Mr. Shahid Ali Habib

advertisement

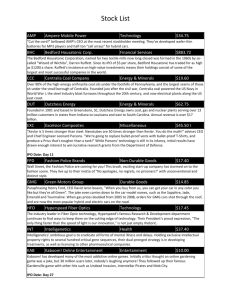

By Mr. Shahid Ali Habib Chief Executive Officer Brief Profile Leading Securities brokerage & Financial Services Firm Brokerage Operation since 1970 One of few listed securities brokerage houses Market Capitalization of 1.7 bn ( $ 17 mn) Parent Company Market Capitalization of 11 bn ( $ 110 mn) 7 out of 13 equity issues over the last 3 years Around 7% market share in KSE traded volume Top 25 companies award for 2008 and 2009, none ever got CFA award for Corporate Finance and Equity Traders 2 Overview of IPO Market IPO activity globally 2012 768 companies $ 118.5 bn 2011 1,225 companies $ 170 bn Local IPO activity - continuous decline over last 4 years 2012 3 companies 500 mn 2011 4 companies 4,479 mn 2010 8 6 companies 6,348 mn No. Of IPOs 6,348 6 4 8,000 Amount (PKR mn) 6,000 4,479 6 4 2 4,000 2,000 3 500 0 2010 2011 2012 00 2013 PKR mn 3 Promoting IPO Market Promotion and development of IPO market are dependent on following Secondary Market Valuations Regulators Government Issuers Advisors Automation Investors 4 Secondary Market Valuation Higher market valuation invites IPOs Higher liquidity Lower debt yields or other instruments Existence of varied Investor Classes (Foreigners, Pension & Provident funds, Banks, Mutual Funds) Individual investors to follow big institutions 5 Regulator’s Role Amendments in Capital Issue Rules are required One positive year of operation for asking premium should be removed one uniform criterion for loan-based projects and equity-based projects Requirement of project appraisal from financial institution should be removed Stock exchange verification of installation of P&E is not required This will reduce the cost of raising equity currently 5%-6% MNCs delisting should be eye opener for Regulators Regulators should give relaxation/remove few condition like: Minimum Application size; To collect 500 applications of 500 shares; increase the percentage of book building portion – currently 75% Delisting reasons should be addressed 6 Government Providing fiscal benefits - Income Tax differential between Public and Private Companies Dividend withholding tax rate differential between listed & unlisted Disinvestment of some stake of government entities like in the past OGDC, PPL HBL Help discovering price for future privatization 7 Advisor’s Role Need to have proper intelligence and research team to look for prospective issuers Shariah compliant issuers should be marketed Due diligence of an Issuer is a must! Should do proper in-depth analysis and valuation of the issuer’s business before bringing the Issue to Public; Proper firewalls between CF and brokerage to maintain confidentiality Ensure all material information is provided to investors/regulators for their own/independent assessment Advisory quality should be of utmost importance Experienced team to provide first-rate advisory services Extensive Road Shows to prospective Investors Country wide road shows to general public for wider participation 8 Issuer’s Role Issuers should be encouraged for listing for expansion – key role for advisors Quality issues can easily attract wider interest and will multiply capitalizations Even in a challenging economies, companies prepared early for their IPO journey are best able to leverage the windows of IPO opportunity when market recovers; Disseminate appropriate and complete information to regulators, advisors and investors; Discuss its future plans with regulators, advisors and investors; Conduct Road shows, presentations and awareness media campaigns; Ensure transparent utilization of IPO proceeds; Keep its investors well informed by company’s strategy even after IPO 9 Automation (User Friendly) Can increase general public investment in IPO by introducing electronic/online subscription methods – some initiatives have been taken recently in the IPO of Aisha Steel Mills Limited; Banks Collaboration is necessary for wider participation Automatic opening of CDC account Using ATM, Online and Mobile Banking Easy mode to attract non resident funds Awareness campaigns through print & electronic media Investor friendly process of application filing 10 Investor’s Role Assess the IPO opportunity meticulously including, but not limited to: Sector analysis Economic analysis Company analysis Sponsors’ profile Comparative analysis, etc Attend investor presentations Carefully review/analyze the Prospectus/OFSD Follow the regulatory procedures Fundamentally strong scrip is a better investment opportunity than the speculative one! 11 Thank You 12