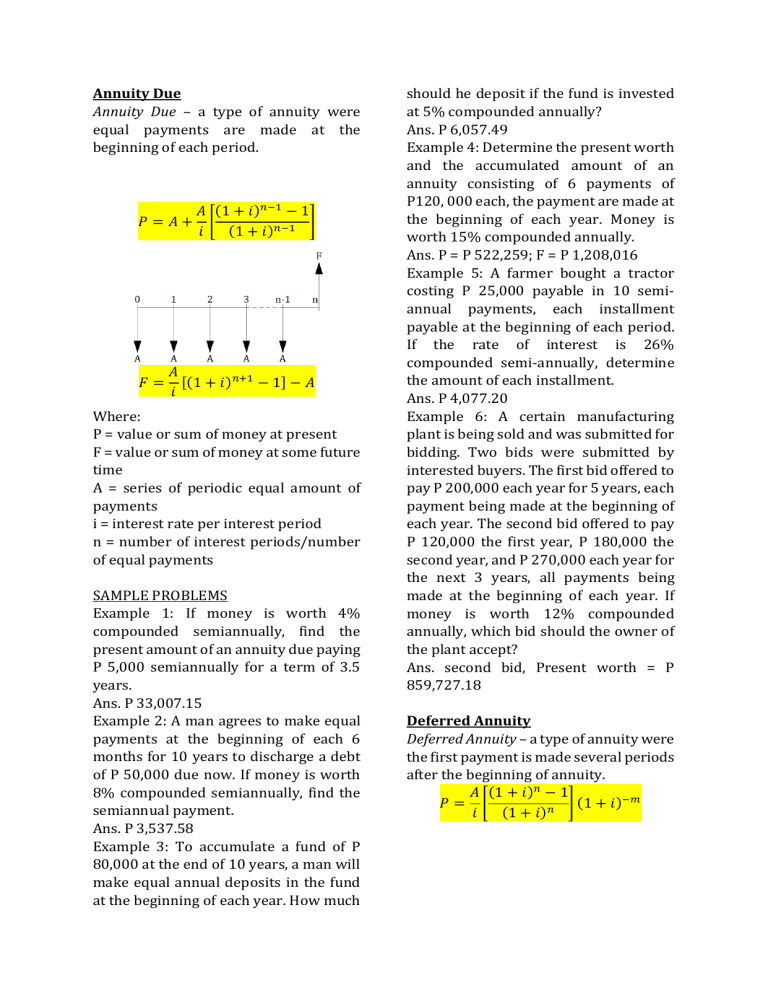

Annuity Due Annuity Due – a type of annuity were equal payments are made at the beginning of each period. 𝑃 =𝐴+ 𝐹= 𝐴 (1 + 𝑖)𝑛−1 − 1 [ ] (1 + 𝑖)𝑛−1 𝑖 𝐴 [(1 + 𝑖)𝑛+1 − 1] − 𝐴 𝑖 Where: P = value or sum of money at present F = value or sum of money at some future time A = series of periodic equal amount of payments i = interest rate per interest period n = number of interest periods/number of equal payments SAMPLE PROBLEMS Example 1: If money is worth 4% compounded semiannually, find the present amount of an annuity due paying P 5,000 semiannually for a term of 3.5 years. Ans. P 33,007.15 Example 2: A man agrees to make equal payments at the beginning of each 6 months for 10 years to discharge a debt of P 50,000 due now. If money is worth 8% compounded semiannually, find the semiannual payment. Ans. P 3,537.58 Example 3: To accumulate a fund of P 80,000 at the end of 10 years, a man will make equal annual deposits in the fund at the beginning of each year. How much should he deposit if the fund is invested at 5% compounded annually? Ans. P 6,057.49 Example 4: Determine the present worth and the accumulated amount of an annuity consisting of 6 payments of P120, 000 each, the payment are made at the beginning of each year. Money is worth 15% compounded annually. Ans. P = P 522,259; F = P 1,208,016 Example 5: A farmer bought a tractor costing P 25,000 payable in 10 semiannual payments, each installment payable at the beginning of each period. If the rate of interest is 26% compounded semi-annually, determine the amount of each installment. Ans. P 4,077.20 Example 6: A certain manufacturing plant is being sold and was submitted for bidding. Two bids were submitted by interested buyers. The first bid offered to pay P 200,000 each year for 5 years, each payment being made at the beginning of each year. The second bid offered to pay P 120,000 the first year, P 180,000 the second year, and P 270,000 each year for the next 3 years, all payments being made at the beginning of each year. If money is worth 12% compounded annually, which bid should the owner of the plant accept? Ans. second bid, Present worth = P 859,727.18 Deferred Annuity Deferred Annuity – a type of annuity were the first payment is made several periods after the beginning of annuity. 𝐴 (1 + 𝑖)𝑛 − 1 𝑃= [ ] (1 + 𝑖)−𝑚 𝑛 (1 𝑖 + 𝑖) Where: P = value or sum of money at present F = value or sum of money at some future time A = series of periodic equal amount of payments i = interest rate per interest period n = number of interest periods/number of equal payments m = number of interest periods when there is no payment made SAMPLE PROBLEMS Example 1: The present value of an annuity of R pesos payable annually for 8 years, with the 1st payment at the end of 10 years is P 187,481.25. Find the value of R if money if money is worth 5%. Ans. P 45,000 Example 2: A parent on the day that child is born wishes to determine what lump sum would have to be paid into an account bearing interest of 5% compounded annually, in order to withdraw P 20,000 each on the child’s 18th, 19th , 20th and 21th birthdays? Ans. P 30,941.73 Example 3: An asphalt road requires no upkeep until the end of 2 years when P60, 000 will be needed for repairs. After this P90, 000 will be needed for repairs at the end of each year for the next 5 years, then P120, 000 at the end of each year for the next 5 years. If money is worth 14% compounded annually, what was the equivalent uniform annual cost for the 12-year period? Ans. P 79,245.82 Example 4: A man wishes to provide a fund for his retirement such that from his 60th to 70th birthdays he will be able to withdraw equal sums of P18, 000 for his yearly expenses. He invests equal amount for his 41st to 59th birthdays in a fund earning 10% compounded annually. How much should each of these amounts be? Ans. P 2,285.25 Example 5: A lathe for a machine shop costs P 60,000, if paid in cash. On the installment plan, a purchaser should pay P 20,000 downpayment and 10 quarterly installments, the first due at the end of the first year after purchase. If money is worth 15% compounded quarterly, determine the quarterly installment. Ans. P 5,439.18 Example 6: A man invests P 10,000 now for the college education of his 2 year old son. If the fund earns 14% effective interest rate, how much will his son get each year starting from his 18th to the 22nd birthday? Ans. P 20,791.64