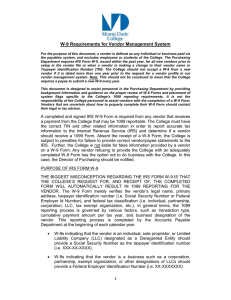

New Vendor Create in Banner Policy

advertisement

Understanding Form W-9 and 1099 Requirements This policy primarily responds to IRS regulations, which governs the taxation and reporting responsibilities of U.S. based entities. On an annual basis, the College must issue 1099 tax statements to all eligible vendors regarding the income they received from the College. The College must also electronically transmit a file to the IRS with accurate data pertaining to those vendors including Name, Address, Tax Identification Number and Gross Income. This policy helps the College with its compliance of IRS regulations concerning the issuance and accuracy of annual tax statements to vendors. This policy will facilitate IRS reporting requirements ▪ Certain types of payments made to vendors must be reported to the IRS. Having a signed W-9 on file allows the College to report the correct combination of Tax Identification Number (TIN) and name, thus avoiding IRS penalties. Evidence of validity is documented. ▪ Having a signed W-9 on file is considered evidence that the payee is a valid individual or business. This helps the College avoid making inappropriate payments to fraudulent entities. Vendor A vendor for this purpose is: Every entity, business or person that has a vendor record in the AP Module Database. Vendor Maintenance The electronic means of storing changes in the vendor information who supply goods and services to the College. Eligible Vendor Vendor that is required to receive a 1099 Form due to the type of payment received or/and their Business Entity Form This policy applies to all faculty and staff that deal with vendors while performing their departmental duties. WHO SHOULD KNOW THIS POLICY Senior Financial or Business Officers Chairs of Departments, Directors of Institutes and Centers Department Administrators Program Directors Faculty Administrative staff with Accounts Payable responsibility Vendor Maintenance The College of William and Mary departments and its units will initiate the request to create or update a vendor record using the new form “Vendor File Maintenance Record”. These are vendors with whom the department wishes to enter into a transaction and a vendor record ----may or may not exist in Banner. Federal regulations require that Form 1099-MISC be sent to each person or company, other than corporations, to whom we have paid at least $10 in royalties or at least $600 in rents, services (including payment for parts and materials), prizes and awards, legal services or medical and health care payments. All payments processed through the Accounts Payable Office must be reviewed for possible 1099 reporting. To ensure proper reporting to the IRS the College must collect the W9 from vendors. 1099 Vendors are flagged during the Vendor Create Process 1099 payments are flagged during the payment process The best way to ensure the information required is enter in the system is to get a vendor to complete IRS Form W-9 before writing any checks. New Vendor Create Every new vendor must complete a Request for Taxpayer Identification Verification form (W9) before it is created in Banner and before the College will make any payments to the vendor. The W9 helps us identify the legal entity of a business or individual. ▪ The W9 form verifies the vendor/payee’s legal name, address, taxpayer identification number, and type of organization (individual, partnership, corporation, etc). ▪ Any false information given by the vendor on a W9 becomes their liability, not the College’s. The IRS site states: If the tax-exempt organization does not obtain an SSN or EIN before the organization pays the contractor, the organization must withhold income tax from the payment, generally referred to as backup withholding. Backup withholding rules require that 28 percent of the payment be withheld, and reported on Form 945, Annual Return of Withheld Federal Income Tax. http://www.irs.gov/charities/article/0,,id=172606,00.html If the AP office receives paperwork we will be better prepared to process the payment. It is important we know the reason we received a new W9 in the office New Vendor Name Change (example: doing business as) Employees and Students receiving payments other than reimbursements Business Entity Change A W-9 form will not be required for the following: Employees of the College including students receiving expense reimbursements or refunds. Nonresident Aliens or Foreign Entities (a set of different forms are required) Petty cash reimbursements Vendors who are reportable include: Individuals Sole proprietors (including doctors and attorneys), Partnerships, Limited Liability Companies (except Corporations) Medical and Healthcare Corporations Trusts and Estates Scholarship and fellowship payments are not 1099 reportable since all "working" scholarships and fellowships are processed through our payroll office. Other types of scholarships are not reportable to the IRS. The best way to ensure you have the information you need is to get a payee to complete IRS Form W9 before you write a check. Never assume that because a business name includes the word “Company” or “Co.” that it is a corporation. Businesses that are Limited Liability Companies or LLCs, can be treated as sole proprietors, partnerships or corporations, so don’t assume that LLC in the business name means you don’t have to file a Form 1099-MISC. If someone refuses to complete Form W-9 or to give the College the information needed to determine if a Form 1099-MISC must be filed, there are two options. Option 1: A payment can be processed, but the payment will have Federal income tax withholdings at the backup withholding rate (currently 28%), and the vendor will receive a net check. Option 2: You can choose to refuse the business. If you have any questions please don’t hesitate to contact the Accounts Payable Office