Fisher College of Business - Office of Academic Affairs

advertisement

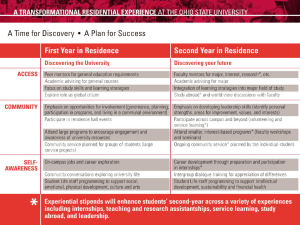

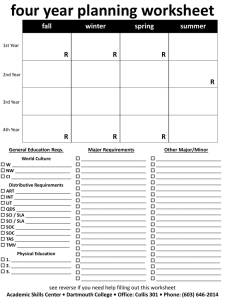

Board of Trustees Presentation Christine A. Poon Dean & John W. Berry, Sr. Chair in Business 1 “I’d like to leave a legacy to help create a school that would bring out the best in kids. . . the kind of students that make an impact on the country and world itself.” - Max M. Fisher 2 Our Vision Forge a vast network of partnerships and collaborations with the rest of the university and the global business community thereby elevating our research, teaching, student experience and the practice of business. 3 Our Students Undergraduate 1000 7,000 6,000 Graduate 33% 950 17% 5,000 900 4,000 3,000 850 2,000 800 1,000 750 0 Au 2003 Au 2012 Au 2003 Au 2012 4 Our People Faculty Tenure and Tenure Track 91 Clinical 9 Senior Lecturers 33 Visiting 6 Subtotal 139 Staff 185 Total 324 5 Our Structure 5 Departments Undergraduate Programs Office 6 Centers Graduate Programs Office Executive Education Unit Career Management Development/Advancement 6 Our Finances Current Sources FY 13 2% 16% 23% State Subsidy UG Fee Revenue 35% 24% Graduate Fee Revenue Outreach Activity Revenue Sponsored Research $72.1MM 7 Our Rankings U.S. News & World Report Undergraduate 2004 Overall: 17 Publics: 10 Supply Chain Management & Logistics: 3 Production & Operations Management : 8 Accounting: 13 Finance: 9 Marketing: 14 Business Week 2013 17 8 5 6 10 11 13 2005 2012-13 Top 50 27 Executive MBA program: 13 14** Undergraduate program: 43 34 MBA program: 8 *USNWR Overall and Public rankings are based on a combination of reputational scores and program data; specialization rankings are based solely on reputation surveys. **Number reflects the most recent ranking of EMBA programs in 2011 Discussion Items • Faculty • Undergraduate Program • Graduate Program • Outreach • Centers and Executive Education • Tell the Fisher Story 9 Faculty 10 Excellent Progress in Research Impact and Productivity 11 Financial Times School 2013 U.S. Research Rank Harvard 1 Pennsylvania 2 UC Berkeley 3 MIT, Duke 4 Stanford, Chicago, NYU 6 Northwestern, Michigan 9 Columbia 11 Ohio State 12 Texas Austin 16 North Carolina 17 Indiana 27 12 Faculty Retention Assistant Associate Full 28 27 16 Chair/Distinguished 20 13 Undergraduate Program 14 Our Undergraduate Rankings Fisher Texas Indiana Rank 34 9 13 Average SAT/ACT (6%) 1305 1362 1299 Median Starting Salary (10%) $50K $55K $53K Academic Quality (30%) 35 35 28 Student Survey (30%) 45 11 20 Recruiter Survey (20%) 13 4 1 15 Student Experience • • • Increase number of students with a four-year Fisher experience Dedicated Office for Student Experience Increase number of honor/honors-like programs Financial Services Manufacturing Health Care Industry Clusters Business Analytics Honors, Honors Accounting, Honors Cohort Energy/ Sustainability Consumer Packaged Goods Dean’s Leadership Academy 16 Graduate Programs 17 Program 2003 2012 Change FTMBA 287 240 -16% WPMBA 262 295 +13% MAcc 95 84 -12% MHR 71 111 +56% SMF 0 43 NA MBLE 0 78 NA MBOE 0 31 NA EMBA 81 71 -12% Total 796 953 +20% 18 Outreach 19 Idealized Center of Excellence • Interdisciplinary • Academic Strength and Interest • Economic Interest to Region/Nation • Generate Innovative Research • Collaboration among Companies and College • Student Engagement 20 Build Partnership with the Business Community through Centers of Excellence Center for Operational