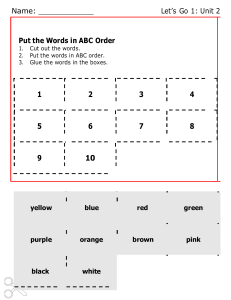

MCFM Control & Performance Management Sessions 2+3 Lecture Materials Winter 2024 HRA Reporting for Control & Performance Management Sessions 2+3 Table of Contents Material 1: Lecture (Sessions 2+3) on “Cost Analysis & Budgeting Process” (Page 3) Material 2: Exercises, Problems and Mini-Quiz (Page 37) Material 3: (Page 49) Maria Joao Martins Ferreira Major (2012), Management Accounting Change in the Portuguese Telecommunications Industry, Journal of Management and Business Studies, Vol. 14(4) pp. 115-125, May 2012. CFM_RC&PM Lecture – Sessions 2+3 – Winter 2024 MCFM Control & Performance Management Sessions 2 + 3 WINTER 2024 HRA 1 Sessions 2+3 Outline • Discuss about costs classification and performance measures of the production process; • Discuss about management accounting applications and the concept of break-even in business planning; • Examine the objectives and role of planning, management control and performance analysis; • Discuss about budget preparation and practices for decision making; Explain how standard costs are developed; MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 2 2 SKM_BS (W2024) 3 sur 59 1 Part 1 Cost analysis & Decision Making: Performance Measures 3 Reminder: Building Blocks of Managerial Accounting • Have an efficient Cost Management Systems, • Assist in Preparation of financial statements, • Clear Identification of costs nature and costs behavior MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 4 4 SKM_BS (W2024) 4 sur 59 2 Cost Accounting & Decision Making ü To control costs ü To measure and improve productivity ü To devise improved production process ü To decide on new products ü To decide on obsolete products ü To decide on prices ü To respond to rival products (Johnson and Kaplan, 1987) MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 5 5 Section 1 Costs Classifications 6 SKM_BS (W2024) 5 sur 59 3 Classifications of Costs Manufacturing costs are often classified as follows: Direct Material Direct Labour Manufacturing Overhead Prime Cost MCFM - Winter 2024 Conversion Cost Sessions 2 +3: Cost Analysis & Budgeting Process 7 7 Manufacturing Overhead Manufacturing Overhead includes all costs of manufacturing except direct material and direct labour. Examples: Indirect materials and indirect labour Materials used to support the production process. Examples: lubricants and cleaning supplies used in the automobile assembly plant. MCFM - Winter 2024 Wages paid to employees who are not directly involved in production work. Examples: maintenance workers, janitors and security guards. Sessions 2 +3: Cost Analysis & Budgeting Process 8 8 SKM_BS (W2024) 6 sur 59 4 Relationship between Direct & Indirect Costs Fair share of indirect cost (overheads) Direct cost of the unit Full cost of the unit 9 Sessions 2 +3: Cost Analysis & Budgeting Process MCFM - Winter 2024 9 Methods of Overheads Allocation • Variable costing – product cost includes variable production costs – all fixed costs treated as period costs • Absorption costing (traditional method) – all (fixed and variable) production costs are charged to cost centers and then to product/services using an allocation base that reflects activity, e.g. labor hours • Activity-based costing (ABC method) – uses cost pools to accumulate the cost of significant business processes or activities and then assigns the costs from the cost pools to products based on cost drivers, which measure each product/ service’s demand for activities MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 10 10 SKM_BS (W2024) 7 sur 59 5 Traditional (Full) Costing System Direct Material Resource Direct Labor Resource Direct Trace Direct Trace All Indirect Resources Cost Driver Products MCFM - Winter 2024 All Unallocated Costs Unallocated Sessions 2 +3: Cost Analysis & Budgeting Process 11 11 A two-stage Allocation Process (traditional costing system) MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 12 12 SKM_BS (W2024) 8 sur 59 6 The ABC Approach § “Sophisticated” application of Full (Traditional) Costing Method, the ABC method is considered to improve managerial accounting information § Expenses are caused by activities (including overheads). § The system accumulates overhead costs for each activity, then assigns the costs of activities to the products or cost objects that require that activity. § A COST