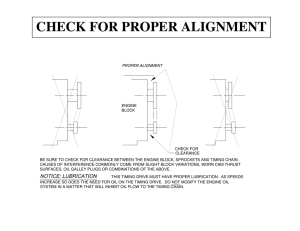

ASIMCO INTERNATIONAL CASTING COMPANY (A) After a heated debate. Ron Martin, general manager of ASIMCO International Casting Company (A1CC). returned to his office from a product meeting to review an inviting offer to bid on new business. Mr. Tadayi. general manager of SAME, a new potential customer, had offered glowing praise after his three-hour tour of AICC's operations. “I'm a foundry man. and this is one of the best foundries 1 have visited. In many ways this plant is as good as those in Japan. We are willing to discuss a long-term supply contract with you”. AlCC’s sales director had observed. "This is a golden opportunity to dramatically build our sales and reputation." In response, the operations director quickly countered, "But the product doesn't fit our process and equipment. SAME’S 4G6 gasoline engine block is very different from our current diesel engine castings, and I don't think our people are ready for that yet’’. It was September 1998. and AICC. a Chinese joint venture between ASIMCO and Caterpillar, had recently finished several major projects designed to upgrade its operations. Martin was now feeling significant pressure to increase revenue as the Chinese plant was operating far below capacity. But was SAME the right customer for AICC? This order might also provide the ideal opportunity to change the molding process to a new. higher quality technology. Or should the plant’s limited engineering resources be focused on meeting the needs of Caterpillar? Martin expected Caterpillar to soon authorize test runs of two new products, although the annual production volumes were very uncertain. FOUNDRY INDUSTRY IN CHINA Iron castings, whereby a metal object is obtained from molten metal that solidified in a mold, were used in a wide array of market applications. In China, the industry was both large and diverse, with many small operations to service local needs. In 1997. there were approximately 22,000 foundries producing a total of 12 million tonnes of castings annually. (Comparable figures for the United States were 3,000 foundries producing about 14.5 million tonnes.) Because of the shortage of investment capital, many foundries used older technologies that were labor-intensive and delivered marginal quality. A major market for the foundry industry was the automotive and transportation sector. For example, castings represented about 45 per cent of an automobile by weight, with the most technologically complex castings being the engine block and the engine head. Most of the foundries supplying this sector were subsidiaries of large automotive groups, termed captive foundries: these foundries shipped most of their castings to other business units in the same auto group. Transfer prices were typically at or below cost, w with the parent company subsidizing any foundry' losses. One such auto group. First Auto Works (FAW), was based in Changchun, in northern China. Its 43 subsidiaries employed more than 100.000 people and produced a wide range of parts, components and vehicles. In an effort to improve overall efficiency. FAW had started to outsource non-critical parts. While engine manufacturing was still viewed as critical and had been retained in-house, some industry analysts expected that even these foundry operations would soon be separated out to encourage competition on quality and price. FAW’s five foundries had a total capacity of 208,000 tonnes annually, although current shipments were estimated to be only 140.000 tonnes (overcapacity was common throughout the industry). The products of these foundries were generally simpler in design and of lower quality than castings produced in leading foundries in Japan and the United States. Unfortunately. FAW did not have either the equipment or technical competence (i.e., the engineering or production worker capabilities) to produce newer, more complicated block and head castings. To address these shortcomings, the foundries w ere gradually being upgraded to improve quality. In contrast to many captive foundries. Komatsu Changzhou Foundry (KCF) was a major foundry in China that had benefited from foreign investment of RMB250 million.1 In 1998. KCF had the capacity to produce 24.000 tonnes of castings, although it too was reported to be operating at less than 50 per cent of capacity. Among its many products. KCF produced an engine casting that approached the complexity and quality demanded for SAME'S 4G6 engine block. Foundries capable of producing such engine castings required substantial capital investment and usually took two to three years to build and startup operations, with key equipment for sophisticated casting operations being imported from Germany and Japan. Operations were also very laborintensive, and worker training was a substantial undertaking, often requiring six or more months. To protect the industry, the Chinese government historically had imposed high duties on imported parts. These duties were expected to fall from 30 per cent to 10 per cent by 2005. But cost was not the only challenge. Evolving environmental standards were forcing domestic manufacturers to introduce new engine designs that reduced emissions and improved fuel economy. Naturally, these engines were much more complex to cast than their predecessors. It was clear that if Chinese foundries were unable to produce new designs quickly, the complex engine castings would continue to be imported from elsewhere in the world. ENGINE BLOCK MANUFACTURING Design of Engine Blocks Medium- and heavy-duty trucks and tractors favored diesel engines, while passenger cars and vans typically used gasoline engines. Gasoline