CV Tomas Sjögren - Org.umu.se

advertisement

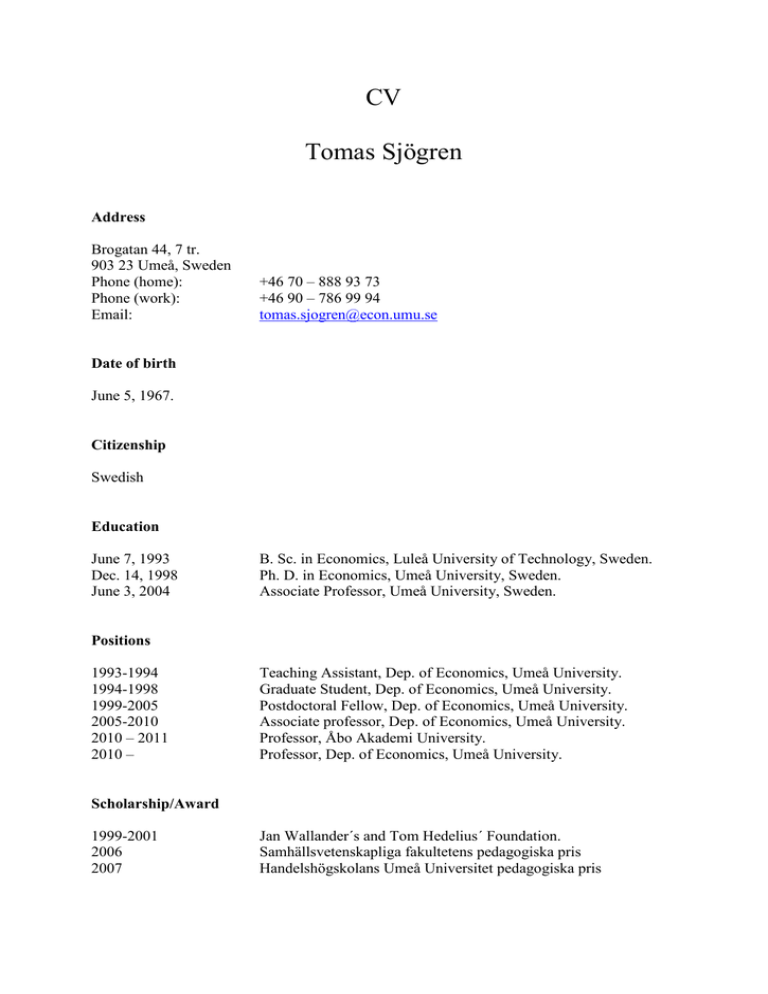

CV Tomas Sjögren Address Brogatan 44, 7 tr. 903 23 Umeå, Sweden Phone (home): Phone (work): Email: +46 70 – 888 93 73 +46 90 – 786 99 94 tomas.sjogren@econ.umu.se Date of birth June 5, 1967. Citizenship Swedish Education June 7, 1993 Dec. 14, 1998 June 3, 2004 B. Sc. in Economics, Luleå University of Technology, Sweden. Ph. D. in Economics, Umeå University, Sweden. Associate Professor, Umeå University, Sweden. Positions 1993-1994 1994-1998 1999-2005 2005-2010 2010 – 2011 2010 – Teaching Assistant, Dep. of Economics, Umeå University. Graduate Student, Dep. of Economics, Umeå University. Postdoctoral Fellow, Dep. of Economics, Umeå University. Associate professor, Dep. of Economics, Umeå University. Professor, Åbo Akademi University. Professor, Dep. of Economics, Umeå University. Scholarship/Award 1999-2001 2006 2007 Jan Wallander´s and Tom Hedelius´ Foundation. Samhällsvetenskapliga fakultetens pedagogiska pris Handelshögskolans Umeå Universitet pedagogiska pris Research grants 2002 2008 Swedish Council for Working Life and Social Research (FAS), with Thomas Aronsson as the project leader. Research grant from the Bank of Sweden Tercentenary Foundation (Stiftelsen Riksbankens Jubileumsfond), the Swedish Council for Working Life and Social Research (FAS), the National Tax Board (Skatteverket), with Thomas Aronsson as the project leader. Visiting Spring 1996 Spring 2000 Autumn 2000 Exchange Graduate Student, Dep. of Economics, University of Wisconsin, Madison, USA. Guest Research Fellow, FIEF, Stockholm, Sweden. Guest Research Fellow, Dep. of Economics, Michigan State University, East Lansing, Michigan, USA. Ph.D. Dissertation Union Wage Setting in a Dynamic Economy, 1998, Umeå Economic Studies 480. Book Chapters 1. Welfare Measurement, Hyperbolic Discounting and Paternalism, with Kenneth Backlund, Handbook of Environmental Accounting, 50-77. 2. Local Public Goods and Income Heterogeneity, The Theory and Practice of Environmental Economics – Essays in Honour of Karl-Gustaf Löfgren, 85-101, with Thomas Aronsson, Kenneth Backlund and Magnus Wikström. 3. Public Goods, Optimal Distortionary Taxation and Union Wage Setting, The Theory and Practice of Environmental Economics – Essays in Honour of Karl-Gustaf Löfgren, 102-127, with Thomas Aronsson, Kenneth Backlund and Magnus Wikström. Journal Articles 1. Optimal Tax and Expenditure Policy in the Presence of Emigration - Are Credit Restrictions Important? Forthcoming in Indian Growth and Development Review, with Kenneth Backlund and Jesper Stage. 2. Can Labor Market Imperfections Cause Overprovision of Public Inputs? Forthcoming in Journal of Economic Research, with Diego Martinez. 