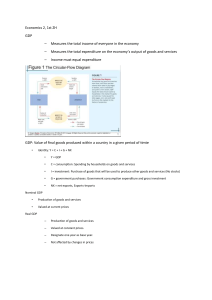

Principle #1: People Face Trade offs People, society, governments, everybody faces trade offs. Trade offs are a result of scarcity. Resources are scarce and limited. Time itself is also scarce. Example of trade offs: Consumption VS Investment Efficiency VS Equity Efficiency is the size of the pie If you can produce more output for each input, than you are more efficient Equity is the slices of the pie. Over taxing can reduce incentive to work (“which will shrink the pie”) Principle #2: The Cost of Something is What You Give Up to Get It Chapter 1 principle #8 The main determinants of your standards of living is Productivity Productivity Y/L Y/L = Output/Input Eg: GDP/# of workers = GDP per worker Eg: W/P = Real wage = $/Hr W = Money wage P = price of goods and services The noninal wage is different from the real wage nominal wage means you are making $13.60 an hour Real wage is what you can actually buy with $13.60 Y/L lbs of apples / hr W/P $ / hr Nominal/Real = ($ / hr) / ($ / lbs) = lbs/hr = (Y/L) productivity Principle #9 is Inflation Inflation is a monetary phenomenon Central banks print more money to pay off debts which it owes to citizens which causes inflation and thus increasing the prices of goods and services Budget deficit summation of all debts Deficit is the build up of debts as a result of spending too much Either spend less (What conservatives want) or tax more (What NDP wants) Principle #10 In the short run there is an inverse relationship between prices and the unemployment rate Finance: Short term is considered less than 1 year and long term is 5 year to 10 years Macroeconomics: Short run is when you don’t have flexibility, you can’t change your behaviour The long run is when you have more flexibility, enough time to react. Eg: Wages are said to be flexible when they respond to changes in supply and demand within a set time interval Short run: Prices are fixed Long run: Prices undergo change Behaviour of corporations in the short run VS long run is based on the current situation Prices experience change in the long term but not as much in the short term High inflation is bad for the economy but a little inflation is good for businesses. A little inflation greases the wheels of the economy G, u, 𝜋, E, r rate variables g: growth rate of the country u: unemployment rate 𝜋 (pi): inflation rate Ε: Exchange rate r: interest rate Unemployment rate is never 0% because of what economists call “mismatch of skills” According to economists there will always be unemployment for this reason. Another reason the unemployment rate is never 0% is because of structural changes in industries. Chapter 5: growth rate Percentage change of GDP. GDP is the market value of all newly produced goods and services in a domestic economy for a given time The market has many buyers and sellers setting the price and quantity A Robinson Crusoe economy only has two participants One buyer and one seller Market value comes from the price Police officers, fire fights, etc do not have a market value because they are providing services at a wage given by the government The public is not affecting the wages with any form of competition The public services come at the cost of the economy Volunteering doesn’t contribute to the economy because they don’t have wages The Canadian GDP is understated because there are many volunteers, police officers, lawyers, etc The underground economy is not included in the calculation of the GDP As long as someone is hired and has a wage they contribute to the GDP The services provided must be apart of the market Household Labour (chores, cooking, cleaning, etc) are not considered apart of the GDP Canada has high volunteer services so their GDP is understated Countries with lots of household labour have understated GDPs Only the purchasing of new goods is included in the GDP because including old goods that have already been paid for (old cars, stocks, old furniture) would be considered “Double counting” which would result in a huge exaggerated GDP figure. In order to avoid an exaggerated GDP we only include the purchase of new goods The increase in sales of new cars would be included for calculation of the real economy GDP will consider All newly produced final goods and services in a domestic economy for a given time period Market value of all newly produced final goods and services are included in the GDP because used goods and services are already paid for The opposite of final goods is intermediate goods EG: Wheat baker makes cupcakes (Intermediate good) Cupcakes bought by customer (Final good) Iron ore Steel (Intermediate good) Stainless steel forks (Intermediate good customer buys steel forks (Final good) Wheat to farmer who makes bread (Final good) Intermediate good is not considered in calculating GDP Service goods Purchase of imported goods within the domestic economy is not considered as part of the Canadian GDP. That is counted in the foreign GDP If it was manufactured on Canadian soil, it is considered as a part of the Canadian GDP Recession is 2 consecutive quarters in which the GDP declines 2 quarterly periods is 6 months 1 quarter is 3 months Annual period is 12 months and contains 4 quarterly periods Recession is not identified until 6 months have passed There are 3 methods of