Forensic Accounting/Investigation Methodology - acfe

advertisement

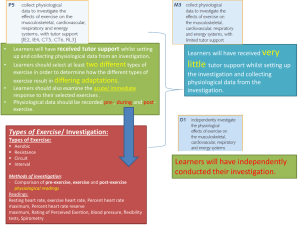

ACCOUNTING TECHNIQUES USED IN A FRAUD INVESTIGATION Mary Anne Basilone, CPA, CFE, MMT, MA Diane A. Matthews, PhD, CPA/CFF, CFE Carlow University Master of Science in Fraud & Forensics Bachelor of Science in Forensic Accounting Bachelor of Science in Accounting 1 TOPICS COVERED INVESTIGATIVE METHODOLOGY METHODS OF PROOF DIRECT INDIRECT DIGITAL ANALYSIS TECHNIQUES 2 METHODOLOGY OVERVIEW STEPS IN CONDUCTING A COMPREHENSIVE FRAUD INVESTIGATION 3 PROCESS MAP Dorrell, D., Gadawski, G. (2012). Financial forensics body of knowledge. Hoboken, New Jersey: John Wiley & Sons. 4 INVESTIGATIVE METHODOLOGY THE PROCESS MAP 5 Forensic Accounting/Investigation Methodology (FA/IM)© FOUNDATIONAL INTERPERSONAL DATA COLLECTION AND ANALYSIS Surveillance -Electronic, Physical Interviews & Interrogation Assignment Development Data Collection Scoping Background Research Identify parties to the case Correlate the matters of law Confirm technical capabilities AICPA/BVFLS Practice Aids Litigation Services Handbook, 4th & Cumulative Supplements NACVA Resources Laboratory Analysis Analysis of Transactions Clear conflict - firm-wide database Insure matching of expectations between counsel and facts and circumstances of matter Determine whether engaged as consultant or expert Prepare and secure engagement letter & retainer Establish concrete timelines, e.g. discovery cutoff, report submittal, etc. Establish counsel communications protocol, e.g. whether/how subject to discovery PostAssignment Testimony & Exhibits Potential Issues Tasks to be Performed References Confidential Informants Trial Preparation Undercover Purpose of Stage TRIAL/REPORTS Identification of all parties Specification of key timelines Privilege determination Agreement on standards Deliverables “Entity / Party Chart” Signed engagement letter & retainer Retainer 6 Forensic Accounting/Investigation Methodology (FA/IM)© FOUNDATIONAL INTERPERSONAL DATA COLLECTION AND ANALYSIS Surveillance -Electronic, Physical Interviews & Interrogation Assignment Development Data Collection Scoping Background Research Continually define/refine universes of data, primary and secondary Confidential Informants Trial Preparation Laboratory Analysis Analysis of Transactions Potential Issues Tasks to be Performed Initiate data collection processes Prepare Document Request(s) as necessary TASKS Genogram Entity(s)/party(s) chart Background investigation References Litigation Services Handbook, 4th, (matter-specific references) GenoPro Gold PostAssignment Testimony & Exhibits Undercover Purpose of Stage TRIAL/REPORTS Insure that all possible data sources are defined Establish protocol to manage data requested and obtained Deliverables “Entity(s)/Party(s) Chart” Genogram Document Request Timeline Analysis 7 Forensic Accounting/Investigation Methodology (FA/IM)© FOUNDATIONAL INTERPERSONAL DATA COLLECTION AND ANALYSIS Surveillance -Electronic, Physical Interviews & Interrogation Assignment Development Data Collection Scoping Background Research Gain confidence of parties Obtain information from parties Confidential Informants Trial Preparation Laboratory Analysis Analysis of Transactions Potential Issues Tasks to be Performed For Depositions: Prepare Deposition Matrix Attend depositions with counsel and advise References Kolb’s “Experiential Learning” www.Reid.com ; w-z.com Edwin T. Hall works ACFE Fraud Examiner’s Manual For Interviews: Background investigation on identified parties Use interpersonal communication techniques to analyze responses for further investigation Proxemic communication Kinetic communication Expectations-based