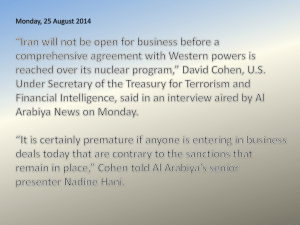

contribution - United Way Conferences Site

advertisement

New NFP Accounting Guidance: The AICPA’s New NFP A&A Guide United Way Worldwide Financial Management and Human Resources Forum October 8, 2013 Andrew M. Prather, CPA Shareholder aprather@clarknuber.com 425-635-4571 C LARK N UBER P . S . Agenda • AICPA’s New Overhauled NFP A&A Guide • Briefly - New Auditing Standards C LARK N UBER P . S . Page 1 Learning Objectives • AICPA’s New Overhauled NFP A&A Guide – Aware of the new Guide, understand specific new accounting guidance, equipped with tools to do further research • Clarified Auditing Standards – Aware of new standards and impact to your auditors report C LARK N UBER P . S . Page 2 Overhaul of the AICPA Audit and Accounting Guide Not-for-Profit Entities C LARK N UBER P . S . Page 3 Focus of the NFP Guide • Not-for-profit entities • GAAP-basis financial statements • Audited financial statements C LARK N UBER P . S . Page 4 Issuance of Overhauled 2013 Guide • The AICPA has issued a comprehensive revision of the Audit and Accounting Guide Not-for-Profit Entities in the spring of 2013 – Financial Reporting Executive Committee (FinREC) – Not-for-Profit Entities Expert Panel – Not-for-Profit Guide Task Force • First revision, other than annual conforming changes, since the Guide was released in 1996 C LARK N UBER P . S . Page 5 Source of New Guide Content • Considered over 100 questions that had been asked by members who called the AICPA Help Line • Authoritative guidance from FASB Codification • Non-authoritative guidance from FinREC conclusions • Incorporated relevant nonauthoritative AICPA literature – NFP-related Technical Questions and Answers (TIS) section 6140 – AICPA White Paper on Fair Value Measurement – Alternative investments TIS section 2220.18–.27 C LARK N UBER P . S . Page 6 Authoritative Status of AICPA Guides • Accounting & Financial Reporting – Basis of accounting content is from GAAP, but Guides provide additional explanation and practical guidance • Auditing – Auditing guidance considered interpretive publication under AU-C section 200 “The auditor should consider applicable interpretive publications in planning and performing the audit.” AU-C 200.27 • Effective Date of 2013 NFP A&A Guide C LARK N UBER P . S . Page 7 Table of Contents • • • • • • • • • • • • • • • • • Chapter 1 – Introduction Chapter 2 – General auditing considerations Chapter 3 – Financial statements, the reporting entity, and general financial reporting matters Chapter 4 – Cash, cash equivalents, and investments Chapter 5 – Contributions received and agency transactions Chapter 6 – Split-interest agreements and beneficial interests in trusts Chapter 7 – Other assets Chapter 8 – Programmatic investments Chapter 9 – Property and equipment Chapter 10 – Debt and other liabilities Chapter 11 - Net assets and reclassifications of net assets Chapter 12 – Revenues and receivables from exchange transactions Chapter 13 – Expenses, gains, and losses Chapter 14 – Reports of independent auditors Chapter 15 – Tax and regulatory considerations Chapter 16 – Fund accounting Appendices C LARK N UBER P . S . Page 8 Table of Contents • Chapter 2 – General auditing considerations • Chapter 3 – Financial statements, the reporting entity, and general financial reporting matters • Chapter 4 – Cash, cash equivalents, and investments • Chapter 5 – Contributions received and agency transactions • Chapter 6 – Split-interest agreements and beneficial interests in trusts • Chapter 8 – Programmatic investments • Chapter 11 - Net assets and reclassifications of net assets • Chapter 13 – Expenses, gains, and losses • Chapter 14 – Reports of independent auditors C LARK N UBER P . S . Page 9 Details on What’s New • Supplementary conference material: – Listing of Sections with New or Enhanced Guidance – AICPA flyer on where to purchase copy of the Guide C LARK N UBER P . S . Page 10 Chapter 3, Financial Statements, the Reporting Entity, and General Financial Reporting Matters • Statement of functional expenses – Required as a basic financial statement for voluntary health and welfare entities – FinREC encourages presentation by all NFPs that are supported by the general public • NFP with contributions of 20-30% of total revenue presumed to be supported by general public (excluding gov’t support) • Consider facts & circumstances and use judgment C LARK N UBER P . S . Page 11 Related Party Transactions • GAAP disclosure requirements – Material related party transactions (but not compensation, expense allowances) – Relationship results in operating results or financial position significantly different than if entities not related C LARK N UBER P . S . Page 12 Who Are Related Parties? • DEFINITELY: – – – – Affiliates (“control” – upstream, downstream, sideways) Equity method investee Employee benefit plans the NFP sponsors Management of the entity; members of their immediate families • PROBABLY: – – – – – Officers, board members, founders, substantial contributors Immediate family members of Board/management Parties providing concentrations in revenues and receivables Certain national and local affiliates Other entities with common Board/executives C LARK N UBER P . S . Page 13 Examples of Related Party Transactions • NFP leases office space from a Board member • NFP uses legal services provided by a firm in which a Board member’s spouse is a person of influence, such as a partner. • NFP purchases printing services from a printing shop owned by a Board member • A national NFP provides financial consulting to a local affiliate, either for a fee or for no fee (or one brothersister organization provides consulting to another, either for a fee or for no fee) • NFP makes grants to a separate organization whose executive director is a Board member of the NFP C LARK N UBER P . S . Page 14 Practical Considerations • GAAP definition of “related parties” different from IRS/990 • Recommend use of IRS/990 information gathering as primary tool; GAAP disclosure can leverage IRS/990 information C LARK N UBER P . S . Page 15 Chapter 3, Continued • Significantly expanded guidance on interests in related entities – Summary chart of examples that reference to sections of both the Guide and the FASB ASC • NFP entities • For-profit entities • Special-purpose leasing entities C LARK N UBER P . S . Page 16 Excerpt from Exhibit 3-2 C LARK N UBER P . S . Page 17 Chapter 4, Cash, Cash Equivalents, and Investments • Significantly expanded guidance on common investments by NFPs – Summary chart of examples that reference to sections of both the Guide and the FASB ASC C LARK N UBER P . S . Page 18 Excerpt from Exhibit 4-1 C LARK N UBER P . S . Page 19 Chapter 5, Contributions Received and Agency Transactions • Core accounting considerations – Distinguishing contributions from other transactions • Contributions • Agency transactions • Exchange transactions – Recognition and measurement of contributions C LARK N UBER P . S . Page 20 Chapter 5, Continued • Receipt of resources by a NFP --a contribution, exchange, or agency transaction? – Flowchart 5-1 – Determining Whether a Transfer to a NFP Includes a Contribution – Table 5-1 – Indicators Useful in Distinguishing Contributions from Exchange Transactions – When elements of both are present, divide the transaction in two, measuring exchange first • Examples C LARK N UBER P . S . Page 21 Chapter 5, continued • Agency Transactions – Definition: a type of transaction in which the NFP acts as an agent, trustee, or intermediary for another party that may be a donor or donee – Resource inflow to NFP is not a contribution, no revenue recognized – Key consideration is “variance power” C LARK N UBER P . S . Page 22 Chapter 5, continued • Exchange Transaction Example: Grants – Use Table 5-1 to determine if grant is contribution or exchange based on the facts and circumstances – If contribution - consider if any conditions exist, consider donor restrictions – If exchange – determine revenue recognition – NFP should establish accounting policy for grants so they are accounted for consistently – Government grants • Apply the above guidance • FASB Not-for-Profit Advisory Committee topic C LARK N UBER P . S . Page 23 Chapter 5, continued • Recognition and Measurement of Contributions – Contributed fundraising material, informational material, or advertising, including media time or space – Below-market interest rate loans – Administrative costs of restricted contributions – Contributed use of facilities C LARK N UBER P . S . Page 24 Chapter 5, continued • Contributed Fundraising Material, Info Material, or Advertising, Including Media Time or Space – Examples –public service announcements, radio advertising time, newspaper print space – Donated asset, not a donated service – • Record contribution even if the asset would not typically needed to be purchased if not provided by donation – FinREC recommends: Recognize a contribution if NFP has active