computing the GDP: Expenditure Product Income Note: in a Robinson Crusoe economy where there is a Pina Coladas Pina Coladas has Pineapple and coconuts Cost of making Pina Coladas: Pineapple ($5) + coconuts ($5) (Product method) Pina Colada sold to one buyer (consumer) for $10 (Expenditure) The seller (producer) now has $10 to pay for his labour as a wage (Income) The GDP is $10 in all 3 scenarios In reality all 3 methods do not have the exact same result due to statistical discrepancies: -not all business owners report all sales honestly -under the table transactions -tax evasion -etc Most important method is the expenditure method Focus on expenditure and product method Most economists compute the GDP on the basis of the expenditure approach National Accounts Identity Y = C + I + G+ NX C = consumption ( biggest component of expenditures, about 56%-57%) I = investment (most volatile and therefore most affect on GDP) G = government expenditures NX = Net exports = exports – imports = X – M Consumption of: Durable goods (laptops, cars, fridges, etc) Nondurable goods: (perishable food, soap, etc) Expenditure of durable goods: You buy cars once in a while such as when you have a job and the economy is doing well (not when you are unemployed and the economy is not doing well) Expenditure of durable goods goes up and down with the economy Unlike nondurable goods that has more consistent expenditures because people need to eat even when the economy is low Durable goods expenditure is an indicator of the economy (Car sales) Indicators help observe the health of the economy Investment expenditures: Business fixed investment: Factories, machines, etc Inventory: stock up goods and services to sell in the future Housing Note: during a recession Y goes down, main culprit is I (investment) Y = C + I + G + NX Government expenditures: go up during wars, go up when building roads, bridges, buildings, public infrastructure Imports are not apart of GDP Family buys a fridge: GDP Goes up Consumption of durable goods Page 111: Problems and applications 1. a) GDP goes up b) up c) Inventory down, expenditure up therefore nothing d) (buys a pizza) GDP goes up e) up f) Consumption goes up, Net exports (NX) goes down therefore no result on GDP Income approach: Y = f(L, K) Y = pi (profits of entrepreneurs) L = wages of workers (“w”) K = Interest rates of Capitalists (“r”) Pi+w+r GDP basis of income approach GDP on the basis of product approach: (PA X qA) + (PB X qB) Nominal GDP (NGDP) = ∑ Pt X qt “t” is for time “t – 2” means two years ago EG: 2009 ($2 X 3 apples) + ($1 X 4 Bananas) = NGDP $10 2010 ($4 X 3 apples) + ($2 X 4 Bananas) = NGDP $20 You did produce more apples and bananas, they just got more expensive now Real GDP looks at how many products and services you actually sold. Hence you would select a base year and use it’s prices for the quantities of goods sold in other years. Always focus on increase in Real GDP over Nominal GDP if you want to know if the economy is actually being more productive Real GDP uses fixed prices of the base year that you want to compare to the other years Eg: Base year 2009, use 2009 prices on the quantities of goods in 2010, 2011, 2012, 2013, etc Therefore, Real GDP will not change when prices change, it will only change when more goods and services are sold RGDP = ∑ Po X qt Quality of life is based on the real GDP. Do we actually have more stuff to enjoy in our lives. NGDP = Pcurrent X Qcurrent 𝑵𝑮𝑫𝑷 𝑹𝑮𝑫𝑷 = GDP Deflator RGDP = PBase Year X Qcurrent Chapter 5: Problems and applications page 111 #5 Price of milk $1 $1 $2 2013 2014 2015 Quantity of milk 100 200 200 Price of honey $2 $2 $4 Quantity of honey 50 100 100 NGDP: 2013 ( Pm X qm ) + ( Ph X qh ) = $1 X 100 + $2 X 50 = $200 2014 $400 2015 $800 RGDP (use 2013 as base price) 2013 2014 2015 ( Pm2013 X qm2013 ) + ( Ph2013 X qh2013 ) = $1 X 100 + $2 X 50 = $200 ( Pm2013 X qm2014 ) + ( Ph2013 X qh2014 ) = $1 X 200 + $2 X 100 = $400 ( Pm2013 X qm2015 ) + ( Ph2013 X qh2015 ) = $1 X 200 + $2 X 100 = $400 A good analyst would ask these questions the data they are analyzing: 1) Nominal data or Real data? 2) Why is more money being spent? Is the population going up? 3) Adjust for distribution of the population (Eg: Rural regions of Alberta has smaller population density than Urban regions of Alberta) GDP deflator = (NGDP) / (RGDP) NGDP = Pcurrent X Qcurrent If either P or Q goes up than the NGDP will go up RGDP only goes up when quantity goes up Therefore GDP deflator: (P X Q) / Q = P The GDP deflator effectively presents price Price index: This is a composite price, a weighted average price of the economy is a normalized average (typically a weighted average) of price relatives for a given class of goods or services in a given region, during a given interval of time GDP deflator = ( ∑ Pt X qt ) / ( ∑ Po X qt ) Apply to question of page 111 $5 Price of milk $1 $1 $2 2013 2014 2015 Quantity of milk 100 200 200 Price of honey $2 $2 $4 Quantity of honey 50 100 100 NGDP: 2013 ( Pm X qm ) + ( Ph X qh ) = $1 X 100 + $2 X 50 = $200 2014 $400 2015 $800 RGDP (use 2013 as base price) 2013 ( Pm2013 X qm2013 ) + ( Ph2013 X qh2013 ) = $1 X 100 + $2 X 50 = $200 2014 ( Pm2013 X qm2014 ) + ( Ph2013 X qh2014 ) = $1 X 200 + $2 X 100 = $400 2015 ( Pm2013 X qm2015 ) + ( Ph2013 X qh2015 ) = $1 X 200 + $2 X 100 = $400 