Feedback - EMR Portal

advertisement

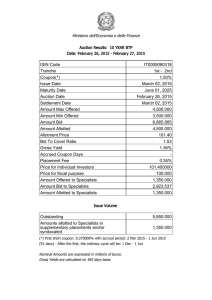

Implementation Co-ordination Workshop Place your chosen image here. The four corners must just cover the arrow tips. For covers, the three pictures should be the same size and in a straight line. 12th February 2015 CM Delivery 2015 Welcome Safety Introductions Agenda Re-Visit 2014 Success Factors Agenda Time 09:30 Topic Introduction Summary of 2014 Feedback from the 2014 Capacity Auction Feedback from 2014 Prequalification 10.30 Coffee Break 11.00 IT systems update Next steps for 2018 Agreement Holders Expected changes for 2015 2015 Timetable Q&A 13:00 Close 3 2014 CM Implementation Success Factors Success Description Pre-qualification & the Auction happened on time • Planned dates were met / only moved under an agreed governance process • The Auction ran and cleared in 2014 • Capacity was procured for delivery year of 2018/19 Pre-qualification ran smoothly and all applicants had the best opportunity to successfully pre-qualify • Rules/Guidelines were finalised in time, available to everyone, simple to understand and delivered the results expected • Procedures were explained, available to everyone, simple to understand and supportive (e.g. helping not blocking) • NG Systems were simple to use; ready on time; seen, tested and understood by applicants in advance; worked as intended and gave the results expected • Applicant Systems were ready on time and able to communicate with NG Systems as expected The Auction ran smoothly and all bidders had the best opportunity to secure a capacity agreement • As above for Pre-qualification • The Auction was “liquid”, included a diverse range of technologies/applicant sizes and offered best value to consumers • The Auction Monitor approved the auction outcome Settlement is on schedule for delivery • Smooth transfer of data from NG to Elexon • Payment/Settlement systems implementation is on track • Generators and Suppliers are confident of delivery of fit-for-purpose Settlement systems Summary of 2014 Ian Nicholas 5 2014 Capacity Market Summary 67.29GW of Capacity Prequalified for the 2014 Auction representing 501 Capacity Market Units 48.6GW target Auction held over three days and 12 rounds in December 2014 49.26GW of Capacity Procured representing 306 Capacity Market Units Clearing Price of £19.40/kW and total expenditure in 2018/19 of approx. £950million (2012 prices) 6 2014 Auction Readiness 240 Authorised Users ‘Bidders’ 77 Companies Multi format user training Material 3 Auction training Events; 130 users trained/ 900exit bids/13 backup bidding calls/ 30 calls general queries Screen Cast user guides Mock Auction Real Auction 7 Feedback Since the auction there have been a number of feedback sessions We have held lessons learnt sessions internally and with the Delivery Partners DECC held an Industry Feedback session Ofgem have commenced their Rule Change Process We have assessed other feedback received during the 2014 process. 8 Feedback from the 2014 Capacity Auction Ian Nicholas 9 Feedback and Q&A from 2014 Auction Auction Feedback How it is being addressed The auction took a long time to run and the rounds could be much shorter Carried out bidder behaviour analysis, likely suggested change would be similar first round and recess with latter rounds being shortened. Target Capacity needed more transparency winter outlook and capacity adequacy reports differed The reporting uses different methods which is explained in the modelling stakeholder engagement, Panel of Technical Experts involvement and DECC. Not clear when the results would be available (intra round results) The auction guidelines will clarify how DECC and NG will report the 2015 auction Why was excess capacity rounded Remove the opportunity to act when the capacity is close to clearing the round. 10 Feedback and Q&A from 2014 Auction Auction Feedback How it is being addressed Can the Price maker status be made public Ofgem review and rule change process is looking into this area. DBA and Exit bid function (1yr refurb issue) DECC review and rule change process Information clarity i.e. de rating capacity entering auction DECC review and rule change process/ possibly a review of the CM register summary details. 11 Feedback from 2014 Prequalification Mark Duffield 12 Feedback and Q&A from 2014 Auction Prequalification Feedback How it is being addressed Late changes to rules caused a lot of problems DECC and Ofgem are looking to ensure that any changes are made in plenty of time this year. Legal opinion and declaration documents seem over necessary We have proposed a Rule Change to combine the certificates and declarations (P062). A further change has been proposed to remove the legal opinion (P023). Rule 3.4.2 (b) states that a previously provided legal opinion can “roll over” providing the information remains accurate and up to date. Prequalification process is intensive Many of the rule changes proposed by NGET are intended to streamline the prequalification process. We will continue to work with stakeholders to make prequalification as straightforward as possible. Appeals process seemed a bit formal for typos or missing data The Appeal process is defined in the regulations and, whilst formal, is necessary to process any changes to applications. 