DRIVER for each activity! COST DRIVER : Any output measure that causes costs (that causes the use of costly resources). MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 13 13 The 2-Stage allocation process (ABC System) MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 14 14 SKM_BS (W2024) 9 sur 59 7 2-Stage Activity-Based Cost System Direct Materials Direct Labor Shipping Costs Overhead Costs First-Stage Allocation Order Size Customer Orders Product Design Customer Relations Other Cost Objects: Products, Customer Orders, Customers 15 Sessions 2 +3: Cost Analysis & Budgeting Process MCFM - Winter 2024 15 2-Stage Activity-Based Cost System Direct Materials Direct Labor Shipping Costs Overhead Costs First-Stage Allocation Customer Orders Product Design Order Size Customer Relations Other Second-Stage Allocations $/Order $/Design $/MH $/Customer Cost Objects: Products, Customer Orders, Customers MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process Unallocated 16 16 SKM_BS (W2024) 10 sur 59 8 How Costs are Treated Under Activity–Based Costing An event that causes the consumption of overhead resources. Activity Activity Cost Pool $$ $ $ $ $ A “cost bucket” in which costs related to a particular activity measure are accumulated. Sessions 2 +3: Cost Analysis & Budgeting Process MCFM - Winter 2024 17 17 How Costs are Treated Under Activity–Based Costing (2) The term cost driver is also used to refer to an activity measure. Activity Measure An allocation base in an activity-based costing system. MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 18 18 SKM_BS (W2024) 11 sur 59 9 Benefits of ABC • Provide more accurate costing – Less likely to under-cost / over-cost due to cost drive usage • May lead to improvements in cost control – Costs divided into a number of activities as compared to two overhead cost pools MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 19 19 Recap: Cost Classifications for Predicting Cost Behaviour How a cost will react to changes in the level of activity within the relevant range. – Total variable costs change when activity changes. – Total fixed costs remain unchanged when activity changes. MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 20 20 SKM_BS (W2024) 12 sur 59 10 Recap: Understanding Cost Behavior Summary of Variable and Fixed Cost Behaviour Cost In Total Per Unit Variable Total variable cost is proportional to the activity level within the relevant range. Variable cost per unit remains the same over wide ranges of activity. Total fixed cost remains the same even when the activity level changes within the relevant range. Fixed cost per unit goes down as activity level goes up. Fixed MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 21 21 Relationship between Direct, Indirect, Variable and Fixed Costs of a Product Cost Fixed cost Indirect cost (overheads) Direct cost MCFM - Winter 2024 Variable cost Total (or full) cost of a particular job or product cost Sessions 2 +3: Cost Analysis & Budgeting Process 22 22 SKM_BS (W2024) 13 sur 59 11 Recap: Manufacturing Cost Flows MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 23 23 SUMMARY OF COST CLASSIFICATIONS Purpose of Cost Classification Cost Classifications Preparing external financial statements • Product costs (inventoriable) • Direct materials • Direct labour • Manufacturing overhead • Period costs (expensed) • Non-manufacturing costs • Marketing or selling costs • Administrative costs Predicting cost behavior in response to changes in activity • Variable cost (proportional to activity) • Fixed cost (constant in total) Assigning costs to cost objects such as departments or products • Direct cost (can easily be traced) • Indirect cost (cannot easily be traced; must be allocated) Making decisions • Differential cost (differs between alternatives) • Sunk cost (past cost not affected by a decision) • Opportunity cost (forgone benefit) MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 24 24 SKM_BS (W2024) 14 sur 59 12 Section 2: Cost Accounting – A Managerial Approach 25 Cost Accounting & Decision-Making • How management accounting could contribute to decisionmaking? – Cost behaviour analysis, – CVP (Cost-Volume-Profit) analysis, • Contribution, breakeven & margin of safety calculations, operating leverage – Alternative approaches to pricing • Cost-plus, target rate of return, optimum selling