Imports from Greece

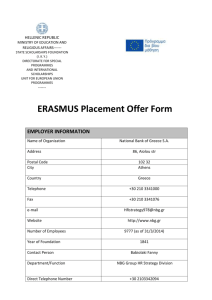

advertisement

Economic Integration and Business Development Opportunities in the Balkans Anthony Bartzokas EBRD Board Alternate Director FING – EBRD BUSINESS DEVELOPMENT WORKSHOP 29 May 2013 Thessaloniki, Greece Outline • The objective of the joint workshop: B2B meetings • Investment recovery in a constrained capital market • Growth and regional integration • Adjustment challenges for Greek firms • Joint IFI Action Plan for Growth in Central and South Eastern Europe Divergence of interest rates on new loans in the Eurozone Source: ECB, March 2013 Obstacles for Greek export oriented firms Source: NBG SMEs Report, March 2013 ICAP Investment Survey: Market orientation of new investment Source: ICAP, Greece (Survey of 1.095 Firms with annual turnover ≥ € 1 m.) International patterns of post-recession investment (272 recovery episodes) Source: Naotaka Sugawara and Juan Zalduendo (2013) Credit-less Recoveries Neither a Rare nor an Insurmountable Challenge, World Bank Working paper No. 6459. Economic growth trends in the Balkans: GDP growth (y-o-y) Source: National statistical offices. Bilateral trade flows have declined Exports to Greece (2005=100) Imports from Greece (2005=100) Source: Bank of Greece Business development obstacles in South East Europe (BEEPS 2008/2009 – per cent deviation from country average) 60% Tax administration Skills Corruption Skills Corruption Tax administration Infrastructure Skills Tax administration Tax administration Corruption Courts Skills Courts Tax administration Crime 10% Tax administration Corruption Tax administration Corruption Courts 20% Skills 30% Infrastructure 40% Corruption 50% 0% Albania BiH Bulgaria Croatia FYR Macedonia Montenegro Romania Serbia Source: EBRD and World Bank, Business Environment and Enterprise Performance Survey IV Structure of Bulgarian Imports from Greece in 2011: Increasing Share of Consumer Goods Structure of Bulgarian Imports from Greece in 2008 Investment Mineral fuels, oils and electricity 10.3% Consumer goods 16.0% goods 10.1% Raw materials 63.5% Mineral fuels, oils and Investment electricity 12.2% goods 6.9% Consumer goods 26.5% Raw materials 54.2% Source: Bulgarian National Bank 10 Greek export oriented SMEs in South East Europe Source: NBG SMEs Report, March 2013 Drivers for outward oriented Greek SMEs Source: NBG SMEs Report, March 2013 Greek outward FDIs: challenges for adjustment Exogenous Vulnerability Factors Business cycle sensitivity Exposure to the Greek market Reputation risk Reliance on external finance FDI stock Infrastructure (Telecommunications, Energy) Processing industries (Construction Material, Metals) Subsidiaries of Greek banks Business Services, Logistics and Tourism Food processing and textiles Adjustment Challenges Debt refinancing Downward cost adjustment Value chain diversification Disinvestment High probability of sub-optimal adjustment trajectories reflecting capital market constraints IFI Action Plan for Growth in CESEE • EIB, the World Bank and EBRD new Action Plan of over €30 bn ($38 bn) in 2013-2014. • Focus on investment driven growth, not “crisis management” • Elements: • Special attention to export-led growth and trade integration • Both banking and corporate sector restructuring support for synergies • Acceleration of the use of EU structural funds • Targeted policy advice support (corporate restructuring, NPL/distressed asset management, etc.) • EBRD geographical focus is the Balkans, the hardest hit region.