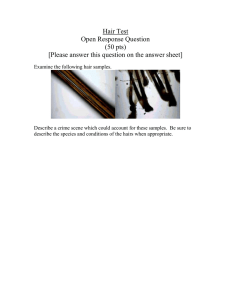

A BUSINESS PLAN ON “RICINUS POWDER” SUBMITTED TO, JSS SCIENCE AND TECHNOLOGY UNIVERSITY, MYSURU, INDIA In partial fulfilment of the requirements for the award of Degree of MASTER OF BUSINESS ADMINISTRATION SUBMITTED BY, N ANANYA 01JST21PMB053 JSS Centre for Management Studies Mysuru – 570 006 UNDER THE GUIDANCE OF, Dr. KAVYASHREE M B Assistant Professor Department of MBA JSS CMS JSS Science and Technology University Mysuru – 570 006 JSS MAHAVIDYAPEETHA JSS CENTRE FOR MANAGEMENT STUDIES JSS SCIENCE AND TECHNOLOGY UNIVERSITY JSS Technical Institutions Campus, Mysuru 570006 JSS Science and Technology University 2022-23 DECLARATION I, N ANANYA, a student of Master of Business Administration at JSS Centre for Management Studies, JSS Science and Technology University, JSS Technical Institution Campus, Mysuru, hereby declare that this Business plan entitled “RICINUS POWDER” is a record of an original and independent work carried out by me during the year 2021, in my IV semester of the course under the guidance of Dr. KAVYASHREE M B, Assistant Professor at JSS Centre for Management Studies, JSS Science and Technology University, JSS Technical Institution Campus, Mysuru, submitted to JSS SCIENCE AND TECHNOLOGY UNIVERSITY, MYSURU, in partial fulfilment of the requirements for the award of Master of Business Administration. I further declare that this business plan and report has not formed the basis for the award of any other diploma or degree of any institution or university. PLACE: MYSURU NAME: N ANANYA DATE: USN: 01JST21PMB053 ACKNOWLEDGEMENT Any presentation completed successfully gives a great sense of achievement and satisfaction. The Entrepreneurship development program would remain incomplete if the people who made it possible and whose constant guidance and encouragement go without mention. I would like to express my gratitude to Dr P. NAGESH, Professor and Dean, JSS Centre for Management Studies Mysuru, for always being a great source of inspiration for providing me a congenial environment for carrying out the Entrepreneurship development program. I would also like to express my gratitude to Dr. SWAROOP SIMHA, Professor and Head of Department, JSS Centre for Management Studies, Mysuru. For always being a great source of inspiration for providing me a congenial environment for carrying out the Entrepreneurship development program. I express my heart filled thanks to Dr. KAVYASHREE M B, Assistant Professor, at JSS Centre for Management Studies, Mysuru, who is also my Entrepreneurship development program guide. Her constant support, inspiring guidance and persistent help has provided useful insights into the issues being addressed in project work at various stages during its execution. Her guidance and support go beyond words. I would like to thank my parents and friends for their cooperation and God, the Almighty, for his blessings and strength. N ANANYA USN: 01JST21PMB053 JSS Centre for Management Studies Mysuru – 570 006 JSS CENTRE FOR MANAGEMENT STUDIES JSS SCIENCE AND TECHNOLOGY UNIVERSITY JSS TECHNICAL INSTITUTIONS CAMPUS, MYSURU-570006 CERTIFICATE This is to certify that, N ANANYA (USN: 01JST21PMB053) a student of Master of Business Administration at JSS Centre for Management Studies, JSS Technical Institution Campus, Mysuru, India, has carried out an Entrepreneurship development program and submitteda report on “RICINUS POWDER” in partial fulfilment of the requirements of the award of MASTER OF BUSINESSES ADMINISTRATION. Ms. N ANANYA has worked under my guidance and the report is recommended for submission. DATE : PLACE : MYSURU Dr. KAVYASHREE M B Assistant Professor Department of JSS CMS JSS Science and Technology University Mysuru – 570 006 JSS CENTRE FOR MANAGEMENT STUDIES JSS SCIENCE AND TECHNOLOGY UNIVERSITY JSS TECHNICAL INSTITUTIONS CAMPUS, MYSURU-570006 CERTIFICATE This is to certify that, N ANANYA(USN: 01JST21PMB053) a student of Master of Business Administration at JSS Centre for Management Studies, JSS Technical Institution Campus, Mysuru, India, has carried out an Entrepreneurship development program and submitted a report on “RICINUS POWDER” in partial fulfilment of the requirements for the award of MASTER OF BUSINESS ADMINISTRATION. Dr. SWAROOP SIMHA Professor and Head of the Department Department of JSS CMS, JSS Science and Technology University Mysuru – 570 006 Dr. P. NAGESH Professor & Dean Department of JSS CMS, JSS Science and Technology University Mysuru – 570 006 CONTENTS BUSINESS CANVAS MODEL ..................................................................................... 1 EXECUTIVE SUMMARY ......................................................................................... 2 INTRODUCTION........................................................................................................... 3 INDUSTRY ANALYSIS ................................................................................................ 4 MARKET ANALYSIS ................................................................................................... 9 SEGMENTATION, TARGETING AND POSITIONING(STP) ............................. 11 ORGANIZATIONAL PLAN ....................................................................................... 12 ABOUT THE PRODUCT ............................................................................................ 13 OPERATIONAL ANALYSIS...................................................................................... 16 FINANCIAL ANALYSIS............................................................................................. 19 CONCLUSION ............................................................................................................. 41 BIBLIOGRAPHY ......................................................................................................... 