price, special pricing decisions, transfer pricing – Segmental profitability (profit contribution), similar to IFRS 8 approach. • Avoidable & unavoidable costs MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 26 26 SKM_BS (W2024) 15 sur 59 13 Cost-Volume-Profit Relationship Interactions • Cost-volume-profit (CVP) analysis is a powerful tool that managers use to help them understand the interrelationship among cost, volume and profit in an organization by focusing on interactions among the following five elements: 1.prices of products 2.volume or level of activity 3.per unit variable costs 4.total fixed costs 5.mix of products sold MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 27 27 Graph of total cost against the volume of activity Cost (€) Total cost Variable costs F Fixed costs 0 MCFM - Winter 2024 Volume of activity (units of output) Sessions 2 +3: Cost Analysis & Budgeting Process 28 28 SKM_BS (W2024) 16 sur 59 14 Break-Even Analysis • Break-even analysis is an aspect of CVP analysis that is designed to answer questions such as how far sales could drop before the company begins to lose money. MCFM - Winter 2024 29 Sessions 2 +3: Cost Analysis & Budgeting Process 29 Break-even chart Revenue/Cost (€) Total sales revenue Break even point Pro fit Total cost Variable costs F Lo ss Fixed costs 0 MCFM - Winter 2024 Volume of activity (units of output) Sessions 2 +3: Cost Analysis & Budgeting Process 30 30 SKM_BS (W2024) 17 sur 59 15 Contribution Margin Analysis The contribution income statement is helpful to managers in judging the impact on profits of changes in selling price, cost, or volume. The emphasis is on cost behaviour. Example Company Contribution Income Statement For the Month of June Sales (500 units) $ Less: Variable expenses Contribution margin Less: Fixed expenses Net operating income $ 250,000 150,000 100,000 80,000 20,000 Contribution Margin (CM) is the amount remaining from sales revenue after variable expenses have been deducted. MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 31 31 CM Ratio Assessment • The contribution margin ratio is determine as follow: CM Ratio = Total CM Total sales • Or, in terms of units, the contribution margin ratio is: CM Ratio = MCFM - Winter 2024 Unit CM Unit selling price Sessions 2 +3: Cost Analysis & Budgeting Process 32 32 SKM_BS (W2024) 18 sur 59 16 Break-Even Analysis The contribution format income statement can be stated in equation form: Profits = (Sales – Variable expenses) – Fixed expenses OR Profits = [P x Q] – [V x Q] - Fixed expenses Where P = selling price per unit, Q = number of units sold; and VC = variable costs per unit. MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 33 33 Break-Even Analysis Profits = [P x Q] – [V x Q] - Fixed expenses We can simplify the above formula: Profits = [CM x Q] – Fixed expenses The Break-even point is when profits are zero, therefore the equation becomes: Break-even point in units sold = MCFM - Winter 2024 Fixed expenses Unit CM Sessions 2 +3: Cost Analysis & Budgeting Process 34 34 SKM_BS (W2024) 19 sur 59 17 Break-Even Analysis Break-even point in units sold = Fixed expenses Unit CM A variation of the break-even formula using the CM ratio instead of the unit CM is shown below. The result using this formula is the break-even in total sales dollars rather than in total units sold: Break-even point in = Total sales dollars Fixed expenses CM ratio 35 Sessions 2 +3: Cost Analysis & Budgeting Process MCFM - Winter 2024 35 Break-Even Analysis • Here is the information from Example Company: Sales (500 units) Less: variable expenses Contribution margin Less: fixed expenses Net operating income MCFM - Winter 2024 Total $ 250,000 150,000 $ 100,000 80,000 $ 20,000 Per Unit $ 500 300 $ 200 Sessions 2 +3: Cost Analysis & Budgeting Process Percent 100% 60% 40% 36 36 SKM_BS (W2024) 20 sur 59 18 Break-Even Analysis We calculate the break-even point as follows: Break-even point in units sold = Fixed expenses Unit CM = $80,000 / 200 = 400 units Break-even point in total sales dollars MCFM - Winter 2024 = Fixed expenses CM ratio = $80,000 / 40% = $200,000 Sessions 2 +3: Cost Analysis & Budgeting Process 37 37 Target Operating Profit Analysis • CVP formulas can also be used to determine the sales volume needed to achieve a target operating profit. • Suppose Example Company wants to know how many units must be