Mumtaz Hasan Khan

advertisement

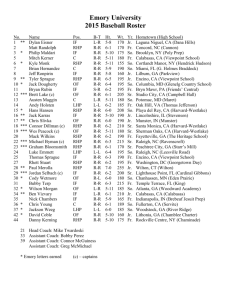

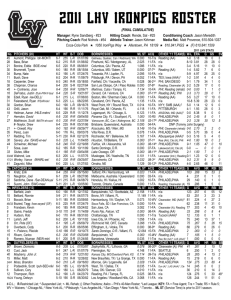

HASCOL PETROLEUM LIMITED – A COMPANY ON GROWTH PATH Oil Marketing Companies in Pakistan PSO Public Sector Enterprise Listed company Shell Private Sector Listed company Attock Petroleum Private Sector Listed company Chevron Private Sector Non-listed TOTAL Private Sector Non-listed Hascol Private Sector Non-listed BYCO Marketing Private Sector Fully owned subsidiary of BYCO OOTCL Private Sector Non-listed Bakri Private Sector Non-listed Zoom Private Sector Non-listed Askar Private Sector Non-listed Admore Private Sector Non-listed Demand of Petroleum is Expected to Grow at a Rapid Rate • The projections show that there is an ever increasing demand for petroleum products • With reduced availability of alternates like CNG demand of petroleum will grow at a much rapid rate Source : Pakistan Oil Report :by OCAC Efficient Infrastructure is Critical for Petroleum Business in Pakistan - Hascol is Present at all Logistics Hub 65% Demand in North Refined + Crude ARL HPL Storage Facilities Tarujabba Common User Facilities Chaklala Machike Other OMCs Facilities Gatti Quetta PARCO & Dhodak Shershah Shikarpur Imports 90% Mehmoodkot Vehari Refined product Imports 45% Port Qasim 90% Supply from South Keamari NRL, PRL & BYCO Local 55% Local 10% Hascol Petroleum - Introduction Start of Operations Year 2005 Number of commissioned retail outlets 200 Products marketed by Hascol Motor fuels (petrol, diesel), consumer/industrial fuels (fuel oil, kerosene, Jet) and lubricants (complete range of motor and industrial lubricants) Market Share (2012) 2% Number of storage terminals 4 Common User storage and handling facilities used 2 Our Board of Directors Mr. Mumtaz Hasan Khan – Chairman & CEO Mr. Khan has 47 years of Experience in the Oil industry. Under his leadership Hascol Petroleum has been granted an oil marketing license by Government of Pakistan. Mr. Khan is also chairman of Sigma Motors. Mr. Khan was a member of Energy Expert Group which prepared the first integrated energy plan of the country. Dr. Akhter Hasan Khan Dr. Khan has retired as Secretary Planning, Government of Pakistan. He has a distinguished academic record with Masters in Public Administration from Harvard University and PHD in Economics from Tufts University. He has served at number of senior positions in Federal Government. He has been on the boards of various public sector organizations. Mr. Farooq Rahmatullah Mr. Rahmatullah has experience of more than 45 years in oil industry at both local and international level. He has served as chairman of Shell Companies in Pakistan, Director General of Civil Aviation Authority, chairman OGDC and chairman of LEADS Pakistan. He is chairman of PRL and director of Faysal Bank and Society for Sustainable Development. Mr. Najmus Saquib Hameed Mr. Hameed is Hon. Vice Chairman and CEO of Layton Rahmatulla Benevolent Trust (LRBT). He has over 47 years experience in senior management positions in multinational companies like Unilever and Pakistan Tobacco; from where he retired as chairman of the company. He is currently on the Board of NIB Bank and Sigma Motors Limited. Mr. Liaquat Ali Mr. Ali is Chartered Accountant by profession and is a Fellow Member of ICAP. He has over 18 years of experience in in leasing and investment banking. Presently, Mr. Ali is a partner of Avais Hyder Liaquat Nauman (AHLN) a member firm of RSMi international which is the 6th largest network of independent accounting and consulting firms in the world. Mr. Sohail Hasan Mr. Hasan is a Chartered Accountant and a member of the Institute of Chartered Accountants in England and Wales and ICAP. He was Senior Partner of A.F.Ferguson & Co. He has served as a member of the Provincial Finance Commission, Punjab and is a currently a member of the Corporate Law Review Commission of