how to look up a vendor - The University of Tennessee at Chattanooga

advertisement

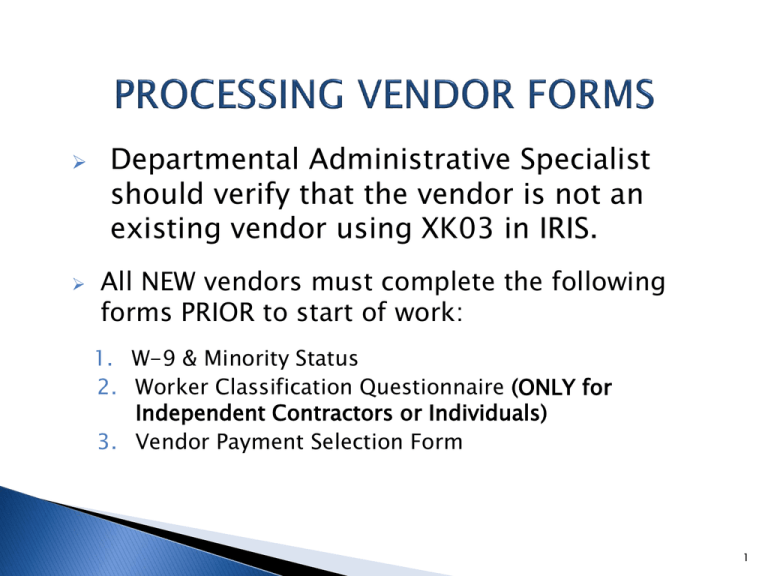

Departmental Administrative Specialist should verify that the vendor is not an existing vendor using XK03 in IRIS. All NEW vendors must complete the following forms PRIOR to start of work: 1. W-9 & Minority Status 2. Worker Classification Questionnaire (ONLY for Independent Contractors or Individuals) 3. Vendor Payment Selection Form 1 2 Make sure Name is the only item here. Check appropriate box MUST be completed. We cannot help them complete the form. Here is where DBA (Does Business As) goes, if none leave blank. Address goes here that matches their tax information. It is not the remittance address and cannot be a P.O. Box. Social Security Number for Individual Federal Tax ID Number for Company/Business “DO NOT” enter both. Make sure Vendor has signed and dated. If Individual/sole proprietor is checked a WCQ (Worker Classification Questionnaire)must be completed. 3 If they are an individual have them check “No”. 4 WCQ (Worker Classification Questionnaire) This Form is ONLY needed for Individuals or Independent Contractors. Companies DO NOT need to fill out this form. THE WCQ can be found at: http://acctspayable.tennessee.edu/w9/forms/Workers%20Classification%20Questionnaire.pdf UTC Disbursements Website under Vendor Creation Forms 5 6 7 8 9 10 THIS MUST BE SIGNED IF YOU COMPLETED PAGE 4 and/or PAGE 5 11 WCQ & T-27 FOR STUDENTS • On page 3 of the WCQ the bottom check mark indicates that approval from financial aid is required to be attached to WCQ for any Student (current or future term). • When a T-27 for a student is submitted there are two requirements: 1. T-27 must identify payee as a student; this should be written on the top of the form. 2. T-27 must be signed by Financial Aid authorizing payment prior to submission. (eventually going to a smart form) 12 The following payment methods and terms are available to University vendors. ◦ E-Payables – This is the university’s preferred method of payment. The terms for E-Payables are net and the vendor will be able to process these payments as soon as their invoices are approved in accordance with policy. NET (Payable immediately); IRIS CODE “E” ◦ Direct Deposit (ACH) – If the vendor is unable or unwilling to accept Epayables as a method of payment, the university prefers to pay them via an electronic payment directly into their bank account. NET 30 (Payable in 30 days); IRIS CODE “A” ◦ Check – This is the most expensive method for the university to pay vendors and will only be permitted in special circumstances and requires approval from the Treasurer’s Office. The payment terms for this method is NET 40 (Payable in 40 days). IRIS CODE “C” Vendor Payment Selection Form can be found at: http://acctspayable.tennessee.edu/w9/forms/vendor%20payment%20selection%20form.pdf UTC Disbursement Website under Vendor Creation Forms 13 If a NEW vendor chooses NOT to complete the Payment Selection Form or desires to have check payment the department will have to contact Cindy Stockdale in the UT Treasurer’s Office at cstockda@tennessee.edu to request an exception. The email should explain why the vendor request payment by check only. IF the Treasurer’s Office allows the exception the department will scan the exception email from the Treasurer’s Office with the Vendor Payment Selection Form and this two page document will be attached in IRIS. If this form has banking information filled in then the form should be: uploaded in IRIS (for new vendor request or requesting remit address) faxed (if updating a 1 address or only adding this form to the vendor), Fax # is on the bottom of the form DO NOT email, due to confidential data, UNLESS it is a “refused” form for an EXISTING vendor. 