42 BUSINESS CANVAS MODEL Key Partners Local formers Raw material suppliers Cosmetic organisations Custom relationship Customer segments Profit margins Variety of Customer ingredients satisfaction For best Repeat Customers results Quality of service No side effects Good for all the people Key Resources Provides good service loyalty mass market workers youths Employees Quality testing location, youth, gender Key actions Value proposition Cost structure Channels Reserve streams Margin in sales Good relationship customers Regular customers Initial Investment = 66,80,500 Assets = Land, Shed Fixed cost = Maintenance Variable cost = Raw materials 1 with EXECUTIVE SUMMARY Castor seed is the source of castor oil, which has a wide variety of uses. The seeds contain between 40% and 60% oil that is rich in triglycerides, mainly ricinolein. The seed also contains ricin, which is also present in lower concentrations throughout the plant. The fruit of this spiny, greenish (to reddish-purple) capsule containing large, oval, shiny, bean-like, highly poisonous seeds with variable brownish mottling. Castor seeds are obtained from the ripe fruits. There are diverse Castor Oil applications in various personal care & cosmetics industries as it carries many essential benefits for the body (primarily skin &hair). Castor Oil has supreme cleansing, moisturizing, dispersant, anti-viral, anti-bacterial, anti-inflammatory, anti-acne attributes as well as vitamin E and other assorted properties. There are diverse Castor Oil applications in various personal care & cosmetics industries as it carries many essential benefits for the body (primarily skin &hair). Castor Oil has supreme cleansing, moisturizing, dispersant, anti-viral, anti-bacterial, anti-inflammatory, anti-acne attributes as well as vitamin E and other assorted properties. The powder can be mixed with other ingredients such as hibiscus powder, rose petals powder, amla and neem powder can be mixed with it for better results by mixing these ingredients with castor powder the strong smell of castor seed can be avoided and by using this powder by mixing it with rose water or normal water and applying it to the roots and hair lengths will make the hairs strong from the roots and the hairs shiny and silky, the consistent use of this product will give great result and helps for the growth and to have healthy hair. The castor seed powder has long shelf life as it can be stored for 1-2 years in a dry and cool place this powder can be used by both male and female as people nowadays are facing a lot of hair fall this product can be a great hair care product to include in one’s hair care routine 2 INTRODUCTION Castor plant belongs to Euphorbiaceae family. Castor is an important non-edible oilseed crop and is grown especially in arid and semi-arid region. It is reported to have originated in the tropical belt of both India and Africa. Its seed is the castor bean, which, despite its name, is not a bean (that is, the seed of many Fabaceae). Castor is indigenous to the south eastern Mediterranean Basin, Eastern Africa, and India, but is widespread throughout tropical regions (and widely grown elsewhere as an ornamental plant) Castor seed is the source of castor oil, which has a wide variety of uses. The seeds contain between 40% and 60% oil that is rich in triglycerides, mainly ricinolein. The seed also contains ricin, which is also present in lower concentrations throughout the plant. The fruit of this spiny, greenish (to reddish-purple) capsule containing large, oval, shiny, bean-like, highly poisonous seeds with variable brownish mottling. Castor seeds are obtained from the ripe fruits. There are diverse Castor Oil applications in various personal care & cosmetics industries as it carries many essential benefits for the body (primarily skin &hair). Castor Oil has supreme cleansing, moisturizing, dispersant, anti-viral, anti-bacterial, anti-inflammatory, anti-acne attributes as well as vitamin E and other assorted properties. There are diverse Castor Oil applications in various personal care & cosmetics industries as it carries many essential benefits for the body (primarily skin &hair). Castor Oil has supreme cleansing, moisturizing, dispersant, anti-viral, anti-bacterial, anti-inflammatory, anti-acne attributes as well as vitamin E and other assorted properties. Other Castor Oil applications in cosmetics and personal care are to formulate products like creams, shampoos, lip gels, lipsticks, hair oils, deodorants, perfumes, lubricants, sunscreens, and other personal hygiene. As castor seeds are widely used in cosmetics especially for hair treatments the castor seed powder can be used for the growth and other hair care treatments the smell of castor oil can be very strong for some consumers so it 3 will be difficult for them to use such products in that case these castor seeds can be converted into powder and to avoid the strong smell of the castor seeds. The powder can be mixed with other ingredients such as hibiscus powder, rose petals powder, amla and neem powder can be mixed with it for better results by mixing these ingredients with castor powder the strong smell of castor seed can be avoided and by using this powder by mixing it with rose water or normal water and applying it to the roots and hair lengths will make the hairs strong from the roots and the hairs shiny and silky, the consistent use of this product will give great result and helps for the growth and to have healthy hair. The castor seed powder has long shelf life as it can be stored for 1-2 years in a dry and cool place this powder can be used by both male and female as people nowadays are facing a lot of hair fall this product can be a great hair care product to include in one’s hair care routine. INDUSTRY ANALYSIS The cosmetic industry describes the industry that manufactures and distributes cosmetic products. These include color cosmetics, like foundation and