GDP Deflator: GDP deflator = (NGDP) / (RGDP) X 100 2013 GDP deflator = (2013 NGDP) / (2013 RGDP) 2014 GDP deflator = (2014 NGDP) / (2014 RGDP) 2015 GDP deflator = (2015 NGDP) / (2015 RGDP) Therefore GDP deflator: 2013: ( $200 / $200 ) X 100 = 2014: ( $400 / $400 ) X 100 = 2015: ( $800 / $400 ) X 100 = 100 100 200 Notice how the base year will always have a GDP deflator of 100 due to how it is dividing by itself and thank multiplying by 100 Growth rate of RGDP is “g” Inflation is “𝜋” (percentage change of GDP deflator) GDP deflator: 2013: 100 2014: 100 2015: 200 100−100 100 200−100 2015: 100 2013 to 2014: no change, no inflation 2014 to 100% inflation (yikes) Therefore 2014-2015 experienced an inflation rate of 100% g = growth rate (percentage change of RGDP) RGDP (2013 as base price) 2013 = $200 2014 = $400 2015 = $400 g for 2013 – 2014 is 400−200 = 200 100% change in growth g for 2014 – 2015 is 400−400 = 400 0% change in growth Limitations of GDP: 1) GDP does not measure income distribution 2) GDP does not calculate leisure time. High work hours does not increase GDP but that means a reduction in quality of life. Leisure time is necessary for consumers to be able to have a quality of life. 3) GDP does not take into account of the degradation of the environment. Pollution results in a low quality of life. 4) GDP goes up any time you use a public service, such as police services, health care services, etc (this does not mean your economy is being more productive or living standards are going up) 5) Volunteering Chapter 6 cost of living: Measure of cost of living is based on inflation rate 𝜋 CPI (Consumer price index) Weighted average of the overall cost of a fixed basket of goods and services of the average consumer If the index goes up, inflation is occurring It is based on the average consumer Note: Seniors consumer more medical goods and services than the average consumer Individuals will have different consumer habits when compared to the average consumer 𝜋 CPI fixed basket of goods and services CPI ( ∑ 𝑃𝑡 𝑋 𝑞𝑜 ) VS 𝑋100 ( ∑ 𝑃𝑜 𝑋 𝑞𝑜 ) ( ∑ 𝑃𝑡 𝑋 𝑞𝑜 ) 𝑋100 ( ∑ 𝑃𝑜 𝑋 𝑞𝑜 ) GDP deflator ( ∑ 𝑃𝑡 𝑋 𝑞𝑡 ) ( ∑ 𝑃𝑜 𝑋 𝑞𝑡 ) 𝑋100 The CPI uses BASE QUANTITIES (quantities from the base year) The GDP deflator the quantities of the year in question (2008 uses 2008 quantities, 2009 uses 2009 quantities, 2010 uses 2010 quantities, etc) The GDP Deflator versus the Consumer Price Index The GDP deflator is the ratio of nominal GDP to real GDP Because nominal GDP is current output valued at current prices and real GDP is current output valued at base-year prices, the GDP deflator reflects the current level of prices relative to the level of prices in the base year. Economists and policymakers monitor both the GDP deflator and the consumer price index to gauge There are two important differences that can cause them to diverge. 1) GDP deflator reflects the prices of all goods and services produced domestically (the consumer price index reflects the prices of all goods and services bought by consumers). EG, price of an airplane produced by Bombardier and sold to the Canadian Forces rises. Even though the plane is part of GDP, it is not part of CPI. Thus, the price increase shows up in the GDP deflator but not in the CPI. 2) CPI compares the price of a fixed basket of goods and services to the price of the basket in the base year. Statistics Canada changes the basket of goods every two years. By contrast, the GDP deflator compares the price of currently produced goods and services to the price of the same goods and services in the base year. EG: Page 128 problems and applications Question 1 (calculate CPI) Calculating Inflation Rate using CPI: Example (𝐶𝑃𝐼 𝑜𝑓 𝑌𝑒𝑎𝑟 2010)− (𝐶𝑃𝐼 𝑜𝑓 𝑌𝑒𝑎𝑟 2009) (𝐶𝑃𝐼 𝑜𝑓 𝑌𝑒𝑎𝑟 2009) 𝑋100 = 50% Thus 𝜋 = 50% (inflation) Note: Whenever Canada adjusts wages they look at the weighted average of the CPI. But note how individuals will consumer different goods. For example, the consumers of apples experience an increase in the price of apples while the consumers of bananas did not experience an increase in the price of bananas. If the wage is increased, the consumers of bananas get to enjoy the wage increase more than the consumers of apples (apples got more expensive while bananas did not) If your preferences are similar to the average consumer than the impact of inflation to you and the average consumer will be more similar Inflation has varying effects on different consumers because not everyone will have a similar consumer preference to the average consumer Chapter 6 Problems and applications Question #2 page 126 2014 2014 2015 2015 price quantity price quantity ( ∑ 𝑃𝑡 𝑋 𝑞𝑜 ) ( ∑ 𝑃𝑜 𝑋 𝑞𝑜 ) Tennis Balls Tennis Racquets Gatorade $2 100 $2 100 $40 10 $60 10 $1 200 $2 200 𝑋100 Use 2014 as the base year Borrow $100 at no interest Two people. Guy borrows $100 from lender This economy only has peanut butter only consume peanut butter $5 for a jar peanut butter Purchasing power of 20 Jars of PB with $100 1 week passes and you experience inflation. Money supply has increased, things are more expensive. The dollar is worth less. It is now $10 for a Jar The new purchasing power of $100 is now 10 jars of PB The lender’s $100 lost value (The $100 lost purchasing power by the time it was paid back) The borrower is “paying back less” to the lender Inflation is a gain