engine blocks tended to be much smaller, often weighing less titan 1(X) kilograms, versus 150 kilograms or more for a diesel engine block (see Exhibit 1). These basic design differences translated into much more demanding technical requirements, in such areas as metal strength and dimensional tolerances, for gasoline engine blocks. The tighter specifications were reflected in market prices and manufacturing challenges. The market price for high-quality diesel engine block castings averaged at RMB8.000 per tonne, with a range of RMB6.000 to RMB9.000 (industry practice was to quote prices by weight, not pieces). The greater complexity of the gasoline engine blocks tended to inflate scrap rates, which translated in price premiums of 40 per cent to 50 per cent. finally. head castings were priced on average about 25 per cent higher than the comparable engine block. Basic Foundry Processes Foundry' operations for engine block production comprised several basic stops (see Exhibit 2). 1. A set of three-dimensional shapes was produced in the core-making operation. These shapes, termed cores, were largely made of sand with a resin additive, and subsequently formed the inner surfaces and voids of a casting. Depending on the casting design, basic cores could be assembled into more complex shapes (e.g., piston cylinders). New core machines could be added or removed to accommodate changes in demand or to configure new products. 2. In a parallel operation, molds were created that would later form the outer surface of the finished casting. Molds were formed using one of two technologies: green sand process or cold core capsule process (see Molding Process Technology). The mold was transferred to a large metal frame, called a flask, which was used to move the mold through the remainder of the foundry' process. A molding line was designed to accommodate a particular size of flask, and dozens of flasks were placed on a molding line. This line was always viewed as the heart of the foundry' operations and required the largest proportion of capital investment. To improve efficiency, molds could be designed to create multiple copies of the same casting, with the number being limited by the molding technology and the relative sizes of the casting and flask. For example, several castings of a gasoline engine block or a single casting of a diesel engine block might be produced in the same flask on a molding line. Suppliers of molding equipment had become quite specialized because of significant product and process differences between diesel and gasoline engine blocks. DISA, a Japanese firm, was a frequent supplier of equipment for casting gasoline engine blocks, whereas German suppliers such as Kunkel Wagner, provided equipment that was better suited for large, heavy diesel engine blocks. Diesel and gasoline engine blocks were typically produced in separate foundries, or if in the same foundry', in separate molding lines. 3. Assembled cores were transferred from core-making operations and inserted in molds (see Exhibit 3). Next, molten metal was poured into the assembled molds. The raw material for iron castings was prepared by mixing and melting together different grades of raw iron, foundry scrap, steel scrap, ferroalloys and other metals. Finally, the solidified castings were extracted from the molds, cleaned, inspected and painted before shipment to customers. Because of the size and weight of the filled molds, little inventory was possible between the molding line and downstream operations. Manufacturing Challenges Product quality and operational efficiency depended to a significant degree on three major factors: product complexity, labor skill and process design. As the complexity of the cast¬ing increased, more cores were needed to create the necessary- product features and voids, which also tended to increase the likelihood of quality- problems. The foundry process was very labor-intensive, especially in the core assembly and the cleaning of the casting surface. In core assembly, workers bolted together a dozen or more cores, and then placed the assembled cores into molds. While skilled workers could do this with a reasonable degree of accuracy, new workers used additional tools to check the positioning of the cores. In developed countries with high labor costs, such as Japan, foundries might use capital-intensive, automatic core assembly machines to reduce labor costs and lower defects. During assembly, workers also checked for broken cores. Again, judgment was needed, as some broken cores could be used successfully for castings, while others, depending on the nature of the defect, would cause a problem. Changing a broken core required additional rework and slowed operations. Finally, process technologies could be used to improve the quality of castings and raise productivity. Molding Process Technology Green Sand Technology Green sand molding was the traditional foundry technology, whereby the mold was formed from a mixture of silicon sand, bentonite clay and coal. The mixture was packed around a pattern, and then compressed into the required shape using high pressure. The pattern was then removed, and its imprint became the mold cavity into which the molten metal was poured. The mold was then transferred to the flask to be moved through the rest of the foundry operations. This method required highly skilled production workers, particularly when the cores were set and assembled into the molds prior to adding the molten metal. Any deviation from specifications in the placement of the cores resulted in dimensional defects, which could not be detected until final inspection. Dimension defects