mascara, skincare and hair care such as moisturizers and cleansers, hair care such as shampoos, conditioners and hair colors, and toiletries such as bubble bath and soap. The manufacturing industry is dominated by a small number of multinational corporations that originated in the early 20th century, but the distribution and sale of cosmetics is spread among a wide range of different businesses. The cosmetics industry has been segmented on the basis of category, gender, and region. On the basis of category, the market is divided into skin and sun care products, hair care products, deodorants & fragrances and makeup & 4 color cosmetics. By gender, it is divided into men, women, and unisex. On the basis of distribution channel, it is categorized into hypermarkets/supermarkets, specialty stores, pharmacies, online sales channels, and others. Region wise, the market is studied across North America, Europe, Asia - Pacific. On the basis of category, the skin and sun care products segment constituted a major cosmetics market share in 2022; however, the deodorants & fragrances segment is projected to experience growth at the highest CAGR during the forecast period. Skin care products and hair care products play a major role in daily healthcare regimen of individuals. Presently, rise in awareness about beauty and consciousness are the prominent factors that drive demand for skin care products. On the basis of gender, the women segment led, in terms of the cosmetics market size is expected to continue to grow robust during the cosmetics market forecast period. Convergence of advancements, beauty, and lifestyle propels growth of the market. Moreover, the cosmetics market across the globe has witnessed continues and sustained growth over years, owing to rise in beauty-conscious female population. Cosmetic Industry at Global market level: The global cosmetics market size was valued at $380.2 billion in 2022, and is projected to reach $463.5 billion by 2027, registering a CAGR of 5.3% from 2021 to 2027. Presently, cosmetics have become an indispensable feature of modern lifestyle of individuals. In addition, growth in consciousness about external beauty along with individual’s internal intellect has become one of the major driving factors for use of cosmetics in the global market. Presently, along with women, there is a rise in use of cosmetics among men in their daily routine, which complements growth of the global cosmetics market demand. Hence, such changing lifestyles, have led to growth of the global cosmetics market. Manufacturers are changing their product branding and advertising strategies to accelerate their sales across various countries. Innovative strategies such as new product launches with natural ingredients and appealing packaging have been adopted by manufacturing companies to increase sales of their cosmetics products. As cosmetics have become an integral part of individual’s lives, consumers, especially women, prefer to use cosmetics products, which are handy and easy to use while travelling or attending social meetings. Moreover, use of natural ingredients for manufacturing of cosmetics products, which does not have any adverse effect on skin is an advantage, and also it is a popular strategy of manufacturers to attract more customers. This also helps in increasing revenue of companies operating in this industry. Collectively, all strategies adopted by manufacturers drive the global cosmetics market. However, chemicals used in manufacturing of cosmetic products can harm an 5 individual’s skin or other parts of the body. In addition, application of cosmetic products on a daily basis could be dangerous for skin. Chemicals used as ingredients in cosmetic products can have many adverse side effects on skin. Long-term and extensive use of chemical rich shampoos, serums, and conditioners lead to heavy hair fall problems. Moreover, extensive use of color cosmetic products for eyes and lips can also cause many skin diseases and consequential health hazards. Therefore, increase in awareness of probable side effects of cosmetics and skin concerns among customers is an important factor that limits growth of the market as a whole. On the basis of distribution channel, the hypermarkets/supermarkets segment held a major share in the market in 2019, and is projected to remain dominant during the forecast period. Hypermarkets/supermarkets are gaining popularity, owing to availability of a broad range of consumer goods under a single roof, ample parking space, and convenient operation timings. Moreover, increase in urbanization, rise in working class population, and competitive pricing boosts popularity of hypermarkets in developed and the developing region. Cosmetic Industry at National level: India's cosmetics market is segmented by product type, category, and distribution channel. On the basis of product type, the market is segmented into color cosmetics and hair styling and coloring products. On the basis of the distribution channels, the market is segmented into hypermarkets and supermarkets, specialty stores, pharmacies and drugstores, online retail stores, and other distribution channels. For each segment, the market sizing and forecasts have been done on the basis of value. Cosmetics are designed to enhance one's appearance (makeup), conceal blemishes, enhance one's natural features (such as the eyebrows and eyelashes), add color to a person's face, and can be used to change the appearance of the face entirely to resemble a different person, creature, or object. Due to increasing standard of living and changing lifestyle, the demand for cosmetic products such as skin care, hair care and fragrance are increasing rapidly, thereby providing high impetus to the Indian cosmetic industry. According to India Cosmetic Market Overview, 2022-28”, cosmetic market in India was growing with a CAGR of more than 9% from last few years. The India cosmetic market consists of five segments viz. Skin Care, Hair Care, Fragrance, Color Cosmetics and Oral Care. Hair Care accounts for majority of the market share, followed by oral care, skin care, fragrance and color cosmetic. 