The BFSI Sector Skill Council of India - DDU-GKY

advertisement

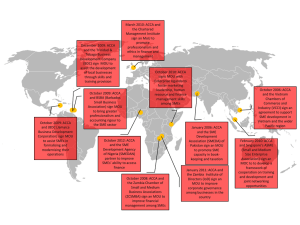

The BFSI Sector Skill Council of India (BFSI SSC) M B N RAO (Former Chairman & MD Canara Bank and I B A) 1 The Prime Minister’s Skill Development Agenda • PM has recently indicated that India should skill 85 lac people in the next fiscal year • He wants to skill people so as to facilitate a 10% growth rate for the country • His broader mandate is that India should skill 500 million by 2022 • The mandate for this major skill development initiative comes directly from the PMO • Ministry of Finance and MHRD are the key ministries involved 2 National Skill Development Mission India @ 75 Skill deficit to be one of the most challenging factors in achieving the nation’s growth targets GoI has taken up a target of up/skilling 500 mn people by 2022 Creation of a 3 tiered structure Hon. PM of India National Council on Skill Development (NCSD) Apex policy making body Headed by Advisor to PM, Mr. S Ramadorai Planning Commission National Skill Development Co-Ordination Board Co-chaired by Mr. S Ramadorai and Mr. Montek Singh Ahluwalia Co-ordinate skill development activities of various ministries and state governments Ministry of Finance National Skill Development Corporation (NSDC) Funding Body Sec 25 Company under MoF 3 4 Need for Focus on Skilled Development in the BFSI Sector • Increased need for skilled employees over the next ten years as financial institutions expand geographically and in terms of business turnover • The BFSI Sector in India impacts the country’s economic conditions and its global relationships • Projected increase of 4.5 million in BFSI sector workforce by 2022 • Currently, a significant number of skill gaps are reported throughout the industry which need to be addressed • Overall, across the nation, only 10 – 20% of graduates are truly industry ready. This calls for a serious intervention – both in the BFSI sector and all across India 5 What is a Sector Skill Council (SSC)? • A SSC is an initiative of government and industry working together to create an ecosystem for continual skill development within that industry to meet its manpower requirements in terms of quantity and quality. All SSCs are overseen by the NSDC. • It will create National Occupational Standards (NOS) by clearly defining skill requirements for a job roles within the industry. • Create a National Vocational Qualification Education Framework (NVQEF) that will define what specific qualifications are required by job level, creating a clear career progression and skill upgrading path for an employee • To create a a Labor Market Information System (LMIS) – which will gather and information on skill needs, skill gaps and projections on skill development needs. This system can be made available to the government and industry as well, for their use. • Provide Accreditation and Certification for skill development programs that the industry can use as a certifier of standards and quality • Create financial inclusion programs and educate the public on how to use financial services more effectively 6 The BFSI Sector Skill Council of India • The BFSI SSC will be jointly owned by industry organizations who will be invited to drive this initiative from within the industry • It is a part of a nation-building plan to address skill development issues in quantity and quality on a sectoral basis being shepherded by NSDC • Industry leadership is critical to address the skill development issues in any significant way 7 BFSI SSC to be the Apex Body for Skill Development In the Sector Research Quality Assurance Create Skill Development Plan Streamline certification framework Create sector specific competency standards Conduct certification of (master) trainers - - Benchmark with intl. standards Labour Market Information Systems Conduct productivity analysis of human resources Conduct certification of workers Undertake accreditation of all sector specific courses Delivery Mechanism Catalyze training delivery organizations to meet industry requirements - Work with industry to train existing workers Provide training to (master) trainers - Develop trainer modules & e-learning modules Develop CoEs Tracking the latest technological trends 8 Promoters • Currently the BFSI SSC is promoted by: – BSE – NSE – CII 9 Board of Directors The Board of Directors of the BFSI SSC are as follows: • Mr. M. B. N. Rao - Former