Excellence Center for Entrepreneurship Nationwide Center for Advanced Analytics Facilitate a powerful connection with business community The Risk Institute Big Data Center for the Middle Market And elevates our research and teaching 21 Tell the Fisher Story 22 Go Beyond: The Essence There is a singular driving force behind what we do here at Fisher. Go Beyond. It is the core of Max Fisher’s compelling legacy – that with our intellect and heart, we go beyond what’s expected, what’s ordinary, what’s comfortable. Our uniquely prepared students make a meaningful and lasting impact in business, in community, and in the world. This drive defines us. It makes us Fisher. Go Beyond. 23 Supplement 24 3. Letter from the Dean/ Information about the college Since 1916, The Ohio State University Fisher College of Business has produced exceptional leaders who meet the challenges of a changing global business environment through creative and effective solutions. In 1993, the college received a gift from alumnus Max. M. Fisher, a leading industrialist, philanthropist and public servant. Mr. Fisher's desire to see his alma mater become one of the premier management institutions in the country spearheaded the construction of a state-of-the-art, six-building campus. In recognition of his commitment, the college was named the Max M. Fisher College of Business. Since then, the college has undergone a corporate turnaround; narrowing the focus of its programs, recruiting leading faculty, placing a renewed emphasis on experiential learning, and offering a wide range of international study options. Faculty and staff have also established new scholarship and fellowship opportunities, strengthened their commitment to diversity, and created innovative academic and corporate partnerships. As a result, Fisher's international reputation continues to rise and is reflected in rankings which place the college among the top 25 business schools in the nation at both the undergraduate and graduate levels. Fisher College of Business website: http://www.cob.ohio-state.edu/ Strategic Plan website: www.go.osu.edu/FCOBstrategicplan2012 25 4. College Structure and Leadership Christine A. Poon Dean and John W. Berry, Sr. Chair in Business Departments (5) Research & Business Partnership Centers (11) Department of Management & Human Resources Chair, David B. Greenberger Center for Entrepreneurship Center for Operational Excellence (COE) Center for Business Performance Management (CBPM) Department of Accounting & MIS Chair, Waleed Muhanna Department of Management Sciences Chair, Peter Ward Department of Finance Chair, Ingrid Werner Department of Marketing & Logistics Chair, Walter Zinn Center for International Business Education and Research (CIBER) Center for Real Estate Education and Research Charles A. Dice Center for Financial Economics Initiative for Managing Services Innovation Initiative National Center for the Middle Market Nationwide Center for Advanced Customer Insights Global Supply Chain Forum 26 4. College Structure and Leadership (Continued) Christine A. Poon Dean and John W. Berry, Sr. Chair in Business Associate Deans Anil Makhija, Senior Associate Dean Karen Hopper Wruck, Senior Associate Dean H. Rao Unnava, Associate Dean for Executive Programs Pat West, Associate Dean for Undergraduate Programs Support Unit Directors Joddi Giacobbi, Chief Information Officer Cynthia Anderson, Interim Executive Director, Office of External Relations Barb DeYoung, Executive