Collective insurances provide protection for your employees

Collective insurances provide protection for your employees

The collective insurances are part of the Swedish protection system. A company that is bound by collective agreement, either via membership of an employer’s association or through signing a collective agreement with a trade union, is required to sign an insurance agreement through Fora. Insurance agreements can also be signed by companies that are not bound by collective agreement.

The collective insurances are an insurance package?

As a new customer, you sign a basic agreement with Fora.

Registration forms are available at www.fora.se. The following insurances are included in the basic agreement:

In the event of illness: Group Sickness Insurance (AGS)

Provides the employee with compensation for part of their loss of income when they are on sick leave. Applies to a person who is ill and is eligible for sickness benefit or sickness/activity compensation.

In the event of death: Group Life Insurance (TGL)

Group Life Insurance (TGL) provides compensation to survivors in the event of a death.

In the event of work injury: Work Injury Insurance (TFA)

Work injury insurance (TFA) provides compensation in the event of an injury at work, a work illness or an accident on the way to or from work.

In the event of redundancy: Severance Pay Insurance (AGB) and Career readjustment support

Severance Pay Insurance (AGB) provides cash compensation if the employee loses their job due to redundancy. If the company is bound by collective agreement and/or is a member of an employer’s association, Career readjustment support to find new work or training will also be included.

In the event of parental leave: Supplementary Parental Benefit

Insurance (FPT)

While you are on parental leave and receiving parental benefit from the Swedish Social Insurance Agency, you can receive additional compensation during your parental leave.

For pensions: SAF-LO Collective Pension Insurance

SAF-LO Collective Pension Insurance is an occupational pension for private sector wage earners. Pension entitlement is earned between the ages of 25 years and 65 years through you as an employer paying pension premiums to Fora.

Who is covered by what?

Employed wage earners have the SAF-LO Collective Pension

Insurance occupational pension and are insured through

AGS, TGL, TFA, AGB and FPT and, if the company is bound by collective agreement, Career readjustment support as well. Salaried employees are insured through TFA. If the company is bound by collective agreement and/or is a member of an employer’s association, salaried employees will also be connected to TRR.

The company owner, as well as any husband/wife or registered partner who is active in the company, will be insured through TFA.

Premiums, fees and invoice

The premiums for the different insurances are calculated as a percentage of the salaries for your employees. To enable us to calculate premiums, your company needs to report salaries for your employees to Fora. Find out more about how you report at www.fora.se.

Claims and pension selection

AFA Insurance is insurance provider for TGL, TFA, AGS,

AGB and FPT. If an employee sustains an injury, it is his or her responsibility to report the injury to AFA Insurance. You as an employer confirm their employment.

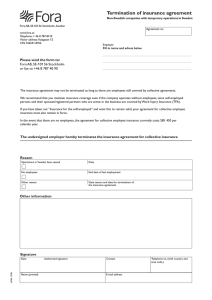

Cancelling the agreement

If the company ceases to operate in Sweden, you should cancel the insurance agreement. In that case, we kindly ask you to fill in the “Cancellation of insurance agreement” form.

In other cases, different rules will apply depending on whether the company is bound by collective agreement or not. You will find additional information and cancellation forms at www.fora.se.

If you have any questions

If you have any questions, you are welcome to contact our

Customer Service on telephone + 46 (0)8787 40 10. You can also find out more at www.fora.se.

Vasagatan 12, SE-101 56 Stockholm, tel: +46 (0)8-787 40 10 www.fora.se