6 Hindustan Unilever is a prominent player in the cosmetic industry due to its vast product portfolio in every segment. Hair care market is considered to be one of the mature markets in India. However, the availability of counterfeit hair care products is one of the major challenges in the market. HUL, P&G, Dabur, Marico and Godrej are players operating in the organized hair care category. Hair care market is segmented into four categories such as hair oil, hair shampoo, hair colors and hair styling products. Hair oil dominates the market followed by hair shampoo. Skin care has become an exciting legroom for new product development and manufacturers are trying to convince consumers that they should adopt a skin care regimen by various product launches and aggressive marketing strategies. Skin care market is segmented into five categories such as facial care, body care, sun care, and hand care and other makeup removal & depilatory products. Facial care products dominate the market due to its various variants. On the other hand, India oral care market is segmented into five categories such as toothpaste, toothbrush, toothpowder, mouthwash and other oral care products that include dental floss, oral care chewing gum, etc. Toothpaste segment dominates the oral care category. Colgate-Palmolive India, HUL, and Dabur are the major players operating in the oral care market. Fragrance industry's rapid growth is attributed primarily to the advent of functional products such as perfumes and deodorants. India fragrance market is divided into two segments viz. Perfume and Deodorant. Deodorants dominate the market while perfume along with its innovations is growing fast. The fragrance market in India is one of the largest in terms of production, consumption, import and is in process of taking off as more youngsters are wearing a fragrance in the form of perfumes and deodorants. Fogg is leading in the deodorant category followed by a host of other brands. Color cosmetics market consists of four broad categories viz. Eye Makeup, Facial Makeup, Lip Products and Nail Products. The market registered a strong growth in the last few years. Color cosmetic was mainly driven by the growth of mascara, eye liner/pencil, blusher and eye shadow, amongst others. Lakme, Revlon and L'Oreal are known to be the big three brands in the category, followed by scores of unorganized players. 7 Future growth prospect of Cosmetic Industry: India's cosmetics products market is projected to register a CAGR of 4.23% over the next five years. For many years, the Indian beauty industry has been one of the fastest-growing markets in the world. With over a billion people and rising disposable income, India is considered one of the most promising markets for global companies looking to expand their reach. However, despite this growth, there are still challenges facing Indian companies seeking to enter this market. For example, there has been a significant amount of consolidation in the Indian beauty industry over recent years as large multinational corporations have attempted to take advantage of the lucrative market. This has resulted in an increasingly competitive landscape where many smaller players struggle to remain competitive and continue to grow their businesses. To help navigate this increasingly competitive landscape, this article will outline some key recommendations for newcomers looking to enter or expand their presence within the Indian beauty industry. The future of Indian cosmetics industry is bright, but it’s up to new entrants to make sure they get a fair shot at success. A few years ago, the Indian beauty market was dominated by multinationals, but that’s changing. The Indian cosmetics industry is growing at an alarming rate, thanks to the country’s growing middle class. However, this growth has come with a price: the industry is plagued by problems that include low production value, poor product quality, and a lack of transparency. As a result of these problems, many newcomers have been put off from entering the industry. But as we see with other industries in India—such as software or engineering—there are ways for new players to make an impact on the market without investing significant amounts of money. In this article, we’ll give you some recommendations for newcomers interested in entering the Indian cosmetics industry. Focus on local brands: 8 India is not like other countries where most people are used to Western brands and don’t know how to find local ones. The Indian cosmetics industry is going to be one of the most exciting industries to watch over the next few years. With a rapidly growing population and a growing middle class, India’s cosmetics market will continue to grow at an astounding rate. But this growth comes with challenges as well. There is a lot of competition out there, and it’s difficult for new entrants to make their mark on this market. That’s where we come in— we’ve got some recommendations for what you can do if you’re interested in getting involved in the Indian makeup industry. India is one of the largest markets for cosmetics. The industry is expected to grow at a CAGR of 6.7% over the next five years, according to Euromonitor International. This growth has been driven by increasing consumer spending power, rising disposable income levels and growing awareness about skin care products. In fact, the cosmetics industry in India is expected to show strong signs of expansion during the next five years. The market size is expected to reach $1 billion by 2024. The cosmetics market in India is currently dominated by foreign brands but due to its huge population base; it has