Slide 1 - The University of Texas

advertisement

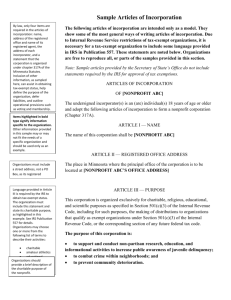

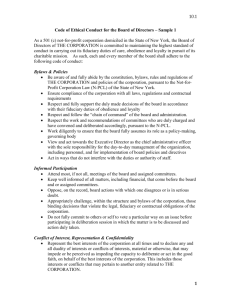

What is a nonprofit corporation? Forming an organization to serve an unmet need Benefits and limitations of a nonprofit corporation 2 A corporation in which no part of its income is distributed to a member, director or officer of the corporation A nonprofit must qualify for federal Tax-Exemption under section 501(c)(3) of the Internal Revenue Code It must be organized and operated exclusively for one or more of the following purposes: religious, charitable, scientific, testing for public safety, literary, educational, or prevention of cruelty to children or animals 3 What is the primary purpose of the nonprofit? Does the community have an unmet need? What target audience will be served? What are competing organizations already providing? Is there a strong commitment from organizers and participants to build the nonprofit? Is there an adequate source of funds to support the organization? 4 Benefits: o Members and directors are shielded from personal liability o Organization can be eligible to receive government or community development loans and grants Limitations: o Nonprofit cannot be organized for the purpose of financial profit for its members or directors o Nonprofits are absolutely precluded from engaging in partisan political campaign activities and their lobbying is heavily regulated 5 Charitable purposes are broadly defined as services that are beneficial to the public’s interest The organization must serve an open class of people and not limit its activities to specific individuals Examples: Providing food for homeless, relief of the poor, distressed, or underprivileged, advancement of education, formation or maintenance of public buildings, promoting the development of arts 6 Educational purposes include instruction of the public on subjects useful to individuals for the benefit of the community and for self-development Examples: Publishing public interest educational materials that do not conflict with certain rules and regulations with the Internal Revenue Service; conducting public discussion groups, forums, panels, lectures, or workshops; serving educational institutions, such as a college bookstore, alumni association, or athletic organizations 7 Publishing groups can obtain nonprofit status if they do not target their activities to commercial markets and sell the publications Examples: Publishing material on environmental preservation, highway safety, or drug and alcohol abuse information 8 Characterized by community based leadership and its work primarily in the development of affordable housing, job training, and small business assistance There are four independent bases for federal taxexemption for a nonprofit community development organization: o Relieving the poor and distressed o Combating community deterioration o Eliminating discrimination o Lessening the burdens of government 9 For-profit Corporation: Profits are controlled and distributed to shareholders Unincorporated Association: Lacks the strict organizational, reporting, and registration requirements imposed on nonprofit corporations Fiscal Sponsorship: Occurs when a group partners with an existing organization to conduct a certain activity or program 10 Step 1: Check availability of name with the Texas Secretary of State in Austin at www.sos.state.tx.us/corp/forms_boc.shtml 11 Step 2: Prepare Certificate of Formation in the document filed with the Secretary of State to form the nonprofit corporation. Certificate of formation must include: o Purpose Clause - Defines the charitable purpose of the corporation o IRS Language - Special clauses relating to the dissolution of the nonprofit, “inurement”, and a general statement that the corporation will follow nonprofit requirements o Initial Directors – Names the directors constituting the initial board, with a minimum of 3 directors 12 Step 2: Prepare Certificate of Formation in the document filed with the Secretary of State to form the nonprofit corporation o Incorporator – The person who signs the certificate of formation o Registered Agent and Address – The agent is the incorporator or the officer of the corporation. The registered office generally cannot be a post office box o Members - The nonprofit corporation needs to be governed by voting members, board of directors, or a combination of the two 13 Step 3: File the certificate with the Secretary of State o The incorporator needs to submit the completed Certificate of Formation in duplicate together with a $25 filing fee. This is mailed to P.O. Box 13697, Austin, TX 78711-3697. o The incorporator needs to order a “certified copy” of the certificate of formation to submit with the federal taxexemption paperwork 14 Step 4: Prepare Bylaws o Meetings o Leadership o Provisions for Membership o Quorum o Controls o Committees o Fiscal Year o Bylaw Amendments 15 Step 5: Meeting of initial directors to adopt bylaws and transact business o Adopt Bylaws o Elect Officers o 501(c)(3) Application 16 Step 6: Apply for a federal employer identification number o In order to be tax-exempt, an organization must obtain a Federal Employer Identification Number and is needed whether or not the organization has members o The organization should complete an IRS form SS-4, available on the IRS website at www.irg.gov and place the completed form in the organization’s minute book o When the information is completed the EIN is obtainable easily online at https://sa2.www4.irs.gov/modiein/individual/index.jsp 17 Step 7: Prepare federal tax-exemption application o Must file a Form 1023 with the IRS at www.irs.gov. The site contains step by step directions of what a Form 1023 entitles o The following must be included in the Form 1023: Certified copy of the certificate of formation Copy of bylaws Financial statements including: Revenue and Expense Statement for current year, and three preceding fiscal years; proposed budgets for the next two fiscal years with anticipated financial support Narrative description of past, present and future planned activities with an emphasis on broad public benefit of the organization’s activities Annual accounting period (fiscal year) Employer Identification Number (EIN) Statement as to whether the organization is claiming status as a private foundation or public charity 18 Step 8: Apply for sales, franchise and hotel taxexemption from Texas comptroller ◦ To apply for state exemption based on the federal exempt status, complete Form AP-204 located at www.window.state.tx.us/taxinfo/exempt/index.html ◦ Include a copy of the exemption determination letter issued by the IRS, including any addenda ◦ The organization name on the IRS letter must match the organization’s legal name as listed in the certificate of formation 19 Step 9: Apply for property tax-exemptions from the local tax appraisal district ◦ To receive the exemption, an organization should submit Form 50-299 at www.window.state.tx.us/taxinfo/taxforms/02form06.html ◦ Also include a copy of the comptroller determination to their local appraisal district 20 A nonprofit corporation must: o Hold an annual meeting o Prepare alphabetical list of names of all voting members o Refrain from making a loan to a director. o Maintain current and accurate financial records o Prepare annual reports in accordance with accounting standards 21 A nonprofit corporation must also: o Keep records, books and annual reports at its principle office for three years for public inspection o Keep current registered agent on record o Submit IRS Form 990 every tax year o Submit Secretary of State Form 802-General Information 22 The Board of Directors Private Watchdog Groups (National Charities Information Bureau and the American Institute of Philanthropy) The State (The Attorney General’s Office) IRS Individual Donors and Members 23 A lawyer is not required, but may help you by avoiding unnecessary mistakes which might jeopardize your ability to incorporate or gain tax-exempt status Lawyer will also advise on certain corporate responsibilities Lawyer may also be able to recommend an accountant to comply with ongoing federal and state tax, bookkeeping, and reporting obligations 24 25 The University of Texas Pan American o 1201 W University Dr, ITT 1.404R o Edinburg TX, 78539 (956) 292-7566 sbnrc@utpa.edu Hours of Operation: o Mon – Fri o 8 am to 5 pm http://ce.utpa.edu/sbnrc Join 26 us on Facebook