US Compensation Structures - Employee Ownership Australia and

advertisement

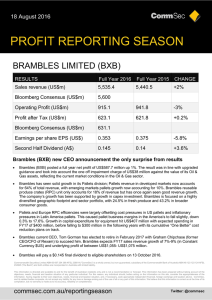

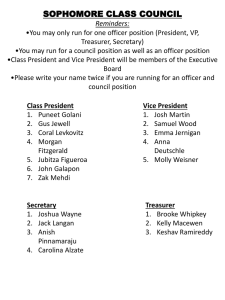

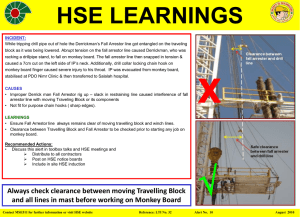

Brambles Global Employee Share Plan Phil Turss Group Vice President Remuneration & Benefits Employee Ownership Group 10 May 2012 Agenda • Brambles overview • Commitment to share ownership • Brambles global employee share plan – MyShare • Plan design – Global std vs. local customisation • MyShare – Key strengths and key challenges • Global employee share plan costs • MyShare participation • Where to over the next 3 years? • Key learnings • Does employee share ownership drive employee engagement? 2 Brambles overview • Brambles is named after Walter E. Bramble who established W E Brambles & Sons in 1890 as a carrier service between Sydney and Newcastle • Listed in Australia with Sydney HQ, and major Regional head offices in Orlando and Atlanta, USA and London, UK • Business size: – 17,000 employees worldwide – Operates in 54 countries covering Americas, EMEA and Asia Pacific – Sales last financial year were US$4.7B 3 Brambles overview (cont’d) Brambles three main businesses are: – CHEP is a global leader in the provision of equipment pooling services, managing approximately 300 million pallets and containers on behalf of its customers to help them transport products safely and efficiently. – Recall manages the secure storage, retrieval and destruction of physical and digital information for approximately 80,000 customers worldwide. – IFCO operates a pool of approximately 116 million reusable plastic containers worldwide and, in the USA, sorts repairs and reissues almost 200 million pallets a year through its national pallet management network. 4 Our commitment to employee share ownership • Brambles has a long history with employee share plans • In 2008 we developed a new global remuneration strategy • Employee share ownership is a key part of that strategy • Board Remuneration Committee and senior management commitment • Major shareholder support 5 Brambles global employee share plan - MyShare • Introduced in late 2008 • Key principles: – All employees can participate (Blue collar worker through to CEO) – Same plan worldwide – Post tax annual purchase of between AU$100 and AU$5,000 – One-for-one matching of shares purchased and held for 2 years – Rewards employee investment in the company 6 Plan design- Global std vs. local customisation • A key principle of MyShare is “one plan worldwide” • Pros: – Same treatment for all – One set of plan rules approved by shareholders – Supports global mobility – Avoids constant “gaming” to seek out tax minimisation loopholes – Substantially reduces the cost of the plan • Cons: – May not maximise individual country tax rules 7 MyShare – Key Strengths • Encourages share ownership from our employees • Affordable to employees (Low annual min) • Gives a global identity for employees as part of the Brambles Group • Strong EVP – worldwide benefit with a single plan for all • Assists employee retention “MyShare participants as a group are now our 20th largest shareholder” 8 MyShare – Key Challenges • Offered in 45 countries supported by 84 payrolls • Different languages • Differing tax regimes • Share ownership not a way of life in some countries • High levels of participation in a small number of countries 9 Global employee share plan costs • Delivering a global employee share plan is expensive – Legal & Tax Due Diligence costs – Expatriate tax issues – Communications – External & internal administration costs – Cost of providing the Shares • If you want to deliver the goods, you need to pay the freight 10 MyShare – Participation rate to date Participation over 40% Participation between 11 - 39% Participation of 10% or less 11 MyShare – Where to in next 3 years? We believe we can achieve 40-50% participation overall: • To date most communication has been electronic via webinars • Enhanced communication via a “road show” to major countries • Shareholder approval to occasionally increase the level of matching + MyShare – Key learnings • Set your principles from the outset – Principles will drive the strategy • Good relationship with the external administrator is essential – It is too complex to administer without good systems and processes 13 MyShare – Key learnings (cont’d) • Strict ground rules are important in reducing admin costs • Don’t be guided by anecdotal complaints or requests based on individuals • Don’t leave it to a single source of communications 14 Does employee share ownership drive engagement? • Any evidence? • In isolation, it is not a panacea for delivering higher levels of engagement • To be effective, employee ownership needs to become an on-going feature of the company's remuneration and employee engagement strategy • Major commitment from the Board and management is a key to its success 15 Questions & Answers