Introduction to Healthcare and Insurance at UChicago

advertisement

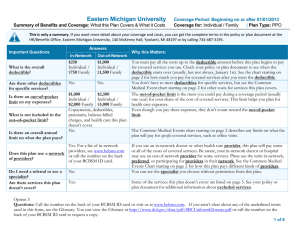

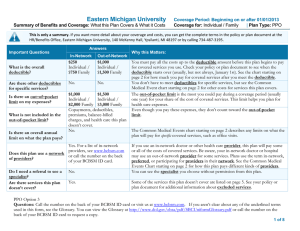

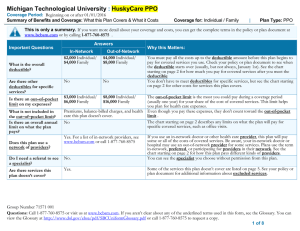

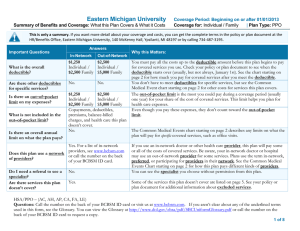

An Introduction to Healthcare & Insurance at The University of Chicago STUDENT HEALTH AND COUNSELING SERVICES Accessing Healthcare at UC • Student Health Service (SHS) 860 E. 59th St. (Goldblatt Pavilion Entrance), R-100 (773) 702-4156 healthcare.uchicago.edu • Student Counseling Service (SCS) 5737 S. University Avenue (773) 702-9800 counseling.uchicago.edu • Health Promotion & Wellness (HPW) Woodlawn Social Services Center, 950 E. 61st St., 3rd floor (773) 702-8247 wellness.uchicago.edu Student Life Fee vs. Insurance (U-SHIP) • All registered students pay a quarterly Student Life Fee. – Provides access to Student Health Service and Student Counseling Service • Health services covered by the Student Life Fee: e.g., acute/chronic care, routine physicals, short-term psychotherapy, academic/study skills counseling, etc. • Private insurance / U-SHIP covers: – Prescriptions, hospitalizations, ER care, lab tests, long-term psychotherapy, consultation and treatment by specialists, etc. Where to Go for Services Primary medical and mental health care, wellness programming: • Covered by Student Life Fee & provided by SHS, SCS, HPW Referrals provided to specialists / for tests • If on U-SHIP, referral required from SHS/SCS; if referral is not obtained in advance, $50 penalty is assessed Is it an Emergency? • If SHS closed, call 24-hour Nurse Advice Line – 773.702.1915 – to determine if ER services are required (otherwise, claim may be denied) Student Health Insurance Plan: U-SHIP • UC requires ALL students to have adequate health insurance • All registered students enrolled annually in U-SHIP • Deadline: by 4th Friday of one’s first registered quarter, each year, all students must either: – Waive out of U-SHIP (comparable coverage required) or – Enroll dependents • Students remain enrolled for the full academic year Enroll or waive at: http://studentinsurance.uchicago.edu Navigating Health Insurance Insurance Terminology • Premium – The amount of money – generally paid on a monthly, quarterly or annual basis – that you pay to cover the cost of your health insurance. • Deductible – The amount you need to pay before your insurance plan starts to cover your medical costs. • Annual out-of-pocket maximum – The amount your insurance plan does not pay and you are expected to pay. • Co-insurance – A percentage of the cost of your treatment that you are required to pay (i.e., 10%, 20%, or 30% typically), after your plan’s deductible has been fully paid. For additional help, see the “Health Insurance Glossary” on the SCHS website: studenthealth.uchicago.edu Navigating Health Insurance : U-SHIP • 2013-2014 Premium – $3,021 (billed in 3 quarterly installments of $1,007) • Deductible – $200 (in-network); $500 (out-of-network) • Annual out-of-pocket maximum – $1,500 (in-network); $2,500 (out-of-network) • Co-insurance – 10%; plan pays 90% after deductible has been met • Prescriptions paid by co-pay, 3 tiers of coverage ($10, $25, $40) Navigating Health Insurance : U-SHIP Example You’re running across the quad, slip on the ice, and break your leg. Ooops. SHS refers you to a specialist who sends you to X-ray, then sets your leg, and gives you a cast. When the cast is removed, you are referred to 12 sessions of physical therapy. Here’s the bill, BEFORE insurance, and with U-SHIP applied: Aggregated doctor/hospital bill: What you’re responsible for: Specialist visit (with tests): $ 3,480 Deductible: Cast & crutches: $ (balance is now $ 11,277) Follow-up doctor’s visit: $ 2,750 U-SHIP covers 90% ($10,149.30) Physical therapy: $ 4,320 Co-insurance costs (10%): $ 1,127.70 Total billed costs: $ 11,477 927 Your total bill for injury: $ 200.00 $ 1,327.70 Alternative Insurance Examples Here are two more possibilities, with two alternate insurance plans: UHC Internat’l Plan ISO Plan $ 1,754 Premium $1,428 $350 Deductible $500 $7,500 Out-of-Pocket $1,500 80% Co-insurance 80% Here’s how the insurance scenario plays out: UHC Internat’l Plan ISO Plan $ 11,477 Total billed amount $ 11,477 $350 Deductible owed $500 $2,225.40 Co-insurance owed $2,195.40 $2,575.40 Total amount due $2,695.40 $4,329.40 Total paid (w/ premium) $4,123.40 Alternative Insurance: Comparable Coverage To waive U-SHIP, students must have active insurance with comparable coverage: 2013-2014 plan year • Alternate plans must include list of UC-designated required benefits • Must provide benefits at established coverage levels (i.e., 80%) 2014-2015 plan year – requirements tied to ACA • Alternate plans must include ACA “essential health benefits” • Individual plan out-of-pocket maximum < $6,350 • Family plan out-of-pocket maximum < $12,700 • Must also provide coverage for non-emergency care in Chicago! Provides greater flexibility for students and families Wider range of plans will meet requirements to waive coverage Researching Alternatives to U-SHIP To waive U-SHIP, alternate insurance plans must: • Meet University requirements for comparable coverage • Be active from the time of the student’s arrival on campus through the end of their program or the end of the current academic year Beginning in 2014-2015, a subset of alternate insurance plans will be audited for compliance. Accessing Insurance Assistance at UC Student Health Insurance office • Woodlawn Social Services Center, 950 E. 61st Street, 3rd floor United Healthcare Student Resources On-campus insurance reps: Sue Williams & Janice Thomas • Mon-Fri, 8:00 am-4:30 pm, rooms 368 / 370 • 773.834.4543 (option #2) or uchicagoadvocates@uhcsr.com UC Student Health Insurance Coordinator Student advocate: Marcy J. Hochberg • Mon-Fri, 8:30 am-5:00 pm, room 366 • 773.702.1279 or mhochberg@uchicago.edu ONE SERVICE <<< MULTIPLE LOCATIONS Summing Up – Affording Health Care at UC Health care access: • Student Health / Student Counseling – covered by Student Life Fee • Additional services, testing, specialists – covered by insurance Reviewing alternate insurance plans: • Consider impact of all costs: premium, deductible, outof-pocket max, co-insurance, co-pays • Must meet UC requirements for comparable coverage • Review exclusions carefully! Questions? shcs.uchicago.edu