Director, Fiscal and Budget Melinda McDonald, Executive Director, Undergraduate Programs David Harrison, Director, Office of Minority Student Services Larry Murphy, Executive Director, Executive Education Jeffrey Rice, Executive Director, Career Management Nancy Lahmers, Executive Director, Graduate Programs Kurt Roush, Executive Director, Global Business Office Francisco-Xavier Gomez-Bellenge, Associate to the Dean for Special Projects Ann Hamilton, Executive Director, Marketing Communications 27 5. Academic Programs Undergraduate Business Major with specializations in Accounting, Aviation Management, Economics, Finance, Human Resources, Information Systems, International Business, Logistics, Marketing, Operations, Real Estate, and Insurance; a General Business degree is available on the smaller campuses Graduate Masters: Full-time MBA, MBA for Working Professionals, Master of Accounting, Master of Human Resource Management, Specialized Masters-Finance, Master in Business Logistics Engineering PhD: Human Resource Management, Business Administration, Accounting/MIS Executive Executive MBA, Master of Business Operational Excellence 28 9. Undergraduate Graduation Rate The six-year graduation rate of the college has increased by over 8 percentage points since 2007 Graduation Rate and Cohort Size* Fisher College of Business Columbus campus 2007 78.1% 676 71.2% 5,964 2008 82.5% 722 72.7% 5,940 2009 78.4% 741 74.9% 6,354 2010 83.5% 726 78.0% 6,037 2011 85.2% 750 79.7% 5,940 2012 86.4% 878 82.4% 6,266 * 2007 represents the entering class of 2001 29 10. Undergraduate Student/Faculty Ratio and Class Size Percentage of Classes by Size: Autumn 2012 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Percentage of classes of 50 or more Percentage of classes between 20 and 49 Percentage of classes under 20 Fisher College of Business Fisher College of Business University Percentage of classes under 20 7% 27% University Percentage of classes between 20 and 49 65% 57% Percentage of classes of 50 or more 28% 16% Student to Faculty Ratio 49 to 1 19 to 1 30 12. Faculty: Tenure Track FTE by Rank 100 90 80 70 60 50 40 30 20 10 0 In the past 10 years Assistant Professor FTE has surpassed Associate Professor FTE 2003 2004 Instructor 2005 2006 2007 Assistant Professor 2008 2009 2010 2011 Associate Professor 2012 Professor 2012 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Professor 38 41 36 34 31 33 35 36 37 35 Associate Professor 33 32 31 30 26 25 23 22 21 23 Assistant Professor 17 15 11 16 19 22 25 26 25 31 1 2 1 1 - - 1 - 2 1 89 90 79 81 76 80 84 84 85 90 Instructor Total 31 13. Diversity & Inclusion: Percent of Tenure Track Faculty FTE by Gender 100 90 Over the past ten years, the percentage of tenure track Business faculty FTE who are female increased by 39% 80 70 60 50 40 30 20 10 2003 2004 2005 2006 2007 Female 2008 2009 2010 2011 2012 Male 2012 Male Female Grand Total 2003 71 18 89 2004 72 18 90 2005 62 17 79 2006 62 20 82 2007 57 19 76 2008 62 18 80 2009 63 21 84 2010 62 22 84 2011 64 21 85 2012 65 25 90 32 14. Diversity & Inclusion: Percentage of Tenure Track Faculty FTE by Ethnicity 100 90 In the last 10 years, underrepresented minority faculty FTE increased from 3 to 8, an increase of 167% 80 70 60 50 40 30 20 10 0 2003 2004 2005 2006 Asian Asian Undisclosed URM White Grand Total 2003 12 3 3 71 89 2004 11 3 4 72 90 2005 9 2 4 64 79 2006 10 3 5 64 82 2007 10 2 5 59 76 2008 10 2 7 61 80 2007 Undisclosed 2009 13 2 7 62 84 2010 14 2 7 61 84 2008 