Bank

advertisement

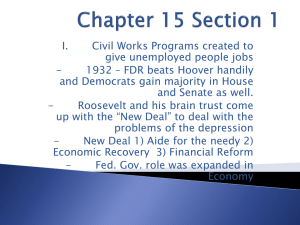

Unit 5 Microeconomics: Money and Finance Chapters 10.2 Economics Mr. Biggs The History of American Banking Bank - An institution for receiving, keeping, and lending money. American Banking Before the Civil War During the early history of the United States, banks were very informal businesses that merchants managed in addition to their regular trade. Deposits in these early informal banks were not very secure. Two Views of Banking In the 1790s, Alexander Hamilton and the Federalists believed that a centralized banking system was necessary for the United Stated to develop healthy industries and trade. Hamilton proposed the creation of a national bank. National bank - A bank chartered or licensed by the federal government. Thomas Jefferson and the Antifederalists wanted a decentralized system where the individual states would establish and regulate the banking within their borders. The First Bank of the United States In 1791 the Congress set up the Bank of the United States. The bank succeeded in bringing order and stability to American banking. The Antifederalists argued that a national bank was unconstitutional. In 1804, Alexander Hamilton was killed in a duel with Aaron Burr and the United States Bank lost its main backer. The bank only functioned until its charter ran out in 1811. Chaos in American Banking Once the first bank’s charter expired, state banks began issuing bank notes not backed by gold. The result was financial confusion, increased prices, and lack of confidence. The Second Bank of the United States The Second Bank of the United States was chartered for 20 years in 1816. It ensured that state banks had sufficient reserves to cover notes they issued. Despite difficulties arising from decentralized banking, many Americans distrusted a national bank. This included President Andrew Jackson, who vetoed the renewal of its charter in 1832. The Free Banking Era The fall of the Second Bank triggered a period dominated by state banks. The period between 1837 and 1863 is known as the “Wildcat Era” of banking and was noted for its high rate of failure. State chartered banks often did not keep enough gold and silver to back the paper money they issued. This caused bank runs. Bank run - Widespread panic in which great numbers of people try to redeem their paper money for gold or silver. Fraud and the use of many different currencies were problems associated with state chartered banks. The Later 1800s By 1860, 8,000 different banks were issuing currency. Currency in the North and South Greenbacks - Paper currency issued by the U.S. government during the Civil War. The South issued confederate currency based on cotton. The confederate currency eventually became worthless. Unifying American Banks The National Banking Acts of 1863 and 1864 gave the federal government the power to: Charter banks Require banks to have sufficient reserves Issue a national currency The Gold Standard In the 1870s the United States adopted the gold standard. Gold Standard - A monetary system in which paper money and coins are equal to the value of a certain amount of gold. This gold standard restored confidence and stability after the Civil War. Banking in the Early Twentieth Century Continuing problems in the nation’s banking system led to the Panic of 1907. Some banks did not have adequate reserves and had to stop exchanging gold for paper money. As a result of the 1907 crisis, the government made plans to reinstate a central bank. The Federal Reserve System The Federal Reserve Act of 1913 established the Federal Reserve System. Federal Reserve System - The nation’s central banking system. Central bank - Bank that can lend to other banks in time of need. The system has twelve regional Federal Reserve Banks called member banks. Member banks - Bank that belongs to the Federal Reserve system. Each of the regional Federal Reserve Banks allows member banks to borrow money to meet short term demand and prevent panics. Federal Reserve notes - The national currency we use today in the United States. This allows the Federal Reserve to control the amount of money in circulation. Banking and the Great Depression The Fed helped to restore confidence in the nation’s banking system, but could not prevent the Great Depression. Great Depression - A severe economic decline that lasted for more than a decade. During the 1920s, banks made many high risk loans that were not paid back, farmers had crop failures, and the stock market crashed. Thousands of banks across the country failed. Banking Reforms The banking system was taken off the gold standard and an individual’s ability to exchange dollars for gold was restricted. A fiat currency was established. Congress established the Federal Deposit Insurance Corporation (FDIC) in 1933. Banking in the Later Twentieth Century Through the 1960s, the interest rate banks could pay depositors and the interest rate banks could charge for loans was highly regulated. The government relaxed banking regulations in the 1970s and 1980s. The Savings and Loan Crisis Banking deregulation along with high interest rates, bad loans, and fraud caused many Savings and Loans to fail. In 1989, the Financial, Reform, Recovery, Enforcement Act (FIRREA) was passed which abolished the independence of the savings and loan industry and transferred insurance responsibilities to the FDIC. Banking in the 1990s In 1999 the Glass-Steagall Act (Banking Act of 1933) was repealed. Banks could now sell stocks and bonds instead of having to decide whether they are investment banks or commercial banks. The End