also attracted domestic brands. Market Analysis: In India, the color cosmetics market is among the fastest growing due to the acceptance of western culture. The penetration of color cosmetics in the Indian market is rising as the aesthetic appeal of the younger generation grows. In the Asian region, India is considered one of the fastest-growing countries in the cosmetics products market. Furthermore, the color cosmetics industry (including the eye, facial, and lip makeup categories) is the most prosperous industry in India. Local companies, such as the Shahnaz Husain Group, are exclusively providing herbal and ayurvedic cosmetic products due to the prolonged health benefits they offer the skin. With the increasing penetration of the internet, the online market for the purchase of cosmetics products has seen rapid growth in the last 3–4 years in India. This category has attracted a few vertical specialists, like Nykaa, Purplle, Nnnow, etc., who are riding on the increasing e-tail growth and vying for a significant piece of the online cosmetics pie. Nykaa offers more than 600 brands in both offline and online stores in India. Color cosmetics, which deal with the eye, facial, and lip makeup categories, are the most prosperous industry in India. Local companies, such as Soul tree, Herbal Hills, Himalaya, and The Shahnaz Husain Group, among others, are exclusively providing herbal or ayurvedic cosmetic products due to the prolonged health benefits they offer the skin. Most cosmetics companies rely on a multi-level distribution strategy, which includes 9 placing products with department stores, specialty retailers, pharmacies, salons, spas, freestanding stores, travel retail outlets, websites and mobile applications. However, some companies, like Avon Products, Inc. (AVP) and Mary Kay, use a door--to--door selling method to directly reach customers. Competitors: The Indian cosmetics market is highly fragmented owing to the presence of various domestic as well as international players operating in the market. Leading companies are partnering with international exhibition organizers to launch their cosmetic products at several international beauty community events, such as Cosmoprof, Canton Fair, and Fashion Fest. Additionally, the players in the market use other strategies like endorsements by popular celebrities, discounts, other offers, and other such strategies for positioning their brands in the minds of the consumers and increasing the sales of the cosmetic products offered by them. Some of the major players in the market studied are L’Oreal, The Estée Lauder Companies, Vellvette Lifestyle Private Limited (Sugar Cosmetics), and Natura & Co. (The Body Shop International Limited), Wow, Biotique, Mama Earth, Plum among others. 4P’S of Marketing: Product: Creating a marketing campaign starts with an understanding of the product itself. Who needs it, and why? What does it do that no competitor's product can do? Perhaps it's a new thing altogether and is so compelling in its design or function that consumers will have to have it when they see it. The product is castor seed powder which is new to the industry which helps in hair growth and to maintain healthy hair when used as a hair mask. Price: Price is the amount that consumers will be willing to pay for a product. Marketers must link the price to the product's real and perceived value, while also considering supply costs, seasonal discounts, competitors' prices, and retail markup. Price of the product will depend on the size of the product and the ingredients of the product approximately between 100-150rs per 50gm product. 10 Place: Place is the consideration of where the product should be available—in brick-and-mortar stores and online— and how it will be displayed. Mainly focused on the urban areas and the locations where there will be no availability of natural products which can increase the sales Promotion: The goal of promotion is to communicate to consumers that they need this product and that it is priced appropriately. Promotion encompasses advertising, public relations, and the overall media strategy for introducing a product. Promoting through social media and through digital marketing as it required less cost and effort and also by selling the product in online platforms which makes easy for marketing as most of the consumers are now depending on the online shopping this is great way to gain sales and profit. STP: Segmentation: The main goal here is to create various customer segments based on specific criteria and traits Geographic segmentation: Diving your audience based on country, region, state, province, etc. Demographic segmentation: Dividing your audience based on age, gender, education level, occupation, gender, etc. Behavioral segmentation: Dividing your audience based on how they interact with your business: What they buy, how often they buy, what they browse, etc. Psychographic segmentation: Dividing your audience based on “who” your potential customer is: Lifestyle, hobbies, activities, opinions, etc. Females and Males who are between 18 to around 26 years as they are more focused and by surveying what they are expecting from the product. 