varied dramatically, ranging from as high as 20 per cent to 50 per cent in new' foundries, to as low as five per cent or less for basic castings at foundries in developed countries with highly skilled workers and mature processes, such as that at Mitsubishi Japan. In China, variable costs for materials, labor and utilities collectively amounted to about half the market price. Cold Core Capsule Technology Instead of using green sand to form the exterior surface of the casting, a resin capsule could be employed. Capsules were very similar to cores—formed of sand and resin, and produced on core machines. However, the capsules were cured using sulfur dioxide to create a strong smooth surface. Green sand was then used around the edges of the mold only to position the capsules. Because both sand and capsules were now required, fewer castings were possible in molds that produced multiple copies (sec Exhibit 4). Given the greater strength of the capsules relative to green sand molds, cold core capsule AICC JOINT VENTURE The government had built a military manufacturing base in the 1970s in the central mountainous area of Shanxi Province. Eight scattered factories, collectively1 managed by CTTTC Machining and Manufacturing Inc. (CMMI), were built to produce tanks and military trucks. One of the factories. Factory 5419. was a foundry designed to produce medium to large iron and steel castings for tanks and diesel engines. Unfortunately, the factory now operated at very' low volumes with a workforce of 2,800 people. Worker skills were limited: however, much less training was needed than for a new workforce. The foundry also had a shortage of skilled engineers capable of directing a new product introduction and ramp-up. While engineers were being actively recruited, it had proven difficult to attract and retain qualified people to work and live in this remote mountainous area. ASIMCO Technologies Headquartered in Beijing. China. ASIMCO Technologies was formed in 1994 with total investment of US$300 million to create a leading components manufacturer in China. The strategy was to acquire majority positions in existing suppliers and then add capital, management and technology to bring the acquired companies up to global standards for quality and service. By 1998. ASIMCO was China’s third largest auto parts supplier, with 17 plants and 36 sales offices throughout China. Management was first introduced to Factory 5419 in 1996 and spent six months evaluating the facility and its potential. However. ASIMCO had little specific experience with foundry operations. and the facility clearly needed investment in both advanced technology and better management techniques. The project was presented to Caterpillar, who had been searching for an opportunity to enter a Chinese joint venture. Caterpillar A U.S. Fortune 500 company. Caterpillar was recognized for the advanced design of diesel engines and components, including castings. Engine sales generated about a quarter of the firm’s total revenue, second only to earth-moving machinery. A company-owned foundry in the United States produced most of the castings for the critical components in Caterpillar's diesel engines. As one of the major engine producers in the world, management wanted to establish a presence in China to improve access and gain market information, as well as to develop experience with local operations. This market was expected to grow dramatically over the coming years. A joint venture foundry was seen by Caterpillar as a test before any further expansion into Chi mu and could serve as a backup source of supply for critical castings. Ron Martin, who led the Caterpillar team in their search for a foundry joint venture partner in China, explained the rationale behind the investment decision: Caterpillar did not seek to establish a wholly- owned foundry primarily because local partners could bring access to the market and knowledge of operating in the unique Chinese environment. An established manufacturing operation also was expected to shorten the start-up time because a skilled work force was already in place, which is very critical for a foundry. We visited several potential partners with manufacturing bases in larger cities such as Beijing, Dalian and Guangzhou. However, concerns about possible environmental regulations for foundries in larger cities forced us to search for other sites. What attracted these investors most was the German molding line. Purchased in the late 1970s. it had seldom been used since. Unfortunately, despite its almost new condition, significant investment was needed to enable the production of higher quality castings. To encourage investment. CMM1 significantly discounted the value of the molding line, other equipment, buildings and land. Based on these factors. ASIMCO. Caterpillar and CMM1 established a joint venture, with the agreement signed in February 1997. ASIMCO was the largest contributor of capital, and this foundry represented one of its largest investments. Initially called the Shanxi International Casting Company, the name was later changed to ASIMCO International Casting Company (AICC). The nature of the joint venture also dictated that this would not be a captive foundry. In addition to potentially supplying Caterpillar, the plant would also target the growing market in China for more complex engine castings. FOUNDRY INVESTMENT A start-up team, including three people from the foundry' operations of Caterpillar (U.S.), three from ASIMCO and seven from AICC . started working on redesign and planning, termed technical reform. This began even before the joint venture contract was approved by the government. Hank