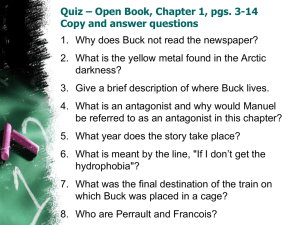

to view the Power Point Presentation.

advertisement

CANADIAN CENTRE FOR POLICY ALTERNATIVES LYNNE FERNANDEZ TWO SECTIONS Seniors’ Poverty Rate The Truth about Taxes • How the • Avoiding the greatest Generational Canadian Divide policy success story may be unravelling GREATEST POLICY SUCCESS STORY IN CANADIAN HISTORY REDUCTION OF SENIORS’ POVERTY RATE WHAT MACLEAN’S ARTICLE GOT RIGHT: GREATEST POLICY SUCCESS STORY IN CANADIAN HISTORY 40 35 30 1976 25 20 15 10 5 0 Seniors 19-64 Under 18 2013 CHILD POVERTY • In 1989 the House of Commons passed a unanimous resolution “to seek to achieve the goal of eliminating poverty among Canadian children by the year 2000” and two years after the entire House of Commons voted to “develop an immediate plan to end poverty for all in Canada.” Neither the promised poverty elimination or plans have materialized. HOW THINGS IMPROVED FOR SENIORS • Direct policy programs: • OAS • CPP • Guaranteed Income Supplement A VERY DIFFERENT LABOUR MARKET • Today’s ageing Canadians enjoyed: • Higher rates of unionization • Better wages • More secure employment • Better benefits, including pensions In sum, they worked in a standard work environment vs. a precarious work environment. COMPREHENSIVE SET OF GOVERNMENT PROGRAMS • Public Healthcare – Canada Health Act enforced by federal government: funded 50% • Public education • National housing strategy THE WEALTHY SENIOR? •Little data to back up the claim of many very wealthy seniors •More income and wealth data required for 65+ group THE BENEFIT CLAW BACK • “DESPITE POLITICAL BLOWBACK, GOVERNMENTS MAY ALSO NEED TO START SUBJECTING SACRED SENIOURS’ BENEFITS LIKE PENSION INCOME-SPLITTING OR CPP AND OAS TO A ‘MEANS TEST”- A SLIDING SCALE BASED ON INCOME.” A LIFETIME OF TAXES • A LIFETIME OF PAYING TAXES = FULL ACCESS TO OAS • CPP IS AN INSURANCE PROGRAM: IF YOU PAY IN, YOU SHOULD BENEFIT. PERIOD • WE MUSTN’T ERODE THE UNIVERSALITY OF THESE PROGRAMS NEED TO REFORM CPP • OECD warns that reform needed if future ageing Canadians are to enjoy financial security • Private pensions are mainly concentrated among high-income workers • Coming decades will see an increase in poverty for ageing Canadians • Women, who face more breaks in their careers and whose wages are not equal to men’s, will be hit the worst NOT JUST ABOUT INCOME • We need a new Healthcare Accord: • Not renewed • We need to renew Special Operating Agreements for low income housing: • Not renewed WE NEED A RE-ENERGIZED FEDERAL COMMITMENT TO HEALTHCARE AND HOUSING: NOWHERE ON THE HORIZON “CASH-STRAPPED GOVERNMENTS” • HAVE TO MAKE A CHOICE BETWEEN SUPPORTING AGEING CANADIANS OR SUPPORTING YOUNGER CANADIANS….. • WHE NEED TO ASK WHY???? THE TRUTH ABOUT TAXES TAX FAIRNESS TAX CUTS • Between 1995 and 2009 tax revenue had dropped from 36% of GDP to 33% of GDP. • $50 billion LESS in public revenue. A BUCK IS A BUCK •Royal commission on taxation, or the Carter Commission said: •A buck is a buck, or all income should be taxed at the same rates regardless of its source WHEN A BUCK ISN’T A BUCK • Wealth (company assets, real estate, gold bars etc.) subject to capital gains • Capital gains taxed at half the rate of income (wages, pensions etc.) IF A BUCK WERE A BUCK… • If capital gains were taxed the same as employment income, we would increase revenues