Interviewing On Wall St

advertisement

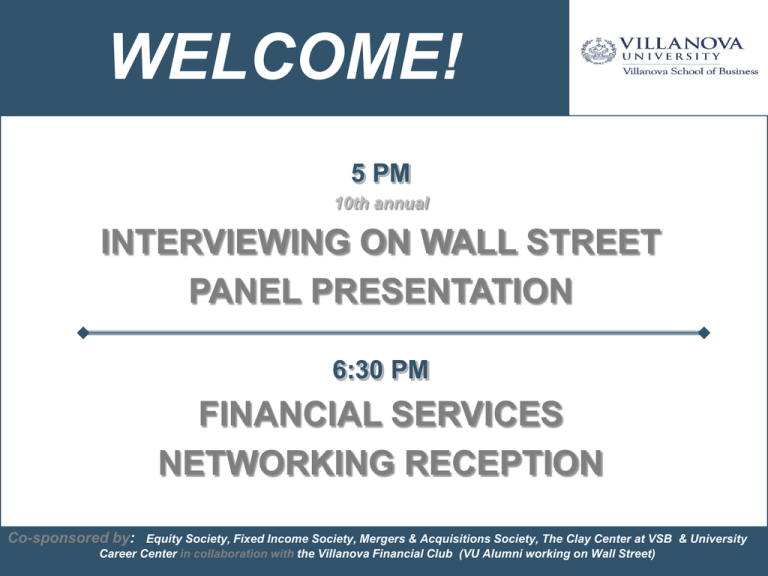

WELCOME! 5 PM 10th annual INTERVIEWING ON WALL STREET PANEL PRESENTATION 6:30 PM FINANCIAL SERVICES NETWORKING RECEPTION Co-sponsored by: Equity Society, Fixed Income Society, Mergers & Acquisitions Society, The Clay Center at VSB & University Career Center in collaboration with the Villanova Financial Club (VU Alumni working on Wall Street) 10th annual Interviewing on Wall Street Panel & Networking Reception Agenda Welcome - Dr. Patrick Maggitti - Dean, Villanova School of Business Introduction of Speakers/Panelists Featured Speakers Q&A with Panel Wrap-Up & Introduction of Reception Employers Financial Services Networking Reception Co-sponsored by: Equity Society, Fixed Income Society, Mergers & Acquisitions Society, The Clay Center at VSB & University Career Center in collaboration with the Villanova Financial Club (VU Alumni working on Wall Street) 10th annual Interviewing on Wall Street Panel & Networking Reception Panelists George Coleman(VU ‘78) - Moderator Managing Director-Investment Banking; Vice Chairman-Global Equities, Credit Suisse Bob Bosse (VU ‘86) Executive Director, Corporate & Investment Bank, JP Morgan Steve Hanwacker (VU ’01) Senior Financial Advisor, Merrill Lynch Wealth Management Bryan Rolfe (VU ‘86) Managing Director, Debt Capital Markets, BMO Capital Markets Todd Sullivan(VU '95) Managing Director- ISG Operations, Morgan Stanley Kathleen Barr (VU ’14) – Barclays S’13 Finance Intern; Biology Major Katharine Macomber (VU ’14) – Barclays S’13 Compliance Intern; Arts Economics Major Co-sponsored by: Equity Society, Fixed Income Society, Mergers & Acquisitions Society, The Clay Center at VSB & University Career Center in collaboration with the Villanova Financial Club (VU Alumni working on Wall Street) 10th annual Interviewing on Wall Street Panel & Networking Reception George Coleman (VU ‘78) Managing Director-Investment Banking; Vice Chairman-Global Equities, Credit Suisse Co-sponsored by: Equity Society, Fixed Income Society, Mergers & Acquisitions Society, The Clay Center at VSB & University Career Center in collaboration with the Villanova Financial Club (VU Alumni working on Wall Street) Villanova How to Prepare for an Interview September 2013 The materials may not be used or relied upon in any way. Confidential Confidential 5 What Does A Global Financial Institution Do? PRIVATE PRIVATE BANKING/ BANKING WEALTH MGMT Wealth management solutions Corporate & Retail Bank in Switzerland INVESTMENT BANKING Sales & Trading Prime Brokerage Research Capital raising and advisory services SHARED SERVICES Corporate Communications Human Resources Information Technology Legal & Compliance Operations Risk ASSET MANAGEMENT Alternatives Asset Allocation Global Distribution Confidential 6 Prepare before you go Preparation is half the battle Confidential 7 What We Look For Applications Team Player Collaboration Skills Problem Solving/Intellect Leadership Potential >150 Hires Initiative and Drive Communication Skills Confidential 8 Interview Best Practices First Round On Campus On Trading Desk With HR Recruiter Super Day Five 30 minute interviews Usually about 30 candidates Think of it as the Super Bowl. Job offers are made the next day. Confidential 9 Interview Best Practices from the Interviewers Perspective Interviews Best Practices Your job is to elicit evidence from the candidate to support your rating on each competency Be clear on what core competency you are testing Let the candidate talk 80% of the time; remember, you have the job already! Confidential 10 Interview Structure Opening Introduce yourself – your role and tenure with the Firm Putting an initially nervous candidate at ease (e.g., by switching to a non-interview discussion tangent) Closing About 3–4 minutes prior to end, wind down the interview: – ask if there is anything else the candidate would like to tell you – allow the candidate to ask one or two questions – thank candidate for his/her time; provide your contact information should candidate have further