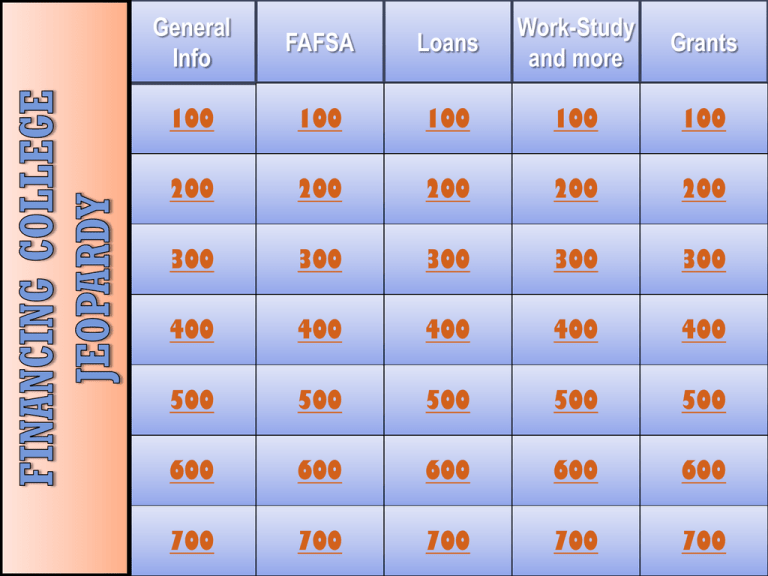

Blank Jeopardy

advertisement

General Info Loans Work-Study and more FAFSA Grants 100 100 100 100 100 200 200 200 200 200 300 300 300 300 300 400 400 400 400 400 500 500 500 500 500 600 600 600 600 600 700 700 700 700 7001 100 Name three types of financial aid? 2 Loans, grants, and scholarships (also work-study and educational savings plans) 3 200 Who should you contact to talk about your financial aid package? 4 The Financial Aid Office at the school to which you applied 5 300 What’s the difference between a loan and a grant? 6 Loans have to be repaid. Grants are “free” money. 7 400 TRUE or FALSE: Enrolling as a part-time student will affect your financial aid package. 8 TRUE Your status as a full-time or part-time student determines your eligibility for aid. Generally, more aid is available for full-time students. 9 500 Name three sources of financial aid. 10 •The federal government •The state government •The school you plan on attending •Employers •Banks •Scholarship organizations •Family •Faith-based organizations 11 600 What is the “net price” of a college? 12 The amount of money a family must secure through loans, workstudy, or cash deposits to attend a given school. advertised cost of school – grants, scholarships, & discounts net price 13 700 Other than tuition, name 2 expenses associated with the cost of college. 14 •Room & Board •Textbooks •Transportation •Meals 15 100 TRUE or FALSE: The FAFSA is free to complete. 16 TRUE You should not pay any fee to complete the FAFSA. It is FREE and free assistance is available. 17 200 What is the earliest you can complete the FAFSA for the upcoming school year? 18 January st 1 ex. For the 2012-2013 school year, you can start the FAFSA on January 1, 2012. 19 300 What are the age requirements for the FAFSA? 20 There are none. The FAFSA is open to students of any age. 21 400 How often should you complete the FAFSA? 22 Every year you plan on attending school. 23 500 What does EFC stand for? 24 Expected Family Contribution 25 600 What is the best time to complete your FAFSA? 26 The sooner, the better. You can fill it out as early as Jan. 1st but you will need your tax information. 27 700 What two types of assets do you NOT need to include in your FAFSA? 28 Retirement and business assets 29 100 TRUE or FALSE: The federal government only gives out loans to students. 30 FALSE The Free Application for Federal Student Aid (FAFSA) can qualify BOTH students and their parents for loans to help pay for college. 31 200 What is the name of the federal loan given to parents of college students? 32 The PLUS loan 33 300 What is the name of the federal loan given to most students? 34 The Stafford loan Some students also qualify for a Perkins loan. 35 400 What does it mean if you get a loan that is “subsidized”? 36 The government will pay the interest on your loan while you are in school. 37 500 When do you have to start repaying your federal loans? 38 Six months after you have completed school or stopped enrolling. 39 600 What is the difference between a federal loan and a private loan? 40 Federal Private •serviced by the gov’t •6-month grace period •deferral & forgiveness options •different repayment plans •serviced by a bank •may not have a grace period •may not have deferral or forgiveness options •may not have flexible repayment options 41 700 Name one instance when a loan payment can be deferred? 42 •Enrollment in school •Economic hardship •Unemployment •Military Service 43 100 How do you qualify for work-study? 44 Check the work-study option when you file the FAFSA. (Your FAFSA information will determine your eligibility for workstudy.) 45 200 How do I find a work-study job? 46 The Financial Aid Office at your college can tell you where to find work-study job listings both on and off campus. 47 300 When do I get the money I earn through work-study? 48 Work-study money is given in the form of a paycheck. Depending on your job, you may get a weekly, bi-weekly, or monthly check. 49 400 Is there a limit to the amount of money you can earn through a work-study job? 50 Yes The amount of work-study money you can earn per year is determined by your FAFSA and shown on your Student Aid Report. 51 500 TRUE or FALSE: Individual colleges offer their own grants and scholarships 52 TRUE! Financial aid is available from colleges themselves as well as the federal and state government. 53 600 What is the difference between financial aid given by colleges and aid given by the government? 54 Aid from Colleges Aid from Gov’t •Contingent on your •Not linked to a enrollment to that particular school particular school •May take more •Determined by factors into FAFSA/PHEAA consideration than just the FAFSA 55 700 How do I qualify for financial aid from individual colleges? 56 1. Complete the FAFSA 2. Meet all schoolbased deadlines (which tend to be much earlier than FAFSA deadlines) 57 100 TRUE or FALSE: Grants are “free” money and do not need to be repaid. 58 TRUE 59 200 What is a Pell grant? 60 A Pell grant is a grant given by the federal government for post-secondary education. 61 300 What factors determine if you get a grant? 62 • Financial Need (determined by your FAFSA) • Timeliness (grant money is given on a “first come-first serve” basis. The earlier you complete your FAFSA, the better) 63 400 Other than the federal government, who else gives out grants for college? 64 The state of Pennsylvania 65 500 How do you get a state grant? 66 1. Complete the FAFSA. 2. Complete the state grant form. In Pennsylvania, it is called the PHEAA. (Pennsylvania Higher Education Assistance Agency) 67 600 Do I have to be a resident of Pennsylvania to get a Pennsylvania state grant? 68 Yes. For more details about state grant eligibility, visit www.pheaa.org 69 700 Where can I find the PHEAA application? 70 When you complete the FAFSA, there will be a link to the PHEAA application on the confirmation page. *Remember to download the signature page, sign it, and mail it in! 71