Who speaks for Islamic Finance?

advertisement

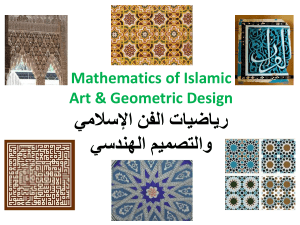

Global Trends In Islamic Finance Annual Islamic Finance Conference July 3 2013, Mombasa, Kenya Overview + Shameless Advertisement + Trends (7 Dichotomies) + Questions + Bonus Slides? – More Dichotomies – Ugly Statistics Shameless Advertisement + World’s 3rd largest financial data vendor + Founded September 1978 + 1990 released first non-US data + 1996 listed on NYSE + 2009 dual listed on NASDAQ + Great Islamic investment (debt to capital) FactSet Services + + + + + + + + + + Broker Research Corporate Activism Corporate Governance Economic Estimates Events Financial Entities Fixed Income Fundamentals Global Filings + + + + + + + + + + + Market Aggregates Mergers Mutual Funds New Issue Ownership People Private Company Private Equity Research Transcripts Venture Capital Recent Recognition + 2011, Inside Market Research names us “Best Research Provider” + 2011, Ranked 60 by Forbes on “America’s Best Small Companies” list + 2009, Received PilotHouse Innovator Award from Nemertes Research + 2009, Ranked 59 by Business Week’s InfoTech’s 100 + 2009, Best Analytics provider, Inside Market Data + 2007, Named to Deloitte Tech Fast 50 Dichotomies -Mutually Exclusive -False Dichotomy -Top 7 – Here they come! Source: Wikipedia #1 +Prophet vs Profit – Why do we participate in Islamic Finance? – Why do others participate in Islamic Finance? – Does everyone have the same motivation? #2 +Islamic vs Participatory – How should Islamic financial institutions be identified? – Does a rose by any other name smell as sweet? – Islamic? Participatory? Cooperative? House? Ethical? “Bank”? #3 +Apple vs Halal Foods – – – – Intra vs Extra-investment? Halal Foods 560 b per year Islamic Finance valued at: 1.8 t Dow Jones Industrial Market Capitalization 4.4 t; Nasdaq 5.5 t; S&P 500 14.9 t – Nairobi Stock Exchange Market Capitalization 1.7 t – Apple Market Capitalization: 372 b; Google 292 b #4 +Inter vs IntraBenchmarking – LIBOR? vs IIBR? – IIBR must always be higher than LIBOR? #5 +Growth vs Profit – Growth rates of 15% per annum for years – ROE was 12% in Islamic Banking vs 15% in Conventional – Islamic Bank Challenges • • • • Subscale Operations Asset Quality Negative Operating Income Weak Risk Culture Source: E&Y Competitiveness Report #6 +SEA vs Gulf – – – – – Who will influence global Islamic markets the most? Who speaks for Islamic Finance? Who sets the standards? Who will train the next generation of scholars? Who will Africa follow? Or will Africa forge its own identity? #7 +Data vs Relationship – How are decisions made in Islamic Finance? – How are decisions made in places where Islamic Finance is practiced? Break Questions? Joe Nehila Content Development jnehila@factset.com *Were they true or false dichotomies? Bonus - Dichotomies +Windows vs Fully Fledged Banks +Core vs Varied Offerings +Niche vs Alternative +Retail Banking vs Investment +Lower Class vs High Net Worth +SME vs Micro Bonus – Dichotomies 2 +Informal vs Formal Systems –Not just informal economy, Cooperatives, Credit Unions, SME Banks, Microfinance Banks, etc. +Mitigation vs Contract Law +Centralized vs Disbursed Authority +Top Down or Bottom Up Bonus - Stats +2010 new equity = $387 b +Most from Emerging Market (60%) +Global Stocks $212 t (2010) +$96 t foreign investments Source – McKinsey, Aug 2011 Mapping Global Capital Markets Bonus - Stats +Africa on the Map? –“Rest of World” –Egypt Only –GIFR • Kenya 22 (down from 17) • UK 12; US 15 • Sudan 9; Egypt 14; SA 21; Algeria 27, Tunisia 28; Nigeria 32, Senegal 36; Gambia 42, Mauritius 43 Source – GIFR 2013; E&Y Competitiveness Report Bonus - Stats +Banking –Bahrain, $47b vs $13b (27%) –Egypt, $215b vs $8b (3.8%) –Malaysia $579b vs $106b (19%) –Indonesia 4% –Kuwait 33% –Pakistan 6% –Saudi Arabia 49% –Turkey 5% –UAE 17% Source –E&Y Competitiveness Report Bonus – Math Problem +Problem – – – – – – $212 t total finance value $2 t Islamic value $210 t conventional value .9% value Islamic to Conventional CAGR Islamic 20% CAGR conventional 1.5% How long will it take to: 5% 7.5% 10% 20% 50% Bonus – Math Solution +Solution 5% 7.5% 10% 20% 50% 10 Years 13 Years 15 Years 19 Years 24 Years Realistic (2.75% Conventional, 15% Islamic Growth) 5% 15 Years 7.5% 19 Years 10% 21 Years 20% 28 Years 50% 36 Years Bonus – Math Prediction +Prediction -1.6 billion Muslims, 23% of world population -Varying levels of adherence -Attractive to non-Muslims -Growth Rates: Islamic 15% 7 years, 10% 10 years, 7% 15 years, 5% thereafter Conventional: 2.5% 2 years, 3% 3 years, 5% 4 years, 3.5% thereafter 5% 7.5% 10% 12.5% 15 % 20% 50% 34 Years (World Takes Notice) 62 Years (Significant Waypoint) 83 Years (Important Achievement) 98 Years (Target) 110 Years (Realistic Objective) 130 Years (Stretch) 194 Yeras (*Unlikely unless rebranded as an alternative and ethical)