loss when credit quality improves – Reporting such gains and losses is not useful – Board’s Request for Information on measurement of liabilities – ED on classification and measurement © IFRS Foundation | 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org 2011 October IFRS Conference | Financial Instruments | C&M and Impairment Financial Liabilities FVO and own credit continued 20 To address ‘own credit risk’ • Retain IAS 39 measurement requirements for financial liabilities: – – – – held for trading fair value through P&L hybrid liabilities bifurcation requirements in IAS 39 ‘vanilla’ liabilities amortised cost maintain FVO (with current eligibility conditions) BUT • Separate out ‘own credit risk’ for FVO • ‘Own credit risk’ portion would be separated in a manner similar to that previously used in IFRS 7 for disclosure (IFRS 7 B4) © IFRS Foundation | 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org 2011 October IFRS Conference | Financial Instruments | C&M and Impairment Financial Liabilities FVO and own credit continued 21 Financial liability at FVO on statement of financial position at (full) fair value Change in FV attributable to all factors except ‘own credit risk’ Change in FV attributable to ‘own credit’ (not recycled) Profit or Loss Profit Statement of Comprehensive Income XXX Other Comprehensive Income Mandatory for all liabilities at FVO unless this would create or enlarge an accounting mismatch © IFRS Foundation | 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org 2011 October IFRS Conference | Financial Instruments | C&M and Impairment XXX Impairment IAS 39 requirements: • Incurred loss approach for financial assets • Impairment loss only recognised when: – trigger (loss) event occurs – impact can be reliably estimated • More than one model depending on classification © IFRS Foundation | 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org 2011 October IFRS Conference | Financial Instruments | C&M and Impairment 22 Impairment continued 23 Criticisms of the incurred loss approach: • Expected losses not recognised before trigger events – overstates/front-loads interest revenue – results in ‘too little, too late’ recognition of loan losses – triggers inconsistently applied • Does not reflect the underlying economics of the transaction • Need to improve usefulness of financial statements and timing of recognition of losses © IFRS Foundation | 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org 2011 October IFRS Conference | Financial Instruments | C&M and Impairment Hedging 24 • ‘Hedging’ and ‘hedge accounting’ are two different things • What is hedging? – managing risks by using one financial instrument (‘hedging instrument’) purposely to offset the variability in FV or cash flows of a recognised asset or liability, firm commitment, or future cash flows (‘hedged item’) © IFRS Foundation | 30 Foundation Cannon Street | London 6XH | Street UK. www.ifrs.org © 2011 IFRS 30 EC4M Cannon | London EC4M 6XH | UK | www.ifrs.org Example: Hedging 25 • On 1/12/X1 a jeweler purchased 1,000 ounces of gold for $1,500 per ounce to manufacture jewelry whose selling price fluctuates with changes in the gold price • Jeweler is concerned the gold price will decline. – buys an option (settled net in cash) to sell 1,000 ounces of gold at $1,500 anytime in the next two months. The option is measured at FVTPL. – at 31/12/X1 gold price is $1,400 – the $100,000 gain on the option is recognised in profit or loss in 20X1– but the ‘loss’ attributable to the reduced selling price will affect profit or loss in the future (ie when the sale is recognised). • Accounting ‘mismatch’ © IFRS Foundation | 30 Foundation Cannon Street | London 6XH | Street UK. www.ifrs.org © 2011 IFRS 30 EC4M Cannon | London EC4M 6XH | UK | www.ifrs.org What is hedge accounting? 26 • Matching the change in FV of the hedging instrument and the hedged item in profit or loss for the same period • Hedge accounting is only an issue when normal accounting would put the two fair value changes in different periods—sometimes referred to as an ‘accounting mismatch’ © IFRS Foundation | 30 Foundation Cannon Street | London 6XH | Street UK. www.ifrs.org © 2011 IFRS 30 EC4M Cannon | London EC4M 6XH | UK | www.ifrs.org Hedge accounting IAS 39 requirements 27 • Hedge accounting recognises the offsetting effects of changes in the fair values or the cash flows of the hedging instrument and the hedged item. • Strict conditions must be met before hedge accounting is possible: – there must be formal designation and documentation of a hedge, including the risk management strategy for the hedge. – the hedging instrument must be expected to be highly effective in achieving offsetting changes in fair value or cash flows of the hedged item that are attributable to the hedged risk. © IFRS Foundation | 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org Types of hedge accounting Fair value hedge accounting 28 • Hedge exposure to fair value changes of recognised asset or liability or unrecognised firm commitment (or portion of these attributable to a particular risk) • Hedge of the foreign currency risk of a firm commitment • Recognition of gains and losses on hedged item and hedging instrument in profit and loss and adjust the carrying amount of the hedged item (if not measured at cost) © IFRS