Pakistan Mr. Saleem Butt – Director & COO Mr. Butt is Chartered Accountant by profession. Mr Butt has over 22 years of diverse experience in Finance, Supply Chain, Sales, Management, Human Resources, Administration, IT and ERP Project Implementation. He had worked with Shell for 14 years in Pakistan and overseas. Mr. Butt is currently serving as director of PRL and TRG Pakistan Limited. Oil Marketing is Dominated by a Single Player and MNCs seem to losing Interest - An Efficient Local Player has opportunities • Of Muti-National Companies (MNCs) Chevron is selling out their fuel business in Pakistan • Shell’s market share has gone down by 300 bps in last 5 years • Attock on the other hand has grown their market share by 300 bps in the same period We Have High Aspirations for Growth… Our People are Our Strength Mr. Muhammad Ali Ansari – Chief Financial Officer Mr. Aamir Millwala – General Manager Lubricants Having 10 years of experience to his credit, Mr. M Ali Ansari is the Chief Financial Officer at Hascol Petroleum Limited. He is a Chartered Accountant by profession and has been associated with Hascol since December 2009. Mr. Millwala is a sales expert of petroleum Industry with over 13 years of experience. He joined Hascol Petroleum Limited in March 2013 prior to joining Hascol Petroleum, Mr. Millwala has worked for Shell Pakistan and played a role of lynch pin in number of business development which were completed under his leadership and guiding qualities. Mr. Zafar Munshi – General Manager Retail & Marketing Mr. Zafar Munshi currently holding the position of General Manager Retail and Marketing is among the senior most retailer in the Oil Sector. Mr. Zafar Munshi has been associated with the oil industry for around 20 year with vast experience in development of retail outlets, sales & marketing. Previously, he was employed in the retail function at Shell Pakistan Limited. Mr. Shamim Operations Raza Naqvi – General Manger Mr. Naqvi is a seasoned petroleum Industry expert with more than 33 years of experience in the petroleum industry. He possesses around 30 years of diversified refinery experience in PRL. Prior to joining Hascol Petroleum Ltd, Mr. Naqvi has worked for a reputable OMC for approximately 3 years, therefore having a well-rounded experience of upstream and downstream petroleum industry. Mr. Ahsan Abidi – Head of Internal Audit Mr. Abidi is the Head of Internal Audit at Hascol, having almost 35 years of work experience. Prior to joining Hascol in August 2012, he had worked with Overseas Oil Trading Company as well as Admore Gas Limited. He also has prior experience in Finance division at Shell Pakistan Limited. Mr. Imran Jawed – Head of Commercial Fuels Mr. Imran Jawed is Head of Commercial Fuels at Hascol Petroleum Limited, having a rich experience of more than 10 years of marketing, supply chain & logistics. His diversified experience ranges from IPP’s, CPP’s, Vessel / Port Bunkering, export to Afghanistan, General Industries and on special projects. Prior to joining Hascol Petroleum, he was associated with Overseas Oil Trading Company and Admore Gas Limited. A significant proportion of HPL employees have experience of working in multinational oil companies like Shell, Chevron. We have Technology and Infrastructure • From 1st of January 2013 HPL has gone live on J D Edwards – An ERP solution that connects and synergize all our network • A significant proportion of HPL employees has experience of working in multinational oil companies like Shell, Chevron. Our Retail Outlets are in Every Part of the Country and We Plan to Grow Further Province Sindh Balochistan Punjab KPK & Fata AJK & Gilgit Total Commissioned Sites Sites in Plan Total 68 7 94 26 5 200 71 8 177 39 5 300 139 15 271 65 10 500 High Standards of Facilities and Service is Our way of Doing Business • More than 200 retail sites are in operation • Another 300 in