Module 2: Proposal and Budget Preparation

advertisement

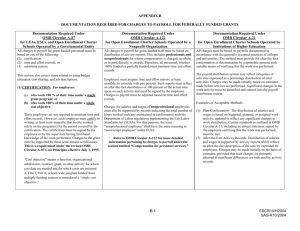

Module 2: Proposal and Budget Preparation Office of Research and Sponsored Programs The University of Mississippi 100 Barr Hall ~ 662-915-7482 www.research.olemiss.edu Proposal elements READ agency announcement/guidelines Cover page Abstract or project summary Narrative References/citations Personnel vitae Budget and justification Facilities/resources statement Certifications/assurances Current and pending support Updated February 2011 2 Cover page Most federal agencies will specify format Generally includes items such as: Project title Project period Amount of funding requested Investigator name and title Signature of investigator Signature of Authorized Institutional Representative* (*at UM, Vice Chancellor of Research and Sponsored Programs) Updated February 2011 3 Signature of the investigator(s) Signature of the investigator(s) [sometimes optional] – Indicates that the data in the proposal is true and correct Indicates the investigator’s acknowledgment of responsibility for the conduct of the project and submission of technical reports Indicates the investigator’s compliance with all required certifications Updated February 2011 4 Signature of the Authorized Institutional Representative Signature of the Authorized Institutional Representative [usually mandatory] – Indicates that to the best of the signer’s knowledge the data in the proposal is true and correct Indicates that the proposal has been duly authorized by the institution Indicates that the applicant will comply with all required certifications and assurances Applicant is The University of Mississippi UM’s Authorized Institutional Representative is the Vice Chancellor for Research and Sponsored Programs Updated February 2011 5 Abstract or project summary The abstract is a very brief description of the project, its goals, and its projected outcomes, including the significance of the project to the particular field being studied. Updated February 2011 6 Abstract or project summary Agency will usually specify the length Written in less technical language than the proposal narrative Some technical terms should be used May be used by the agency to assign reviewers or to direct the proposal to an appropriate study panel Often used by the agency to illustrate to the public what the agency is funding Updated February 2011 7 Project narrative/statement of work (SOW) The narrative identifies the need for the project and explains how the work will be accomplished. Updated February 2011 8 Project narrative/statement of work (SOW) Defines the need and how it is related to the overall societal issues identified in the program announcement Defines quantifiable and achievable objectives of the project Defines the methodology or approach that will be used to accomplish the objectives Updated February 2011 9 References/citations A list of works cited in the proposal Updated February 2011 10 Current and pending support Some agencies (e.g., NSF, US Army) require a list of the investigator’s current and pending support Format is provided by the agency Updated February 2011 11 Personnel vitae The personnel vitae (a.k.a. curriculum vitae, or c.v.) is a document detailing a person’s academic and professional accomplishments. Updated February 2011 12 Proposal budget The budget is the financial expression of the project. Budget format and content must meet agency requirements ORSP requires a detailed budget [link to sample] Updated February 2011 13 Purpose of the budget The budget serves two purposes: It estimates the cost of doing the work described in the narrative or statement of work It provides a means for monitoring the financial aspects of the project Updated February 2011 14 Sections of the budget Direct costs Facilities and administrative costs (a.k.a. F&A or indirects or overhead) Narrative justification Updated February 2011 15 Relevant regulations We are bound by OMB, federal, state, agency, and university regulations. Updated February 2011 16 Direct costs As defined by the federal government: Direct costs are those costs that can be identified specifically with a particular sponsored project, an instructional activity, or any other institutional activity, or that can be directly assigned to such activities relatively easily with a high degree of accuracy. 2 CFR, Part 220 Cost Principles for Educational Institutions (a.k.a. OMB Circular A-21) Updated February 2011 17 Direct costs Costs incurred for the same purpose in like circumstances must be treated consistently as either direct or F&A costs. Where an institution treats a particular type of cost as a direct cost of sponsored agreements, all costs incurred for the same purpose in like circumstances shall be treated as direct costs of all activities of the institution. 2 CFR, Part 220 Cost Principles for Educational Institutions (a.k.a. OMB Circular A-21) Updated February 2011 18 Facilities and administrative (F&A) costs F&A costs are those that are incurred for common or joint objectives and therefore cannot be identified readily and specifically with a particular sponsored project, an instructional activity, or any other institutional activity. 