13 Feedback and Q&A from 2014 Auction Prequalification Feedback Prequalification for Proven DSR is difficult so had to prequalify as unproven and post a bid bond Settlement periods used as delivery evidence not the same as balancing services evidence DSR have to 'pre qual' for balancing services and it is completely different-can they be aligned How it is being addressed There are a number of Rule changes proposed in this area (P044, P063 and P082). Complicated interaction between balancing services and the CM – we have proposed some rule changes but it is an area that needs further development with the industry. 14 Feedback and Q&A from 2014 Auction Stakeholder engagement/General Feedback Feedback How it is being addressed Lack of enduring IT System for Prequalification New system being developed, will be covered later on the agenda. The system should pre-populate the next prequalification application We are planning to prepopulate the system with information submitted during 2014 Need to keep the open comms experienced between industry and NG for new entrants and the next implementation w/shops should cater for the two types of audience; existing and new participants. We have a schedule for future IC events and we will be aiming to cover a range of subjects both for those who have already participated in 2014 and new entrants for 2015. FAQ's not always helpful with mandatory/optional data seemed not to be consistent We recognise there were issues with some of the guidance. Feedback on how to improve them is always welcome and systems and guidance for 2015 will be improved. Free text field in CM register contains sensitive info (i.e. MPAN details) The contents of the CM register is defined in the rules. A number of Rule Changes have been proposed in this area to streamline the Register. 15 Questions? 16 IT Systems Update Ian Woolley 17 Where are we…. 18 High Level Architecture External Parties Energy Industry & Trade Associations Comms Channels Portal Alerts & Notifications Existing Generators Prospective Generators Web DSR Aggregators CfD Admin Companies & Users Allocation Comms & Queries Appeal Mgmt Reporting LCF Budget Monitor 2014 CfD Allocation solution to be evolved Counterparty & Settlement Agent Authentication Service FAQ & Guidance CM Auction Solution CM Admin PreQualification Eligibility Auction System DECC User Authentication Administration System CRM CfD Allocation Solution Ofgem Secure Email Public Participants (market) Private Interim Portal Live in June 2014. Upgrades planned for April and June 2015 Northern Ireland Parties (SONI) Obligation Tracking Registry CfD Contracts Eligibility Documentation CMU Obligations Auction System CM Auction solution 19 live November 2015 New CM Administration solution to be live June 2015 CM Admin system - Plan on a Page All "End" Dates 2014 Dec 2015 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Admin System Development Design/Requirements Portal 03/02, CM 19/02 Development Portal 03/03, CM 14/04 Test Preparation Portal 13/02, CM 10/03 UAT Portal 25/03, CM 27/05 Training Portal 26/03, External 29/06 Environments Live 24/03 Go Live Regime Cycle Portal 10/04 Key: System training (ext) Portal Milestones Familiarisation CM Milestones Window opens Regime/Rules Milestones Window closes CM 23/06 Pre-Qual open 20/07 Pre-Qual closes 14/08 Stakeholder Events Assessment Results 25/09 Engagement & Change Engagement There will be an IS representative at all Implementation Coordination events We will keep you updated on progress We will communicate issues to you at earliest opportunity We will provide “Proof-of-Concept” demonstrations at appropriate points Change We are working very closely with DECC, Ofgem and other Stakeholders to understand and provide for necessary Regulation and Rule changes Where we have confident forward visibility we are building this in IBM/Power Auctions are supporting us in change impact assessments We will mobilise an Auction Solution change project once we have clarity Questions? 