pipeline at various stages of completion We Carry an International Lubes Brand in Our Portfolio FUCHS is a leading independent lubricants manufacturer of the world. In 2009,its sales revenues were €1,178.1 million. The company has 36 production facilities with over 100,000 customer base in more than 100 countries. FUCHS is among top 10 lubricants manufacturers in the world. We Pioneer New Ideas and Execute those – LPG AutoMax Automax LPG in operation at HascolOne since last year Focusing on CNG sites for LPG growth Our Storage & Distribution Facilities - I Amangarh in KPK – 1500 MT Shikarpur in Sindh – 6,500 MT Our Storage & Distribution Facilities - II Terminal at PQA, Karachi – 32,000 MT Under construction Installation at Machike , Punjab – 7,000 MT Description Profit & Loss Accounts 2013 2014 2015 2016 Sales - gross 51,287,525 60,956,912 67,213,712 74,317,023 Sales - net of sales tax 44,664,186 53,084,855 58,533,643 64,719,623 Cost of sales (43,523,262) (51,753,410) (57,075,378) (63,119,829) Gross profit 1,140,924 1,331,445 1,458,265 1,599,795 Selling and distribution expenses (486,075) (519,756) (552,521) (585,490) Administrative expenses (163,762) (179,823) (198,646) (220,544) Operating profit 491,087 631,866 707,098 793,760 Finance cost (60,778) (44,883) (43,430) (44,744) Other income 115,796 126,164 137,936 151,379 Profit before taxation 546,105 713,147 801,604 900,396 Taxation 126,880 150,801 166,280 183,853 Profit after taxation 419,225 562,346 635,324 716,543 EPS 4.63 6.21 7.01 7.91 2017 81,854,823 71,283,982 (69,499,217) 1,784,765 (620,305) (245,892) 918,569 (47,839) 166,739 1,037,469 202,500 834,969 9.22 We have the Right Credit Rating: A- and A-2 for Long-term and Short-term - by JCR-VIS Roadmap to IPO The Issue: 25mn shares at a Floor Price of PKR 17 / share calculating to a total size of PKR 425mn Around 18.75mn shares are being issued via Book Building and 6.25mn shares will be issued to General Public at the strike price determined during book building PKR 300mn will be utilized for Capex on Machike Storage Facility and new retail outlets along with PKR 125mn for Working Capital The Company has achieved a Compound Annual Growth Rate (CAGR) of 48.87% in topline over the last 5 years Given the strategic positioning of the Company in OMC sector along with its future growth plans, we believe that achieving listing at this point will not only assist the company in achieving its growth plans and improving its brand image but also provide an opportunity to share the future gains with its investors HPL has appointed AKD Securities Limited and Avais Hyder Liaquat Nauman Chartered Accountants as Joint Lead Managers & Arrangers for the proposed IPO. HPL is currently in the process of preparing the formal listing application to the relevant Regulators and it is intended that the IPO will be launched in June 2013. Roadmap to IPO Oil Marketing Companies - Pakistan Indicators PSO* SHELL** APL* HPL** Retail Oulets 1864 780 403 200 Sales PKR 1,199,927,907,000 PKR 244,316,875,000 PKR 176,812,437,000 PKR 29,775,296,000 PAT / LAT PKR 9,056,055,000 (PKR 2,082,531,000) PKR 4,120,315,000 PKR 218,283,000 Shares 205,622,821 85,609,886 69,120,000 65,600,000 EPS PKR 44.04 (PKR 24.33) PKR 59.61 PKR 3.33 Market Price*** PKR 198.37 PKR 142.38 PKR 500.28 PKR 17.00 P/E (x) 4.50 N/A 8.39 5.11 Shareholders' Equity PKR 49,959,908,000 PKR 6,175,590,000 PKR 12,383,323,000 PKR 1,065,488,000 Book Value PKR 242.97 PKR 72.14 PKR 179.16 PKR 16.24 P/B (x) 0.82 1.97 2.79 1.05 *Annual Financial Statements - June 2012 **Annual Financial Statements - December 2012 ***Market Prices as at 24th April 2013 The floor price of PkR17 per share represent a FY12 P/E multiple of 5.11 (x) & a FY12 P/B multiple of 1.05 (x) which when compared with the average P/E and P/B multiple of the sample selected above, calculates to an upside potential of 26.31% and 77.77% respectively. Thank you