Regulation E 12 CFR § 205.2(m).

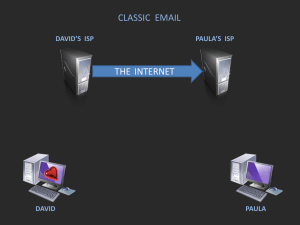

advertisement

Payment Systems ACH Payments Basic Concepts ACH Payments Governing Law • EFTA applies to natural persons with consumer accounts. • Common Law of Contracts • NACHA Rules (Incorporating Article 4??) Basic Concepts ACH Payments The Players Originator: The one who makes the entry that initiates the transaction (not necessarily the payor) Originating Depositary Financial Institution (ODFI): Financial Institution of the Originator ACH Operator: Party that carries communication and funds from ODFI to RDFI (usually a Federal Reserve Bank) Receiving Depositary Financial Institution (RDFI): Financial Institution of the Receivor Receiver: Party to which an entry is directed Basic Concepts ACH Payments Types of Entries Credit Entry: Pay money Debit Entry: Withdraw money Note two ways to pay money: Payor initiates a credit entry Payee initiates a debit entry Payments settled at Federal Reserve Accounts of the participating banks Basic Concepts ACH Payments Timing Debit Transaction must be entered the day before the specified Settlement Date Credit Transaction must be entered one or two days before the specified settlement date Return of Entries (Debit or Credit) must be made by RDFI to its ACH Operator by the second business day after the Settlement Date Basic Concepts ACH Payments Timing Stopping Debit Entries Consumers can stop if they notify RDFI three banking days before the settlement date ODFI’s have five banking days to retract duplicate or erroneous entries (but must act in 24 hours of discovery) Originators can retract if they notify Receiver by the settlement date (No right to retract after the settlement date for dissatisfaction with underlying transaction) Basic Concepts ACH Payments Timing Consumer Receivers of an erroneous or fraudulant debit entry must notify RDFI within 15 days of a statement showing the entry. RDFI must recredit “promptly” probably meaning one day. Basic Concepts ACH Payments Risk of Loss for Unauthorized Items ODFI warrants that the entry accords with proper authorization. Unauthorized Entry Timeline 1 2 3 33 O sends ODFI RDFI RDFI fraud sends debits sends entry R statement account 47 R notifies RDFI of error RDFI gets funds from ODFI for breach of warranty ODFI pursues O for funds POS Conversion Problem 8.9.1 • You pay ISP by an ACH transfer. You agreed to this in account set up and provided bank information. • Is this most likely a credit entry or a debit entry? See NACHA 14.1.28 Problem 8.9.1.a • You pay ISP by an ACH transfer. You agreed to this in account set up and provided bank information. • Is this most likely a credit entry or a debit entry? See NACHA 14.1.28 • A Debit Entry Originated by ISP Problem 8.9.1.a • You pay ISP by an ACH transfer. You agreed to this in account set up and provided bank information. • Is this most likely a credit entry or a debit entry? See NACHA 14.1.28 • But it could be a recurring credit entry initiated by you. Usually debit entries will be for amounts that vary each month Problem 8.9.1.b • You live in Chicago (near Chicago Fed) • ISP in Washington (near Seattle Fed) • Identify parties and roles assuming a debit entry Problem 8.9.1.b • • • • • • You Your Bank Chicago Fed Seattle Fed ISP Bank ISP Receiver RDFI Receiving ACH Operator Originating ACH Operator ODFI Originator Problem 8.9.1.c • Assume next debit is due Monday April 1 • What (and by when) do you need to do to stop the debit NACHA 8.4 Problem 8.9.1.c • Assume next debit is due Monday April 1 • What (and by when) do you need to do to stop the debit • Oral or written notice to stop given to your bank within three banking days of April 1. NACHA 8.4 Problem 8.9.1.c • Banking Day means “any day” on which a DFI is open for banking business during any part of such date. NACHA 14.1.14 Problem 8.9.1.c • Banking Day means “any day” on which a DFI is open for banking business during any part of such date. NACHA 14.1.14 • Unlike under Regulation CC Saturday can be a banking day! Problem 8.9.2 • You pay your credit card by ACH transfer (a credit entry to your bank) from your home computer • You initiate a $7000 payment but change your mind the next day. Can you retract? Problem 8.9.2 • You pay your credit card by ACH transfer (a credit entry to your bank) from your home computer • You initiate a $7000 payment but change your mind the next day. Can you retract? • There is nothing you can do! – This is not a debit entry so no stop payment under NACHA 8.4 – Originators can only reverse entries that are erroneous (NACHA 2.5 and 8.1) Problem 8.9.3 • Your bank pays a check not properly payable • This causes your account not to have enough to cover a scheduled debit which is thus returned • The intended payee car lender repossesses car and this casues other damage • Is your bank laible to you? Problem 8.9.3 §4-402(a) gives customers a right to consequential damages for wrongful dishonor of an “item” An ACH debit is not an “item” But NACHA 14.1.28 says “item” shall include an entry and Article 4 will apply What does that mean? Problem 8.9.3 NACHA 14.1.28 says “item” shall include an entry and Article 4 will apply What does that mean? Unless contrary NACHA Rule Article 4 rules apply. Probably, as a matter of private contract banks agree to be liable for wrongfully dishonored debits as if they were items and Article 4 applied! Problem 8.9.4.a Cliff pays by POS conversion at his grocery store Recently a double entry was put through for groceries What should he do? Problem 8.9.4.a Under EFTA 908(c) if he reports this error to his bank they must recredit within the earlier of their investigation being complete or 10 business days NACHA requires a “prompt” recredit which is probably 1 business day NACHA 8.6 Problem 8.9.4.b Instead of POS this was a telecheck where telemarketer despite not being authorized created a paper tele check. Problem 8.9.4.b Article 4 applies so check was not properly payable Under new tele check presentment warranty, depositary bank warrants the tele check was authorized so it bears the loss