for the borrower Inflation is a loss for the Lender Deflation is a gain for the lender Deflation is a loss for the borrower Inflation is good for borrowers and bad for lenders because it reduces the value of the money paid back to the lenders deflation is bad for borrowers and good for lenders because it increases the value of the money paid back to the lenders Pc Qc $2 100 $2X100= $200 $3 $75 $225 2014 Expenditure 2015 Expenditure Pb $1.50 Qc 50 Pa $0.10 80 $0.20 $75 $1.50 Qa 500 $50 $120 500 $100 2014 is the base Pt is prices in 2015 ( ∑ 𝑃𝑡 𝑋 𝑞𝑜 ) ( ∑(𝑃 𝑜𝑓 2015) 𝑋 (𝑞 𝑜𝑓 2014) ) 𝑋100 ( ∑(𝑃 𝑜𝑓 2014) 𝑋 (𝑞 𝑜𝑓 2014) ) 𝑋100 ( ∑ 𝑃𝑜 𝑋 𝑞𝑜 ) ( 3𝑋100 )+($1.50𝑋50)+($0.20𝑋500) 𝑋100 = ( 2𝑋100 )+($1.50𝑋50)+($0.10𝑋500) 475 325 = 146.15 1950 gas costs vs 2017 gas costs Your grandpa was paying $0.10 / L back in 1950 and you are currently paying $1.08 / L. What is the 1950 $0.10/L worth today that your grandpa was paying back then Use CPI $/L $0.10 / L $x / L 1950 2017 X= 0.10𝑋130 12.5 CPI 12.5 130 =$1.04/L Grandpa was paying the equivalent of $1.04/L compared to what you’re currently actually paying of $1.08 / L You’re therefore paying $0.04 more than your grandpa was paying back then. If you were to go backwards and see what your $1.08/L is worth in 1950 then: 125 $1.08/L X = $0.1038/L 130 $0.1038/L compared to $0.10/L your grandpa was paying back then You are paying $0.0038 more than grandpa (back in 1950) Wizard of Oz economics analogy Dorothy meets three characters the Scarecrow how has now brain the Tin man who has no heart the Lion who has no courage They travel to the Emerald city by traveling on the Yellow Brick Road to meet the wizard The Wizard doesn’t solve their problems Dorothy gets back by tapping her Silver Slippers (Check out https://en.wikipedia.org/wiki/Political_interpretations_of_The_Wonderful_Wizard_of_Oz for further details) Economic/Political Implications: Dorothy American Economy, projected naïve and innocent At the time the American Economy was experiencing deflation Emerald City (Green) Federal Reserve (Central Bank of United States) Wizard of Oz The government (couldn’t solve the deflation problem) Yellow Brick Road Gold backed U.S Dollar Scarecrow the farmers who borrowed at high interest rates and are in trouble (Deflation is bad for borrowers) Tin Man Industrial class, they don’t care as much (hence the lack of heart analogy) The Cowardly Lion metaphor for William Jennings Bryan ( https://en.wikipedia.org/wiki/William_Jennings_Bryan ) ( https://en.wikipedia.org/wiki/Cross_of_Gold_speech ) You can’t print gold, it has a limited supply so instead they decided to also mint silver (represented by the silver shoes) Eventually the gold rush also helped deal with the situation $1000 in the bank, nominal interest rate of 10% P = $10 / pack of gummies $1000 has a purchasing power of 100 packs of gummies If you wait a year than you will have $1100 Which has a purchasing power of 110 packs of gummies Suppose inflation (𝜋) = 0%, 6%, 10%, 12%, -2% 𝜋 = 0 p = 10 X 1.00 = 10 1) 10% - 0% = 10% Real Interest Rate the Real Interest Rate = Nominal Interest rate No change in purchasing power of pack of gummies 𝜋 = 0.06 p = 10 X 1.06 = 10.60 2) Note: 10% - 6% = 4% Real Interest Rate 1100 10.60 = 103.7 packs (after saving and experiencing inflation) = 104 packs Increase in Purchasing Power 104−100 = 100 0.04 4% actual increase in purchasing power of pack of gummies (Same as Real Interest rate) 3) 𝜋 = 0.10 p = 10 X 1.10 = 11.00 Note: 10% - 10% = 0% Real Interest Rate 1100 = 11 100 packs (after saving and experiencing inflation) = 100 packs Increase in Purchasing Power 100− 100 100 = 0.00 0% actual increase in purchasing power of pack of gummies (Same as Real Interest rate) 𝜋 = 0.12 p = 10 X 1.12 = 11.20 4) Note: 10% - 12% = -2% Real Interest Rate 1100 11.20 = 98.21 packs (after saving and experiencing inflation) = 98 packs Increase in Purchasing Power 98− 100 = 100 -0.02 -2% actual increase in purchasing power of pack of gummies (Same as Real Interest rate) 𝜋 = -0.02 p = 10 – (10 X 0.02) = 9.80 5) Note: 10% - (-2%) = 12% Real Interest Rate 1100 = 9.80 112.24 packs (after saving and experiencing inflation) = 112 packs Increase in Purchasing Power 112− 100 100 = 0.12 12% actual increase in purchasing power of pack of gummies (Same as Real Interest rate) Notice: 1 2 3 4 5 i (nominal Interest rate) 10% 10% 10% 10% 10% = 𝜋 (inflation) + R (real interest rate) = = = = = 0% 6% 10% 12% -2% + + + + + 10% 4% 0% -2% 12% Fisher’s equation: (i=𝜋+r) https://en.wikipedia.org/wiki/Fisher_equation Pg 127 Problems and applications #11 #9 ( i = 𝜋 + r ) 1970s r = i + 𝜋 “𝜋” was increasing thus “r” was decreasing 𝑌 = 𝐿 𝑂𝑢𝑡𝑝𝑢𝑡 𝐼𝑛𝑝𝑢𝑡 𝐺𝐷𝑃 = ℎ𝑜𝑢𝑟𝑠 𝑜𝑓 𝑙𝑎𝑏𝑜𝑢𝑟 Y = A * 𝑓( 𝐾, 𝐿, 𝐻, 𝑁 ) A: technology K = physical capital eg: equipment, machines, etc The more physical capital you have, the more you can produce (at a rate of diminishing returns) L: labour (brute labour force) H: human capital (entrepreneurs) N: natural resources Y = A * 𝑓( 𝐾, 𝐿, 𝐻, 𝑁 ) 𝑌 y= 𝐿 1) y = 𝑓(𝑘) (lowercase “k”) K y = 𝑓(𝑘) Trade off: Saving vs Consuming To get more physical capital you need more money, but than you need to save more. If you don’t want to save than: FDI or FPI Foreign direct investment (FDI) Foreign Portfolio Investment (FPI) FDI is when foreigners come and build factories FPI is when foreigners