Chapter 8

Designing the Survey Questionnaire

McGraw-Hill/Irwin

Copyright © 2013 by The McGraw-Hill Companies, Inc. All rights reserved.

Questionnaires in Marketing Research

• Questionnaire: A formal, structured response

framework consisting of a set of questions and

scales designed to generate primary data.

• Can be administered orally or textually (i.e.

“written”)

8-2

Questionnaires in Marketing Research –

Two Main Kinds

• Descriptive survey questionnaires collect data

that can be turned into knowledge about

consumers, companies, markets, etc.

• Predictive survey questionnaires predict

changes in attitudes and behaviors and are

used to test research hypotheses.

8-3

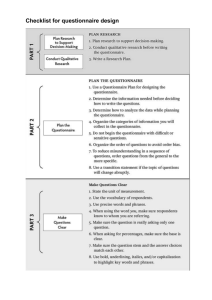

Steps in Questionnaire Design

8-4

Step 1: Confirm Research Objectives

• Example of Research Objectives:

– To collect data on selected customer demographic

characteristics and lifestyle dimensions of our

different market segments

– To identify preferred banking services, as well as

attitudes and feelings toward those services

8-5

Step 2: Select Appropriate Data Collection Method

• We will develop and administer an internet

survey with the following sections:

– Section I: Banking services

– Section II: Lifestyle dimensions

– Section III: Banking relationships

– Section IV: Demographic characteristics

8-6

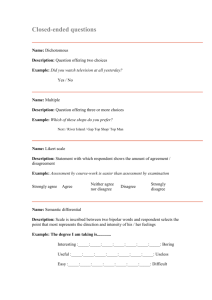

Step 3: Develop Questions and Scaling

• Question formats

– Unstructured questions: Open-ended questions

allow respondents to reply in their own words –

no pre-determined choices imposed by the

researcher (like an essay test!)

– Structured questions: Closed-ended questions

that require the respondent to choose from a predetermined set of responses or scale points

(pretty much any scale we have looked at so far)

8-7

Step 3: Develop Questions and Scaling

• Bad questions: Any questions that prevent or

distort the fundamental communication

between researchers and respondents

• A question is bad when it is:

– Unanswerable

– Leading (loaded)

– Double-barreled

8-8

Step 3: Develop Questions and Scaling

• Other considerations:

– Use simple words; avoid technical words or jargon

– Make questions as concise as possible

– Avoid using qualifying phrases (always,

sometimes, never, etc.) in question stems, but

they’re generally ok in response scales

– Ensure response categories are mutually exclusive

– Ensure question and corresponding scale

descriptors are meaningful to respondents and

“jive” with each other.

– Grammar, diction and spelling must be flawless!!!

8-9

Step 3: Develop Questions and Scaling

• Sensitive questions: Questions about income,

sexual beliefs or behaviors, medical

conditions, financial difficulties, drug/alcohol

consumption, or other questions that

respondents might skip, answer falsely or

otherwise take offense to should appear near

the end of the survey.

8-10

Step 3: Develop Questions and Scaling

• Skip questions: Used if the next question (or

set of questions) should be responded to only

by respondents who meet a previous

condition

• Much easier to implement in web/digital surveys

8-11

Step 4: Determine Layout and Evaluate

Questionnaire

• Introductory section: Gives the respondent an

overview of the research

• Re-mention the purpose of the research (if indicated)

• Set any necessary ground rules

• Provide general instructions

• Screening questions: Used to disqualify

inappropriate respondents

• This should usually/mostly be done before the formal

survey is administered

• Research questions section: Focuses on the main

research questions of interest

8-12

Step 4: Determine Layout and Evaluate Questionnaire

• Ensure instructions are clear for each section

• Arrange questions in a logical order.

– Keep questions using the same response formats in close

proximity if possible.

– Start with easy questions and ask the more difficult

questions later in the survey.

• Be mindful of coding needs when choosing response

formats, especially if manual entry of data will occur.

• The entire survey should be as short as possible

without sacrificing the integrity and amount of data

collected – it’s ultimately a judgment call!

• End with a thank-you statement.

8-13

Step 4: Determine Layout and Evaluate

Questionnaire

• Response order bias: Occurs when the order

of the questions, or of the closed-end

responses to a particular question, influences

the answer given

• Common methods variance (CMV): Falsely

correlated answers due to a subject’s need to

appear consistent across a series of related

questions.

8-14

Step 5: Obtain Initial Client Approval

• Provide copies of the questionnaire to all

parties involved in the project

• Client may identify any overlooked items or

other problematic aspects of the survey (i.e.

inaccurate representations, offensive

questions, etc.)

• What if client makes a stupid suggestion!?

8-15

Step 6: Pretest, Revise, and Finalize the

Questionnaire

• Final evaluation of the questionnaire is

obtained from a pretest

– Helps the researcher determine:

• How much time respondents will need to complete the

survey (Is survey too long?!)

• Whether to add, delete or revise instructions, questions

and scales that are biased or poorly written.

• Where did subjects get confused or misled?

• Helps with how to frame aspects of the cover letter

(see subsequent slides)

8-16

Step 7: Implement the Survey

• Administer the survey to the “real” (i.e. nonpretest) sample.

• Keep correcting any survey shortcomings /

errors that are revealed during

implementation without changing the

fundamental nature of the survey so that

results remain comparable across the

changes.

• Good + Bad Data is usually better than All Bad

Data

8-17

The Cover Letter / Invitation to Participate

• Cover letter / Invitation:

• Designed to enhance respondent willingness to

accurately and faithfully complete and/or return

the survey in a timely manner

8-18

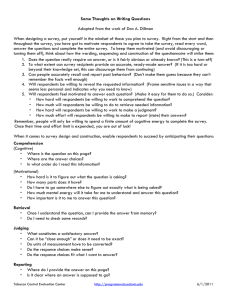

Guidelines for Developing Effective Cover Letters

8-19

Collecting Data

• Interviewer instructions: Used to train

interviewers how to:

– Select prospective respondents

– Screen them for eligibility

– Conduct the actual interview

• Screening questions

• Quotas: A tracking system that collects data

from respondents and helps ensure that

subgroups are represented in the sample as

specified

8-20

Collecting Data: Interviewer Instructions

• Used to train

interviewers how

to:

– Select prospective

respondents

– Screen them for

eligibility

– Conduct the

actual interview

8-21

Collecting Data: Contact Records

• Contact Record:

Gathers basic

summary

information

about an

interviewer’s

performance

efficiency

8-22