questions (and return his/her call) Confidential 11 11 Do your homework -- Research Before you arrive at a Wall St. interview you must: Know recent industry news Know the firm What does the firm do? What separates the firm from its competitors? What major transactions has the firm been a part of recently or in the past? How successful has the firm been recently or in the past? The basics: top leadership, major locations, number of employees, etc Know the position What are the required skills / qualifications the job demands? For which division are you interviewing? What does a typical analyst do in this division? How could you add value to this division, even if you don’t have the technical skills? Know your resume Does your resume accurately reflect you key achievements? Most important info at the top Be ready to discuss your resume in 3-5 minutes Confidential 12 Think like the interviewer -- Pre-emptive thinking In order to succeed in a Wall St. interview, try to anticipate the questions you are likely to be asked: Specific questions to prepare for Open ended – “How do you perform under pressure?” Past performance – “Tell me about a time when you showed leadership during a difficult situation?” Interpersonal / communication skills – “What distinguishes you from your peers?” Problem solving abilities – “What difficult issue have you solved recently?” Intellectual skills – “How many ping pong balls can fit in a 747? With or without the seats?” Motivational/work skills – “Give an example of when commitment to a job or activity paid off.” Why Credit Suisse? Remember THINK FIRST! Before answering any question, think about what you want the interviewer to come away with when you are finished answering it. Tips for good answers Good answers are thoughtful, clear, interesting, confident, and relevant Give examples when possible Don’t over-prepare Confidential 13 First impressions It’s more than just words Confidential 14 Dress to impress What is appropriate Men Wear a suit. If you don’t have one, wear a button down shirt, tie, nice pants and a blazer Do not wear a lot of cologne, jewelry, a crazy tie, unpolished shoes or white socks Women Wear a suit. If you don’t have one, wear nice pants or skirt with a twin set or blazer. Do not wear short skirts, tight pants, too much perfume, long dangly earrings, or too much make-up Everyone Always come clean with neat hair and dress in clean, pressed clothes Confidential 15 Actions can speak louder than words Proper decorum and attitude Waiting at the interview Do not smoke Do not chew gum Review your resume • Go over things you feel are the most important • Rethink the questions you are likely to be asked When the Interviewer comes out Stand up immediately Walk over to him / her Firm, dry, confident handshake Look them in the eye, introduce yourself SMILE Confidential 16 During the interview How to Make it Count Confidential 17 Don’t just survive, thrive How to successfully sell yourself Speaking points Speak slowly Avoid all slang Avoid “um” and “like” as fillers in your sentences Speak confidently but NOT arrogantly Keep eye contact when speaking or listening Answer the question asked Be positive in all your answers Market yourself Don’t be afraid to put it on the line – “I want this job and I will work as hard as it takes to get it” Body language The rest of your body language can say just as much as your mouth Sit up, lean forward, be engaged Stand until the interviewer sits Confidential 18 Technical Questions / Brainteasers Be prepared to answer technical questions related to what is on your resume The purpose of technical questions and brainteasers are not necessarily to get a correct answer, but to see how you think Walk the interviewer through the response showing the thought process behind each step If you get stuck, ask the interviewer for input as you are responding Confidential 19 Follow through Closing the interview Have questions ready for the interviewer Ask about the job, the firm, the firm’s culture DO NOT ASK ABOUT MONEY See “other tips” for example questions to ask