by $8.4 billion. • So, we could add $8.4 billion dollars to pay for a pharma-care plan and national housing strategy that would help ALL low income Canadians PENSION-INCOME SPLITTING • INCOME SPLITTING ALLOWS HIGHINCOME SENIOR TO TRANSFER INCOME TO LOWER-INCOME SPOUSE • ELIMINATES HIGH-INCOME SENIOR’S OAS CLAWBACK PENSION INCOME SPLITTING • 7 out of 10 senior families get NO benefit at all from pension income splitting • The richest 10% of senior families receive more than the bottom 70% combined. • The cost of pension income splitting for senior couples in 2015 is estimated at $1.7 billion ($1.2 billion federally and $500 million provincially). • In contrast, it would cost $1.5 billion a year to lift all Canadian seniors out of poverty. ON ONE HAND… •WE’VE SAID THAT OAS SHOULD NOT BE CLAWED BACK ON THE OTHER HAND… • THIS “CORRECTION” [PENSION SPLITTING] DOES NOT HELP LOWINCOME PENSIONERS • THE RICHEST 40% OF PENSIONERS GAIN MOST OF THE BENEFITS FROM PENSION INCOME SPLITTING • THE POOER THE SENIOR FAMILY, THE LESS BENEFIT IT RECEIVES POOREST 10% VS RICHEST 10% •THE POOREST 10% OF SENIORS RECEIVE AN AVERAGE OF 10 CENTS IN TERMS OF A TAX BREAK •THE RICHEST 10% RECEIVE AN AVERAGE OF $820 KEEP IT SIMPLE •No claw backs: universality •Tax income and wealth equally •Eliminate tax loopholes •Prevent tax avoidance •Restore progressivity CORPORATE TAX CUTS • FALLEN FROM 28 PER CENT IN 2000 TO: • 18% effective January 1, 2010 • 16.5% effective January 1, 2011 • 15% effective January 1, 2012 IT ADDS UP • When federal government cut corporate income tax rate from 18.5% to 15%, we lost $1.75 BILLION for each percentage point decrease • $6.125 BILLION TAX HAVENS •Cost Canadians $10 billion a year PROGRESSIVE TAX SYSTEM •AS INCOME INCREASES, SO SHOULD THE RATE AT WHICH IT IS TAXED TAX RATES ON WEALTHY • In 2014: 29% on earnings over $136,270. • In 1981 rate was 43% on earnings over $119,000 (1981 dollars) • Before WWII, was as high as 90% TAX FAIRNESS • A STRONGER HEALTHCARE SYSTEM: • Renew 10-year accord • Add pharma-care; long-term care; home care; • Renew Federal Commitment to Canada Health Act TAX FAIRNESS • Means to help all low-income Canadians, including children • Means to maintain improvements for ageing Canadians. TAX FAIRNESS • MEANS TO RESTORE NATIONAL HOUSING STRATEGY: • Renew Special Operating Agreements which are due to start expiring • Restore housing security to all lowincome Canadians • Eliminate national housing crisis TAX FAIRNESS • Restore the Employment Insurance Program • National childcare program • Restore funding to healthcare TAX FAIRNESS •Let’s avoid the generational divide DIVIDE AND CONQUER • Great success in lowering seniors’ poverty rate did NOT occur on backs of younger generations • Deliberate policy decisions such as: • CCP; OAS; GIS • NATIONAL HOUSING STRATEGY • VIABLE UNEMPLOYMENT INSURANCE SYSTEM • PROGRESSIVE INCOME TAX SYSTEM TO SUPPORT ALL THIS AND MORE: • EDUCATION • HEALTHCARE IT WAS THE WHOLE PACKAGE • A broad range of government supported programs and policies created the greatest policy success story in Canadian history • By dismantling those programs, Canada’s ageing population will begin to feel the pinch again and… • Tomorrow’s seniors will not do as well. IT’S ABOUT ALL OF US •REFUSE TO BUY INTO IT’S THEM OR IT’S US ARGUMENT •A FAIR TAXATION SYSTEM = A FAIR SOCIETY