14 This form should be SHREDDED once it is received by Treasurer’s Office or uploaded in IRIS 15 Fax form. DO NOT EMAIL. 16 The next time you pay an independent contractor or an individual the departmental administrative specialist should verify that all forms have been updated. Updated forms can be verified using IRIS transaction ZAP_VENDOR_ATTACHMTS. If forms are not updated you must have: W-9/Minority Status Form WCQ Vendor Payment Selection Form-we should encourage vendor to select either E-payables or ACH payment option. If they wish to stay with check payment they should complete the form and indicate “refused” and sign it. In this situation attach the “refused” form and email to ap_vendor@tennessee.edu along with updated W-9/Minority Status Form and the WCQ. 17 WCQ does NOT need to be filled out for a company. A new W-9/Minority Status Form must be completed when making any vendor changes. Vendor Payment Selection Form-we should encourage vendor to select either E-payables or ACH payment option. If they wish to stay with check payment they should complete the form and indicate “refused” and sign it. In this situation attach the “refused” form and email to ap_vendor@tennessee.edu along with updated W-9/Minority Status Form. 18 Upload ALL forms to IRIS when: ◦ Requesting/Creating a Brand new vendor (1 number) ◦ Requesting/Creating a Remit Address (2 number) E-mail Forms to AP_VENDOR (except the Vendor Payment Selection Form) ◦ When the only update to a vendor is adding the WCQ ◦ When need to change a “1” address that does not match W9. If you have a vendor payment form to go along with this update, do not e-mail the Payment form, refer to it in the email by indicating a fax is on the way. Fax (only the Vendor Payment Selection Form) ◦ When you request a change in the “1” address, reference in the e-mail that this form is being faxed ◦ When the only update to the vendor is this Payment Form 19 XKO3-DISPLAY VENDOR 20 Input the vendor number in this field. It can be a “1” or a “2” number but only a “1” number should be submitted on an invoice. Next click on the green icon to check all the boxes. Then press “Enter” OR click on Green Check. 21 22 Click the Match box 23 If you know the Tax ID Number enter here If you know the vendor name you can enter name or partial name using wild cards (*). If you know the PO Box you can search by PO Box. Once you’ve made an entry then click the green check. If you know the vendor address you can search by address OR you can search just by postal code. 24 25 What if I found a vendor number but it begins with a “2”? How can I find the “1” number? 26 Query for Alternate Vendors I have a vendor that begins with a “2” These are not vendor numbers they are remit to address numbers When you have only the “2” you need to find the “1” number in order to do this you can use Y_DEV_17000025 - Query for Alternative Vendors Enter the “2” number and it will tell you the “1” number it is connected to 27 If you have a “2” remittance number and you need to find the “1” vendor number for your invoice you can use this transaction to find it. Enter the “2” number here. Then click on the clock. 28 The vendor number will appear here. 29 SUBMIT A VENDOR 30 SUBMIT A VENDOR 31 SUBMIT A VENDOR 32 SUBMIT A VENDOR 33 SUBMIT A VENDOR Services of Object: To attach documents 34 ATTACHING THE FORMS 35 SUBMIT A VENDOR 36 SUBMIT A VENDOR Write this number down and keep it 37 38 IRIS TRANSACTIONS XK03 - Search for/display vendor - Locate payment method/terms - View current WCQ attached ZAP_VENDOR_ATTACHMTS- Identify the documents that are attached ZXK1 - Create vendor request ZXK5 - Resubmit vendor request Y_DEV_17000025 - Locate the “1” number to a “2” 39