Andrea Morgan, Gary Moore, Melissa Greenslade

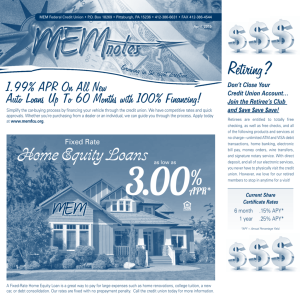

advertisement

BUDGETING FOR COLLEGE: Credit Cards & Credit Reports Andrea Morgan, Gary Moore, Melissa Greenslade Program Coordinators University of Arkansas, Office of Financial Aid What is Credit? Credit the extent to which someone, usually a bank, is willing to loan you money and trusts that you will pay it back in the future. Benefits and Rewards of Using Credit Can be helpful in emergency situations Can be safer for online purchases or travel Safer than carrying cash Establish good credit history Risks of Credit Cards Easy to make impulse purchases Interest rates (APR) and fees can add up and increase the amount you owe Could damage your credit report Establish Healthy Credit Having a good credit history is important! To qualify to borrow more and at a lower interest rate on future purchases, like buying a car or a house Types of Credit: Revolving Secured, Accounts: Credit Cards Store, Standard (Retail) Installment Loans Mortgage Loans Student Loans Don’t use over 15-20% of your net income for nonmortgage debt payments Types of Credit: Secured Credit: something of value is presented to the lender as collateral in case you default on the loan. Examples: Vehicle or House Loans – if you don’t pay, the lender can take back your car or house. Unsecured Credit: a loan that does not have collateral securing the loan. If you stop paying, there is nothing for the lender to take back. Examples: Credit Cards, Student Loans, Personal Loans Dangerous Credit! Payday Loans Cash Advance on your Credit Card Rent to Own Credit Card Rules for Those Under 21 Anyone under 21 will need a co-signer for a credit card and/or to prove ability to pay The co-signer must agree in writing to any credit limit increase Consumers under 21 can sign up for a secured credit card. Evaluating Credit Card Offers www.federalreserve.gov/creditcard When evaluating a credit card offer consider: APR (Annual Percentage Rate) Grace Period and Fees (sample credit card offer handout) APR Annual Percentage Rate: the actual cost of borrowing money, expressed in the form of a yearly measure (monthly interest = APR) Can be Fixed or Variable Fixed stays the same throughout the loan Variable rates can change annually, monthly or quarterly Average Credit Card Interest Rate: 14.97% (#1-6 and 12 on sample credit card offer handout) Credit Card Grace Period The Grace Period is the number of days you have before you’ll be charged interest on your purchase amount, usually between 20 days and 1 month. (#5 on sample credit card offer handout) Credit Card Fees Annual Fees – between $25 and $60 Cash Advance Fees Balance Transfer Fees Late Fees – average $29 Over the Limit Fee - $25 per purchase (#7, 8, 9 on sample credit card offer handout) What to Look for in a Credit Card Offer Look for the lowest APR, no annual fees, a grace period, and rewards you might be interested in getting (cash back, airline miles, etc.) Good credit sources will be able to offer lower interest rates, provide repayment assistance, and remedy errors and correct billing statements www.cardratings.com (credit cards tab) Reading Your Credit Card Statement (sample credit card account statement handout) www.federalreserve.gov/creditcard 1. Summary of Account Activity 2. Payment Information 3. Late Payment Warning 4. Minimum Payment Warning 5. Notice of Changes to Your Interest Rate 6. Other Changes to Your Account Terms 7. Transactions 8. Fees and Interest Charges 9. Year-to-date Totals 10. Interest Charge Calculation Repayment Example Credit Card Balance = $1000 APR 15% $20 minimum payment How long to pay off loan at minimum payment? 7 years! How much interest will be charged during that time? $580! Credit Card Repayment Calculator: www.federalreserve.gov/creditcardcalculator Credit Reports and Credit Scores A credit report is a collection of information about you and your credit history Includes personal information, account information, some public record information, inquiries into your credit, and creditor information list Free credit reports available annually at www.annualcreditreport.com A credit score is a number predicting how risky it may be to lend you money. Fair Isaac Score (FICO) or VantageScore What Makes Up Your Credit Scores FICO Score Payment History- 35% Outstanding Balances30% Length of Credit History15% New Credit- 10% Credit Mix- 10% Best: 850 Good: 720 Worst: 300 VantageScore Payment History- 32% Utilization- 23% Outstanding Balances15% Depth of Credit- 13% Recent Credit- 10% Available Credit- 7% Best: 900-990 Worst: 501-599 Why are Credit Reports and Credit Scores Important? Lenders usually look at your credit history to help determine whether they will extend you credit, how much, and at what interest rate Employers and Service Providers may also look at your credit history Making late payments, having too many credit cards, or being up to your credit limit can have a negative impact on your credit score Negative information can stay on your credit report for 7-10 years Be a Good Credit Consumer Wisely consider the types of debt you have Only borrow for purchases that help you make money, grow your wealth, or satisfy basic needs Use credit cards sparingly; keep debt balance low Stop charging the moment you know you can’t pay the entire balance Pay off credit cards in full and on time each month, or at least pay more than the minimum amount Know your budget and live within your means What if you Are in Over Your Head? Set a budget and stick to it! Pay more than the minimum payment amount Call your credit card company to see if they can work with you on a payment plan Pay off debt with the highest interest rate first or pay off debt smallest balance first Find a reputable credit counselor Use savings or assets to pay off debt Maintain a good payment history for 6 months and then petition to lower your interest rate The Long and Short of It… College Credit for Life http://www.youtube.com/watch?v=dKzrfy0iVLs Before you go… Please complete and submit your evaluation forms PowerPoint presentation and handouts will be posted on our website Thank You! Contact Information: Office of Financial Aid; Andrea, Gary, and Melissa Campus location: 114 Silas Hunt Hall Phone: 479-575-3806 Fax: 479-575-7790 Website: http://finaid.uark.edu/ And find us on Facebook at University of Arkansas Financial Aid!