Billing Information Session

advertisement

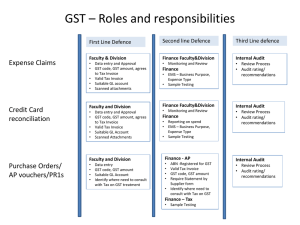

External Billing Procedures: Information Session 0 Agenda Introduction 5 minutes Topic 1: Why is the University Implementing the Cash and Billing Policy? 5 minutes Topic 2: Billing Procedures Key Points 30 minutes Topic 3: Question and Answer 15 minutes Next Steps 5 minutes 1 Logistics Participate Ask questions Turn off cell phones One person at a time Location of washrooms Emergency procedures 2 Session Objectives At the completion of this session, you will be able to: – Explain why the University is implementing the new Cash and Billing Policy – Explain the key points within the External Billing procedures – Manage and process invoices effectively and efficiently – Explain where to go for assistance and help on the policy and procedures 3 Session Structure Presentation Reviews/Questions /Answers 4 Why is the University implementing a new Cash and Billing Policy? Auditor General’s Report – Address potential fraud issues – Provide clear guidelines and proper controls to ensure employees are not placed in a harmful position Decentralized processes – Processing of invoices is managed in a variety of ways – Results in lack of internal controls – Results in invoices not being processed correctly – Increases AR effort in matching payment and invoice 5 Why is the University implementing a new Cash and Billing Policy? Clarify accountability Implement best practices Improve internal controls Ensure customers are credit worthy Ensure the University is compliant with legislation Create efficiency through standardization of processes and procedures – University invoice format standardized 6 How do these changes impact me? You may need to: – Ensure you are aware of the changes and new procedures and have a clear understanding of your role and responsibility – Communicate to your Department staff the implications of the policy – Update your internal processes to align with the policy and procedures 7 Topic 2: Key Points Invoicing Approval of Invoices Granting Credit Cost Recovery Responsibilities of a Billing Unit Wire Payments Collections 8 Invoicing All billing / invoices are to be processed through the Finance, Supply Chain Management and Research (formerly PeopleSoft) system (FSR), Billing Module Key points – Word documents or manual invoices are not an acceptable format – If billing outside of FSR in another system, contact the AR Department – Exceptions: Tuition, Donations, Retail Sales and approved exceptions 9 Approval of Invoices Department Heads – Individual with the authority for approval (e.g., Manager, Researcher, etc.) – Approves all invoices created for Faculty / Department Two methods – Recorded on invoice’s supporting documentation • For example: Signed Contract, PO Document – Documented on a pro forma invoice (printed copy of invoice prior to invoice being set to ready in FSR) • Applicable supporting documentation attached to approved pro forma invoice 10 Granting Credit Department chooses to invoice – Customer rather than obtain payment at time good / service, or – When a recoverable cost is paid Decision to extend credit rests with the accountable Department Head 11 Granting Credit Department / Department Head responsible to – Determine credit worthiness of that customer – Be responsible for associated credit risks • Charges to be charged to Department bad debt account – Notify AR of any changes to customer information Only those authorized by AR may grant credit to a customer – Request submitted in writing to Accounts Receivable using the Request for New AR Customer/Change in AR Customer Information form • New customer is created in FSR so that the invoice can be processed properly 12 Cost Recovery With a Markup: Without a Markup: If amount is > amount paid = recovery with a mark-up (sale) GL account credited must be Revenue account and not an expense account GST is charged as it would be for a normal sale of good/service If amount is not > amount paid = recovery without a markup (true recovery) GL Account credited must be expense account to which original charge posted Unrecoverable portion of GST included in recovery as part of base expense; recoverable portion not to be included No GST charged on the invoice 13 Cost Recovery: GST example Without a Markup: Original Cost = $100 + $5 GST Amount charged to the expense account is $100 + $1.67 (1/3 unrecoverable portion of GST) Amount invoiced as a recovery = $101.67 No amount should be included as GST on the invoice 14 GST Treatment GST Treatment – Department is responsible to ensure correct GST assessment of invoice • Five applicable GST assessment codes – FSR Billing Module automatically calculates the applicable GST depending on the code assigned • Ensure you check the default code prior to overriding • Driven by customer setup and address and assigns GST treatment based on address – Contact AR if unsure of how to apply GST 15 Responsibilities of Billing Unit Timing – Bill only within the current month – Bills outstanding at month end, must be resolved by 11:00 a.m. on the first business day of the following month • Unprocessed items will be deleted by AR – New invoices are not to be backdated to prior period – Posting after the period or backdating causes significant system errors Invoice Request Form – AR can provide billing services for those Faculties / Departments who process < 10 billings per year – Invoice Request Form should be completed and forwarded to AR 16 Payments All payments are to be sent directly to Accounts Receivable – Internal mail should not be used – Department advises customer to send future payments directly to AR – Hand-delivered to AR – Should not be deposited at the Cashier’s Office or included in Departmental deposits Invoice number – System generated alpha numeric characters Cheques must be payable to the University of Calgary 17 Incoming Wire Payments Banking Information – Only AR is authorized to communicate University banking information – Against policy to forward University’s banking information to a Department, Faculty or Customer – Requests must be send to AR via Request for Banking Information Form Form – Accounts Receivable sends out form to customer which outlines all information AR requires to accept and allocate payments 18 Collections Department Collections – Expectations and directions are clearly identified through procedures • Aged Receivables Report – Communicate back to AR collection activities that have been conducted and status Resulting bad debt charged to Department initiating invoice 19 Topic 3: Question and Answer 20 Next Steps: Where to go for Help Financial Services Website – http://www.ucalgary.ca/financial/controller /accounts_receivable Contact: – ar@ucalgary.ca 21 www.ucalgary.ca/financial 22 Next Steps Accounts Receivable is currently assessing training requirements Future Training – Instructor-led courses – Online self-study courses – Reference material 23 Session Evaluation Please complete the session evaluation 24