involvement in determining and managing the message and use of the materials; otherwise not a contribution C LARK N UBER P . S . Page 25 Chapter 5, continued • Below-Market Interest Rate Loans – No or low-interest loan of funds is a contribution to the NFP – Record contribution revenue and interest expense for fair value of the contribution • Fair value typically estimated at difference between market rate interest and actual interest – Related party status doesn’t impact recording – Recognition of contribution/interest different for long-term loan vs. due-on-demand loan C LARK N UBER P . S . Page 26 Example 1 – Long-term loan from a foundation – On 1/1/2013 NFP receives 0% interest loan of $200,000 payable 12/31/2015 – Market interest rate is 6% C LARK N UBER P . S . Page 27 Record receipt of loan 1/1/2013 DR Cash CR Loan payable * $200,000 (167,924) CR Contribution revenue ** (32,076) * calculated at PV of $200K at 6% over 3 years ** donor restricted, release over term of loan Record annual interest (similar entries also booked at 12/31/2014 and 12/31/2015) 12/31/2013 DR Interest expense CR Loan payable $10,075 (10,075) Record repayment of loan 12/31/2015 DR Loan payable CR Cash $200,000 (200,000) C LARK N UBER P . S . Page 28 Example 2 – Due on demand loan from a foundation – On 1/1/2013 NFP receives 0% interest loan of $200,000, due on demand, repaid 12/31/2015 – Market interest rate is 6% C LARK N UBER P . S . Page 29 Record receipt of loan 1/1/2013 DR Cash CR Loan payable $200,000 (200,000) Record annual interest and contribution (same entry also booked at 12/31/2014 and 12/31/2015) 12/31/2013 DR Interest expense $12,000 CR Contribution revenue * (12,000) * unrestricted Record repayment of loan 12/31/2015 DR Loan payable CR Cash $200,000 (200,000) C LARK N UBER P . S . Page 30 Chapter 5, continued • Administrative Costs of Restricted Contributions – Policy of designated a certain % of restricted gifts to offset the costs of raising and administering those gifts • Example – Policy that 5% of contributions to scholarship fund go to pay administrative costs; so $95 of a $100 gift is restricted for the scholarship fund – Policy needs to be effectively communicated to or from the donor prior to receipt of the contribution • If not, then 100% of gift should be donor restricted C LARK N UBER P . S . Page 31 Chapter 5, continued • Contributed Use of Facilities – Recognize contribution revenue in period contribution is received • Record pledge receivable unconditional right to use the facilities for multiple years (temporarily restricted contribution revenue) – Recognized expense in the period the asset is used – Use estimated fair value of comparable rental costs – Recognition of contribution/rent expense different for long-term committed leases vs. monthly usage C LARK N UBER P . S . Page 32 Example 1 – Long-term lease from a company – On 1/1/2013 NFP signs a lease contract – Free use of space for a committed three year term – Market rental rate for comparable space is $20,000 per year – Discount rate is 6% C LARK N UBER P . S . Page 33 Entry when lease contract is signed 1/1/2013 DR Facilities contribution receivable * $59,405 CR Contribution revenue ** (59,405) * calculated at PV of $60K at 6% over 3 years ** donor restricted, release over term of lease Record annual rent (similar entries also booked at 12/31/2014 and 12/31/2015) 12/31/2013 DR Rent expense CR Facilities contribution receivable CR Contribution revenue *** $20,000 (19,703) (297) ***in addition to this new contribution revenue, there would also be a release of restriction of $19,703 C LARK N UBER P . S . Page 34 Example 2 – Monthly use of space from a company – On 1/1/2013 NFP signs a lease contract – Free use of space monthly but no committed term, may be canceled by landlord at any time with 30 days notice – Market rental rate for comparable space is $20,000 per year – NFP uses the space for three years C LARK N UBER P . S . Page 35 Entry when lease contract is signed 1/1/2013 no entry to be recorded Record annual rent (same entries also booked at 12/31/2014 and 12/31/2015) 12/31/2013 DR Rent expense CR Contribution revenue * $20,000 (20,000) *unrestricted C LARK N UBER P . S . Page 36 Chapter 6, Split Interest Agreements and Beneficial Interests in Trust • Examples: – – – – – – Charitable Lead Trusts Charitable Remainder Trusts Perpetual Trusts Charitable Gift Annuities Pooled (Life) Income Fund Life Interest in Real Estate C LARK N UBER P . S . Page 37 