You’re not done yet Stand up, thank the interviewer for their time, shake hands again Write a thank you letter as soon as you get home • Re-emphasize how nice it was to meet them and how much you want the job • Be extremely polite, appropriate, and nice • Remind the interviewer of something you discussed or mention a particularly enjoyable aspect of the conversation If you are invited for a final round interview, request feedback from round 1 interviewers Confidential 20 How to kill an interview Things interviewers hate Being a “know-it-all”, over-aggressive, or overbearing Condemnation of past employers Bad handshake Being late Lack of manners Bad personal appearance Lack of confidence Lack of involvement in school or extracurricular activities Rambling answers Having no questions to ask Over-emphasis on money Lack of interest and enthusiasm Not knowing the job to which you are applying Confidential 21 Other Tips Extra Pointers and Cheat Sheets Confidential 22 Questions to ask an interviewer Tell me more about your program What are the characteristics of your top people? What are the three main characteristics you look for in a candidate? If I were to ask your top rep what he / she likes the most / least about the company, what kind of response would I get? Tell me about a typical day How would you describe the culture of the firm? Will I be required to work in different locations? What are some abilities and skills needed to be successful in this position? Confidential 23 Attributes interviewers look for in candidates Analytical Creative Resourceful Takes Initiative Organized Personable Adaptable Committed Quantitative Detail Oriented Self Motivated Team Player Quick Learner Good Judgment Leader Persuasive Confidential 24 Useful Wall St terms and concepts Asset – Anything owned by a corporation or other legal person Bear market – A market in which prices are generally declining Bond – A debt instrument; a security that represents the debt of a corporation, a municipality, the Federal government, or any other entity. A bond is usually long-term in nature – 10 to 30 years Call – An option to buy a share or commodity Chinese Walls – Regulations which prevent conflicts of interest arising in integrated securities firms Collateral – An asset pledged to support a loan Commodities – Raw materials such as grain or precious metals. Contracts for the purchase and sale of commodities are sold on commodities exchanges Coupon – A mall certificate which is detachable from a bond to be exchanged for dividends, interest payments etc. Also means the rate of interest payable on a fixed-interest security Derivatives – A financial instrument whose characteristics and value depend upon the characteristics and value of an underlying instrument or asset, typically a commodity, bond, equity or currency Dividend – A portion of a corporation’s assets paid to stockholders on a per-share basis. Preferred stock is supposed to pay a regular and prescribed amount. Common stock pays varying amounts when declared Confidential 25 Useful Wall St terms and concepts (cont’d) Equity – The ownership of an investment Exchange floor – Location at a securities exchange where transactions take place Financial models – Tools used to determine the value of an investment in a company, commodity, currency, government initiative and so on. To build a financial model, an analyst may consider past performance, current market trends, political climate and overall value of the issuer, for example Fixed income – Interest-bearing notes, bonds and bills that pay a specified percentage of interest over the life of the loan Hedging – A strategy for balancing risks, as in "to hedge one's bets“ IPO – Initial Public Offering, or the first issue of stock or other securities by a company for sale to the public Mutual fund – A fund operated by an investment firm that raises capital from shareholders to invest in stocks, bonds, options, commodities or many market securities. These funds offer investors the advantages of diversification and professional management Nasdaq – Started