Homebuyers

advertisement

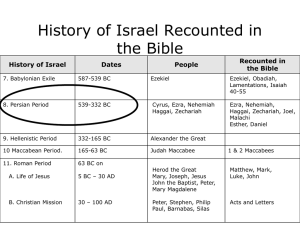

PRESENTATION OUTLINE • Nehemiah Corporation of America • The Nehemiah Program – Overview & Highlights – Homebuyer Requirements – Property Types – How It Works • Advantages of Homeownership • Homebuyer Frequently Asked Questions (FAQs) • Get Started TODAY for Homebuyers • Preparing for Your Mortgage Pre-Approval • Recommendations for the Homebuyer NEHEMIAH CORPORATION OF AMERICA • Established in 1994 • Nonprofit 501(c)(3) community development corporation • Nationwide affordable housing programs – The Nehemiah Program: • National launch in 1997 • Provides downpayment assistance – Other charitable organizations include: • Nehemiah Community Reinvestment Fund, Inc. (NCRF) • Nehemiah Community Foundation, Inc. (NCF) • Nehemiah Urban Ministry Initiatives (NUMI) • Devoted to assisting individuals and families gain access to safe and affordable housing THE NEHEMIAH PROGRAM HISTORY • Flagship program • Created the downpayment assistance industry • Nation’s largest and most trusted downpayment assistance program • Over 250,000 individuals and families have become homeowners using The Nehemiah Program • $1 billion provided in gift funds • $60 million generated in charitable and community reinvestment activities nationwide THE NEHEMIAH PROGRAM OVERVIEW • Exists for one simple purpose: Helping People Become Homeowners • FREE gift funds up to 6% of the contract sales price – Downpayment – Closing costs THE NEHEMIAH PROGRAM HIGHLIGHTS • No repayment of the gift funds • First time and repeat homebuyers • New or resale homes • No geographical restrictions • HUD approved HOMEBUYER REQUIREMENTS • Homebuyer must utilize a loan product which: – Accepts a “gift” for downpayment from a nonprofit charitable organization • Example: FHA insured loans • Homebuyer must purchase a home from a builder/seller who has made their home eligible for purchase by a buyer receiving Nehemiah gift funds PROPERTY TYPES • Property types include owner-occupied: – New or resale home – Condominium – Duplex, triplex or fourplex – Townhome • Property type must qualify with the loan that the homebuyer is using THE NEHEMIAH PROGRAM HOW IT WORKS • The Nehemiah Program provides gift funds to homebuyers who purchase participating homes using an eligible loan product • Gift funds are requested by mortgage lenders on behalf of qualified homebuyers • Nehemiah wires the gift funds prior to closing • After the close of sale, the seller contributes an amount equal to the homebuyer's gift amount • A small processing fee can be paid by either the seller, buyer or lender • Contributions and fees are reinvested for future downpayment gift funds and community development programs across the country ADVANTAGES OF HOMEOWNERSHIP • Fixed-rate mortgage vs. variable rent • Pride of homeownership • Increase property value with home improvements • Move-up potential • Keep up with inflation • Community involvement ADVANTAGES OF HOMEOWNERSHIP • Build wealth through homeownership – Equity – Appreciation – Tax deductions • Mortgage interest • Property taxes • Closing costs • Discount points • Origination fees • New mortgage (in some states) • Check with your lender or tax adviser on these items HOMEBUYER FAQS Q. Do I have to pay the money back? A. No. The Nehemiah Program gifts downpayment and closing costs to homebuyer(s). There is no repayment of the gift funds. Q. Do I have to purchase a home in a certain area? A. No. There are no geographical restrictions. You may purchase a Participating Property in any area. HOMEBUYER FAQS Q. Can I purchase a new home? A. Yes. Both new construction and resale homes are eligible. In fact, Nehemiah partners with many homebuilders across the nation. To view Participating Properties, find a new home community near you or contact a local real estate professional knowledgeable about The Nehemiah Program, visit www.getdownpayment.com. Q. Do I have to be a first time homebuyer to use The Nehemiah Program? A. No. Both first time and repeat homebuyers are eligible to use The Nehemiah Program. HOMEBUYER FAQS Q. Is this a low-income program? A. No. There