2009 URM 2011 14 3 7 61 85 2010 White 2012 18 4 8 60 90 2011 2012 2012 33 15. Faculty Recruitment and Retention: Years in Tenure Track Length of time in track has been fairly stable with a slight shift toward faculty with fewer years in track Tenure Track Faculty: Years in Track 100 90 80 70 60 50 40 30 20 10 0 2003 2004 5 or less 5 or less Between 6 and 10 Between 11 and 15 Between 16 and 20 21 or more 2003 30 7 13 15 23 2005 2006 Between 6 and 10 2004 29 8 9 16 27 Source: Faculty Analytics, OHR 2005 14 19 10 13 24 2007 2008 Between 11 and 15 2006 20 16 10 11 25 2007 19 16 7 13 22 2009 2010 Between 16 and 20 2008 27 15 6 11 23 2009 34 13 7 7 25 2011 2012 21 or more 2010 33 7 14 8 23 2011 35 7 13 8 23 2012 37 11 14 4 25 34 16. Faculty Recruitment and Retention: Turnover & Retirement Eligibility Over the past 10 years, 27 of the 52 voluntary terminations were due to retirement • • 19% of the faculty are currently eligible to retire 47% will be eligible in the next 10 years Retirement Eligibility of Tenure Track Faculty 100% 80% 60% 10.1 or more years 5.1 to 10 years 2.1 to 5 years 40% Source: Faculty Analytics, OHR *Retirement Eligibility is based on years of service and age 20% 0% 0.1 to 2 years Currently Eligible 35 Our Finances 60 40 20 0 2009 2010 2011 2012 2013 General Fund Research/OSP Earnings & Conferences Development & Endowment Fed, State, Priv Grants/Contracts Others in Millions General Fund Research/OSP Earnings & Conferences Development & Endowment Fed, State, Priv Grants/Contracts Others Total 2009 47.3 0.5 2.4 10.5 3.2 -0.2 63.8 Fiscal Year Five Year Change 2010 2011 2012 2013 $ % 50.3 54.1 55.9 53.9 6.6 14% 0.6 0.7 0.9 1.3 0.8 160% 2.1 2.4 2.2 2.6 0.2 8% 10.6 9.2 9.4 10.1 -0.4 -4% 2.2 0.1 65.9 3 0.4 69.8 5 0.3 73.8 3.7 0.5 72.1 0.5 0.7 8.3 16% -350% 13% • • GF accounts for 75% of all current sources and the major source of growth Research/OSP has the most growth at 160% 36 Fisher College of Business - Current Sources Fisher Style FY 2012 FY 2013 In Millions Current Sources % of Total Current Sources % of Total State Subsidy 11.2 15.19% 11.3 15.67% UG Fee Revenue 24.9 33.83% 25.4 35.29% Graduate Fee Revenue 19.8 26.83% 17.2 23.80% Outreach Activity Revenue 16.9 22.93% 16.9 23.44% 0.9 1.22% 1.3 1.80% 73.7 100.00% 72.1 100.00% Sponsored Research TOTAL 37 22. Status of Facilities Overall Quality of Facilities: 95.2% Building Name Converse Hall Fisher Hall Gerlach Hall Schoenbaum Building Mason Hall Pfahl Hall Ownership OSU OWNED OSU OWNED OSU OWNED OSU OWNED OSU OWNED OSU OWNED 59.3% 95.5% 95.6% 95.1% 95.4% 95.5% 43,865 61,574 33,990 30,094 34,534 23,364 College Remaining Facility Value Total Building CRV College ASF % 1,355 3.1% $ 18,369,176 $ 567,428 61,574 100.0% $ 40,125,082 $ 40,125,082 33,990 100.0% $ 20,207,580 $ 20,207,580 11,023 36.6% $ 17,923,042 $ 6,564,953 34,534 100.0% $ 20,041,192 $ 20,041,192 2,672 11.4% $ 14,056,182 $ 1,607,521 $ 89,113,756 College Total Liability $ of Remaining Facility Value $ Current Replacement Value FCI = College Occupied ASF Total Building ASF FCI Composite $ 89,113,756 $ 84,872,135 95.2% College Occupied Facilities Current Replacement Value Fisher College of Business FCI Calculation College Occupied Facilities Current Replacement Value College Remaining Facility Value College FCI $ 230,943 $ 336,485 $ 1,805,629 $ 38,319,453 $ 889,134 $ 19,318,447 $ 321,683 $ 6,243,270 $ 921,895 $ 19,119,297 $ 72,338 $ 1,535,182 $ 4,241,621 $ 84,872,135 Source: Physical Planning and Real Estate 38