analysis Prepare interview matrix (next slide) Establish preliminary hypothesis using Scientific Method PostAssignment Testimony & Exhibits Undercover Purpose of Stage TRIAL/REPORTS Veracity of parties “Hidden agendas” of parties Blind leads Additional/unrelated matters Communication inhibitors Deliverables Deposition Matrix Updated Genogram Updated “Entity/Party Chart” Interview Matrix Video/audio recordings Preliminary Hypothesis 8 Forensic Accounting/Investigation Methodology (FA/IM)© FOUNDATIONAL INTERPERSONAL DATA COLLECTION AND ANALYSIS Surveillance -Electronic, Physical Interviews & Interrogation Assignment Development Data Collection Scoping Background Research Obtain validating data Obtain refuting data Internet research, e.g. Best Websites for Financial Professionals, Business Appraisers, and Accountants, 2nd TimelineXpress software InData (Events Analysis) Laboratory Analysis Analysis of Transactions Combine first-hand knowledge (e.g., Interviews and Depositions) with second-hand knowledge (e.g., Background Research data See “Online Databases – Sources of Information” See “Government Sources of Information” Identify disparities for additional investigation TASKS Establish search protocol Collect data for validation/corroboration PostAssignment Testimony & Exhibits Potential Issues Tasks to be Performed References Confidential Informants Trial Preparation Undercover Purpose of Stage TRIAL/REPORTS Veracity of parties Currency of information Admissibility of data Deliverables Search Log Updated Genogram “Events Analysis” Output notebook 9 Forensic Accounting/Investigation Methodology (FA/IM)© FOUNDATIONAL INTERPERSONAL DATA COLLECTION AND ANALYSIS Surveillance -Electronic, Physical Interviews & Interrogation Assignment Development Data Collection Scoping Background Research Define data collection plan Obtain data / information Surface evidence References IRS’ MSSP (Market Segment Specialization Program) for selected industries IRS Indirect Methods-Intro IRS Indirect Methods-Example Confidential Informants Trial Preparation Laboratory Analysis Analysis of Transactions Potential Issues Tasks to be Performed Identify remaining data needed to substantiate/refute positions Develop plan to obtain data using investigatory steps Surveillance (Electronic / Physical) Confidential Informants Undercover NOTE: All preceding activities are dependent upon evidence admissibility – counsel must advise TASKS Records-based expectations Reasonableness testing PostAssignment Testimony & Exhibits Undercover Purpose of Stage TRIAL/REPORTS Non-existent data Interpersonal data not verifiable Deliverables Data collection plan 10 Forensic Accounting/Investigation Methodology (FA/IM)© FOUNDATIONAL INTERPERSONAL DATA COLLECTION AND ANALYSIS Surveillance -Electronic, Physical Interviews & Interrogation Assignment Development Data Collection Scoping Background Research Obtain data / information Surface evidence Investigator’s Little Black Book, 4th “TimelineXpress” from inData Corporation Criminal Investigations Laboratory Analysis Analysis of Transactions NOTE: All activities in this Stage are dependent upon evidence admissibility – counsel must advise Mobile v. fixed surveillance Lead, participant and covert informants Develop the assumed identity to gather data / information Document all data / information gathered Develop “Lifestyle Analysis” (See document) Validate / correlate prior data obtained through alternate techniques PostAssignment Testimony & Exhibits Potential Issues Tasks to be Performed References Confidential Informants Trial Preparation Undercover Purpose of Stage TRIAL/REPORTS Missing information Privacy laws Unreliable informant