Summit International Associates Inc

advertisement

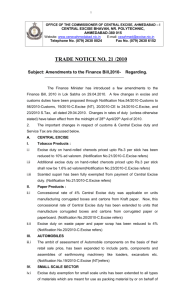

CONCEPT OF TAX Karachi Tax Bar Association May 20, 2011 Contact Address: 4th Floor, Central Hotel Building Civil Lines, Mereweather Road Karachi - Pakistan Phone: 021 – 35644872-7 Fax: 021 – 35694573 E-mail: aar@mimandco.com Presented by: Ali A. Rahim Director CONCEPT OF TAX (General ) WHY TAXATION :- Every country needs funds For Running the Government & Establishment For Defence For Future Developments Programmes 2 CONCEPT OF TAX (General ) TYPES OF TAXATION • FEDERAL TAX INCOME TAX SALES TAX / VAT* FEDERAL EXCISE* CUSTOM DUTY* WEALTH TAX ZAKAT • PROVINCIAL TAX PROPERTY TAX PROVINCIAL EXCISE WATER TAX CUSTOM DUTY USHER/DHAL/ABIYANA & A HOST OF OTHER TAXES * In certain countries these taxes are imposed on the Provincial / State Level. 3 CONCEPT OF TAX INCOME TAX (History ) CHINA HAN. DYNESTY (Ancient) – 10 BC First known history of imposition of Income tax on earnings – 10% which was applicable on professionals and salary. Previously tax used to be levied only on properties (land holdings) and collected by the respective states of which a percentage was passed on to the center. 4 CONCEPT OF TAX INCOME TAX (History ) UNITED KINGDOM In the modern time Income tax was imposed for the first time on income in 1798 to pay for the weapons and equipments to prepare for the “ Napoleon war”. This was the first time that the tax went higher with the income going up. This tax was abolished in 1816. 5 CONCEPT OF TAX INCOME TAX (History ) UNITED STATES In 1861 (Revenue Act 1861) Income tax was imposed on the income of citizens for the first time by the U.S government to fund the Civil War in U.S.A. This continued till 1894 when 2% Income tax was imposed on income over US$ 4,000/- per annum. This brought into the taxation only about 10% of the house hold of U.S.A This was more like a “fixed tax”. In 1895, progressive Income tax was imposed for the first time. 6 CONCEPT OF TAX INDIRECT TAX (History ) EQYPT During the era of the Egyptian Pharaohs a tax was collected by the government on the usage (consumption) of cooking oil. The tax collectors were known as “Scribes” and this is the first known Indirect tax in history. 7 CONCEPT OF TAX INDIRECT TAX (History ) ROMAN EMPIRE History reveals that a tax was imposed for the first time on all imports and exports called “portoxia”. This is the first time that the history of Custom Duty as we now know it, was introduced. It was collected on sea and land routes. 8 CONCEPT OF TAX INDIRECT TAX (History ) ROMAN EMPIRE Julius Caesar was the first person to impose what is today known as “Sales-tax” at 1% of all sales. It was further increased to 4% on sale of slaves only. History elaborates that a revolt started in 60 AD in East Anglia British Isles against in the corrupt tax collectors, and this is the first known corruption in recorded tax history. 9 CONCEPT OF TAX INDIRECT TAX (History ) ROMAN EMPIRE Caesar Augustus was the first person to impose the “Inheritance tax” at 5% on all assets, except gifts to children and spouses. This was the start of the Inheritance tax, followed by the West and was also known as “Estate Duty” in certain Countries. 10 CONCEPT OF TAX INDIRECT TAX (History ) ISLAMIC CONCEPT Islam imposes the followings taxes:(i) Zakat (on properties) (i) Ushr (on agricultural land) (i) Jaiza (paid the (Islamic) victors of the war) 11 CONCEPT OF TAX EVOLUTION OF INCOME TAX (History ) UNDIVIDED INDIA (Contd....) In 1860 for the first time, a tax was imposed by the British government known as Income – tax, which was paid by all persons earning over Rs 600/per annum. This lasted for 5 years. In 1867 a new “License Act of 1867” was introduced in which every person earning over Rs. 200/- per annum was liable to pay the tax @ 2%. Agriculture was exempted. In 1868 a new Act called “ The Certificate Act 1868” was introduced whereby the ½ annas taxable limit was raised to Rs. 500 per anum and the rate of tax was reduced to 1.6 percent. 12 CONCEPT OF TAX EVOLUTION OF INCOME TAX (History ) In 1869 this act was converted into the Income – Tax Act 1869 and one to the important features was that agricultural income was brought into the “taxable net”. 13 CONCEPT OF TAX EVOLUTION OF INCOME TAX (History ) Pakistan adopted the Income – tax Act 1922 when it became Independent in 1947 and this act was followed upto 1979 when a new Income – Tax Ordinance 1979 was promulgated. The concept of the Income – Tax Ordinance was very much the same as the Act of 1922 but was brought into a serial order till a new Law called the Income – Tax Ordinance 2001 was enacted which came into force from 2003. 14 CONCEPT OF TAX EVOLUTION OF INCOME TAX (History ) TYPES OF TAXATION IN PAKISTAN PROGRESSIVE TAX REGRESSIVE TAX PROPORIONATE TAX INCOME TAX SALES TAX EXCISE TAX CUSTOM DUTY SHARE OF TAX 15 CONCEPT OF TAX EVOLUTION OF INCOME TAX (History ) DIFFERENCE BETWEEN OLD ORIDNANCE & ORDINANCE 2001 CONCEPTUAL i) ii) iii) iv) Assessee Vs Tax Payers Assessment Vs Audit Self Assessment Vs Universal Self Assessment Assessment Year Vs Tax Year LAW SPREAD OVER i) ii) iii) iv) Income - Tax Sales - Tax Federal Excise Duty Custom Duty 16 CONCEPT OF TAX EVOLUTION OF INCOME TAX (History ) CENTRAL CONCEPTS Persons Section 80 Residential Status Section 81 Resident Individuals Section 82 Resident Company Section 83 Resident Association of Persons Section 84 Associates Section 85 17 18