in the US as an automated over-the-counter securities quotes system and evolved into the world's first electronic stock market Option – A contract that entitles the buyer to buy (call) or sell (put) a predetermined quantity of an underlying security for a specific period of time at a pre-established price Put – An option to sell shares, bonds or a commodity Confidential 26 Useful Wall St terms and concepts (cont’d) Qualitative research – Research into how an investment's results were achieved including the quality of the people, strategies, systems and infrastructure that achieved them Quantitative research – Numbers-related research using statistical analysis of past performance of companies, products, segments and so on Securities – Stocks and bonds Short sale – The sale of securities that are not owned or that are not intended for delivery. The short seller "borrows" the stock to make delivery with the intent to buy it back at a later date at a lower price Stock dividends – A dividend paid by corporations from retained earnings in the form of stock. The corporation declares the dividend as a percentage of shares outstanding Traders – People who buy and sell securities for brokers, dealers and for their own accounts Yield – Rate of return on investment. Also the dividend payable on a share expressed as a percentage of the market price Confidential 27 Additional Sample Interview Questions Leadership Have you ever been part of a group that was struggling for a sense of direction? What did you do? Have you worked on a team where the member input/work product was of marginal quality? How did you insert yourself? What was the outcome? Describe a time when you had to handle a tough problem which challenged fairness or your ethical posture? Results Orientation Describe your most significant example of initiative where “but for you,” the outcome would not have been achieved. What do you do when priorities change quickly? How did you prepare for this interview? Describe a situation when you exceeded people’s expectations. How did you handle it? Confidential 28 Additional Sample Interview Questions Intellect/Problem Solving “I see you founded x magazine – if Conde Nast approached you to buy it, how would you think about setting a price?” If you were going to buy a new house, how would you decide what to pay for it? Query the candidate on a topical business / economics event Query the candidate on a topical news item about a specific company Collaboration What is your approach in meeting new people? What role do you typically take on in a team? Describe a setback at either school or work. How did you address it? Interest & Knowledge of CS & Industry Did the company have a good quarter? Who is the CEO. His/Her background. Confidential 29 Helpful websites and other resources Websites to be familiar with www.vault.com www.cnbc.com www.bloomberg.com www.cnn.com www.nytimes.com www.wsj.com Books and magazines The Wall St. Journal Time Magazine Forbes The Economist Accounting for dummies Confidential 30 Questions? Confidential 31 10th annual Interviewing on Wall Street Panel & Networking Reception Todd Sullivan (VU '95) Managing Director-Operations; Global Head of Interest Rate & Credit Derivative Operations, Morgan Stanley Co-sponsored by: Equity Society, Fixed Income Society, Mergers & Acquisitions Society, The Clay Center at VSB & University Career Center in collaboration with the Villanova Financial Club (VU Alumni working on Wall Street) 10th annual Interviewing on Wall Street Panel & Networking Reception Bryan Rolfe (VU ‘86) Managing Director, Debt Capital Markets, BMO Capital Markets Co-sponsored by: Equity Society, Fixed Income Society, Mergers & Acquisitions Society, The Clay Center at VSB & University Career Center in collaboration with the Villanova Financial Club (VU Alumni working on Wall Street) 10th annual Interviewing on Wall Street Panel & Networking Reception Bob Bosse (VU ‘86) Executive Director, Corporate & Investment Bank JP Morgan Co-sponsored by: Equity Society, Fixed Income Society, Mergers & Acquisitions