buy shares and bonds of Canadian companies To much FDI and FPI means profits (dividends to foreign shareholders as an example) leaving the domestic company Eg: Oil sands primary foreign owners is America who takes profits from the oil sands from Canada Rises at diminishing rate To gain physical capital (factories, equipment, etc) you need funding To gain funding you need to save To save you need to put off consuming To realize the benefits of saving you must save for the long term Output function y = 𝑓(𝑘) K The slope of this function is called MPK (Rises at diminishing rate) MPK = ∆𝑦 ∆𝑘 The more physical capital you accumulate, the returns diminishes 1960 to 1990 Canada was (2.5%) and Korea had (7%) Canada was experiencing diminishing returns, already had many factories and manufacturing plants in the country. it’s easier for South Korea to experience less diminished returns than Canada that already has a large amount of physical capital If you want to grow you must save but it gest to a point where saving no longer givers you gains Developing countries have an easier time raising GDP so it would make sense for investing in them so we should be seeing a flow of capital to these countries however that does not occur because people only want to invest where it is because: 1) Politically unstable 2) Corruption [property rights] 3) Infrastructure 4) Educated work force (L) Funds will not go to any developing country unless these 4 variables are satisfied Japan lacks natural resources yet their GDP grew Japan had these 4 variables (same as Dubai and Singapore) so they were able to grow y = 𝑓(𝑘, ℎ, 𝑛) you need high educated labour force (human capital “h”) you must provide education externalities: eg: smoker, 2nd hand smoking negative effect to bystanders educating citizens make better citizens, they don’t litter, they vote with a conscience, they follow the law. Education costs resources and money. Brain Drain (BD) Eg: Canadian doctors using Canadian tax payers money to receive education and training but than migrating to America for better pay. Education can cause brain drain Education can cause production to go down Human Capital also experiences a diminishing return Increased education allows more equality, similar salary Increased education allows more equity In economics everything has a cost There is no free lunch Increasing education comes at a cost but has its benefits In the states there is a negativity towards government expenditure Natural Resources Eg: Canada, oil sands Is our growth going to stop if we run out of oil? There was a fear about running out of oil. However, growth did not stop for 4 reasons 1) Because of alternative energy 2) Recycling 3) Technology 4) Energy conversation In economics, the Dutch disease is the causal relationship between the increase in the economic development of a specific sector (for example natural resources) and a decline in other sectors (like the manufacturing sector or agriculture). When your economy is too dependent on one resource from a certain sector thus meaning the economy will go up and down developing on the resource. Eg: Alberta is heavily reliant on the oil sands so Alberta’s economy does well relative to the oil sector Y= 𝑓(𝐾, 𝐿, 𝐻, 𝑁) L: Labour As population goes up, labour goes up Malthus: he believed that population would hit a peak and the amount of agriculture would not be able to support and feed the population thus eventually leading to a decline. https://en.wikipedia.org/wiki/An_Essay_on_the_Principle_of_Population Thomas Malthus thought land was limited therefore population can become unsustainable. But that didn’t happen. 𝑦= 𝑌 𝐿 As Y increases and L increases, your productivity goes up. To maintain productivity, your Y must increase more than L does Developing countries experience infertility but needs more people Tax incentives to make children Immigration can help deal with this Doomsday economists during the 1960s and 1970s believed that we would run out of precious metals (alternative sources like plastic and the act of recycling solved this issue) In developing countries, population is too high In developed countries, population is shrinking and needs to keep up in order to maintain productivity To deal with excess population in developing countries, you can solve this issue by: Educating women (the opportunity cost of pursuing education is having children) As population rises, innovation rises. More people means more ideas And institution building (not just population) Innovation is highly influenced by your type of institution 1966 – 1973 1974 – 1982 1983 – 1988 1989 – 1995 1996 – 2000 2001 – 2014 1.8% 0.5% 1.7% 0.9% 2.1% 0.6% page 146 1875 to early 1900s Canada Confederation Canada Pacific Railway Saskatchewan breadbasket of the world High agricultural sector Feeding the world Ukraine’s citizens immigrated during the agricultural boom to Saskatchewan After the boom there was a bust Canada entered a recession Consumers weren’t buying Investors are not investing Americans consume 60% of Canadian goods During the recession, either rely on government expenditures to build roads and bridges, (public infrastructure) or start a war World War 1 happened During recessions, share prices fall thus affecting companies that now have less funding and this will affect their ability to