Here - Dodd-Frank and the Law

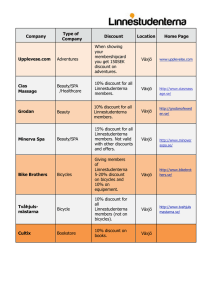

advertisement

2011 Minnesota Case Law and Statutory Update Thomas A. Jensen David C. Jenson May 10, 2012 Watkins Inc. v. Chilkoot Distributing, Inc. Watkins commissions & discounts CDI sales receipts •Watkins and CDI operated for almost 20 years under same agreement (1988 Dealer Agreement) •CDI’s commissions and discounts are based on its own sales and the sales of other sellers it has recruited for Watkins •Lambert Group was recruited by CDI and is a top seller Lamber t Group Other Sellers • Watkins sends CDI the 2006 Agreement Accompanied by confusing letter Follow-up phone call Unclear to CDI whether this is a new contract or merely an information form CDI signs and returns the 2006 Agreement • 2006 Agreement allows Watkins to make unilateral changes • Watkins reclassifies the Lambert Group, significantly reducing commissions and discounts to CDI Watkin s Lamber t Group commissions & discounts CDI sales receipts Other Sellers • CDI sues Watkins for breach of the 1988 Dealer Agreement Watkins argues the 2006 Agreement governs Was a new agreement intended? Signature of CDI = objective manifestation of intent? • Is this the wrong result? Not a consideration on the merits; only denial of summary judgment • Takeaways Objective manifestation of intent, but informed by surrounding facts and circumstances Don’t be sneaky • SCI Minnesota Funeral Serv. Inc. v. Washburn-McReavy Funeral Corp. Minnesota Supreme Court case Affirmed Court of Appeals decision Crystal Lake Stock SCI Washburn $1 Million 100% Crystal Lake 3 Funeral Homes/ Cemeteries Real Estate – $2 Million (MN/CO) Known Not Known • No rescission Mutual mistake Form of transaction, not value or quality Lack of mutual assent Under objective standard, purchase agreement clearly evidenced mutual assent • No reformation Clarifies different remedy than rescission Not a mutual mistake Not a unilateral mistake and fraud or inequitable conduct Here, just a unilateral mistake • Takeaways Stock transaction really does mean all assets and liabilities Absent fraud or inequitable conduct, can’t clear this up later. Diligence and proper representations and warranties key • BOB Acres, LLC v. Schumacher Farms, LLC Court of Appeals case False recital of consideration Specific performance • Purchase Agreement to buy land recited Seller’s receipt of $500 in earnest money • Closing within 60 days; did not close • Parties continued to negotiate and exchange drafts • Earnest money never paid • Buyer sued for specific performance • Consideration? Promise for a return promise is consideration False recital of earnest money does not change this Promise to sell land in exchange for promise to purchase – not relying on earnest money itself • Did Seller waive right to enforce closing deadline (i.e., to cancel the purchase agreement)? Waiver standard is clear and can be shown by behavior alone “Intentional relinquishment of a known right” Here, Seller clearly Never objected to non-payment of earnest money Proceeded with easement arrangements Sent abstract of title to BOB’s attorney Asked township board to split property • Takeaways Non-payment of earnest money is not necessarily fatal to contract formation Can’t have it both ways Provide for remedies by contract, don’t leave to court Provell, Inc. v. JetChoice I, LLC • JetChoice I and JetChoice II, related companies, operate a private jet service • Provell, Inc. considers purchasing a membership in 2008 • After initial talks, Provell begins due diligence investigation • Provell’s due diligence investigation Includes outside counsel and uncovers recent “slowpay” incidents JetChoice II’s financials show a $1.5M loss as of September 2008 Nearly all of JetChoice II’s assets consist of a receivable from JetChoice JetChoice refuses to provide JetChoice I financials Provell CFO expresses concern about financial stability of JetChoice entities • Provell has “assurances” from JetChoice executives regarding their financial health • Provell closes on the purchase of a membership for $2.25M, including $1.25M paid at closing • Within several months, JetChoice files for bankruptcy • Provell sues on a fraud claim to recover the purchase price; claims JetChoice made “numerous misrepresentations” about financial stability • Can Provell prove fraud? False representation of fact susceptible of knowledge Made with knowledge of falsity or ignorance of truth Intended by JetChoice to induce reliance Provell in fact reasonably relied upon representation Provell suffered monetary damage as a result • Summary judgment for JetChoice Failure to establish an essential element = mandatory summary judgment Whether reliance is “reasonable” is evaluated in the context of a party’s intelligence, experience, and opportunity to investigate An independent inquiry into the accuracy of a representation may bar a party from