Problem 8.9.4.c Telemarketer instead creates a TEL entry Problem 8.9.4.c This is now governed by EFTA rules and NACHA as per problem 6.a Problem 8.9.4.d Who bears the loss? Problem 8.9.4.d Who bears the loss? a. Cliff’s bank will recover from the merchant bank under the ODFI warranty and indemnity NACHA 2.2.1.1 b. Telemarketer bank would be responsible to the Payor bank under new revisiosn to Article 4 c. Cliff’s bank will recover from the merchant bank under the ODFI warranty and indemnity NACHA 2.2.1.1 Problem 8-3 • Electra Smith was employed as a clerk for the Business Corporation. • One day it informed her that henceforth all her paychecks would automatically be deposited in the local bank of her choice. She chose Octopus National Bank (ONB), her usual bank. Could she have demanded a check and refused the EFT? EFTA 913 No person may-(1) condition the extension of credit to a consumer on such consumer's repayment by means of preauthorized electronic fund transfers; or (2) require a consumer to establish an account for receipt of electronic fund transfers with a particular financial institution as a condition of employment or receipt of a government benefit. Problem 8-3 ONB informed Electra that she could pay all her bills by phone and that many creditors would be willing to set up an automatic monthly payment plan whereby ONB would pay routine bills unless she instructed otherwise. Electra signed such a contract with her landlord, to whom ONB agreed to transfer $300 on the first day of each month as rent. What details does ONB have to explain to her? See Regulation E §205.7. Problem 8-3 (a)One day ONB’s computer malfunctioned and deducted $1,000 from Electra’s checking account and credited it to an account designated ‘‘Computer Maintenance.’’ Several of her checks bounced as a result. Is the computer’s deduction an ‘‘electronic fund transfer’’ under Regulation E §205.3(b)? If so, is it also an ‘‘unauthorized electronic fund transfer’’ under §205.2(m)? Is the bank liable under §910? EFTA 903 (11) the term “unauthorized electronic fund transfer” means an electronic fund transfer from a consumer's account initiated by a person other than the consumer without actual authority to initiate such transfer and from which the consumer receives no benefit, but the term does not include any electronic fund transfer . . . or (C) which constitutes an error committed by a financial institution. Problem 8-3 • Is this covered by §4-401(a)? (Note UCC §4104(a)(9).) • As to the bounced checks, see UCC §4-402 (Wrongful Dishonor). Problem 8-3 (b) ONB failed to pay Electra’s rent on the first of January because the computer got backlogged with the huge Christmas volume. Can her landlord evict her? When she is evicted and sues ONB over §910, can the bank defend using §910(b)(1)? EFTA 912 If a system malfunction prevents . . . an electronic fund transfer initiated by a consumer to another person. . . [who] has agreed to accept payment by such means, the consumer's obligation to the other person shall be suspended until the malfunction is corrected and the electronic fund transfer may be completed, unless such other person has subsequently, by written request, demanded payment by means other than an electronic fund transfer. EFTA 910 Subject to subsections (b) and (c) of this section, a financial institution shall be liable to a consumer for all damages proximately caused by-(1) the financial institution's failure to make an electronic fund transfer, in accordance with the terms and conditions of an account, in the correct amount or in a timely manner when properly instructed to do so by the consumer, except where-- EFTA 910 A financial institution shall not be liable under subsection (a)(1) or (2) of this section if the financial institution shows by a preponderance of the evidence that its action or failure to act resulted from-(1) an act of God or other circumstance beyond its control, that it exercised reasonable care to prevent such an occurrence, and that it exercised such diligence as the circumstances required; or Problem 8-3 (c) One month Electra had a dispute with her landlord, so she phoned ONB and told them not to pay the next month’s rent due to be transferred four days later. Is oral notice sufficient? Is her notice timely? • If the bank fails to stop payment, what remedy • does she have? What damages does she have? Can she recover her attorney’s fees? EFTA 907 . . . A consumer may stop payment of a preauthorized electronic fund transfer by notifying the financial institution orally or in writing at any time up to three business days preceding the scheduled date of such transfer. The financial institution may require written confirmation to be provided to it within fourteen days of an oral notification if, when the oral notification is made, the consumer is advised of such requirement and the address to which such confirmation should be sent. EFTA 910(c) In the case of a failure described in subsection (a) of this section which was not intentional and which resulted from a bona fide error, notwithstanding the maintenance of procedures reasonably adapted to avoid any such error, the financial institution shall be liable for actual damages proved. Problem 8-3 (d) If Linda Liable in Problem 8-2 had made purchases with point of sale (POS) EFTs, would she be able to assert her defenses against her bank under the EFTA? Problem 8-4 Jane Austen owned a bookstore and handled the store’s financial affairs through a checking account with Octopus National Bank (ONB). If ONB grants the store an ability to pay its debts by EFTs, does the EFTA apply? See §903(2); Regulation E §205.2(b). EFTA 903 (2) the term “account” means a demand deposit, savings deposit, or other asset account (other than an occasional or incidental credit balance in an open end credit plan as defined in section 1602(i) of this title), as described in regulations of the Board, established primarily for personal, family, or household purposes, but such term does not include an account held by a financial institution pursuant to a bona fide trust agreement;