pay back loans to the bank which means the banks are undervaluing CDIC: Canada deposit Insurance corp When people panic and want to withdraw their money from their accounts, the bank won’t be able to give everyone their money. This phenomenon is known as a Bank Run. Canada’s CDIC helps avoid Bank Runs from happening in Canada. Canadians are insured that at least $100,000 of their money in the bank is insured in case of a financial crisis. America experienced bank runs during the great depression 1930s had unemployment at 25% 1 in 4 people were unemployed 25% of the labour force was not working The economists at the time were saying that in the Long run the market will correct itself. They were in the mindset of leaving the market alone to correct itself. But the problem is that we don’t know how long the long run is. John Maynard Keynes famously said at the time, “In the long run we are all dead.” Keynes believed that government intervention was the solution to the great depression. A stimulus plan and government spending would help get the economy recovering. But at the time the government was more interested in balancing the budget. The long run could be 5 to 6 years During the recession, you will need to rely on government expenditure to get money flowing by building bridges, buildings, schools, etc or start a war. World War 1, the government expenditure went up After the war we had another bust cycle 1930s to 1940s the stock market crashed During the second World war in 1942, the Stock Market bull market began. The Dow Jones began rising again in 1942. 1939 World War 2 Canada had the lowest unemployment rate (1939 to 1945 the unemployment rate was around 2%) There will always be unemployment due to mismatch of skills After WW2 we got the baby boomer generation (who fucked everything up for the millennials) The baby boomers were born during the good times and had new innovations 1800s to 1900s, women did chores by hand WW2 woman worked the factories due to lack of men who were off fighting the war Labour force participation went up because women were entering the workforce Technology (washing machines, fridges, etc) allowed household labour to be less time consuming and allowed woman to have more time to work 1973, OPEC, oil prices sky rocketed. Cost of production and transportation went up. During recessions: Prices are low and inventories are full Keynes wanted to use Fiscal Policies to deal with recessions 1973 couldn’t apply Fiscal policies because prices were already too high and was experiencing stagnation Stagnation + Inflation is a hybrid problem for economists. The only solution is to just wait it out. Trudeau 1970s, Canada spent on Social Programs 1980s had a number of recessions (1981, 1989, 1991) The government started buying up debt ($550 billion debt) If the economy is low, spend If the economy is high, save Theoretically over time these two actions should cancel each other out and you should have no debt In reality this approach has not been practiced But we end up buying up debt during both times thus creating larger debt The biggest problem we have is debt 1996: internet was revolutionary because it allowed instantaneous correlations and advancements allowed more efficiencies. Tax spending went down to 10% (the GST also went down 5% under Trudeau) Heritage fund for Alberta: http://www.finance.alberta.ca/business/ahstf/history.html#2008 the Heritage Fund stood at $19.1 billion as of December 31, 2016 the Heritage Fund stood at $17.5 billion as of March 31, 2017 the Heritage Fund stood at $17.2 billion as of June 30, 2017 the fair value of the Heritage Fund stood at $17.1 billion as of September 30, 2017. 2017 the Heritage Fund for Alberta valued at around $17 billion Heritage fund: when Alberta sells oil, it takes the profits and reinvests in mutual funds, pension funds, etc (Invested anywhere). The Alberta Heritage Savings Trust Fund is unique to Alberta. No other province has such a fund. 2007: Subprime mortgage crisis in America caused recession and affected Canada Stock markets correlate with the general economy (usually) Greece 2013, debt led to massive unemployment Any external crisis during a debt issue can lead to economic issues Prime stands for the interest rate given to the best customers Subprime: Investment banks were loaning to people they shouldn’t be loaning too https://en.wikipedia.org/wiki/Government_policies_and_the_subprime_mortgage_crisis “Government housing policies, over-regulation, failed regulation and deregulation have all been claimed as causes of the crisis” George Bush, politicians like to sell 3 things: Food, Clothing, and Shelter During George Bush’s time in office the government wanted to Keep interest rates low Everybody was getting mortgages and spending more than they could afford Real estate was overvalued as they were being bought up by people People were buying multiple mortgages Eventually the market crashed and the property devalued People were in debt while holding useless valued property In America your personal assets are safer than in Canada Obama spent $700 billion of tax payers money to bailout corporations which led to the “Occupy Wall street” movement Asymmetric information There are 3 types of problems due to asymmetric information What is 'Asymmetric Information' Asymmetric information, also known as information failure, occurs when one party to an economic transaction possesses greater material knowledge than the other party. This normally manifests when the seller of a good or service has greater knowledge than the buyer, although the reverse is possible. 