Using alternative financing tools to improve agri

advertisement

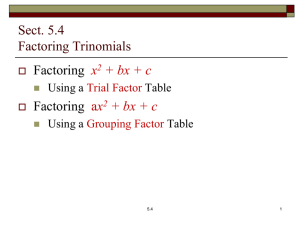

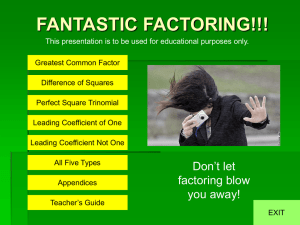

Using alternative financing tools to improve agribusiness finance by Yan Zhang yan.zhang@unctad.org UNCTAD Caribbean Rural Development Briefings 18-19 October 2010, Grenada Agriculture in CARICOM Agriculture is an important contributor to economic growth and sustainable development of CARICOM member countries. However, the development of agriculture is facing many challenges both at national and international levels. Over the last decade, both public and private investment in the agriculture has declined. It is crucial to increase agricultural investment and finance. Main contraints in accessing agricultural finance Agricultural sector often perceived as high risk by many financial institutions; Lack of sufficient eligible collateral; High financing costs; Lack of tailor-made financial products to meet specific needs of agricultural borrowers; Inadequate access to information on available financing schemes/products; Lack of support to build bankable projects. Structured commodity vs. Traditional finance finance Transaction based Looking to the flow of the goods Focus on borrower’s perfomance capacity Innovative loan security (commodities or future proceeds) Balance-sheet based Looking to the flow of funds Focus on borrower’s creditworthiness Traditional loan security (savings, physical assets, third party guarantee) UNCTAD’s thematic work under the AAACP Agricultural commodity financing (e.g.warehouse receipt financing) Commodity exchanges Market information service - Infocomm: http://www.unctad.org/infocomm - Infoshare: http://infoshare.unctad.org Sustainability claims portal - http://193.194.138.42/en/Sustainability-Claims-Portal/ ALL ACP Agricultural Commodities Programme, funded by the European Union UNCTAD’s working approach on agricultural commodity finance To create an enabling environment for agricultural commodity finance Improving access to finance by small producers and SMEs To develop appropriate financing mechanisms for specific commodity Capacity building on alternative financing instruments Agricultural commodity financing projects in the Caribbean region - Regional Caribbean regional capacity building workshop on factoring/receivable discounting (November 2009 in Barbados) National (Grenada) - Improving nutmeg value chain financing Regional capacity building workshop on factoring/receivable discounting Background: Delayed payment by buyers to farmers who are selling agricultural commodities to the main players of the tourism industry; Demand for innovative and suitable financing instruments to reduce risk at farmers’ level and facilitate trade Regional Capacity building workshop on factoring/receivable discounting Objectives: 1. To raise awareness and build capacity in the area of factoring and invoice discounting as a financing technique that can be used to help farmers access financing; 2. Help to integrate small-scale farmers into the supply chain of the tourism industry. Key issues on factoring US definition on factoring " a continuing arrangement between a factoring concern and the seller of goods or services on open account, pursuant to which the factor performs the following services with respect to the accounts receivable…" 1. 2. 3. 4. Purchases all accounts receivable for immediate cash; Maintains the ledgers and performs other book-keeping duties; Collects the accounts receivable; Assumes losses which may arise from the customer’s nonpayment. Key issues on factoring Fondamental points: Short-term, working capital financing Serve SMEs with large number of transactions Finances only post-invoice contractual obligations Factor needs confidence that Buyer accepts goods There needs to be absence of continuing obligations by Seller after delivery of goods Domestic factoring flowchart 1. 2. ③ Seller Buyer 3. ① ② ④ ⑤ ⑦ ⑥ 4. 5. Factor 6. 7. Seller submits the request to the Factor. Factor considers Buyer’s creditworthiness and approves financing limit. Factor and Seller sign factoring agreement. Seller delivers the goods to Buyer and issues the invoices. Seller assigns the invoices to Factor and informs Factor of any special payment arrangements. Factor finances the value of the invoices at the previously agreed rate. Factor collects receivables at the end of the credit period. Factor remits to Seller the balance in excess of the finance cost. Main findings of the workshop In general, the region would follow the UK legal framework on the sale and purchase of invoices and the rights of creditors in the event of a buyer’s insolvency. Development banks and farmers associations are working together to identify solutions to improve farmers’ access to finance. There are a number of initiatives, though at various stage of development, in moving in the direction of developing factoring and invoice discounting as a financing solution to improve farmers’ cash flows. Way forward Development banks - take the lead in developing factoring scheme based on their specific country conditions; Farmers' organizations and SMEs – training on the mechanism and impact of factoring scheme; Ministries - informed from the beginning to provide necessary support in the legal, regulatory and taxation areas; Regional financial institution and organizations - technical assistance to the specific project based on stakeholders' demand; International organizations - capacity building activities Improving nutmeg value chain financing in Grenada Objective: To carry out a study to analyze the nutmeg value chain, identify gaps and bottlenecks for finance, especially those related to financing smallholders, and provide recommendations on how to improve nutmeg sector financing in general and to facilitate access to finance by smallholders in particular. For more information on UNCTAD’s work under AAACP: http://www.unctad.info/en/Special-Unit-onCommodities/Events-and-Meetings/All-EU-ACP-/ Thank you! Merci beaucoup!