3. Mixed Taxation, Public Goods and Transboundary Externalities: A Model with Large Jurisdictions, forthcoming in Public Finance Review, with Lars Persson and Thomas Aronsson. 4. Effects of Migration on Tax Policy in the EU Countries: An Empirical Analysis, forthcoming in China-USA Business Review 10 (7), 508-515, 2011, with Kenneth Backlund and Jesper Stage. 5. An Optimal Tax Approach to Alcohol Policy, FinanzArchiv 66 (2), 153-169, 2010, with Thomas Aronsson. 6. Optimal Taxation and Environmental Policy in a Decentralized Economic Federation with Environmental and Labor Market Externalities, Public Finance and Management, 10 (2), 284-330, 2010. 7. Optimal Income Taxation and Social Norms in the Labor Market, International Tax and Public Finance 17 (1), 67-89, 2010, with Thomas Aronsson. 8. Optimal Taxation and Redistribution in an OLG Model with Unemployment, International Tax and Public Finance, 16 (2), 198-218, 2009, with Thomas Aronsson and Torbjörn Dalin. 9. Environmental Policy and Optimal Taxation in a Decentralized Economic Federation, FinanzArchiv 62 (3), 437-454, 2006, with Thomas Aronsson and Thomas Jonsson. 10. International Environmental Policy Reforms, Tax Distortions and the Labor Market, FinanzArchiv 62 (2), 199-217, 2006, with Thomas Aronsson and Thomas Jonsson. 11. Public Provision of Private Goods and Equilibrium Unemployment, FinanzArchiv 61 (3), 353-367, 2005, with Thomas Aronsson and Mikael Markström. 12. Efficient Taxation, Wage Bargaining and Policy Coordination, Journal of Public Economics 88, 2711-2725, 2004, with Thomas Aronsson. 13. Is the Optimal Labor Income Tax Progressive in a Unionized Economy?, Scandinavian Journal of Economics 106 (4), 661–675, 2004, with Thomas Aronsson. 14. Income Taxation, Commodity Taxation and Provision of Public Goods under Labor Market Distortions, Finanzarchiv 59 (3), 347-370, 2003, with Thomas Aronsson. 15. Wage Setting and Tax Progressivity in Dynamic General Equilibrium, Oxford Economic Papers 54, 490-504, 2002, with Thomas Aronsson and Karl-Gustaf Löfgren. 16. ‘Investment’ in Union Membership: A Managerial Approach, Labour 16 (2), 403-422, 2002. 17. Union Wage Setting and Capital Income Taxation in Dynamic General Equilibrium, German Economic Review 2 (2), 141-175, 2001, with Thomas Aronsson and KarlGustaf Löfgren. 18. Recreation Travel Time Conditional on Labor Supply, Work Travel Time and Income, Tourism Economics 2 (3), 265-272, 1996, with Kurt Brännäs. Working Papers: 1. Comparing Centralized and Decentralized Banking: A Study of the Risk-Return Profiles of Banks, with Ulf Holmberg and Jörgen Hellström. 2. Conflicting Identities and Social Pressure - Effects on the long-run evolution of female labor supply, with Andrea Mannberg. 3. Tax Policy and Present-Biased Preferences: Paternalism under International Capital Mobility, with Thomas Aronsson. 