Inconclusive information Entrapment Engagement/personal risks Deliverables Video/audio recordings Root tracing results Digital photographs Validation /correlation of prior data and deliverables 11 Forensic Accounting/Investigation Methodology (FA/IM)© FOUNDATIONAL INTERPERSONAL DATA COLLECTION AND ANALYSIS Surveillance -Electronic, Physical Interviews & Interrogation Assignment Development Data Collection Scoping Background Research Substantiate information by using scientific methods Background investigation Online sources Government sources Software: Genogram/ Timeline/IDEA software Laboratory Analysis Analysis of Transactions Perform any additional indirect or direct analytical forensic techniques as needed Validate / correlate prior data obtained through alternate techniques Genogram/Entity / Party Chart Deposition Matrix/Interview Matrix Search Log/Background Investigation Lifestyles Analysis Net Worth Method PostAssignment Testimony & Exhibits Potential Issues Tasks to be Performed References Confidential Informants Trial Preparation Undercover Purpose of Stage TRIAL/REPORTS Indirect analytical techniques are inconclusive Direct analytical techniques do not support the indictment Deliverables Documented results Validation /correlation of prior data and deliverables 12 Forensic Accounting/Investigation Methodology (FA/IM)© FOUNDATIONAL INTERPERSONAL DATA COLLECTION AND ANALYSIS Surveillance -Electronic, Physical Interviews & Interrogation Assignment Development Data Collection Scoping Background Research Obtain sufficient relevant data to provide credible evidence Bragg, Steven M., Business Ratios and Formulas (Wiley) Benford’s – www.nigrini.com IDEA software Laboratory Analysis Analysis of Transactions Summarize and analyze the findings of all deliverables and observations Identify any missing information or “gaps” DRAFT the Forensic Accountant’s Report TASKS Common-sizing Horizontal analysis Vertical analysis Statement analysis (written) PostAssignment Testimony & Exhibits Potential Issues Tasks to be Performed References Confidential Informants Trial Preparation Undercover Purpose of Stage TRIAL/REPORTS Forensic Accountant’s Report does not support the indictment Additional techniques do not substantiate missing gaps Deliverables “Gap” Analysis Indictment Matrix WPN (words/pictures/numbers) 13 Forensic Accounting/Investigation Methodology (FA/IM)© FOUNDATIONAL INTERPERSONAL DATA COLLECTION AND ANALYSIS Surveillance -Electronic, Physical Interviews & Interrogation Assignment Development Data Collection Scoping Background Research Prepare for trial Integrate parties & information Ensure the completeness of all testimony and exhibits Writing and Defending Your Expert Report (SEAK) The Visual Display of Quantitative Information (Tufte) Laboratory Analysis Analysis of Transactions Obtain counsel’s and opposition’s DRAFT Trial Brief Identify the presentation sequence of evidence Identify portions of report used as exhibits Identify items used for expert testimony Develop tactical trial plan TASKS Reperform Reverse Proof PostAssignment Testimony & Exhibits Potential Issues Tasks to be Performed References Confidential Informants Trial Preparation Undercover Purpose of Stage TRIAL/REPORTS Meeting tight/changing timelines Presentation too complicated Deliverables Scripted Report 14 Forensic Accounting/Investigation Methodology (FA/IM)© FOUNDATIONAL INTERPERSONAL DATA COLLECTION AND ANALYSIS Surveillance -Electronic, Physical Interviews & Interrogation Assignment Development Data Collection Scoping Background Research Add credibility to the case by providing expert information Confidential Informants Trial Preparation Laboratory Analysis Analysis