2 CFR, Part 220 Cost Principles for Educational Institutions (a.k.a. OMB Circular A-21) Updated February 2011 19 Direct cost criteria Direct costs must be: Reasonable – a prudent person conducting the project would spend the funds in the same manner under the same circumstances Allocable to the project – goods or services involved are chargeable to the project in direct relation to the benefits received Consistently treated – like costs must be treated the same way throughout the university (can’t be charged as a direct cost on some projects and as F&A on other projects) Allowed by the sponsoring agency and the university (some agencies don’t allow things like equipment, foreign travel, food, etc.) Updated February 2011 20 Allowable and unallowable costs See OMB Circular A-21, Section J for general provisions for selected items of cost The purpose and circumstance of the cost generally determine allowability Principal investigators have ultimate responsibility for defending all costs charged to their sponsored projects and to the university Updated February 2011 21 Allowable costs Allowable costs are those costs that are eligible for reimbursement by the sponsoring agency. Updated February 2011 22 Allowable costs To be allowable, costs must be: Reasonable – a prudent person conducting the project would spend the funds in the same manner under the same circumstances Allocable to the project – goods or services involved are chargeable to the project in direct relation to the benefits received Consistently treated – like costs must be treated the same way throughout the university (can’t be charged as a direct cost on some projects and as F&A on other projects Updated February 2011 23 Unallowable costs Are NOT eligible for reimbursement by the sponsoring agency Should NOT be charged as either a direct cost or an F&A cost or cost shared on a federal agreement Updated February 2011 24 Unallowable costs Unallowable activities include: Fundraising Lobbying General public relations Unallowable transactions include: Alcoholic beverages Entertainment Memberships in social, dining, or country clubs Gifts Updated February 2011 25 Direct cost items – salaries and fringe benefits Salaries and fringe benefits of faculty/staff who will be working on the project (based upon the individual’s institutional base salary) Faculty (may include restrictions such as NIH salary cap of $199,700 per year as of 01/01/2010) Technicians Post-docs Administrative and clerical personnel costs are normally included in the university’s F&A. If included as a direct cost item, such costs must be highlighted in the budget and clearly justified in the budget justification. Updated February 2011 26 Direct cost items – salaries and fringe benefits Salaries and fringe benefits of students who will be working on the project Graduate students Undergraduate students Updated February 2011 27 Notes about personnel costs The university is required by OMB Circular A-21 to maintain a personnel reporting system for all employees paid either directly or as a cost share on federal projects. “Failure to make the required confirmation [effort reporting and certification]…in an accurate and timely manner…is one of the principal internal control weaknesses associated with recent cases of noncompliance.” OMB Circular A-133 Compliance Supplement for 2006 Updated February 2011 28 Direct cost items – tuition Graduate Assistant Tuition Remission Cost and Policy: Tuition remission cost for 2010-2011: $2,718 per semester for full-time graduate students (9 hours) University policy: Tuition remission for graduate assistants is required on grants and contracts unless not allowed by the agency or program. Any variations must be approved by the Vice Chancellor for Research and Sponsored Programs. Updated February 2011 29 Direct cost items – consultants Consultants – individuals whose expertise and skills will add value to a project Daily rate plus travel Cost must be reasonable Updated February 2011 30 Direct cost items – equipment Equipment necessary to complete the work of the project Must be project-specific, not general purpose Must be necessary and reasonable Must be clearly justified Sometimes agency and UM definitions are different Updated February 2011 31 Direct cost items – equipment Non-expendable equipment (≥$5,000) If the item is $5,000 or more, and if the sponsoring agency is federal, existing equipment must be screened to determine if suitable equipment is already available, thus: Avoiding the purchase of unnecessary items Determining the most economical and practical procurement Expendable equipment (<$5,000) If no category for expendable equipment, list under supplies category Updated February 2011 32 Direct cost items – supplies Supplies Must be project-specific Consumable supplies and materials which are necessary to the project Examples: Glassware Chemicals Reagents Animals Equipment <$5,000 may be included if no expendable equipment category Office supplies are normally treated as F&A Updated February 2011 33 Direct cost items – travel Travel Must be reasonable and directly benefit the project Must comply with the university’s travel policy Some funding agencies require that a proposal distinguish between domestic and foreign travel If funding agency is federal, any air transportation to, from, between, or within a country other than the U.S. of persons or property must be performed by a U.S. flag air carrier if service provided by such a carrier is “available” Updated February 2011 34 Direct cost items – subcontracts Subcontract – collaborative work with other institution in which an investigator at the other institution will assist UM in accomplishing an externally funded project by performing substantive work on the project (collaborator engages directly in the performance of the specific aims of the project) Updated February 2011 35 Direct cost items – subcontracts Proposed costs should be reasonable and allowable Competitive bidding should be done prior to proposal submission Federal regulations state that we can only charge F&A on the first $25,000 (regardless of the period covered by the subcontract) If subcontractor is identified in the proposal, must include itemized budget Updated February 2011 36 Direct cost items – other Other direct costs include such things as: Communications Publications Animal care costs (not purchase of animals) Human subjects costs Maintenance/service contracts Graphic arts/photographic services Updated February 2011 37 Facilities and administrative (F&A) costs Those expenditures incurred in support of an institution’s major, mission-related functions or activities Allocated based on a determined percentage of the Modified Total Direct Costs Updated February 2011 38 Modified total direct costs MTDC are total direct costs less: Equipment ≥$5,000 Capital expenditures Tuition and patient care Rental or lease of off-site facilities