Sun. the engineering manager from AS1MCO, observed: In many ways, technical reform was more difficult and complicated than building a new facility. Several foundry experts who worked in the Caterpillar foundry brought unique techniques and process designs, and we had to incorporate those into the existing equipment and building. Unfortunately, some equipment, although still functional, had to be scrapped because it did not fit the redesigned process: some buildings also had to be demolished. Yet, we could not simply copy Caterpillar's process design. The molding line was more technically advanced in the U.S., and raw materials like scrap steel were of higher, more consistent quality. Most importantly, workers and engineers in Caterpillar's foundry were more experienced and capable. We tried to simplify AlCC’s process to match local engineering and worker skills. Once the plan was finalized, equipment selection and design of the building renovation was started. AICC selected major manufacturing equipment from the world’s best suppliers, putting the most advanced industrial technology into China to date. Approximately 60 per cent of the equipment was purchased domestically, which helped to limit the capital investment to about RMB275 million. In addition to capital investment, Caterpillar made a five-year commitment to provide technical and management assistance. The general manager, director of technical reform, director of operations and a number of other experts were brought from Caterpillar foundry operations in the United States to oversee the technical reform project and manage daily operations. Production Ramp-Up Production began even as new investment continued. Quality of the incoming raw materials was particularly critical, and Caterpillar’s specifications were adopted for the supply of metal. An experienced metallurgist from Caterpillar U.S. was assigned to visit potential suppliers to evaluate the production process and quality control system. The molding line was designed for medium sized engine blocks and heads. Each flask, measuring 1.2 m x 1 m x 0.45 m. was designed to carry the mold that supported a total casting weight of 150 to 300 kilograms. The molding line was expected to run at 60 molds per hour during the first year, with a further ramp-up to 70 molds per hour by 2000. The line restarted production in June 1998, but unfortunately, was down 70 per cent of the time for repairs and maintenance. Engineers then predicted that downtime should fall to 25 percent over the next year. Current workforce availability allowed for either two 10-hour shifts or three 8-hour shifts over a five-day workweek. Although technical reform was less than half finished, small production volumes were started in mid1998. Ron Martin explained such a strategy: We used existing patterns to make the YC6105 engine block, which was an old and relatively simple casting. This product had been in production for a Chinese engine company prior to upgrading the foundry operations. While manufacturing during equipment installation and building renovation can create problems, these conflicts can be minimized through good scheduling. We expected that it would take at least six months to train our workers, and we wanted them to get ready for more complex work in the near future. To convince potential customers to contract with us, we must sell the factory first, and the best presentation is a running factory. North American customers simply would not sign a long-term contract until they are convinced that AICC is capable of producing high quality castings. NEW MARKET Opportunities AlCC’s primary target markets were domestic and foreign engine manufacturers, who would be likely to pay a premium for high-quality products yet would benefit from lower labor costs. Early efforts resulted in several potential Chinese and North American customers requesting a quotation to produce an existing engine block casting already manufactured in another foundry. To prepare a bid, the foundry would estimate production costs based on a customer-supplied product design, which helped to determine the material, process and quality characteristics. Tighter specifications tended to generate higher scrap rates, which in turn had to be captured in the price quotation. The foundry also paid all development costs related to any new casting; these costs could range from RMB75.000 to more than RMB750,000 (see Exhibit 6). By September 1998, AICC had identified a number of potential customers and products (see Exhibit 7). In contrast long-term contracts for new high- volume engine block castings were negotiated only with established foundries that had a strong reputation for quality and delivery. Both the manufacturer and foundry committed considerable lime, money and energy to develop castings for new engines. For these reasons, engine manufacturers would initially target one supplier, which would typically maintain the supply contract throughout the life of the engine, and later possibly add another foundry as a supplier as the product matured. Caterpillar's 3306 Engine Block and Head Caterpillar had been purchasing castings for engine components from its captive foundry- in the United States, as well as non-captive foundries in Brazil and Mexico. As an investor to AICC, Caterpillar anticipated purchasing castings equivalent to about 30 per cent of AICC’s capacity. However, contracts were not assured, as AICC? still had to compete against other potential suppliers on quality, price and delivery. In 1998. AICC received a request for quotation from Caterpillar for two castings produced in the United States and Mexico: the 