11 Targeting: To look at the segments that have created before and determine which of those segments are most likely to generate desired conversions (depending on the marketing campaign, those can range from product sales to micro conversions like email signups). Targeting people of urban areas who try to depend more on natural resources rather than the chemicals available in market. Positioning: Positioning, which allows to set the product or services apart from the competition in the minds of the target audience. There are a lot of businesses that do something similar, so need to find what it is that makes you stand out. Creating a page/website for the product to show the manufacturing process so the customers will not have any doubts regarding the product whether it is natural or mixed with chemicals most of the products will not provide this information so it will make the product trustworthy for the customers. ORGANISATION PLAN: The organization is small and consist of 3 levels TOP LEVEL President or the founder of the organization MIDDLE LEVEL The managers of production and marketing department will come under the middle level management LOW LEVEL The cleaning staff of the organization who help to keep the organization clean such as cleaning staff 12 ORGANISATION STRUCTURE: President Marketing Production manger manager Workers/ Workers/ Cleaning staff Cleaning staff ABOUT THE PRODUCT: It is a powder made of natural castor seeds to treat hair fall problems and to strengthen the hair roots to make the hair grow stronger and healthy. The castor seed powder when mixed with some other natural ingredients such as rose powder, amla powder, neem powder, hibiscus powder it will smell good and the customers need not to worry about the strong smell of castor seeds. The powder can benefit in many ways to the hair problems such as: Makes hair strong from the roots Helps to control the hair fall By continuous use of the product the hair which has been lost due to hair fall problem will regrow Makes the hair length shiny and soft 13 VISION: To become noticeable for crafting healthy and effective hair care product designed to nourish and rebalance the hair. MISSION: To satisfy the diverse hair care needs of the customers, which can satisfy and provide highest level of nourishment. ORGANISTIONAL CHART: Role President Responsibility Responsible for business strategic planning and company vision To lead and direct team. Taking high level decisions that impact the company’s financial status or functional processes. Leads, guides, directs and evaluates all other officers, managers and employees, and ensures they are carrying out the daily operations of the company. Production manager Oversees the production process and make sure to have enough resources on hand. Planning worker’s schedules, estimate costs and prepare budgets to ensure workflow meets required deadlines, assists in optimal usage of resources such as machines, workforce, raw materials. Aims to minimize production costs while maximizing profits. 14 Marketing manager Responsible for advertising and rise awareness of the product. Gathers and analyses information to identify new markets and customers, demand for products and services, and efficacy of existing marketing campaigns and strategies. Conducts market research, sales forecasting, and strategic planning to assess and ensure the sale and profitability of products. Workers/Cleaning Cleaning and maintaining the organization and making sure they are hygiene. staff Maintaining all facilities by keeping the company premises clean and wellorganized. Monitoring materials stored in their area and respond to visitor’s inquiries about where they can get certain things done. PERSONNEL PLAN: Employee Numbers Designation Salary per Total cost per month month(INR) (INR) Production manager 1 15000 15000 Marketing manager 1 20000 20000 Workers 6 10000 60000 TOTAL 8 95000 15 OPERATIONAL ANALYSIS: RAW MATERIALS: Castor seeds Roses Neem leaves Amla Hibiscus flowers MACHINERIES: Boiler Grinding machines: 1 big, 4small Sieving machine Containers Weighing machine Name and logo printing machine on bags MATERIALS: Compostable bags of 50gm and 100gm. Cardboard boxes PROCUREMENT OF RAW MATERIALS: Castors seeds and are procured directly from the farm which we will cultivate in 4-5 acres of land and store throughout the year in the warehouse Roses are purchased through the local farmers directly from the farm. Neem trees and Hibiscus plants are harvested in 2 -3 acres of land. Amla is purchased from the harvesters dried and stored. 16 MANUFACTURING PROCESS: MANUFACTURING FLOW CHART Boiling seeds Drying seeds and other ingredients in the sunlight Grinding Mixing the powders Packing Collecting the Castor seeds from the farm and removing the outer shell of the seeds and boiling them in the boiler above 80 degree Celsius. Collecting seeds from the boiler and drying them in the sunlight for more than 3 days to dry the oil and storing them in the warehouse for the future use during rainy days. Drying the Roses, Amla, Neem leaves and Hibiscus in the meantime and storing them separately in the warehouse. Getting the dried Castor seeds from the warehouse and grinding them in the grinder into a fine powder. Sieving the powder to separate the fine powder and granules collecting the granules and adding them again to grinder to make into fine powder. 17 Collecting the powder into a big container in the meantime grinding the other ingredients in small grinders and collecting the powder into small containers. Filling the Powder’s into a compostable bags in 7:3 proportion each and packing and storing them in separate cardboard boxes to differentiate based on the required ingredient. ESTIMATION OF THE PROJECT: PARTICULARS INVESTMENT Castor seeds cultivation at 5 acres 6,50,500 Other ingredients 9,50,000 Boiler 9,50,000 Grinding machines 7,50,000 Name printing machine 5,50,000 Containers 8,30,000 Maintenance expenses 10,00,000 Miscellaneous expenses 10,00,000 TOTAL 66,80,500 18 FINANCIAL ANALYSIS FINANCIAL STATEMENTS: COST OF PROJECT AND MEANS OF FINANCE COST OF PROJECT Fixed assets 43,70,000 Current assets 20,10,500 Other initial 3,00,000 expenses 66,80,500 Total MEANS OF FINANCE Own fund Debt Total LIST OF FIXED ASSETS Land 30,00,000 Building 10,00,000 Machinery Total 43,70,000 LIST OF CURRENT ASSETS 20,10,500 Total 20,10,500 23,10,500 66,84,500 OWN FUND Land 30,00,000 Building 10,00,000 Machiner 3,70,000 y 43,70,000 Total 3,70,000 Cash 43,70,000 OTHER EXPENSES Preliminary 1,00,000 expenses Pre-operative 2,00,000 expenses 3,00,000 Total 19 FIXED EXPENSE