Edison HS

advertisement

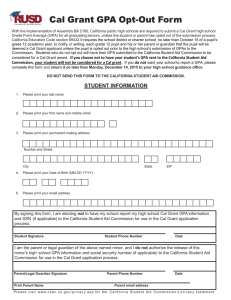

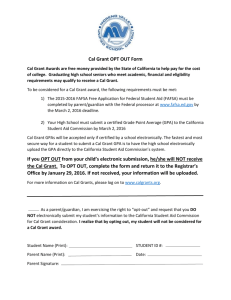

What is Financial Aid? Financial Aid is a general term colleges use to describe all of the programs that help families pay for college or vocational training Sources of Financial Aid 0Federal government 0State government 0Colleges and universities 0Private agencies, companies, foundations and your parents’ employers Types of Financial Aid 0Gift Aid – Grants or scholarships that do not need to be repaid 0Work - Money earned by the student as payment for a job on or off campus 0Loans – Borrowed money to be paid back, usually with interest Cal Grants 0 Cal Grant A Entitlement Awards – for students with a GPA of at least 3.0, family income and assets below the state ceilings, and who demonstrate financial need 0 Cal Grant B Entitlement Awards – for students from disadvantage or low income families with a GPA of at least 2.0, family income and assets below the state ceilings, and who demonstrate financial need 0 Cal Grant C Awards – for students from low income families pursing vocational programs of study Eligibility & Requirements for Cal Grant 0 To be eligible for a Cal Grant, the student must also: be a U.S. citizen or eligible non-citizen be a California resident attend a California college or university 0 Cal Grant Application Requirements • Free Application for Federal Student Aid (FAFSA) • Cal Grant GPA Verification Form Check with your high school or college counselor for more details on how to file the Cal Grant GPA Verification form Need-Based Federal Grants 0 Pell Grants 0 $5550 maximum per year 0 Supplemental Educational Opportunity Grants (SEOG) 0 $4,000 maximum per year *for the lowest income students Types Of Applications 0 FAFSA 0 Cal Grant GPA Verification Form 0 Other Applications or forms as required by the college such as: • CSS Financial Aid Profile • Institutional Scholarship and/or Financial Aid Application 0 Federal tax returns (along with schedules and W-2s) or other income documentation FAFSA Information & Tips File Early Use estimated income information if taxes are not complete at time of FAFSA submission Student and at least one parent must complete & sign FAFSA Federal Pin 0 Pin serves as the electronic signature 0 Both student and at least one custodial parent need PIN to sign the FAFSA electronically 0 May be used to: Check FAFSA status Verify and correct FAFSA data Add additional schools to receive FAFSA data Change home and e-mail address 0 If an e-mail address is provided, PIN will be e-mailed to the PIN applicant within hours Apply TODAY for student & parent PINS: www.pin.ed.gov Getting Ready Before starting the FAFSA, gather: 0 Student driver’s license 0 Student Alien Registration Card 0 Student and Parent 0 Social Security cards 0 W-2 Forms and other records of money earned 0 Federal Income tax form (even if not completed) 0 Records of untaxed income 0 Current bank statements 0 Business, farm and other real estate records 0 Records of stocks, bonds, and other investments Create a file for copies of all financial aid documents submitted Questions? www.collegefinancialaidadvisors.com https://www.udemy.com/college-financial-aid/?couponCode=jodi30 Special 30% discount link for College Night attendees!