Society, The Clay Center at VSB & University Career Center in collaboration with the Villanova Financial Club (VU Alumni working on Wall Street) 10th annual Interviewing on Wall Street Panel & Networking Reception Steve Hanwacker (VU ‘01) Senior Financial Advisor, Merrill Lynch Wealth Management Co-sponsored by: Equity Society, Fixed Income Society, Mergers & Acquisitions Society, The Clay Center at VSB & University Career Center in collaboration with the Villanova Financial Club (VU Alumni working on Wall Street) 10th annual Interviewing on Wall Street Panel & Networking Reception Kathleen Barr (VU ‘14) Summer ’13 Finance Intern, Barclays Katharine Macomber (VU ‘14) Summer ’13 Compliance Intern, Barclays Co-sponsored by: Equity Society, Fixed Income Society, Mergers & Acquisitions Society, The Clay Center at VSB & University Career Center in collaboration with the Villanova Financial Club (VU Alumni working on Wall Street) 10th annual Interviewing on Wall Street Panel & Networking Reception Q&A Co-sponsored by: Equity Society, Fixed Income Society, Mergers & Acquisitions Society, The Clay Center at VSB & University Career Center in collaboration with the Villanova Financial Club (VU Alumni working on Wall Street) 10th annual Interviewing on Wall Street Panel & Networking Reception Co-sponsored by: Equity Society, Fixed Income Society, Mergers & Acquisitions Society, The Clay Center at VSB & University Career Center in collaboration with the Villanova Financial Club (VU Alumni working on Wall Street) 10th annual Interviewing on Wall Street Panel & Networking Reception Co-sponsored by: Equity Society, Fixed Income Society, Mergers & Acquisitions Society, The Clay Center at VSB & University Career Center in collaboration with the Villanova Financial Club (VU Alumni working on Wall Street) 10th annual Interviewing on Wall Street Panel & Networking Reception Co-sponsored by: Equity Society, Fixed Income Society, Mergers & Acquisitions Society, The Clay Center at VSB & University Career Center in collaboration with the Villanova Financial Club (VU Alumni working on Wall Street) 10th annual Interviewing on Wall Street Panel & Networking Reception Co-sponsored by: Equity Society, Fixed Income Society, Mergers & Acquisitions Society, The Clay Center at VSB & University Career Center in collaboration with the Villanova Financial Club (VU Alumni working on Wall Street) 10th annual Interviewing on Wall Street Panel & Networking Reception Alex Hewitt, Equity Society (VU ‘13) Nick Latorre, M&A Society (VU ‘14) John DiMieri, Fixed Income Society (VU ‘14) Co-sponsored by: Equity Society, Fixed Income Society, Mergers & Acquisitions Society, The Clay Center at VSB & University Career Center in collaboration with the Villanova Financial Club (VU Alumni working on Wall Street) 10th annual Interviewing on Wall Street Panel & Networking Reception Campus Resources Students Tell All: “Life as a Wall Street Intern” Panel Wednesday, 10/23; Driscoll 134, 6:30pm www.efinancialcareers.com Financial services industry overview by sector, Job News & Advice, Internship/Job postings, etc. PowerPoint AND Video of presentation will be posted to http://claycenter.villanova.edu (Click on “Calendar of Events”) Co-sponsored by: Equity Society, Fixed Income Society, Mergers & Acquisitions Society, The Clay Center at VSB & University Career Center in collaboration with the Villanova Financial Club (VU Alumni working on Wall Street) Financial Services Networking Reception PARTICIPATING EMPLOYERS Barclays BlackRock Blackwood Associates BMO Capital Markets Boenning & Scattergood Bloomberg BNP Paribas Financial Services Credit Suisse DuPont Capital Management First Financial Group FTI Consulting GregoryFCA Hartford Funds Hirtle, Callaghan & Co. JP Morgan KPMG Merrill Lynch Wealth Management Morgan Stanley PNC Bank Stifel Nicolaus Wells Fargo Co-sponsored by: Equity Society, Fixed Income Society, Mergers & Acquisitions Society, The Clay Center at VSB & University Career Center in collaboration with the Villanova Financial Club (VU Alumni working on Wall Street)