Chapter 6, Continued • Beneficial interest in a trust held by another entity – Questions: – What if NFP isn’t notified about trust until years after it is created? – What if NFP is unable to obtain information to verify it is named as an irrevocable beneficiary? – What if NFP is unable to obtain information to measure the beneficial interest? C LARK N UBER P . S . Page 38 Chapter 6, Continued • Answers: – NFP generally needs the following information in order to record beneficial interest in the trust: • Copy of executed trust document, statement from the trustee, or other information to verify existence • Sufficient information about the trust in order to value it (e.g. trust assets, payout rate/amount, age of life beneficiaries) – Make reasonable efforts to obtain necessary information C LARK N UBER P . S . Page 39 Chapter 6, Continued • Answers, continued: – Recognize beneficial interest in the trust and contribution revenue in the first year the necessary information becomes available. – Should not record a prior period adjustment if the NFP made, and continues to make, reasonable efforts to obtain necessary information C LARK N UBER P . S . Page 40 Chapter 8, Programmatic Investments (NEW) • Programmatic investments are any investment by an NFP that meets the following two criteria: – Its primary purpose is to further the tax exempt objectives of the NFP. – The production of income or the appreciation of the asset is not a significant purpose (that is, an investor seeking a market return would not enter into the investment). • Similar to program-related investment, IRS Sec. 4944(c). C LARK N UBER P . S . Page 41 Chapter 8, continued • Specific examples discussed in the chapter: – Loans • Low or no interest loans • Forgivable loans – Guarantees • Guarantee provided without commensurate return – Equity investments • Often no contribution element C LARK N UBER P . S . Page 42 Chapter 8, continued • Core Considerations – Determine when the initial transaction occurs whether the investment is programmatic – If there is a contribution element, report it as contribution expense – Use GAAP for similar financial instruments, except for the contribution element, if any – Significance of the investments and the quantitative and qualitative risks determine the type of financial statement presentation and the extent of disclosures C LARK N UBER P . S . Page 43 Chapter 11, Net Assets and Reclassifications of Net Assets • Significantly expanded guidance on expiration of restrictions – – – – – Using restricted contributions first Gifts of long-lived assets or gifts for their purchase Donor restricted endowment funds Restrictions met in the same year as the contribution was received Promises to give, including implied time restriction on multi-year pledges C LARK N UBER P . S . Page 44 Chapter 11, continued • Expiration of restrictions on promises to give – By specifying future payment dates donors indicate that their gift is to support activities in each period in which a payment is scheduled (i.e. an implied time restriction) – Time restrictions lapse when the receivable is due; gift becomes available for the donor-specified purpose – If gift is for the construction or purchase of a specific long-lived asset, the donor supports activities of the period in which that asset is constructed or placed in service, even though the payment dates extend beyond that period C LARK N UBER P . S . Page 45 Chapter 13, Expenses, Gains, and Losses • Grants payable – Recognize as expense in the period grant is made – Unconditional promise to give cash; recognize expense and accrue payable when promise (grant) is made – Disclose conditional promises to give if material and reasonably possible the conditions will be met C LARK N UBER P . S . Page 46 Chapter 14, Reports of Independent Auditors • New formatting of auditors’ Caused by new “clarified” auditing standards • Applies to all audits – Yes – FS, A-133, EBP, program audit, final cost certification, etc. – No – Review, compilation, agreed-upon procedures, etc. • Effective Date – Audits of periods ending on or after 12/15/2012 C LARK N UBER P . S . Page 47 C LARK N UBER P . S . Page 48 Details on What’s New • Supplementary conference material: – Listing of Sections with New or Enhanced Guidance – AICPA flyer on where to purchase copy of the Guide C LARK N UBER P . S . Page 49 Questions? Andrew Prather CPA Shareholder Clark Nuber P.S. aprather@clarknuber.com 425.635.4571 C LARK N UBER P . S . Page 50