of Transactions Potential Issues Tasks to be Performed PRACTICE, PRACTICE, PRACTICE Deliver expert witness testimony Explain exhibits TEACH the trier(s) of facts References Cross-Examination: T/he Comprehensive Guide for Experts (SEAK) Kolb, Experiential Learning PostAssignment Testimony & Exhibits Undercover Purpose of Stage TRIAL/REPORTS “Surprises” Extraordinary personal stress Deliverables Expert Witness Testimony Transcript 15 Forensic Accounting/Investigation Methodology (FA/IM)© FOUNDATIONAL INTERPERSONAL DATA COLLECTION AND ANALYSIS Surveillance -Electronic, Physical Interviews & Interrogation Assignment Development Data Collection Scoping Background Research Obtain the results of the case Benefit from the experience Laboratory Analysis Analysis of Transactions Learn from the experience Assess firm’s performance TASKS Evaluate performance of each party Update CV Extract “show and tell” as feasible Follow-up with counsel; grading form Potential Issues Your previous results Continuous professional development Deliverables PostAssignment Testimony & Exhibits Tasks to be Performed References Confidential Informants Trial Preparation Undercover Purpose of Stage TRIAL/REPORTS Verdict Judge’s Ruling “Lessons Learned” Updated CV 16 METHODS OF PROOF (OF FRAUD) FOR FINANCIAL INVESTIGATORS DIRECT METHODS SPECIFIC ITEM METHOD FINANCIAL RELATIONSHIPS FINANCIAL STATEMENT ANALYSIS HORIZONTAL VERTICAL TREND RATIO CASH FLOW 17 METHODS OF PROOF (OF FRAUD) FOR FINANCIAL INVESTIGATORS INDIRECT METHODS NET WORTH METHOD (AKA ASSET METHOD) EXPENDITURES METHOD (AKA LIFESTYLES METHOD) (AKA SOURCES AND APPLICATION OF FUNDS METHOD) BANK DEPOSIT METHOD 18 METHODS OF PROOF (OF FRAUD) FOR FINANCIAL INVESTIGATORS Information for specific industries IRS’s Market Segment Specialization Program (MSSP) Audit Techniques Guides (ATGs) Learn distinct , detailed practices in a particular industry Examination techniques Common & unique industry issues Business practices Terminology Example of market segments: Construction or entertainment industry Professions: lawyers or real estate agents 19 METHODS OF PROOF (OF FRAUD) FOR FINANCIAL INVESTIGATORS Direct-Specific item method Most common method Relies on specific transactions Uncovers specific financial transactions which relate to illegal activity, and to the suspect Review books, records, bank accounts… directly traces a transaction Direct (vs circumstantial) proof Easiest to present @ trial Most difficult for the suspect to refute Example: Ghost employee on the payroll 20 FINANCIAL STATEMENT ANALYSIS NEED FOR FINANCIAL STATEMENT ANALYSIS COSO REPORT TO THE NATIONS POWER OF FINANCIAL STATEMENT ANALYSIS FINANCIAL RELATIONSHIPS SALES VERSUS COST OF GOOD SOLD SALES VERSUS ACCOUNTS RECEIVABLE SALES VERSUS INVENTORY ASSETS VERSUS LIABILITIES FINANCIAL STATEMENT FRAUD FICTITIOUS REVENUES TIMING DIFFERENCES CONCEALED LIABILITIES AND EXPENSES IMPROPER DISCLOSURES IMPROPER ASSET VALUATION FINANCIAL STATEMENT ANALYSIS PERCENTAGE ANALYSIS: HORTIZONAL PERIOD TO PERIOD INDUSTRY STANDARDS COMPETITORS VERTICAL COMMON SIZE STATEMENTS TREND ANALYSIS FINANCIAL STATEMENT ANALYSIS CON’T RATIO ANALYSIS LIQUIDITY ASSET MANAGEMENT DEBT MANAGEMENT PROFITABILITY CASH FLOW ANALYSIS OPERATING INVESTING FINANCING INDIRECT METHODS OF PROOF CIRCUMSTANTIAL PROOF ADMISSIBLE IN COURT(1954 Supreme Court Holland v. U.S.) WHEN TO USE? Inadequate books/records Suspected: books do not reflect all income Significant increase in net worth Gross profit % changes significantly Expenses exceed reported income without cause Suspected income from unidentified sources is large 26 INDIRECT METHODS OF PROOF SOURCES OF INFORMATION County courthouse: deeds of ownership, titles, liens, UCC filings The target Informants/associates Real estate records Bankruptcy records State motor vehicle records Loan applications Surveillance Credit card applications/statements Tax returns Insurance records Child support/divorce records Employment: salary, W-2s Cancelled checks Deposit slips 27 INDIRECT METHODS OF PROOF (O NET WORTH METHOD Used to prove illicit income Person’s assets or expenditures exceed known sources of income 4 ways to dispose income: 1. 