22 Next Steps for 2018 Agreement Holders Robyn Jenkins 23 Overview Monitoring Construction Milestones Financial Commitment Milestone Substantial Completion Milestone New Build Refurbishi ng Existing Connection Agreement DSR Test TBC Proven DSR Unproven DSR Metering Assessment Note – not all of these will apply to every CMU, you should check the CM Register, your Capacity 24 Agreement Notice and seek advice if you are not sure which apply to you. Monitoring of Construction Progress (Rule 12.2) The Capacity Provider of any New Build or Refurbishing CMU must (every 6 months from the date of the auction) provide a progress report for each Generating Unit in the CMU comprising A schedule of earliest and latest dates for construction milestones (with an explanation of any material change to the last report) Any material changes to the works described in the construction plan The report must be accompanied by An assessment from an Independent Technical Expert A certificate from 2 directors that they believe the report is an accurate and fair view of the matters described Such report is required every 6 months until the CMU meets Substantial Completion Milestone or the Capacity Agreement Terminates First report due 16 June 2015 – 6 months from the date of the Capacity Auction. 25 Satisfying Financial Commitment Milestone (Rule 6.6) The fulfilment of the Financial Commitment Milestone requires the submission to the Delivery Body of an Independent Technical Report (ITE) where the author of the technical report must declare that they are an Independent Technical Expert and that the report satisfies the Required Technical Standard The ITE report must then declare that Capital Expenditure to at least 10% of the Total Project Spend has been incurred OR: The Capacity Provider has, or will have, sufficient financial resources available to it to meet the Total Project Spend, and the following commitments have been made: the Capacity Provider has entered into a Major Contract; The board of directors have made all of the declarations listed in Rule 6.6.2 (b) Deadline – 2 July 2016 26 Substantial Completion Milestone (Rule 6.7) New Build CMU will have met SCM if the generating unit(s) is/are operating in excess of 90% of its Capacity Obligation Refurbishing CMU will have met SCM when the generating unit(s) is/are operating at or in excess of 100% of the Capacity Obligation* The Capacity Provider must notify the Delivery Body when an ION is issued (or equivalent tests are passed) *DECC have consulted on aligning the requirements for refurbishing CMUs with those for New Build CMUs A rule change has been proposed (P028) highlighting that some refurbishment CMUs will not receive an ION. 27 Evidencing Connection Agreement and/or TEC If you declared that a Distribution Connection Agreement will be in place 18 months prior to the Delivery Year (Rule 3.7.3 (c)) you must submit the Connection Agreement to the Delivery Body. The connection agreement must; Permit the export of at the de-rated capacity of the CMUs it applies to Contain a Registered Capacity or Maximum Export Capacity figure. If you declared the Transmission Entry Capacity will be in place 18 months prior to the Delivery Year (Rule 3.6.3(a) (i)) you must submit the Grid Connection Agreement to the Delivery Body. The connection agreement must; Secure sufficient TEC to meet the de-rated capacity of all CMUs it applies to Include the signature pages Deadline – 31 March 2017 28 Metering Assessments Deadline: 30 September 2015 (T-4 2014 Successful Applicants) Who: Successful Applicants who deferred their metering assessment. (See column AK from the capacity market register) Option 1 - We have developed an excel form which applicants can complete and submit. This will be made available from Friday 13th February on our portal website: www.emrdeliverybody.com Option 2 – The new online system will be available over the summer which will allow applicants to log in and complete their metering assessment. 29 DSR Tests (Rule 13.2) Who: Unproven DSR CMUs who wish to become Proven. To carry out a DSR Test the capacity provider must; Provide the Delivery Body with the MPAN numbers and any other meter details necessary to monitor the component and the Metering Test Certificate or confirmation of the metering configuration for each component (being a configuration approved by the CM Settlement Body). Give the DB notice of its intention to test the DSR CMU through submission of a form The DB may up to 4 hours prior to the settlement period instruct the capacity provider not to activate the DSR CMU Within 5 working days or receipt of the metered volume data the DB must for each settlement period notify the capacity provider of the Baseline Demand, the DSR evidenced and the Proven DSR Capacity. Notification form available from 1 March We expect the Portal to be available before most people are ready to do this Deadline – 31 August 2018 30 Questions? 