Construction and renovation costs Scholarships and fellowships Subaward costs in excess of $25,000 Certain other costs pursuant to the institution’s negotiated F&A rate agreement (e.g., recharge center rates) Updated February 2011 39 Facilities and administrative (F&A) costs Current rates for The University of Mississippi: On campus – 43% Off campus – 26% (In general, “off campus” means more than 50% of the work will be conducted off campus) Updated February 2011 40 To determine F&A: Take your total direct costs Subtract out all the things we listed (equipment >$5,000; capital expenditures; tuition and patient care; rental or lease of off-site facilities; construction and renovation costs; scholarships and fellowships; subaward costs in excess of $25,000) Multiply the remainder (the MTDC) by the appropriate rate Updated February 2011 41 A note about administrative and clerical costs Items such as office supplies, postage, local telephone costs, and memberships shall normally be treated as F&A costs The salaries of administrative and clerical staff should normally be treated as F&A costs 2 CFR, Part 220 Cost Principles for Educational Institutions (a.k.a. OMB Circular A-21) Updated February 2011 42 Sample budgets Sample #1: Salaries by Monthly Effort Updated February 2011 43 Sample budgets Sample #2: Salaries by Per Cent of Effort Updated February 2011 44 Cost share Cost sharing or matching means that portion of the project or program cost not borne by the Federal Government. Uniform Administrative Requirements for Grants and Agreements with Institutions of Higher Learning, Hospitals, and Other Non-Profit Organizations (OMB Circular A-110) Updated February 2011 45 University of Mississippi policy Cost sharing should be included in the budget accompanying the proposal submission only if such arrangements are required or strongly encouraged by the sponsor’s program guidelines. Updated February 2011 46 Federal government guidelines for cost share Be verifiable from recipient’s records Not be included as contributions for any other federally-assisted project or program Be necessary and reasonable for proper and efficient accomplishment of project or program objectives Be allowable under OMB Circular A-21 Not be paid by the federal government under another award (except where authorized) Be provided for in the approved budget (when required) Conform to other provisions of OMB Circular A-110 Updated February 2011 47 If cost sharing is mentioned anywhere in the proposal, we are required to document and report to the agency. Updated February 2011 48 Cost shared costs can be: Cash (such as purchases made specifically for the project) In-kind (employee time or other goods and services) Provided by the university Cannot normally use Fund 10 for cash cost share The university’s agreement to any such cost sharing must be secured by the prospective investigator during the proposal development process. Provided by a third party At the time of the proposal submission, the prospective investigator must have written confirmation from the third party on the amount and nature of cost sharing to be provided. Updated February 2011 49 A note about third party contributions Volunteer services – value at rates consistent with those paid for similar work in the recipient’s organization Employee services – value at employee’s regular rate of pay plus fringe benefits Donated supplies – value at fair market value at time of donation Loaned equipment or space – value at fair market rental rate Donated equipment – determine cost share according to purpose of award [work with Accounting on these] Updated February 2011 50 Often used for cost share: Salaries plus associated fringe benefits (and F&A) Tuition remission Others, such as graduate students, equipment, travel, supplies, etc. (plus their associated F&A) Unrecovered F&A costs, when allowed by sponsor Updated February 2011 51 How to calculate cost share It depends on the proposal guidelines Some require a percentage of MTDC Some require a percentage of total project value Your Program Development Specialist in the ORSP will help you determine the correct amount. Updated February 2011 52 Budget justification (narrative) One of the most important pieces of the proposal Provides a categorical justification for the requested funds Purpose is to show the need of requested budget items Explains staffing patterns, benefits (fringes), other personnel support costs, facilities and equipment needs, supply needs, etc. Updated February 2011 53 Facilities/resources statement Identifies the resources and facilities of the institution as a whole and of the department that are available to the project Identifies any unique staffing resources available to the project, but for which funding is not required Updated February 2011 54 Certifications/assurances Certifications and assurances are commitments that the university is in compliance with various laws and executive orders applicable to federal assistance. Updated February 2011 55 Certifications/assurances – examples Certification Regarding Lobbying and Disclosure of Lobbying Activities Certification Regarding Debarment and Suspension* Misconduct in Science Conflict of Interest Blood Borne Diseases Human Subjects Compliance Use of Animals in Research *Common audit finding. Institutions must ensure that vendors, contractors, and subrecipients are not suspended, debarred, or otherwise excluded from transactions with the government. Updated February 2011 56 Resources 2 CFR Part 220 (OMB Circular A-21): Cost Principles for Educational Institutions 2 CFR Part 215 (OMB Circular A-110): Uniform Administrative Requirements for Grants and Other Agreements with Institutions of Higher Education, Hospitals and Other Non-Profit Organizations OMB Circular A-133: Audits of States, Local Governments, and Non-Profit Organizations UM Institutional Information for Proposal Preparation UM Manual for Research and Sponsored Programs UM Accounting Guidelines and Policies UM ORSP Program Development Specialists [x7482] Updated February 2011 57