sold to earn a profit of $100,000. MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 38 38 SKM_BS (W2024) 21 sur 59 19 Target Operating Profit Analysis Units sold to attain Fixed expenses + Target operating profit = the target profit Unit contribution margin $80,000 + $100,000 = 900 units $200/unit MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 39 39 The Margin of Safety The margin of safety is the excess of budgeted (or actual) sales over the break-even volume of sales. Margin of safety = Total sales – Break-even sales Margin of safety percentage = Margin of safety in $ Total budgeted (or actual) sales MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 40 40 SKM_BS (W2024) 22 sur 59 20 Weaknesses of Breakeven Analysis Three general problems Non-linear relationships Stepped fixed costs Multi-product businesses MCFM - Winter 2024 41 Sessions 2 +3: Cost Analysis & Budgeting Process 41 Operating Leverage A measure of how sensitive net operating income is to percentage changes in sales. Degree of = operating leverage Contribution margin Operating income % change in = operating income Degree of Op. Leverage x % change in sales MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 42 42 SKM_BS (W2024) 23 sur 59 21 Operating Leverage Example Company, the degree of operating leverage is 5: Sales Less: variable expenses Contribution margin Less: fixed expenses Net income $100,000 $20,000 MCFM - Winter 2024 Actual sales 500 Units $ 250,000 150,000 100,000 80,000 $ 20,000 = 5 43 Sessions 2 +3: Cost Analysis & Budgeting Process 43 Operating Leverage (cont’d) With an operating leverage of 5, if sales are increased by 10%, net operating income would increase by 50%. Percent increase in sales Degree of operating leverage Percent increase in profits × 10% 5 50% Here’s the verification! MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 44 44 SKM_BS (W2024) 24 sur 59 22 Operating Leverage (cont’d) Sales Less variable expenses Contribution margin Less fixed expenses Net operating income Actual sales $ 250,000 150,000 100,000 80,000 $ 20,000 Increased sales (550) $ 275,000 165,000 110,000 80,000 $ 30,000 10% increase in sales from $250,000 to $275,000 . . . . . . results in a 50% increase in income from $20,000 to $30,000. MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 45 45 Cost Structure and Profit Stability: Marginal Analysis § Cost structure refers to the relative proportion of fixed and variable costs in an organization. § Managers often have some latitude in determining their organization’s cost structure (i.e. avoidable vs. unavoidable costs). MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 46 46 SKM_BS (W2024) 25 sur 59 23 Conclusion on Marginal Analysis May be used in four key areas of decision making: 1 2 3 4 MCFM - Winter 2024 Accepting/rejecting special contracts Determining the most efficient use of scarce resources Make-or-buy decisions Closing or continuation decisions Sessions 2 +3: Cost Analysis & Budgeting Process 47 47 Part 2 Planning, Budgeting & Management Control 48 SKM_BS (W2024) 26 sur 59 24 What is a Management Control System? • A management control system is a logical integration of management accounting tools to gather and report data and to evaluate and analyze performance Purposes of a management control system: • Management control system gathers and reports information on performance at different levels: • • • • Total-organisation level Customer/market level Individual-facility level Individual-activity level. MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 49 49 Planning, Control & Performance Analysis • Planning and budgeting processes involve formal reviews of plans and include the actions that are felt to be good for the organization to take — action controls • Planning and budgeting processes serve to get information needed for decision making to the right managers — personnel controls • Budgeting involves setting targets which are often used later as standards against which to evaluate performance — results controls MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 50 50 SKM_BS (W2024) 27 sur 59 25 Advantages of Planning & Budgeting Define goal and objectives Communicate plans Think about and plan for the future Advantages Coordinate activities Means of allocating resources Uncover potential bottlenecks MCFM - Winter 51 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 