4. Labor Market Distortions and Intergenerational Income Distribution - What Will be the Consequences for Growth? 5. Age Dependent Discount Rates and Welfare Measurement. 6. Labor Income Taxation in an Economic Federation with Imperfect Labor Markets. 7. Quasi-Hyperbolic Discounting and Mixed Taxation, with Thomas Aronsson. 8. Does Wage Bargaining Justify Environmental Policy Coordination? with Thomas Aronsson and Lars Persson. 9. Optimal Tax and Expenditure Policy in the Presence of Migration – Are Credit Restrictions Important? with Kenneth Backlund and Jesper Stage. 10. Optimal Taxation and Asymmetric Information in an Economy with Second-Hand Trade, with Thomas Aronsson and Mikael Witterblad. 11. On the Provision of Public Goods in an Economy with Union Wage Setting and Distortionary Taxation, with Thomas Aronsson and Karl-Gustaf Löfgren. 12. A Note on Environmental policy Reform, Distortionary Taxation and Imperfect Competition, with Thomas Aronsson and Karl-Gustaf Löfgren. 13. Income Taxation, Old Age Pensions and Disability Benefits, with Thomas Aronsson. 14. International Capital Movements and Labor Market Imperfections, with Thomas Aronsson and Karl-Gustaf Löfgren. 15. Centralization of Wage Setting under Endogenous Union Membership. 16. Wage Setting in Dynamic General Equilibrium under Public Consumption Externalities, with Thomas Aronsson and Karl-Gustaf Löfgren. Other Articles Platt skatt – ett realistiskt alternativ? Ekonomisk Debatt 2006 (2), 30 – 39. Discussant Dissertation 1. Income Redistribution Policies, by Lasse Frisgaard Gunnersen, Aarhus Denmark 2012. 2. Licenciate: Spencer Bastani, Uppsala 2010. 3. Essays on Public Spending: A Computational Approach, by Antonio Jesus Sanchez Fuentes, Sevilla Spain 2009. 4. Discussant at pre-dissertation seminar on Environmental Policy and the Properties of Environmental Damages, by Ficre Zehaie 2004. Participant Grading Committee 1. On Risk Prediction, by Carl Lönnbark 2009. 2. Stock, Data, Trade Durations, and Limit Order Book Information, By Ola Simonsen 2006. 3. Essays on the Political Economy of Land Use Change, by Johanna Jussila 2005. Supervision of Doctoral Students Supervisor: 4 PhD students. Co-supervisor: 5 PhD students. Teaching Experience Extensive teaching in microeconomics, macroeconomics, financial economics, mathematical economics, econometrics and public economics at the graduate and undergraduate level. Referee international journals (selection): FinanzArchiv, International Tax and Public Finance, Journal of Public Economics, Mathematical Social Sciences, Scandinavian Journal of Economics, Tourism Economics. Other External examiner of the applicants on a lectureship in Economics at Högskolan Dalarna, 2009. Member of the Hiring Committee at the Faculty of Social Sciences at Umeå Unbiversity, 2011 -.