CALCULATION CALCULATION OF FIXED EXPENSES Total Fixed Expenses 1 2 3 4 5 Maintenance 3,000 3,000 3,000 3,000 3,000 Water 10,000 10,000 10,000 10,000 10,000 Telephone 2,000 2,000 2,000 2,000 2,000 Electricity 15,000 15,000 15,000 15,000 15,000 2,00 2,00 2,00 2,00 2,00 2,00 2,00 0 0 0 0 0 0 0 15,0 15,0 15,0 15,0 15,0 15,0 15,0 00 00 00 00 00 00 00 40,000 40,0 40,0 40,0 40,0 40,0 40,0 40,0 00 00 00 00 00 00 00 Transportation 40,000 40,000 40,000 40,000 20 6 7 8 9 10 11 12 3,00 3,00 3,00 3,00 3,00 3,00 3,00 0 0 0 0 0 0 0 10,0 10,0 10,0 10,0 10,0 10,0 10,0 00 00 00 00 00 00 00 36 , 00 0 1 ,20, 000 24 , 00 0 1 ,80, 000 4 ,80, 000 DEPRECIATION CALCULATION CALCULATION OF DEPRECIATION Fixed Assets % 1 2 Depreciation Schedule 3 0.10 0.10 37,000 1,00,000 33,300 90,000 29,970 81,000 26,973 72,900 24,276 65,610 2,18,481 5,90,490 Annual Depreciation 1,37,000 1,23,300 1,10,970 99,873 89,886 8,08,971 Monthly Depreciation 11,417 10,275 9,248 8,323 7,490 Land Machinery Building Value 30,00,000 3,70,000 10,00,000 Useful Life Yrs 5 5 5 Depreciation REVENUE CALCULATION 21 Residual Value 4 5 Revenue Calculations SELLING PRICE 22 Areca plate per unit price Total Revenue Annual Turnover 4.2 4.2 4.2 4.2 4.2 4.2 4.2 4.2 4.2 4.2 4.2 3,62,88 3,62,88 3,62,88 3,62,88 3,62,88 3,62,88 3,62,88 3,62,88 3,62,88 3,62,88 3,62,88 0 0 0 0 0 0 0 0 0 0 0 43 ,54, 5 60 23 4.2 3 ,62, 88 0 24 CASHFLOW ESTIMATION EBIT 1st Year Revenue s Cost of Goods Gross Profit 1 2 3 4 5 6 7 8 9 10 11 12 Annua l 2,16,0 00 28,80 0 1,87,2 00 2,16,0 00 28,80 0 1,87,2 00 2,16,0 00 28,80 0 1,87,2 00 2,16,0 00 28,80 0 1,87,2 00 2,16,0 00 28,80 0 1,87,2 00 2,16,0 00 28,80 0 1,87,2 00 2,16,0 00 28,80 0 1,87,2 00 2,16,0 00 28,80 0 1,87,2 00 2,16,0 00 28,80 0 1,87,2 00 2,16,0 00 28,80 0 1,87,2 00 2,16,0 00 28,80 0 1,87,2 00 2,16,0 00 28,80 0 1,87,2 00 25 ,92, 00 0 3,45,60 0 22 ,46, 40 0 25 Employee Salary Advertisin g Maintenan ce & Repairs Telephone Depreciati on Electricity Total Operating Expenses EBIT 97,85 0 3,000 97,85 0 3,000 97,85 0 3,000 97,85 0 3,000 Operating Expenses 97,85 97,85 97,85 0 0 0 3,000 3,000 3,000 10,00 0 10,00 0 10,00 0 10,00 0 10,00 0 10,00 0 10,00 0 10,00 0 10,00 0 10,00 0 10,00 0 10,00 0 1,20,00 0 2,000 11,41 7 15,00 0 1,39,2 67 2,000 11,41 7 15,00 0 1,39,2 67 2,000 11,41 7 15,00 0 1,39,2 67 2,000 11,41 7 15,00 0 1,39,2 67 2,000 11,41 7 15,00 0 1,39,2 67 2,000 11,41 7 15,00 0 1,39,2 67 2,000 11,41 7 15,00 0 1,39,2 67 2,000 11,41 7 15,00 0 1,39,2 67 2,000 11,41 7 15,00 0 1,39,2 67 2,000 11,41 7 15,00 0 1,39,2 67 2,000 11,41 7 15,00 0 1,74,2 67 2,000 11,41 7 15,00 0 1,39,2 67 24,000 1,37,00 0 1,80,00 0 17 ,06, 20 0 47,93 3 47,93 3 47,93 3 47,93 3 47,93 3 47,93 3 47,93 3 47,93 3 47,93 3 47,93 3 12,93 3 47,93 3 5,40,20 0 26 97,85 0 3,000 97,85 0 3,000 97,85 0 3,000 1,32,8 50 3,000 97,85 0 3,000 12 ,09, 20 0 36,000 EBIT 2nd Year Revenues Cost of Goods Gross Profit Employee Salary Advertisin g Maintenan ce & Repairs Telephone Depreciati on Electricity Total Operating Expenses EBIT 1 2 3 4 5 6 7 8 9 10 11 12 Annual 3,62,88 0 34,560 3,62,88 0 34,560 3,62,88 0 34,560 3,62,88 0 34,560 3,62,88 0 34,560 3,62,88 0 34,560 3,62,88 0 34,560 3,62,88 0 34,560 3,62,88 0 34,560 3,62,88 0 34,560 3,62,88 0 34,560 3,62,88 0 34,560 43 ,54, 56 0 4,14,720 3,28,32 0 3,28,32 0 3,28,32 0 3,28,32 0 3,28,32 0 3,28,32 0 3,28,32 0 3,28,32 0 3,28,32 0 3,28,32 0 3,28,32 0 3,28,32 0 39 ,39, 84 0 97,85 0 3,000 97,85 0 3,000 97,85 0 3,000 97,85 0 3,000 Operating Expenses 97,85 97,85 97,85 0 0 0 3,000 3,000 3,000 10,00 0 10,00 0 10,00 0 10,00 0 10,00 0 10,00 0 10,00 0 10,00 0 10,00 0 10,00 0 10,00 0 10,00 0 1,20,00 0 2,000 10,27 5 15,00 0 1,38,1 25 2,000 10,27 5 15,00 0 1,38,1 25 2,000 10,27 5 15,00 0 1,38,1 25 2,000 10,27 5 15,00 0 1,38,1 25 2,000 10,27 5 15,00 0 1,38,1 25 2,000 10,27 5 15,00 0 1,38,1 25 2,000 10,27 5 15,00 0 1,38,1 25 2,000 10,27 5 15,00 0 1,38,1 25 2,000 10,27 5 15,00 0 1,38,1 25 2,000 10,27 5 15,00 0 1,38,1 25 2,000 10,27 5 15,00 0 1,73,1 25 2,000 10,27 5 15,00 0 1,38,1 25 24,000 1,23,30 0 1,80,00 0 16 ,92, 50 0 1,90,1 95 1,90,1 95 1,90,1 95 1,90,1 95 1,90,1 95 1,90,1 95 1,90,1 95 1,90,1 95 1,90,1 95 1,90,1 95 1,55,1 95 1,90,1 95 22 ,47, 34 0 27 97,85 0 3,000 97,85 0 3,000 97,85 0 3,000 1,32,8 50 3,000 97,85 0 3,000 12 ,09, 20 0 36,000 EBIT 3rd Year Revenues Cost of Goods Gross Profit Employee Salary Advertisin g Maintenan ce & Repairs Telephone Depreciati on Electricity Total Operating Expenses EBIT 1 5,04,00 0 48,720 4,55,28 0 2 5,04,00 0 48,720 4,55,28 0 3 5,04,00 0 48,720 4,55,28 0 4 5,04,00 0 48,720 4,55,28 0 5 5,04,00 0 48,720 4,55,28 0 6 5,04,00 0 48,720 4,55,28 0 7 5,04,00 0 48,720 4,55,28 0 8 5,04,00 0 48,720 4,55,28 0 9 5,04,00 0 48,720 4,55,28 0 10 5,04,00 0 48,720 4,55,28 0 11 5,04,00 0 48,720 4,55,28 0 12 5,04,00 0 48,720 4,55,28 0 1,12,5 28 3,000 1,12,5 28 3,000 1,12,5 28 3,000 1,12,5 28 3,000 Operating Expenses 1,12,5 1,12,5 1,12,5 28 28 28 3,000 3,000 3,000 10,00 0 10,00 0 10,00 0 10,00 0 10,00 0 10,00 0 10,00 0 10,00 0 10,00 0 10,00 0 10,00 0 10,00 0 1,20,00 0 2,000 9,248 2,000 9,248 2,000 9,248 2,000 9,248 2,000 9,248 2,000 9,248 2,000 9,248 2,000 9,248 2,000 9,248 2,000 9,248 2,000 9,248 2,000 9,248 15,00 0 1,51,7 75 15,00 0 1,51,7 75 15,00 0 1,51,7 75 15,00 0 1,51,7 75 15,00 0 1,51,7 75 15,00 0 1,51,7 75 15,00 0 1,51,7 75 15,00 0 1,51,7 75 15,00 0 1,51,7 75 15,00 0 1,51,7 75 15,00 0 1,89,7 75 15,00 0 1,51,7 75 24,000 1,10,97 0 1,80,00 0 18,59,3 00 3,03,5 05 3,03,5 05 3,03,5 05 3,03,5 05 3,03,5 05 3,03,5 05 3,03,5 05 3,03,5 05 3,03,5 05 3,03,5 05 2,65,5 05 3,03,5 05 36 ,04, 06 0 28 1,12,5 28 3,000 1,12,5 28 3,000 1,12,5 28 3,000 1,50,5 28 3,000 1,12,5 28 3,000 13,88,3 30 36,000 Annual 60 ,48, 00 0 5,84,640 54 ,63, 36 0 EBIT 4th Year Revenu es Cost of Goods Gross Profit Employee Salary Advertisin g Maintenan ce & Repairs Telephone Depreciati on Electricity 1 2 3 4 5 6 7 8 9 10 11 12 Annu al 7,76,44 7,76,4 8 48 34,374 34,374 7,76,4 48 34,374 7,76,4 48 