1) Adverse selection Solution to adverse selection is screening. You end up collecting something which is bad. People who don’t have the means to pay back will be over represented in the transaction. To fix this you screen the customer which is forcing them to hand in all of their income statements and any relevant information that can help the banks decide whether to give the mortgage or not. Adverse selection occurs before the transaction occurs. 2) Moral Hazard Monitoring/restrictive covenants is the solution to this problem. You undertake riskier activities after the transaction occurs. Closely related to being more reckless in a car that is insured than being more careful when you’re not insured. Restrictive covenants puts restrictions on the borrower. 3) Principle Agent Problem To deal with the principle agent problem, use monitoring. Agents are people who act on behalf of the principal. To solve this, shareholders vote for the had directors that effects CEO behaviour to act in the best interest of the company. Bailing out corporations using tax payers money after the subprime mortgage crisis led to the occupy Wall Street movement Upcoming issue 10 years from now: baby boomer generation is getting older and retiring and there isn’t enough people replacing them in the work force. Canada should have been giving people incentives to have children 10 years ago so that 10 years from now, these kids will be in their 20s. When you’re in school you’re more of a spender, it’s not until you get out of school with a degree and join the work force and get a mortgage and a car, than you will be more of an earner. To solve the issue of the declining baby boomer work population, use immigration to replace the retiring workers. Another upcoming issue 10 years from now in Canada is the environment. Currently the productivity of Canada is 0.6 2017 to 2030 (about over a decade) Another upcoming issue for Canada 10 years from now is the Debt. The biggest economic issue for Canada is it’s debt. There is no easy solution. The financial Markets are where you go for direct borrowing. Financial intermediaries (Banks) lend to smaller businesses and individuals who don’t have the direct access to the financial markets that the institutes have. In the financial markets the companies borrow money directly by issuing bonds and shares to sell to gain more funding. But smaller companies have trouble raising money. They have to go through the bank. Asymmetric information about smaller businesses which puts banks at a disadvantage due to the risk involved. However, the bank can afford the risk. Banks exist to solve the asymmetric problem for smaller businesses and individuals. Long term bonds barely keep up with inflation and can easily end up with negative returns All investors have different views about the markets which effects what they invest in Public companies are owned by the people P/E price to earnings ratio The P/E of Canada is 15 Information comes from the income statement Salves revenue (COGs: Cost of goods sold) EBIT (Earnings before interest) EBT (earnings before taxes) NI (Net Income) Bonds have tax incentives so companies feel inclined to issue them due to the tax benefits The government of Canada is giving companies tax incentive to issue bonds Dividends (Given to shareholders) Retained earnings (dividends are not given out and are instead reinvested in the company) Revenue - (COGs + EBIT + EBT) = Net Income The net income is used to calculate the Price to Earnings Ratio MacEwan University Introduction to Macroeconomics ECON 102 – GS01 Fall 2015 Term Test I (30 marks) Multiple Choice Questions (1 mark each) 1) GDP measures: a. the value of all intermediate goods produced domestically within a given period. b. the value of all goods and services sold in an economy within a given period. c. the value of all final goods and services produced domestically within a given period. d. the government's domestic product. 2) Which one depicts the unit for real wage a. $ / hr b. $ / lb c. kg / hr d. lb / kg 3) Which of the following is included in GDP? a. revenue from the sale of a two-year old car b. the fees charged for a stock broker's services c. the receipts from a sale of land d. the value of lawn care service provided by a sixteen-year-old as part of his weekly chores 4) The expenditure approach to GDP accounting includes: a. dividends and interest. b. investment. c. stock and bond purchases. d. depreciation. 