relying on the representation unless the investigation is not “adequate to disclose the falsity” • Summary judgment for JetChoice Provell argues that some of the representations made by JetChoice could not be independently verified Court responds that it doesn’t matter; the facts that Provell did uncover were such that they should have doubted any representation relating to the financial stability of JetChoice • Takeaways Whether a party’s reliance is “reasonable” for purposes of a fraud claim depends on the party’s intelligence, business sophistication, experience, and opportunity to investigate An opportunity to investigate will bar a fraud claim where the investigation demonstrated that representations were false or uncovered information that should have led the party to doubt the truth of representations Quinn v. Elite Custom Transporters and Motorcoaches, LLC • Elite’s business was suffering All tangible assets and intangible assets relating to the tangible assets are encumbered pursuant to bank loans Assets exceed liabilities, which include $600k owed to the IRS for delinquent payroll taxes • The Quinns order a custom motor home for $875k and pay up front Elite never delivers the motorhome and never returns the money or personal property Quinns sue Elite for breach of contract and conversion Elite fails to respond, and the Quinns obtain a default judgment in the amount of $1M After judgment is entered against it, Elite transfers all of its assets to a new company • New company is Elite Custom Transporters and Motorcoaches, LLC • Assets transferred include all tangible and intangible assets and goodwill Homer Bruggeman Gretchen Bruggeman $120 / 60% Brenda Bruggeman $80 / 20% Jim Bruggeman Assets Elite Assumed liabilities Elite #2 Jim Bruggeman • After the transfer, Elite #2 operates the same business that Elite had operated • Since the Quinns can’t recover their judgment against Elite, they sue Elite #2 fraudulent transfer in violation of the Minnesota Uniform Fraudulent Transfer Act (FTA) seek to hold Elite #2 liable under a successor liability theory • Threshold question: has any “transfer” occurred for purposes of FTA? Encumbered assets are not “assets” under the FTA The only thing transferred by Elite to Elite #2 that hadn’t been encumbered was goodwill Open question under MN law whether goodwill can be an “asset” under FTA • Court says that goodwill CAN be an asset for purposes of FTA, remands for determination of the value of the goodwill Court can’t determine summary judgment on FTA claims whether transfer was fraudulent depends in part on the value of the goodwill • Court reaffirms unpublished 2009 decision, Schwartz v. Virtucom Exception to statute against successor liability (302A.661) for transfers that violate the FTA Can’t determine summary judgment because can’t yet determine whether the FTA has been violated • Takeaways Goodwill can be an asset for purposes of FTA (if it’s unencumbered) There is an exception to the general rule against successor liability for transactions that violate the FTA • Staehr v. Western Capital Resource, Inc. • U.S. District Court • Pleading requirements in derivative claims when new Board has been elected and obligation to make demand on new Board Blackstreet Δ Πs/Minority Shareholders LOI Assets Common Stock Purchase Agreement WERCS Δs/Majority SH of Western Preferred and Common Western Western Directors and Officers Δs • Old Western Board (pre-closing) Majority interested (WERCS) • New Western Board (post-closing) Only one WERCS director • Litigation begins – no derivative claims made • Blackstreet transaction closes (March 2010) • New Western Board elected (Blackstreet controls company) • Defendants file motion to dismiss (October 2010) • Plaintiffs file Amended Complaint • First time derivative claim filed but plaintiffs did not first make demand on new Board regarding derivative claim • FRCP 23.1: Pleading requirements for shareholder derivative claims Complaint must state with “particularity” efforts to get desired action from the directors Defendants say plaintiffs did not plead the futility of making a demand on the new Board Plaintiffs say that futility excuses their failure to make a demand because board was engaged in bad conduct By filing the derivative complaint for the first time in the amended complaint, coupled with the fact that there was a new, independent board, plaintiffs were required to make a demand on the new board None of the exceptions applied • Takeaways: Creates new MN law by adopting DE’s Braddock standard MN courts continue to look to DE law for precedent Thank You Thomas A. Jensen (612) 335-1809 tom.jensen@leonard.com David C. Jenson (612) 335-1464 david.jenson@leonard.com http://www.leonard.com © 2012, Leonard, Street and Deinard Professional Association. Leonard, Street and Deinard and the Leonard, Street and Deinard logo are registered trademarks.