3306-engine block and the 3306 head. AICCs quotation of RMB2.200 for the engine block and RMB1.100 for the head was based on the prices charged by the Mexican supplier. The engine block and heads would use the same green sand molding technology that was employed by the U.S. and Mexico foundries. Because of the size of (he castings, only a single piece (i.e., one block or one head) could be cast in each mold. Preliminary engineering estimates indicated that an engine block would require about 72 minutes per tonne of production time from a core machine; an engine head would require about 130 minutes per tonne. If the bid was accepted. AICC would proceed with detailed process design and start-up. which was expected to take at least 12 months. AICC would assign the only two senior product engine's to manage this start-up process because of the importance of this customer; more junior staff simply did not have sufficient experience. Once production commenced. Caterpillar U.S. would approve the products and process for mass production. However, annual volumes were very uncertain, as most production might still remain in North American foundries. While marketing estimates exceeded 7,000 tonnes annually by 2000. volumes might vary from as little as 1.000 tonnes up to 8,000 tonnes per year. Mitsubishi’s SAME 4G6 Engine Block The 4G6 engine was a mature design used in jeeps and light buses. The 4G6 engine block was relatively light in weight, with tight specifications for both the metal strength and dimensional accuracy. The engine was currently produced using green sand technology in Japan for the Japanese market. The Japanese foundry had an excess annual capacity of 50,000 castings. Despite the excess capacity. Mitsubishi had entered a new joint venture. SAME, to produce this engine in China for the Chinese market. Production from SAME’S plant was expected to commence in early 1999, and ultimately, the plant was to assemble up to 150.000 gasoline engines, all of the 4G6 design. In order to test the new assembly line, S.AME planned to import key components from Japan to simplify start-up. However, higher labor and utility costs in Japan, combined with shipping costs and import duties, suggested that imported engine blocks were likely to be at least twice the price of those potentially supplied by a Chinese foundry. A major task for SAME's purchasing department was to source local suppliers. Potential suppliers for the engine block casting included FAW. KCF and AICC. The volume of engine sales in the Chinese market varied considerably from month to month, with sales in March to May being the highest, sometimes amounting to 50 per cent of annual sales. Engine manufacturers typically give suppliers a three-month rolling forecast for the monthly demand. As AICC product engineers developed a preliminary process design for the bid. it became clear that the choice of molding process technology was a major issue. The green sand and cold core capsule processes required different patterns, and changing the process at a later point would require significant additional investment. If green sand molding was used, four engine block castings could be produced in each mold. Producing this large number in one mold was only feasible because the 4G6 engine block was about one-quarter of the size of diesel engine blocks such as the Caterpillar's 3306. Alternatively, using the cold core capsule technology for the 4G6 would offer definite advantages in terms of quality. This technology, if adopted, would be its first application in China. However, because the capsules required additional space in the mold, only two castings could be produced per mold. The core machines would also have to produce capsules as well as cores, which would require about 276 minutes per tonne of production (twice that for green sand molding). If necessary, core machines could be purchased for approximately RMB1.2 million to supplement the six core machines currently installed . GOING FORWARD Martin faced several critical decisions. Should AICC continue to aggressively pursue both the Caterpillar and Mitsubishi orders? His basic concerns centered on plant capacity, process design and organizational capabilities. Il was not clear how the two could be managed simultaneously, and if AICC aggressively pursued only one, which one? In terms of the capacity. Martin was feeling intense pressure to ramp up both revenue and production volumes to justify the recently completed capital investments. It was not clear that dropping either potential order would be well-received by the joint venture partners. Unfortunately, the small production volumes had generated only- very limited data on which to estimate costs. Martin was also very concerned about how capable the molding process and people were to quality demands of any new orders. The inherent quality advantages of the cold core capsule process technology might smooth start-up and offer other strategic benefits. Producing the Mitsubishi 4G6 casting might provide the perfect opportunity to learn about this new technology. Organizationally, there was a critical shortage of engineering resources. Only two experienced senior product engineers were capable of leading new product start-up. Until now. Martin had planned to assign them to lead the two Caterpillar products. He was not confident that these engineers could address the needs of SAME too. While the Caterpillar’s U.S. foundry was willing to provide technical support when needed for any new production, the U.S. foundry did not produce a small engine block similar to the 4G6. If AICC experienced problems during start-up. how would they be overcome?