2. 3. 4. Save it Buy assets Pay off debt Spend it 28 INDIRECT METHODS OF PROOF (O NET WORTH METHOD FORMULA Assets -Liabilities =Net worth -Prior year’s net worth =Increase in net worth +Living expenses =Income (or expenditures) -Funds from known sources =Funds from unknown sources 29 INDIRECT METHODS OF PROOF (O EXPENDITURES METHOD Sources & Application of Funds; Lifestyles Method CLUES Lavish residence Expensive cars/boats Vacation home Private schools for children Exotic vacations WHEN TO USE?...WHEN TARGET Operates mostly on a cash basis Little or no net worth but large expenditures Little or no change in assets or liabilities 30 INDIRECT METHODS OF PROOF (O EXPENDITURES METHOD FORMULA Total expenditures (i.e., Application of funds) -Known sources of funds =Funds from unknown sources 31 INDIRECT METHODS OF PROOF (O BANK DEPOSIT METHOD WHEN TO USE? Assets & liabilities are fairly constant No indications of extravagant lifestyle Target’s known income is being deposited into financial institutions HOW? Analyze bank deposits, cancelled checks, currency transactions 32 INDIRECT METHODS OF PROOF (O BANK DEPOSIT METHOD FORMULA Total deposits to all accounts -Transfer and redeposits =Net deposits to all accounts +Cash expenditures =Total receipts from all sources -Funds from known sources =Funds from unknown or illegal sources 33 DIGITAL ANALYSIS TECHNIQUES SOFTWARE PROGRAMS PERFORM DATA MINING Extracting information from databases Comb DB for obscure patterns Sort data to detect potential fraud same address for two employees DATA ANALYTICS Statistical process used to analyze data Identify red flags, transaction trends, patterns, anomalies 34 DIGITAL ANALYSIS TECHNIQUES FUNCTIONS Sorting Record selection Joining files Multi-file processing Correlation analysis Date functions Graphing Verifying multiples of a number Compliance verification Duplicate searches Vertical ratio analysis Horizontal ratio analysis 35 DIGITAL ANALYSIS TECHNIQUES FUNCTIONS Data file inquiry Random unit sampling Calculate totals Calculate averages Specific criteria searches Unusual item inquiries Link analysis graphics Identify gaps in sequence Identify duplicates Differentiate normal patterns from suspect patterns Benford’s Law analysis Stratification 36 DIGITAL ANALYSIS TECHNIQUES EXAMPLES Identify invoices w/o PO Look for invoices from vendors not “approved” Analyze claims paid by insurance providers Look for high volume purchases from one vendor Match names, addresses, phone numbers, SS numbers between employee and vendor files Identify dormant accounts with activity Search for large, rounded transaction values 37 DIGITAL ANALYSIS TECHNIQUES COMMERCIAL SOFTWARE Excel ACL IDEA ActiveData for Excel AutoAudit SNAP! Reporter DataWatch’s Monarch for Windows Oversight Systems Case Management Software—Analyst’s Notebook i2; LexisNexis CaseMap Organize, evaluate, explore evidence Timeline Software— TimelineXpress (inData Corp) Genogram--GenoPro 38 ACCOUNTING TECHNIQUES USED IN A FRAUD INVESTIGATION Mary Anne Basilone, CPA, CFE, MMT, MA Chair, Accounting & Forensic Accounting Programs mabasilone@carlow.edu Diane A. Matthews, PhD, CPA/CFF, CFE Associate Dean, School of Management damatthews@carlow.edu 39