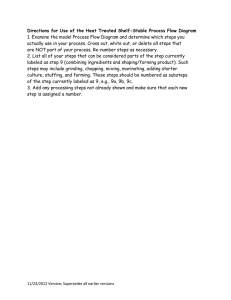

“Unveiling Financial Shenanigans: Understanding Earnings Manipulation and Channel Stuffing” In the world of corporate finance, transparency and integrity are paramount. However, behind the glossy facade of financial reports, some companies engage in deceptive practices to artificially inflate their sales figures, creating a mirage of success. One such tactic, known as "channel stuffing," is a covert maneuver that warrants a closer examination. What is Channel Stuffing? Channel stuffing is a deceptive business strategy where a company floods its distribution channels with excess inventory towards the end of a financial reporting period. The primary goal is to artificially boost sales figures, meeting or exceeding targets set by investors, analysts, or management. This practice often involves offering distributors or customers significant discounts, incentives, or extended payment terms to persuade them to accept more products than they actually need or can sell. How Does Channel Stuffing Work? The mechanics of channel stuffing are both simple and insidious. As a financial reporting period draws to a close, pressured by the need to meet quarterly or yearly targets, companies resort to aggressive sales tactics. They may offer distributors preferential terms or provide additional products for free, enticing them to accept larger-than-usual shipments of inventory. These excess products are then recorded as sales revenue in the company's financial statements, artificially inflating revenue figures for the reporting period. While this may create the illusion of robust sales growth and financial health, it's a short-term strategy with longterm consequences. Real-Life Examples: The annals of corporate history are rife with instances of channel stuffing. One prominent case involves tech giant Computer Associates (now known as CA Technologies), which faced allegations of channel stuffing and other accounting irregularities in the early 2000s. Executives at Computer Associates artificially inflated sales figures by pressuring distributors to accept excess inventory, leading to a massive accounting scandal and legal repercussions.