are no income limits or asset restrictions. No matter what your income, if you’re using a loan product that allows gift funds from a nonprofit organization to purchase a home, your lender can request up to 6% of the contract sales price for downpayment and closing costs on your behalf. Q. What is a “Nehemiah Participating Home”? A. Any residential property that the seller has made or will make eligible for purchase by a buyer receiving Nehemiah gift funds. The seller agrees to sell their home using The Nehemiah Program by signing the Participating Home Agreement. HOMEBUYER FAQS Q. Will using downpayment assistance delay when I can move into my house? A. No. Gift funds work in conjunction with an existing loan product (such as an FHA loan) so the process and underwriting are the same. There is no reason for this process to be extended. In fact, the paperless Online Processing System (OPS®) allows Nehemiah to process a gift funds request on the same day it is received. Nehemiah wires the gift amount requested by the lender on behalf of the buyer at least 24 hours prior to closing. HOMEBUYER FAQS Q. Can I negotiate the sales price before telling the seller that I want to use downpayment assistance? A. Typically a homebuyer using downpayment assistance will purchase a home at market value without further negotiations or price reductions. This allows the seller to make a contributions back to Nehemiah after the close of sale and still maintain their desired net bottom line. HOMEBUYER FAQS Q. Doesn't the seller basically pay the buyer's downpayment? A. No. Under mortgage guidelines, it is inappropriate for a seller to contribute money towards a downpayment in order for a homebuyer to purchase the seller's property. Nehemiah wires the money requested on behalf of a homebuyer from its pre-existing pool of funds and forwards it to the closing/title company. Only after the close of sale does Nehemiah collect the seller’s contribution and a small processing fee. GET STARTED TODAY! Homebuyers: • Work with the industry professional(s) who are involved in this homebuyer educational event. They are already familiar with The Nehemiah Program and have a genuine desire to help you become a homeowner. • Call Nehemiah Customer Service at 877-634-3642. Helpful representatives can answer any questions you may have and provide you with referrals to real estate professionals, builders and mortgage lenders in your area. GET STARTED TODAY! Homebuyers: • Get pre-approved for a home loan. This step lets you know how much house you can afford. • Find Your Dream Home! Use a Designated Nehemiah Specialist or New Home Builder Partner to find your dream home. • For more information, visit www.getdownpayment.com PREPARING FOR YOU MORTGAGE PRE-APPROVAL • In preparation for your pre-approval, have the following information (where applicable) on hand when talking to your lender: – Last 2 years W-2’s and tax returns – Recent paycheck stubs (30 days) – Last 3 months bank, stock and asset statements – Last 12 cancelled rent or mortgage payment checks – Picture I.D. PREPARING FOR YOU MORTGAGE PRE-APPROVAL • Self-Employed: – Last 2 years of completed personal and business tax forms – Year-to-date profit & loss and financial statements • Veterans: – Certificate of Eligibility – DD214 (if certificate is not available) RECOMMENDATIONS FOR HOMEBUYERS • Free Nehemiah Online Homeownership Education Course – English language: http://www.getdownpayment.com/buyers/hec.asp – Spanish language: http://www.pagoinicialgratis.com/buyers/hec.asp?tab=1 • Home Inspections – Impartial evaluations that provide homebuyers with information about the property’s overall condition RECOMMENDATIONS FOR HOMEBUYERS • Free Nehemiah Online Post-Homeownership Education Course – English language: http://www.getdownpayment.com/buyers/posthec.asp?tab=1 – Spanish language: http://www.pagoinicialgratis.com/buyers/posthec.asp?tab=1 • The New Homeowner’s Handbook. What To Do After You Move In, written by Nehemiah Corporation with Barbara B. Buchholz and Margaret Crane – Comprehensive look at what new homeowners can expect – Available online at www.amazon.com