51 The Role of Budgets and Budgeting • A budget is a quantitative expression of the planned money inflows and outflows that reveal whether a financial plan will meet organizational objectives, • Budgeting is the process of preparing budgets, • Budget provides a way to communicate the organization’s short-term goals to its employees, MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 52 52 SKM_BS (W2024) 28 sur 59 26 The Role of Budgets and Budgeting (2) • Budgeting the activities of each unit can: – Reflect how well unit managers understand organization’s goals, – Provide an opportunity for the organization’s senior planners to correct misperceptions about organization’s goals, • Budgeting also serves to coordinate the many activities of an organization MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 53 53 The Role of Budgets and Budgeting (3) • Budgets help to anticipate potential problems, such as: – Borrowing needs as the budget reflects the cash cycle and provides information to anticipate cash shortages, – If budget planning indicates that organization’s sales potential exceeds it manufacturing potentials, then the organization can develop a plan to put more capacity in place or to reduce planned sales. MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 54 54 SKM_BS (W2024) 29 sur 59 27 The Elements of Budgeting • Budgeting involves forecasting the demand for three types of key resources: – Resources that create variable costs, – Resources (short and long-term) that create fixed costs, – Resources that enhance the potential of the organization’s strategy. MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 55 55 Stages in the Budgeting Process 1.Communicate details of budget policy and guidelines to those people responsible for preparing the budget. 2. Determine the factor that restricts output. 3. Preparation (forecasting) of the sales budget. 4. Initial preparation of budgets. 5. Negotiation of budgets with higher management. 6. Co-ordination and review of budgets. 7. Final acceptance of budgets. 8. Ongoing review of the budgets. MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 56 56 SKM_BS (W2024) 30 sur 59 28 Sales Budgeting Principles • Proper accounting system to measure performance product-wise, territory-wise, customer-wise and sales person-wise, • Ensure planning premises or assumptions are made based on accurate information obtained from dependable sources, • Sales forecasts should be reliable. MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 57 57 Sales Budgeting Approach • By and large, budgets are prepared for a period of one year. In some companies, budgets are prepared for longer periods e.g. 5 years or more, • Basically, sales budget consists of forecasts of sales volume and profit, • From sales volume we derive sales revenue, and we estimate net (sales) profit by reducing sales expenses from sales revenue, • Thus, sales budget mainly consists of sales volume section and sales expenses section. MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 58 58 SKM_BS (W2024) 31 sur 59 29 Method of Estimating Sales Expenses • Deciding how much to spend on field sales activities is one of the most difficult task in saes budget, • Following methods are commonly used: – Historical data, – Percentage of sales method, – The work load method, or – Standard costs method. MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 59 59 Planning and Budgeting Tools • Standard Cost: – Measures total costs (by nature) to produce a product or service under anticipated conditions, – Often refers to the cost of a single unit. • Budgeted Cost: – The cost, at standard cost, of the total number of planned (budgeted) units. MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 60 60 SKM_BS (W2024) 32 sur 59 30 Budget is a Plan • Budget is a the financial plan of sales activities which are estimated in terms of quantity and value, • Once the sales budget is approved, it is left to the sales department persons to implement their plan, within the time frame and cost frame envisaged, • Thus, sales budget serves as a “standard” or “quota” of the various activities of the organization, the next logical step to planning and budgeting. MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 61 61 Planning & Budgeting Analysis • Prepare a static budget, or a Master Budget, a