presentation

advertisement

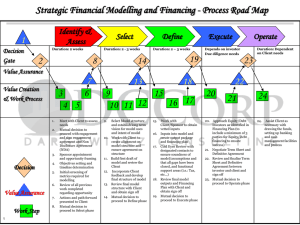

Financing Services Inc. Business Process Outsourcing: Internal Management vs. External Outsourcing Arrangements David Martin Director, Portfolio Management TD Financing Services Financing Services Inc. Business Process Outsourcing: Internal Management vs. External Outsourcing Arrangements About TD Financing Services Internal Process Management: The Upside BPO: The Downside The Case for BPO Understanding the Value of BPO and the People Behind it Financing Services Inc. Business Process Outsourcing: Internal Management vs. External Outsourcing Arrangements About TD Financing Services… Formerly VFC Inc., a non-prime vehicle finance company founded in 1996; In 2006, acquired by TD Bank Financial Group; In 2010, rebranded from VFC Inc. to TD Financing Services, offering indirect lending products such as prime/non-prime vehicle loans, and home mortgages; In 2011, with the completion of the sale of Chrysler Financial, to be rebranded “TD Auto Finance” with the set objective of expanding the new brand in the North American market. Financing Services Inc. Business Process Outsourcing: Internal Management vs. External Outsourcing Arrangements Internal Management: The Upside • The development of sound internal processes with proper regulatory oversight is instrumental to a company’s success; • Hiring and retaining top talent is key to the successful development and deployment of internal best practices; • Internal employees, it could be said, have more stake “in the game” with regards to the servicing of a portfolio, as opposed to BPO companies which tend to concentrate solely on their respective bottom lines; • Internal controls mitigate the potential risk of security threats from both a communication and privacy perspective. Financing Services Inc. Business Process Outsourcing: Internal Management vs. External Outsourcing Arrangements BPO: The Downside • From a subject matter expert/knowledge perspective the evolution of an attitude of indifference in employees due to BPO may take root (i.e. Who cares, just outsource it.); • The loss of independence in terms of managing a portfolio can evolve in cases of weak internal regulatory oversight; • The risk of impacts on a company’s goodwill with regards to BPO tends to be a major concern for FIs; • The possible underestimation of running costs (i.e. internal IT expenses, administration expenses, etc.); • The lack of a proper business continuity management (BCM) model. BCM consists of a set of steps, to successfully identify, manage and control the business processes that are, or can be outsourced. (Forbes, Gibb, and Steven Buchanan. A Framework for Business Continuity Management, 2006) Financing Services Inc. Business Process Outsourcing: Internal Management vs. External Outsourcing Arrangements The Case for BPO: BPO vendors can help a company improve its performance by transforming fixed costs (salaries) into variable costs creating more flexibility; Outsourcing can provide a reduction in resource management, freeing up valuable human resources; BPO offers state of the art technology, the ability to handle high volumes which prevents bottlenecking; BPO can speed up the delivery of results, necessary for company growth initiatives; BPO can reduce risk by contractually guaranteeing results-driven performance and regulatory accountability. Financing Services Inc. Business Process Outsourcing: Internal Management vs. External Outsourcing Arrangements BPO & the People Behind it - In order for businesses to have successful outsourcing initiatives, a thorough understanding of the business’s needs and expectations is required. Vendors hire staff. Businesses must be cognizant of this and ensure the need for BPO is validated thoroughly. - Business’s and vendors alike need to evolve their current relationships. The conventional “us and them” relationship is not as productive as a business partner relationship. - Businesses must be willing to venture into new ways of improving, not only their own businesses, but that of the vendors in their employ (i.e. incentive programs). Financing Services Inc. Business Process Outsourcing: Internal Management vs. External Outsourcing Arrangements BPO and the People Behind it Vendors must be fully integrated with your strategic objectives on a year to year basis. They need to have a transparent and open relationship built on substance (i.e. We expect vendors to have an internal understanding of our business). Many of our vendors have assisted us – from an internal perspective – in filling and improving “gaps” in business processes. Nickel and diming does not work. Pay for performance and reap the rewards! Financing Services Inc. Business Process Outsourcing: Internal Management vs. External Outsourcing Arrangements What to make of all of it… A business must thoroughly review its overall strategic objectives before engaging the in BPO. Arguably, internal employees have more “in the game” than some external service providers. However, as a company grows, simply adding employees internally may not be an option. When engaging a service provider for BPO, it is important to establish a business partnership based on openness, transparency and accountability. Stop the vendor/client adversarial relationship and build each others’ businesses! How? Involve them in your business, and reward solid performance! Financing Services Inc. Questions?