DEXIT – A MARKETING OPPORTUNITY

advertisement

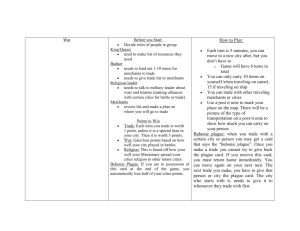

DEXIT – A MARKETING OPPORTUNITY Easier than cash, faster than debit Content DEXIT the company Concept – Technology and Benefits Demand Competitors Company concerns and the final decisions Target market Product Revenue Promotion Dexit the company Formed as new company in 2001 Started as private, became public in 2004 Bell Canada as partner in 2004 Get a stake in Canada’s low-value cash transactions Deciding how and who to target with their service Before/After approach Concept and Technology To provide easy & fast payment through RFID technology Over the counter small cash payments. Tags held by consumers Readers on merchants counters Wireless link between reader and tag Withdraw money from consumers Dexit account Benefits Benefits for merchants Lower cash-handling costs (both theft and shrinkage) Reduce line-ups Turn walk-aways into customers Reduced need to check for counterfeit money Benefits for consumers Faster than credit cards No more messing with coins Can track their transactions online Demand Two prior attempts had shown an interest from both consumers and merchants Mondex and Scotiabank Canadians among the world’s heaviest users of electronic payment systems 350,000 retailers in Canada accepted payment via IDP in 2001 17,6 million monthly IDP users were counted in Canada in 2001 IDP: Interac Direct Payment Demand Interac Direct Payment Transactions by Province (in millions) Ontario (ON), Quebec (PQ) and British Columbia (BC) top three markets Toronto (ON) Accounting for close to 30% of their province’s respective debit transaction market. Competitors Retailers that issued their own proprietary payment cards or gift cards Credit and Debit card issuers More towards Dexit than Dexit is towards them ExxonMobil Speedpass (1997) and Oyster (the new and developed) Both using RFID Company concerns and the final decisions Product - Thoughts Confident on using RFID Consumers too accustomed to using cards? Key chain fob or other kind of gadget? Product - Decision Target market - Thoughts Target national or in a specific geographic area? Target group of individuals who were comfortable with newer technologies (Like the Dexit tag)? Who where the heavy users? Better for low-value transactions Target merchants based on the demographics and lifestyles of the consumers? Target market - Decision Small target area within Toronto Targeting areas with a high consumer-to-merchant ratio Hospitals College campus’ Subway stations office towers Various take-away food and convenient shops Target a younger consumer base (students) “Pendlers” on their way to work (potential heavy users)? Should they have target another area/group? Public transportation Taxi Parking Revenue model - Before launch Decision for finding revenue Merchants Transaction fee and how much? Set subscription fee? Consumers Fee for each transaction? Willing to pay if cost is transparent? Revenue model - Solution Fees from merchants, based on a percentage of the transaction value. Consumers pay 1.5$ each time they allocate new funds to the Dexit account. Licensing fees from organizations (royalties). Interest rates on prepaid accounts Income from sales of Dexit point-of-sale terminals, RFID tags/readers Partners in crime In mid 2004 Dexit partnered with Bell Bell have exclusive rights to market and sell in Canada Getting access to Bells relations to 500.000 merchants and 15 mill. customers. Leads to lower marketing costs: Sales and Marketing costs having gone from almost 1.5 million$ in Q2 2004 to less than 600.000$ in Q2 2005) Licensing of system to other organizations Promotion - Before launch Limited marketing budget Push or pull? Posters, TV, radio, newspaper, Webpage Hire sales force? Promotion - Solution Posters in the geographical area of service Subway station, side of busses. Special offers using Dexit’s webpage Marketing surveys for existing customers Ineffective webpage (show the bugger) SWOT - Not Forgot STRENGTH Reliable system Propriety system B2B and B2C target market Bell (strong partner) Fast transactions High entry cost WEAKNESS Webpage not consumer-centric High consumer acquisition cost Expensive hardware for merchants High entry cost OPPORTUNITY Licensing of system (Royalties) Possibility to port the system to online sales Profit by substitute the cash market with e-cash so big competitors don’t see it as a threat – Investors THREAT Adoption conservatism (Like Euro in DK) New entries Not yet reached critical mass (lack of awareness) Other technologies (mobile phones) Wrap - Up The status of Dexit, today, is still uncertain. Only gained 20.000 consumers over the last 2 years Only gained 460 new merchants since launch Many investors Their license agreements with Bell First-mover advantage in Canada Will they survive on the market? Have they done it right? Thank you for your time