budget based on the level of output planned at the start of the budget period, • Develop a flexible budget using budgeted revenues or cost amounts based on the level of output actually achieved, • Compute the difference and measure how the difference in level of activity (actual vs. Forecast) affected your planning process. MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 62 62 SKM_BS (W2024) 33 sur 59 31 Master Budget Summarized A combination of all the budgets of an organisation. All the budgets in a master budget link back to the assumptions made about the quantity and value of sales incorporated in the sales budget. Therefore, it’s very important to get these assumptions right. MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 63 63 The Master Budget: An Overview Ending Finished Goods Budget Direct Materials Budget Sales Budget Production Budget Selling and Administrative Budget Direct Labor Budget Manufacturing Overhead Budget Cash Budget Budgeted Financial Statements MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 64 64 SKM_BS (W2024) 34 sur 59 32 Functional Budgets MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 65 65 Budgeted Income Statement using IFRS format, or not? MERCHANDISING PROFESSIONAL SERVICES* Budgeted Income Statement Fees income Sales Purchases >> COGS Professional and support labour costs e.g. lawyer + legal assistant Marketing expenses Admin. expenses Financial expenses Marketing expenses Admin. expenses Financial expenses Cash budget * sell expertise and knowledge MCFM - Winter 2024 MANUFACTURING Sales Production + Ending Inventories * direct materials (usage + purchases) * direct labour * factory overhead >> COGS Marketing expenses Admin. expenses Financial expenses Capital expenditure budget Budgeted balance sheet Sessions 2 +3: Cost Analysis & Budgeting Process 66 66 SKM_BS (W2024) 35 sur 59 33 Main Criticisms of Budgeting 1. Encourages rigid planning and incremental thinking; 2. Very time-consuming; commits the company to a 12 month commitment, which can be risky if budgets are based on uncertain forecasts; 3. Represents a yearly rigid ritual; produce inadequate variance reports leaving the ‘how’ and ‘why’ questions unanswered; 4. Encourages spending what is in the budget even if this is not necessary in order to guard against next year’s budget being reduced; 5. Focus on achieving the budget even if this results in undesirable actions. MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 67 67 Any Questions? MCFM - Winter 2024 Sessions 2 +3: Cost Analysis & Budgeting Process 68 68 SKM_BS (W2024) 36 sur 59 34 MCFM FINANCIAL CONTROL & PERFORMANCE MANAGEMENT SESSIONS 2+3 EXERCISES & PROBLEMS WINTER 2024 Part I: Costs Analysis & Performance Measures SECTION I: Cost-Volume-Profit Analysis Exercise 1. 1: Cost of Production, Cost per Unit Denver City Manufacturing currently produces 2,000 glasses per month. The following per unit data apply for sales to regular customers and is based on 1,000 units produced. Direct materials Direct manufacturing labor Variable manufacturing overhead Fixed manufacturing overhead Total manufacturing costs $200 40 70 50 $360 The plant has capacity for 3,000 glasses. Plant supervisor's salary is $15,000. Required: a. What is the total cost of producing 2,000 glasses? b. What is the total cost of producing 1,600 glasses? c. What is the per unit cost when producing 1,600 glasses? Exercise 1. 2: Contribution Margin Arthur's Plumbing reported the following: Revenues Variable manufacturing costs Variable nonmanufacturing costs Fixed manufacturing costs Fixed nonmanufacturing costs $4,500 $ 900 $ 810 $ 630 $ 545 Required: a. b. c. d. e. Compute contribution margin. Compute contribution margin percentage. Compute gross margin. Compute gross margin percentage. Compute operating income. SKM_CPM (Sessions 1+2) – QUESTIONS of Exercises & Problems (Winter 2023) 37 sur 59 1 of 11 Exercise 1. 3: Contribution Margin, Breakeven Point Anglico's most recent income statement is given below. Sales (8,000 units) $160,000 Less variable expenses (68,000) Contribution margin 92,000 Less fixed expenses (50,000) Net income $42,000 Required: a. b. c. d. e. f. g. Contribution margin per unit is If sales are doubled total variable costs will equal If sales are doubled total fixed costs will equal If 20 more units are sold, profits will increase by Compute how many units must be sold to break even Compute how many units must be sold to achieve operating income of $60,000 Compute the revenue needed to achieve an after tax income of $30,000 given a tax rate of 30% $ ________ per unit $ ________ $ ________ $ ________ # ________ # ________ $ ________ Exercise 1. 