The First National Bank - Everett Public Schools

advertisement

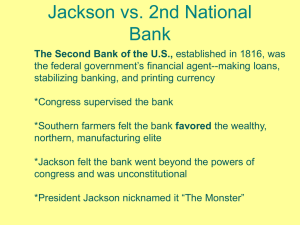

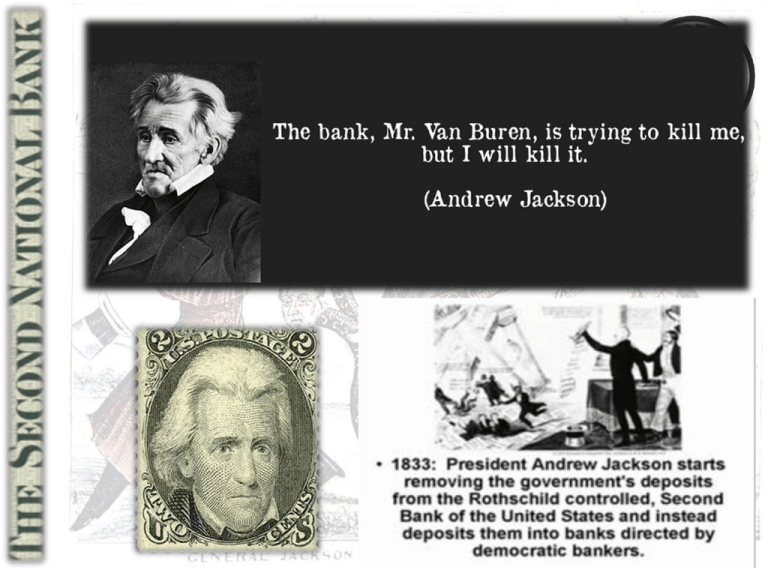

Review Money equates to Power Power equates to control Who ever controls the money then controls the power. Whoever controls the Power makes the laws. Whoever makes the laws stays in control and controls the money.. The Era of Good Feelings with the Democratic Republicans in control has come to halt with the Election of 1824 between Jackson and JQ Adams. Adams wins which inspires Jackson to become even more determined to win the White House. In 1828, Jackson eventually wins the White House and takes control. One of his priorities was to take control of the financial system. In order to understand the dynamics that play out we must first review how the bank came into existence. The First National Bank The First Bank was established under Washington’s administration. The original concept about the bank was conceived by Alexander Hamilton in order to handle the debt that was incurred by the Revolutionary War. Hamilton saw the Bank as a means to secure funding for the government by utilizing the money of wealthy Americans to in turn lend out at a higher interest rate. The immediate controversy with this first Bank was the government relationship with private wealthy individuals. These people would be in a position of control over the government. Also, nowhere in the Constitution is there a reference to a National Bank. Yet Hamilton argued that Congress had the right to use whatever methods necessary to stabilize the country. Jefferson was immediately suspicious of a National Banking system because of the ultimate control of a central government with the involvement of private individuals. The First National Bank Hamilton argued for the ability to provide credit and stimulate the economy. He used the central banks of Europe as an example for the American Bank. On December 15, 1790, Hamilton submitted a report to Congress making the case. He proposed a Bank of the United States with a goal of seeking out $10 million capital by selling stock. The Bank would be based in Philadelphia and chartered for 20 years. The federal government would have a minority stake in the Bank, and its board of directors would be private individuals, ensuring a mix of public oversight and private enterprise. The Bank would be able to lend the government money and safely hold its deposits, give Americans a uniform currency, and promote business and industry by extending credit. Together with Hamilton's other financial programs, it would help place the United States on an equal financial footing with the nations of Europe. The First National Bank Hamilton's bank plan had a relative easy time in Congress. The Senate passed it on January 20, 1791, and the House followed in February. But support for the Bank fell largely along sectional lines, with Northern endorsement and Southern opposition. Among those Southern opponents was James Madison, who worried that the Bank's placement in Philadelphia, the nation's temporary capital, might thwart the decision to put the permanent seat of government further south on the banks of the Potomac River. Madison also noted that the Constitution did not provide power to establish a national bank; and if a power was not in the text, by what authority could it be done? When the Bank bill reached George Washington, Thomas Jefferson, who termed the banking industry "an infinity of successive felonious larcenies," also weighed in against it on constitutional grounds, urging a veto. The Bank was granted its charter and lasted until 1811 and was replaced by the Second National Bank. The Second Bank of the US The War of 1812 revealed the weakness of the American financial system In 1816 the charter of the Bank of the United States was eventually rechartered. Support for the second Bank of the United States came from political figures who were concerned with the financial problems of the Federal government, as revealed by the difficulties financing the costs of the War of 1812. Support also came from business leaders who were concerned with the financial chaos of the time. The charter called for capital of $35 million, of which $7 million was to be supplied by the U.S. government. The Bank was controlled by a board of twenty directors, 15 elected by the private stockholders and 5 appointed by the President of the United States. The Bank was to pay the U.S. government $1.5 million per year for its franchise. The first president of the Second Bank was William Jones. His tenure as Secretary of the Treasury was marked by mismanagement of finances of the Bank of the United States. . The Second Bank of the US The Second Bank was not closely monitored and it was looted out of a million dollars before it was revealed. The next president of the Second Bank was Langdon Cheves. Cheves cut back operation, reducing the bank loans from $41 million to $31 million and brought stability to the Second Bank. However, the stockholders resented the reduction in dividends and was replaced by Nicholas Biddle of Philadelphia. Traditionally Banks are run by a President and a Board of Directors with ties to industry and manufacturing, and therefore was biased toward the urban and industrial northern states. When Andrew Jackson was elected he immediately expressed his resentment of the bank's lack of funding for expansion into the unsettled Western territories. Jackson also objected to the bank's unusual political and economic power and to the lack of congressional oversight over its business dealings. The Bank War Jackson considered the Bank, under the direction of Nicholas Biddle, an elitist institution that monopolized the banking industry and favored eastern manufacturing interests at the expense of common working people. Later that year, Jackson presented his case against the bank in a speech to Congress; however, Congress generally agreed that the bank was indeed constitutional. Controversy over the bank lingered for the next three years. In 1932, the divisiveness led to a split in Jackson's cabinet. that same year, the obstinate president vetoed an attempt by Congress to draw up a new charter for the bank. All of this took place during Jackson's bid for re-election; the bank's future was the focal point of a bitter political campaign between the Democratic incumbent Jackson and his opponent Henry Clay. Jackson's promises to empower the "common man" of America appealed to the voters and paved the way for his victory. He felt he had received a mandate from the public to close the bank once and for all, despite Congress' objections. Biddle vowed to continue to fight the president, saying that "just because he has scalped Indians and imprisoned Judges [does not mean] he is to have his way with the bank." The Bank War On September 10, 1833, Jackson removed all federal funds from the Second Bank of the U.S., redistributing them to various state banks, which were popularly known as "pet banks." In addition, he announced that deposits to the bank would not be accepted after October 1. Finally, Jackson had succeeded in destroying the bank; its charter officially expired in 1836. Jackson did not emerge unscathed from the scandal. In 1834, Congress censured Jackson for what they viewed as his abuse of presidential power during the Bank War. With the dissolution of the bank went its conservative monetary policy. State banks extended easy credit and issue paper money freely, touching off a round of western land speculation and inflation. In 1836, Jackson sought to restore economic order requiring buyers of public land to pay in gold or silver. he order effectively dried up credit and ended the feverish land speculation, but it also precipitated the Panic of 1837, which started shortly after Jackson left office.