Chairman and Managing Director, Canara Bank and Indian Bank, Chairman BFSI • Mr.Sudhakar Rao - Chairman BSE Institute Limited, Retd. Chief Secretary to Government of Karnataka. • Mr. Ashishkumar Chauhan - Managing Director and CEO of BSE Limited • Ms. Chitra Ramkrishna - Managing Director and CEO of National Stock Exchange of India Limited • Mr. Ambarish Datta - Managing Director and CEO of BSE Institute Limited 10 Current Status • • • • • Définition of National Occupation Standard Qualification Packs (NOS-QPs) for Key roles in the industry initiatied NOS-QPs for 6 roles defined Assessment Criteria for these NOS-QPs are being created Training providers who can provide training programs aligned to these NOS-QPs are being accredited Training programs for some of the NOS-QPs are being rolled out in different parts of the country 11 Currently Defined National Occupational Standards • National Occupational Standards – Qualification Packs defined for the following roles: – Business Correspondent – Equity Dealer – Life Insurance Agent – Loan officer – Mutual Fund Agent – SME officer 12 Business Correspondent • • • • • SECTOR: BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) SUB‐SECTOR: BANKING OCCUPATION: FINANCIAL INCLUSION SERVICES REFERENCE ID: BSC / Q 0301 Brief Job Description: – Business Correspondents (BCs) are representatives appointed by banks to act as their agent and provide banking services in remote locations where the bank does not have a presence in order to promote financial inclusion. BCs are responsible for spreading awareness related to banking and bank's products, assisting the bank in business generation activities and are permitted to carry out regular transactions for customers on behalf of the bank. 13 Equity Dealer • • • • • SECTOR: BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) SUB‐SECTOR: Capital Markets OCCUPATION: Broking/Trading REFERENCE ID: BSC / Q 0201 Brief Job Description: – Equity dealers buy and sell investment and financial instruments on behalf of their clients. They also provide market insights and investment advice to potential and existing clients as per the organizational standards and procedures 14 Life Insurance Agent • • • • • SECTOR: BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) SUB‐SECTOR: Insurance OCCUPATION: Insurance Services REFERENCE ID: BSC / Q 0101 Brief Job Description: – Life Insurance Agents are individuals who are licensed under section 42 of the Insurance act of 1938 by IRDA and appointed by a Life Insurance Company to solicit and procure life insurance business on their behalf, in a manner consistent with the interest of the clients and the company. – It is the responsibility of the Life Insurance Agent to provide service while ensuring that the business relationship is sustained without a lapse until the policy results into a claim upon death or when a policy matures. 15 Loan officer • • • • • • SECTOR: BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) SUB‐SECTOR: Non Banking Financial Services OCCUPATION: Credit Services Also known as Credit Processing Officer, Loan Processing Officer, Branch Credit Manager REFERENCE ID: BSC / Q 0401 Brief Job Description: – Loan officers evaluate, authorize, or recommend approval of loan applications for people and businesses. Their tasks include compiling the loan application file, performing preliminary checks, approving loans and submitting recommendations for loans beyond their limits for further processing. 16 Mutual Fund Agent • • • • • SECTOR: BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) SUB‐SECTOR: Non‐Banking Financial Services OCCUPATION: Financial Services REFERENCE ID: BSC / Q 0601 Brief Job Description: – A mutual fund agent is representative of a bank or similar financial institution, who offers mutual funds to prospective investors, maintains records of their investments and conducts regular market research to advice customers. 17 SME Officer • • • • • • SECTOR: BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) SUB‐SECTOR: Banking and Financial Services OCCUPATION: Banking services Also known as Relationship Manager for handling SME accounts REFERENCE ID: BSC / Q 0501 Brief Job Description: – SME officers are in charge of handling, maintaining and building relationships with SME customers. They support customers with transactions, process their applications, monitor their accounts and advice customers when required. 18