31 Expected Changes for 2015 Mark Duffield 32 Regulations and Rules changes for 2015 All changes published in draft form in Parliament as The Electricity Capacity (Amendment) Regulations 2015 Key Changes affecting Prequalification 2015 Inclusion of capacity from Interconnectors from the 2019/20 Delivery Year Aggregation of Generating Units De Minimis threshold for DSR CMUs Ineligibility of EDR Pilot Participants for the Transitional Auctions Ability to submit additional information at Tier 1 Dispute Other Changes not affecting Prequalification Provisions relating to the repayment of capacity payments Demonstrating Satisfactory Performance 33 Regulations and Rules changes for 2015 Regs Changes affecting 2015 Prequalification Inclusion of capacity from Interconnectors from the 2019/20 Delivery Year Interconnector Owners will be able to participate in capacity market auctions but will be eligible for 1-year agreements only De-rating factors for interconnectors to be determined by the Secretary of State Prospective interconnectors that fail to complete construction face a “non-completion fee” Aggregation of Generating Units Restriction on common ownership of CMU components relaxed for CMUs with Capacity less than 50MW 34 Regulations and Rules changes for 2015 Regs Changes affecting 2015 Prequalification De Minimis threshold for DSR CMUs Clarity added to Regulations to confirm DSR CMUs only eligible if meet a 2MW de-minimis capacity Ineligibility of EDR Pilot Participants for the Transitional Auctions Plant with Electricity Demand Reduction pilot not eligible for the Transitional Capacity Auctions Ability to submit additional information at Tier 1 Dispute Special circumstances that were applied to National Grid disputes for the first auction extended to the second auction 35 Regulations and Rules changes for 2015 Regs Changes not affecting 2015 Prequalification Provisions relating to the repayment of capacity payments Certain Capacity Payments must be repaid if the agreement is terminated or if there is a metering fault Demonstrating Satisfactory Performance If satisfactory performance is not demonstrated by 30 April in a Delivery Year then payments for whole of May withheld regardless of when, subsequently, satisfactory performance is demonstrated 36 Regulations and Rules changes for 2015 Rules Changes for 2015 Ofgem has published 81 separate proposals for amending the Capacity Market Rules Ofgem Consultation planned for Spring 2015 on the changes they are proposing to take forward and implement in time for Prequalification in 2015 All changes to the CM Rules planned to be implemented by June 2015 National Grid has submitted 29 change proposals in all Majority focussed on streamlining prequalification Some minor changes to clarify the auction process Some proposals requiring further industry development put forward in expectation they could be implemented in time for 2016 prequalification 37 Questions? 38 2015 Timetable James Greenhalgh 39 Overview of 2015 Capacity Market process 2015 Jan Auction parameterstarget volume, Price cap (15th June) Mar May Auction Guidelines June July 2016 Prequalification results for CM Sept Nov Dec Jan DECC/Industry Review Process Revised Rules Prequalification open for CM (T-4 & TA) 8th Dec NG runs T-4 CM auction NG runs Transitional CM auction 2015 CM Timeline – Key dates When What Who By 1st June Submit Electricity Capacity Report to SoS Delivery Body By 15th June Decision on whether a T-4 auction is to be held SoS Late June Publication of final CM Rules Ofgem Late June CM Pre-qualification System available to applicants Delivery Body 29th June Publish “Formal” Auction Guidelines (T-4 & TA) Delivery Body 20th July – 14th Aug Pre-qualification window open for Applicant submissions (T-4 & TA) Applicants 14th Aug – 25th Sept Assessment of Pre-qualification submissions (T-4 & TA) Delivery Body 25th Sept Pre-qualification Results Day (T-4 & TA) Delivery Body 17th Nov Publish “Final” Auction Guidelines & Bidder details (T-4 only) Delivery Body 25th Nov Run “Mock” Auction (T-4 only) App / DB 8th – 11th Dec Run “Full” Auction and notify bidders of provisional results (T-4 only) App / DB 15th Dec Auction Monitor report submitted to SoS (T-4 only) Auction Monitor 23rd Dec Auction Results Day (T-4 only) DB / DECC 5th Jan 2016 Publish “Final” Auction Guidelines & Bidder details (TA only) Delivery Body 13th Jan 2016 Run “Mock” Auction (TA only) App / DB 22nd Jan 2016 Issue Capacity Agreements (T-4 only) Delivery Body 26th – 29th Jan 2016 Run “Full” Auction and notify bidders of provisional results (TA only) App / DB 2nd Feb 2016 Auction Monitor report submitted to SoS (TA only) Auction Monitor 10th Feb 2016 Auction Results Day (TA only) DB / DECC 26th Feb 2016 Issue Capacity Agreements (TA only) Delivery Body 41 Stakeholder events Calendar 2015 2015 Jan Feb March Feb March April May June June July 12th 18th 15th 19th 2nd 17th 6th April AM AM AM+PM AM+PM AM AM+PM AM May June July Prequalification open for CM (T-4 & TA) Sept Information DECC Stakeholder Bulletins contact Harry Bannister harry.bannister@decc.gsi.gov.uk National Grid Portal https://emrdeliverybody.com Mail list emr@nationalgrid.com Helpline 01926 655300 Alternatively contact james.greenhalgh@nationalgrid.com 43 Questions? 44