34,374 7,76,4 48 34,374 7,76,4 48 34,374 7,76,4 48 34,374 7,76,4 48 34,374 7,42,07 7,42,0 4 74 7,42,0 74 7,42,0 74 7,42,0 74 7,42,0 74 7,42,0 74 7,42,0 74 7,76,4 48 34,37 4 7,42,0 74 7,76,4 48 34,37 4 7,42,0 74 7,76,4 48 34,37 4 7,42,0 74 7,76,4 48 34,37 4 7,42,0 74 93 ,17, 37 6 4,12,4 88 89 ,04, 88 8 1,12,5 28 3,000 1,12,5 28 3,000 1,12,5 28 3,000 1,12,5 28 3,000 Operating Expenses 1,12,5 1,12,5 1,12,5 28 28 28 3,000 3,000 3,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,00 0 10,00 0 10,00 0 10,00 0 1,20,0 00 2,000 8,323 2,000 8,323 2,000 8,323 2,000 8,323 2,000 8,323 2,000 8,323 2,000 8,323 2,000 8,323 2,000 8,323 2,000 8,323 2,000 8,323 2,000 8,323 24,000 99,873 15,000 15,000 15,000 15,000 15,000 15,000 15,000 15,000 15,00 0 15,00 0 15,00 0 15,00 0 1,80,0 00 29 1,12,5 28 3,000 1,12,5 1,12,5 1,50,5 1,12,5 28 28 28 28 3,000 3,000 3,000 3,000 13 ,88, 33 0 36,000 Total Operating Expenses 1,50,8 50 1,50,8 50 1,50,8 50 1,50,8 50 1,50,8 50 1,50,8 50 1,50,8 50 1,50,8 50 EBIT 5,91,2 24 5,91,2 24 5,91,2 24 5,91,2 24 5,91,2 24 5,91,2 24 5,91,2 24 5,91,2 24 7 8 EBIT 5th Year Revenu es Cost of Goods Gross Profit 1 2 3 4 5 6 10,36,8 00 38,880 10,36,8 00 38,880 10,36,8 00 38,880 10,36,8 00 38,880 10,36,8 00 38,880 10,36,8 00 38,880 9,97,92 0 9,97,92 0 9,97,92 0 9,97,92 0 9,97,92 0 9,97,92 0 30 1,50,8 1,50,8 1,88,8 1,50,8 50 50 50 50 18 ,48, 20 3 5,91,2 5,91,2 5,53,2 5,91,2 24 24 24 24 70 ,56, 68 5 9 10 11 12 Annua l 10,36,8 10,36,8 00 00 38,880 38,880 30,72 0 38,88 0 30,72 0 38,88 0 30,72 0 38,88 0 9,97,92 0 8,160 8,160 8,160 28,80 0 38,88 0 10,08 0 84 ,15, 36 0 4,66,56 0 79 ,48, 80 0 9,97,92 0 INTEREST CALCULATION Loan Structure Value Ratio Loan Amount Land Total Project Value Working capital Total investment Cost 30,00,000 13,70,000 10,00,000 53,70,000 0.85 0.85 11,64,500 8,50,000 20,14,500 Injection 33,55,500 31 Capital Structure Debt Equity Total D/E Funds Ratio 0.60 1 20,14,500 33,55,500 53,70,000 38% 62% 100% Cost of Equity RFR 6.74 % 10.8 0% Equity Risk Premium Beta 1.21 Cost of 19.8 Equity 1% Corporate 15% Tax 32 WACC D/E Debt 0.60 Equity 1 Ratio 0.375 1 0.624 9 Pre-Tax 0.1190 0.19808 Risk Premium for new company After Tax 0.101 0.037 1381 9 0.198 0.123 08 8 0.161 7 0.108 0 WAC 26.97 C 1% 33 PAYBACK PERIOD CALCULATION Payback period for Equity Discounted Cash Flow Cumulative Discounted Cash Flow Year Cash Flow 0 (53,70,000) 1 1,71,496 1,43,142.51 (52,26,857) 2 15,29,446 10,65,522.14 (41,61,335) 3 26,63,644 15,48,883.24 (26,12,452) 4 55,79,561 27,08,050.49 95,598 5 45,79,093 18,55,027.77 19,50,626.14 34 Year 3 Months 11.00 Year Cash Flow Discounted Cash Flow 0 (53,70,000) 1 1,71,496 1,43,142.51 (52,26,857) 2 15,29,446 10,65,522.14 (41,61,335) 3 26,63,644 15,48,883.24 (26,12,452) 4 55,79,561 27,08,050.49 95,598 5 45,79,093 18,55,027.77 19,50,626.14 Payback period Payback period for Equity Payback period Year 3 Months 11.00 35 Cumulative Discounted Cash Flow 6.9 NPV IRR CALCULATION Cash Flow from operation Revenue Variable Expense Other Operating Exp (exclude interest) Interest Expense Profit or loss before taxation Accumulated loss 1 (53,70,000) 2 3 Profit after tax 5 25,92,000 43,54,560 60,48,000 93,17,376 84,15,360 2,59,200 4,14,720 5,84,640 4,12,488 4,66,560 17,06,200 16,92,500 18,59,300 18,48,203 20,47,759 2,23,270 1,84,514 1,40,887 91,775 36,489 4,03,330 20,62,826 34,63,173 69,64,910 58,64,552 - Taxes 4 - - - 60,539.82 3,09,630.11 5,19,822.28 10,45,433.00 8,80,269.23 3,42,790 17,53,195 29,43,351 59,19,477 49,84,283 7,63,600 23,70,640 37,15,030 71,56,558 59,90,927 2,23,270 1,84,514 1,40,887 91,775 36,489 Cash Flow Summary EBITDA Less Interest 36 Principal Payment CAPEX 3,08,294 3,47,050 3,90,677 - - 4,39,789 - 4,95,075 - Taxes 60,540 37 3,09,630 5,19,822 10,45,433 8,80,269 38 Calculate NPV Total investment FCF (53,70,000) - - - - - (53,70,000) 1,71,496 15,29,446 26,63,644 55,79,561 45,79,093 1,53,258 12,21,445 19,01,016 35,58,604 26,09,931 PV of FCF PV of Forecast Flows 94,44,255 NPV Terminal Value (To Calculate Terminal Value) Take FCF for 9th year with 0 % increase (Growth) Growth in percentage WACC-GROWTH (r-g) this will be denominator Take numerator as 9th yr FCF Terminal Value (Numerator / Denominator) PV of terminal value Total Value NPV @ WACC IRR 40,74,255 0.00% 26.97% 94,44,255 40,74,255 30% 39 0 1 From Equity Point of View 40 2 3 4 5 CONCLUSION 41 CONCLUSION The castor seed powder when mixed with some other natural ingredients such as rose powder, amla powder, neem powder, hibiscus powder it will smell good and the customers need not to worry about the strong smell of castor seeds As castor seeds are widely used in cosmetics especially for hair treatments the castor seed powder can be used for the growth and other hair care treatments the smell of castor oil can be very strong for some consumers so it will be difficult for them to use such products in that case these castor seeds can be converted into powder and to avoid the strong smell of the castor seeds. Makes hair strong from the roots helps to control the hair fall by continuous use of the product the hair which has been lost due to hair fall problem will regrow makes the hair length shiny and soft. The powder can be mixed with other ingredients such as hibiscus powder, rose petals powder, amla and neem powder can be mixed with it for better results by mixing these ingredients with castor powder the strong smell of castor seed can be avoided and by using this powder by mixing it with rose water or normal water and applying it to the roots and hair lengths will make the hairs strong from the roots and the hairs shiny and silky, the consistent use of this product will give great result and helps for the growth and to have healthy hair. 42 BIBLIOGRAPHY https://kvk.icar.gov.in/API/Content/PPupload/k0447_29.pdf https://www.webmd.com/vitamins/ai/ingredientmono-897/castor-bean https://www.ajol.info/index.php/ijaaar/article/view/141516/131256 43