PowerPointPresentation

advertisement

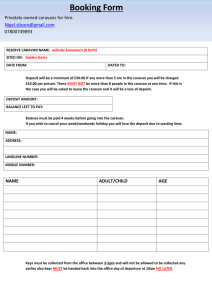

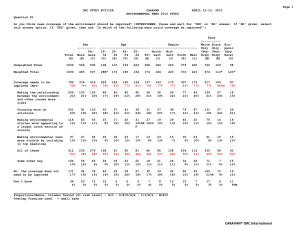

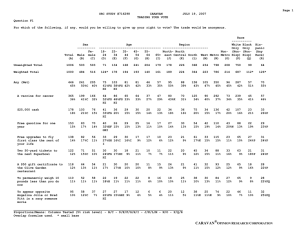

Every employee wants a better quality of life, it’s easy to make a good decision about choosing Caravan as an alternative benefit plan to your organization In business for over 10 years 100% Satisfaction Guarantee License and Bonded Integrated Credit Solutions Enhancing Employee Loyalty Nationwide. Serving both Commercial and Consumer Client’s Caravan believes that customized, personal attention for each individual case is the way to go, and focuses on customer support and long-term solutions. Our goal is to provide the best customer service in the industry, and currently our Credit Services Life-Cycle Management System remains unmatched. In Short, we have ethical standards, resources, and expertise that typical credit services companies simply cannot offer. We are dedicated to helping our clients invest in a better quality of life, restore their credit and come out with a renewed financial optimism while saving both time and money. UP to 80% of financially distressed workers spend time at their place of employment worrying about personal financial issues instead of working. Employees often admit that their concerns about personal finance interfere with their work. Personal financial distress, therefore negatively impacts employers. Job stress costs American industry alone $300 billion per year from factors like absenteeism which are stress-related. FACT More than half of the 550 million working days lost annually in the U.S. from absenteeism are stressrelated. Unanticipated absenteeism is estimated to cost American companies $602 per worker per year, and health care cost are nearly 50% higher for workers who report high stress levels. STRESS COSTS Types of Stress Anxiety Worry Stress in the Workplace Fatigue Insomnia Financial Stress Depression Blood Pressure Relationship Stress Chronic Pain 0 100 200 300 400 500 THE HARD FACTS ON THE COST OF CREDIT Gross $30K Good Credit Neutral Credit Bad Credit Monthly Net Income $2,187.50 $2,187.50 $2,187.50 Auto Payments $20K Loan $563.00 $693.00 $817.00 Mortgage $150K Loan $924.00 $1,127.00 $1,330.00 Net Income $700 $367.50 $40.50 Income Relativity $46,154.00 $40,826.00 $30,000.00 Loss in Productivity Health and Wellness Low Morale Loss time at work Workplace Accidents Non work related distractions Financial Problems Cause The Costs of those Problems for Employers Building Employee Loyalty NON-TRADITIONAL BENEFITS To maintain organizational competitiveness, employee benefit programs must not only provide traditional benefits, but also provide unconventional benefits. Because the labor market is evolving based on the changing needs of your employees, and has become increasingly competitive for highly skilled workers, innovative employers have incorporated ‘real life” benefit options to attract qualified employees. REALITY The reality is your employees are probably already taking time from work to talk with co-workers about personal financial problems, communicating with creditors about past due payments, paying personal bills, balancing checkbooks, or tying up H/R’s time cashing in 401k’s or getting employee advances. Leaders: Are involved in and committed to both their job and their company. They Represent the most valuable company asset; Careerists: Are dedicated to their job, but uncommitted to the company. They mainly care about their own career and personal achievements, and are thus open to competitive offers from other Potential employers; Loyalists: Are loyal to their company in the long term. However, they show less enthusiasm and dedication In relation to their job tasks, which can reduce their work efficiency; Passengers: Lack commitment to both their job and their employer. These people often provoke disagreements among colleagues and may act against the company’s interests at critical moments. Purchase a Home Automobile Credit Cards Employment Investments Clients come to Caravan Credit Services with less than perfect credit. Clients with a credit score below 680 is considered to be a credit risk by lenders and underwriters. This justifies lenders charging you very high interest rates which equates to paying 200% to 400% of what your Home is worth or paying $15,000.00 more than what your car is worth all due to impaired credit. For years consumers have been denied credit. Whether it’s trying to purchase a home, an automobile, or credit cards. Over the last few years consumers have struggled with Finding suitable employment, renting apartments or maintaining basic day to day life Functions. Consumers have spent countless hours trying to make end meet. Bad Credit has cost consumers and businesses a large amount of money from lost in Productivity, employee loyalty, health problems due to stress and family problems Due to lack of finances and credit. For over the last decade, Caravan has helped tens Of thousands of clients restore their financial and credit viability. Once you enroll in Caravans Credit Services Life Cycle Management System you will be educated on everything you need to know about the credit restoration process, so you can be confident in your future credit making decisions. At Caravan Credit Services we counsel our clients on the components of the scoring system that is used to determine the risk level assigned them by an underwriter when they attempt to make a purchase on credit. We counsel our clients on the importance of paying on time, the importance of keeping their credit utilization ratio down, and that a blend of credit can help them keep their credit score at a respectable level. Our state of the art software allows our restoration counselors the ability to manage and analyze unlimited loan amortization scenarios to evaluate which one would be most convenient for their clients. They are able to advise their clients on which credit cards to pay first whether you want to save money or if getting a better credit score has a priority. Utilizing our client portal, our clients are able to follow along in real time the progress taking place in restoring their credit. The Benefits of Caravans CSLMS Benefits of Caravan’s Credit Services Life-Cycle Management System. • It enhances your employee benefits package. • It creates financial and credit viability for your employees. • Reduces Stress and Increases Productivity. • No cost or liability to your company. Current Non-Traditional Benefits • • • • • • • • • • • • • Massage Service Transit Passes Gym Memberships Fresh muffins every morning One day off per month Shorts and Sandals days Costco memberships Telecommuting Nicer Chairs/Equipment Free/Cheap movie tickets Pool table/big screen TV in lounge Ski lift passes you can borrow Education subsidy CARAVAN CREDIT SERVICES To see if Caravan’s Credit Services Life-Cycle Management System can benefit your company contact one of our National Account Executives Today at: Toll Free no (800) 617-3417 Direct Line: (832) 678-2979 or visit our website at www.caravancredit.com