Foundation | 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org Example: Fair value hedge accounting 29 • Entity borrows 1,000, 3 years, 5% fixed rate, payable at the end, measured at amortised cost • Hedged with a derivative whose value is linked to an interest rate index • End of year 1, market rate = 6%. FV of 50 payable in 1 year at 6% + 1,050 payable 2 years at 6% = 50 x .943396 + 1,050 x .889996 = 982, but this 18 ‘gain’ is not recognised • Value of the derivative declines to -20 • Note: there is small ineffectiveness = 2 © IFRS Foundation | 30 Foundation Cannon Street | London 6XH | Street UK. www.ifrs.org © 2011 IFRS 30 EC4M Cannon | London EC4M 6XH | UK | www.ifrs.org Example: Fair value hedge accounting continued Financial position when loan made: Cash 1,000 Loan payable 1,000 Adjust loan end of year 1 to reflect rate change: Loan payable (hedge acct) 18 P&L (18 gain – 20 loss) 2 Derivative (Liability) 20 Financial position end of year 1: Cash 1,000 Derivative (Liability) 20 Loan payable 982 Equity 2 © IFRS Foundation | 30 Foundation Cannon Street | London 6XH | Street UK. www.ifrs.org © 2011 IFRS 30 EC4M Cannon | London EC4M 6XH | UK | www.ifrs.org 30 Types of hedge accounting Cash flow hedge accounting 31 • Hedge of the exposure to variability in cash flows attributable to a particular risk associated with • a recognised asset or liability or • a highly probable forecast transaction • Hedge of the foreign currency risk of a firm commitment • Portion of hedge deemed to be effective: • gains and losses recognised in OCI • Portion of hedge deemed to be ineffective: • gains and losses recognised in profit or loss • Treatment of cumulative gains or losses differs based on what ‘type’ of asset or liability is subsequently recognised © IFRS Foundation | 30 Foundation Cannon Street | London 6XH | Street UK. www.ifrs.org © 2011 IFRS 30 EC4M Cannon | London EC4M 6XH | UK | www.ifrs.org Example: Cash flow hedge accounting 32 • Entity sells goods for 1,000 floating rate 3-year note receivable • Interest rate risk managed with a derivative (interest rate swap) • End of year 1 interest rates increase – PV of cumulative cash flows increase by 100 • But FV of swap decreases by 105 • Note: Some hedge ineffectiveness © IFRS Foundation | 30 Foundation Cannon Street | London 6XH | Street UK. www.ifrs.org © 2011 IFRS 30 EC4M Cannon | London EC4M 6XH | UK | www.ifrs.org Example: Cash flow hedge accounting continued Opening financial position: Receivable Equity Ineffective portion of hedge: P&L OCI (Equity) Derivative (Liability) Closing financial position: Receivable Equity (OCI) Derivative (Liability) Equity © IFRS Foundation | 30 Foundation Cannon Street | London 6XH | Street UK. www.ifrs.org © 2011 IFRS 30 EC4M Cannon | London 33 1,000 1,000 5 100 (ineffective portion of hedge) 105 1,000 100 (effective portion of hedge) 105 995 EC4M 6XH | UK | www.ifrs.org Types of hedge accounting Net investment in foreign operation • Hedge of a net investment in a foreign operation – as defined in IAS 21 – accounted for similarly to cash flow hedges © IFRS Foundation | 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org 34 Example: Net Investment in foreign operation 35 • Entity A has a wholly-owned subsidiary, Entity B. Entity has a CU functional currency and Entity B has a FCU functional currency. Entity A paid FCU100,000 for the investment in net assets at fair value of FCU80,000. Goodwill of FCU20,000 was recognised. • At acquisition, Entity A loaned Entity CU15,000 (exchange rate was FCU2:CU1). Settlement is not planned or expected in the near future. © IFRS Foundation | 30 Foundation Cannon Street | London 6XH | Street UK. www.ifrs.org © 2011 IFRS 30 EC4M Cannon | London EC4M 6XH | UK | www.ifrs.org Example: Net Investment in foreign operation continued 36 • At acquisition, Entity A designates the net investment in Entity B as a hedged item in its consolidated financial statements. • The maximum amount that can be designated is FCU130,000 • Net assets at FV: FCU80,000 • Goodwill: FCU20,000 • Loan: FCU30,000 • If the loan was expected to be settled in the foreseeable future, it would not form part of the net investment. © IFRS Foundation | 30 Foundation Cannon Street | London 6XH | Street UK. www.ifrs.org © 2011 IFRS 30 EC4M Cannon | London EC4M 6XH | UK | www.ifrs.org Questions or comments? Expressions of individual views by members of the IASB and its staff are encouraged. The views expressed in this presentation are those of the presenter. Official positions of the IASB on accounting matters are determined only after extensive due process and deliberation. © IFRS Foundation | 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org 2011 October IFRS Conference | Financial Instruments | C&M and Impairment 37 38 The requirements are set out in International Financial Reporting Standards (IFRSs), as issued by the IASB at 1 January 2012 with an effective date after 1 January 2012 but not the IFRSs they will replace. The IFRS Foundation, the authors, the presenters and the publishers do not accept responsibility for loss caused to any person who acts or refrains from acting in reliance on the material in this PowerPoint presentation, whether such loss is caused by negligence or otherwise. © IFRS Foundation | 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org