Structures, teams and people

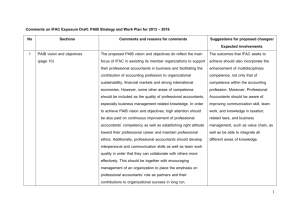

advertisement

Top tips that Financial Planners can learn from Accountants about running their firms Ian Pickford Partner Mazars LLP Director Mazars Financial Planning Ltd Mazars Employee Benefits Ltd In some ways, accountants run similar businesses to financial planners, especially in the new adviser charging world. Accepting the important differences in their professions, this session considers what we can learn from accountants’ business practices. Content • Structures, teams and people • Succession planning • The ‘Business Model’ and how to charge • Professional ethos and training • Client retention • What do accountants do right and what to avoid Structures, teams and people Do you have the right people doing the right job? Structures, teams and people Your structure should define your team . . . not your team define the structure The best goalkeepers don’t usually make the best centre forwards Structures, teams and people • The inverted pyramid Number of staff Highest Staff Cost Structures, teams and people • The ‘professional services ‘pyramid’ Highest Staff Cost Number of staff Structures, teams and people High cost people should be undertaking high value functions • • • • • • • • Do you have high cost staff undertaking functions that lower cost staff could deliver? Push as many low cost functions down the team Do your high cost staff deliver value to the business? Low cost staff should be highly utilised Where do your high cost staff spend their time and what are the results? What KPI’s run your business and how are they communicated to staff? What does your business structure do that stops individuals maximising their output? Productise high frequency and low value processes Succession Planning What are you and your business about? • Custodian • Are you looking to cash in your ‘chips’ • Choice may lead to a different course of action • Although there will be a lot of similarities: • Build a brand • Succession structure • Have something to sell!!! Succession Planning What are you and your business about? • Have a business that is dynamic • Streamline your business • Remove waste and in-efficiencies • Maintain and demonstrate good cash flow • Show improving profit and growth • Be place people want to join • Training plan and graduate/new starter scheme Business model and how to charge What are your KPI’s? New works wins Manage uninvested cash Debt control Billing Identify the KPI’s that make your business work and manage them religiously Business model and how to charge You need to know what it costs to deliver your client work HOW MUCH DOES IT COST YOU TO GIVE ADVICE? Do you know? Business model and how to charge Fees Have a model that suits your proposition • • • • • • Time cost Fixed % FUM Contingency Success Or a combination Business model and how to charge VAT Rule of thumb Advice only VAT-able Implementation of financial products non VAT-able Get professional advice on your client service agreements and fees Business model and how to charge Do not start work without a service/fee agreement in place, which states explicitly: • • • What you will do What the client is responsible for What the fee is and the basis of calculation Don’t do anything outside this without amending the fee Business model and how to charge Debtors Businesses close down not because of a lack of business but a lack of cash flow Collect your debts You are not a charity……. a non payer is not a good client Business model and how to charge Manage your debtors • • • Have an agreed debtor policy Don’t be afraid to go legal Use tools to collect fees e.g. DDM’s, platforms etc. Professional Ethos and Training Are you a ‘Professional Adviser’ or ‘Knowledgeable Salesman’? Selling is at the ‘heart’ of what you do, but don’t give away your Intellectual Property Do the right thing………….if you do why shouldn’t the client pay!!! Professional Ethos and Training Training Past focus has been on Qualifications New world these are a given!!!!!!! Professional Ethos and Training Maintenance and growth training plan for your team which fits your business objectives Important to train ‘soft skills’ • • • • • Fee negotiation Marketing Proposition consultancy Meeting skills Technology Client Retention 1. Value ‘2 way’ relationships 2. Free clients are not ‘2 way’ 3. People tend to value what they pay for 4. Have service agreements and deliver to them Client Retention Professional Clearance Should IFA’s operate this approach? What do Accountants do right and what to avoid Right 1. Hierarchy 2. Manage utilisation and cash flow 3. Emphasis on doing the right thing 4. Recognise ‘graduate training’ What do Accountants do right and what to avoid Avoid 1. Can have a narrow view of the world 2. Advice ‘comfort zones’ 3. Can have ‘silo’ mentality 4. Underestimate the value of soft skills training Questions