Economics for South African students 5th edition Philip Mohr and associates

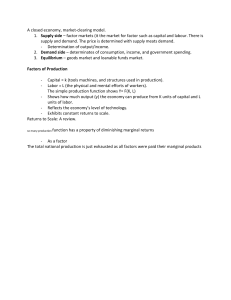

advertisement