5) Which of the following is not a problem associated with the nominal GDP? a. does not account for volunteer work b. overstates the cost of living c. accounts for the expenditure on fighting fires d. does not take into account equity CPI overstates cost of living and GDP does not have anything to do with cost of living Remember the limitations of the GDP and the CPI Issues with CPI: Substitution effect CPI does not capture how people may buy more of an alternative product The CPI of 2013 to 2014 had gone up but the quality of life did not actually go up The substitution affect on the CPI causes it to be overstated CPI Keeps goods fixed and does not take into consideration that new goods and services are being made 6) Government purchases, under the expenditure approach to GDP accounting, includes all of the following except: a. welfare payments. b. salaries of Senators. c. submarines purchased by the government. d. the civil service payroll. Welfare payments are transfer payments and do not involve anything new being made (nothing is being contributed to the productivity of the economy) 7) The Consumer Price Index (CPI) measures changes in prices of: a. all the goods and services included in the Gross Domestic Product. b. certain important commodities, including wheat, crude oil, and tin. c. certain goods and services purchased for consumption purposes. d. goods produced abroad but sold in Canada. The CPI has to do with the consumer. It focuses on the purchases of consumers. 8) From 1960 -1990 South Korea grew at a higher rate than Canada as a. Canada suffered due to the oil price shock of 1973 b. The marginal product of capital was higher in South Korea c. The Korean war boosted the South Korean economy d. The baby boomers exacted a toll on the budget 9) Which of the following does not explain why natural resources will not inhibit growth a. Technological progress b. Recycling c. Switch to alternate fuels d. Diminishing returns Rate of diminishing returns has nothing to do with why natural resources will inhibit not growth. Natural resources will not inhibit growth because of human innovation in technology, discovering alternative fuels, and thanks to recycling. The one that sticks out as unrelated is option D. 10) The % change in ________________ is the _________________ rate a. CPI, growth b. GDP, inflation c. CPI, inflation d. GDP deflator, growth 11) Which of the following countries is lacking an abundance of natural resources? a. Australia b. Japan c. Brazil d. United States 12) One of the most important determinants of economic growth is: a. the birth rate. b. the rate of infant mortality. c. the savings rate. d. the unemployment rate. Save money in order to fund physical capital to be more productive 13) Which of the following was not one of Malthus’s assumptions? a. the economy was agricultural in nature b. technology would increase with population c. the supply of land was fixed d. human sexual desire worked to increase population 14) During deflation the nominal interest rate is ________________ the real interest rate a. Higher than b. Lower than c. Equal to d. greater than or equal to Fisher’s equation: ( i = 𝜋 + r ) r = i - 𝜋 As 𝝅 (inflation, nominal interest rate) decreases interest rate (r) increases Deflation = nominal interest rate (current price, deflation) < real interest rate (actual interest rate, money supply is shrinking so every dollar has more value hence making your real interest rate worth more) 15) Identify the incorrect equation for the base year a. Nominal GDP = Real GDP b. [Nominal GDP / Real GDP] * 100 = 100 c. CPI = GDP Deflator d. Real GDP = GDP Deflator Basically saying that quantity equals price which makes no sense 16) Which year is not associated with recession a. b. c. d. 1929 1942 1973 1981 1942 the economy is booming 17) Screening is the solution for a. Moral hazard b. Asymmetric information c. Adverse selection d. Principal agent problem 18) To convert a nominal variable to a real variable, the nominal variable must be ____________ the price index a. Added to b. Subtracted from c. Multiplied by d. Divided by 19) If the nominal interest rate was 12 percent and the inflation rate was 10 percent in 1980, while the nominal interest rate was 7 percent and the inflation rate was 2 percent in 2001, then a. real rates were higher in 2001. b. real rates were higher in 1980. c. credit was more expensive in 1980. d. credit was cheaper in 2001 because the nominal rate was lower. 20) The subprime mortgage crisis is not explained through a. Asymmetric information b. adverse selection c. moral hazard d. liberalizing markets Short Questions (5 marks each) 1) You are given a choice between $1000 today or $1464 four years from today. Given that the annual interest rate is 10%, then showing your calculations, which one will you prefer? 1000*(1.10^4)= 1464.10 1464.1 > 1464 The $1000 now in order to rely on annual interest rate to return a value 10 cents more than $1464 2) The price and quantities consumed of three items in 1996 and 2002 are given in the following table. Assume 1996 as the base year. Determine the GDP deflator for 1996 and 2002. 1996 2002 GDP Deflator Items p q q p q bread 1 20 10 2 10 butter 2 20 10 3 10 sugar 4 10 10 4 10 NGDP = Pcurrent X Qcurrent RGDP = P1996 X Qcurrent 𝑁𝐺𝐷𝑃 𝑅𝐺𝐷𝑃 = GDP Deflator Nominal: 2 x 10 = 20 3 X 10 = 30 Nominal = 20 + 30 + 40 = 90 4 X 10 = 40 Real: 1 X 10 = 10 2 X 10 = 20 Real = 10 + 20 + 40 = 70 4 X 10 = 40 𝑁𝐺𝐷𝑃 𝑅𝐺𝐷𝑃 90 = 70 = 1.28 Thus GDP deflator is 1.28 Stagflation is synonym for recession, a hybrid form of it. No one’s buying and prices are high despite being in a recession so the government can’t spend to solve the issue. You’re just going to have to wait it out. Inflation and Recession are occurring at the same time. A regular recession can be solved by spending when prices are low. Focus on the expenditure approach and product approach of GDP