4: Breakeven Point, Operating Income In 2017, Craylon Company has sales of $1,000,000, variable costs of $250,000, and fixed costs of $200,000. In 2018, the company expects annual property taxes to decrease by $15,000. Required: a. Calculate operating income and the breakeven point for 2017. b. Calculate the breakeven point for 2018. Exercise 1. 5: Breakeven Point, Margin of Safety Furniture, Inc., sells lamps for $30. The unit variable cost per lamp is $22. Fixed costs total $9,600. Required: a. b. c. d. What is the contribution margin per lamp? What is the breakeven point in lamps? How many lamps must be sold to earn a pretax income of $8,000? What is the margin of safety, assuming 1,500 lamps are sold? Exercise 1.6: CVP Analysis Ben’s Bikes sells two mountain bikes for every four street bikes. The mountain bike sells for $2,000 and has variable costs of $1,250. The street bike sells for $500 and has variable costs of $200. If Ben’s Bikes fixed costs total $1,620,000, how many bikes must be sold in order for the company to break even? How many of these bikes will be mountain bikes and how many will be the street bikes? SKM_CPM (Sessions 1+2) – QUESTIONS of Exercises & Problems (Winter 2023) 38 sur 59 2 of 11 Exercise 1. 7: Breakeven Point Projections Dental Comfort Services provides dental cleanings to its patients. The selling price of a cleaning is $150 and the variable costs associated are $85. The monthly relevant fixed costs are $10,000. Required: a. b. c. d. What is the breakeven point in cleanings? What is the margin of safety in dollars, assuming sales total $30,000? What is the breakeven level in cleanings, assuming variable costs decrease by 20%? What is the breakeven level in dollars, assuming the selling price goes down by 10% and fixed costs increase $1,000 per month? Exercise 1.8: Contribution margin, break-even and target profit analysis Last month’s contribution income statement for Nord Corporation, a manufacturer of exercise bicycles, follows: Sales (500 bikes) ............................ Variable expenses .......................... Contribution margin ......................... Fixed expenses ............................... Net operating income ...................... Total $250,000 150,000 100,000 80,000 $ 20,000 Per Unit $500 300 $200 Required: 1. Compute the contribution margin and the net operating income for monthly sales of 1; 2; 400; and 401 bikes. 2. Compute the contribution margin ratio (500 bikes). Assume that Nord Corporation’s sales increase by $150,000 next month. What will be the effect on (1) the contribution margin and (2) net operating income? 3. Compute the break-even point in quantity and in sales using the equation method 4. Target profit analysis. Assume that Nord Corporation’s target profit is $70,000 per month. How many exercise bikes must it sell to reach this goal? Exercise 1.9: Margin of safety and operating leverage concepts Companies A & B manufacture basketballs. However, the structure of their costs is substantially different: Sales ........................................................... Variable expenses....................................... Contribution margin ..................................... Fixed expenses ........................................... Net operating income .................................. Company A $500,000 100% 350,000 70% 150,000 30% 90,000 $ 60,000 Company B $500,000 100% 100,000 20% 400,000 80% 340,000 $ 60,000 Required: 1. The margin of safety represents the excess of budgeted (or actual) sales over the break-even sales. The margin of safety can be expressed either in dollar or in percentage form. Compare the break-even point (in $ sales) and the margin of safety (in $ sales and in percentage) of these 2 companies. SKM_CPM (Sessions 1+2) – QUESTIONS of Exercises & Problems (Winter 2023) 39 sur 59 3 of 11 2. Operating leverage measures how a given percentage change in sales affects net operating income. Compute the degree of operating leverage (CM / net income) of both companies. Assume that both company A and company B experience a 10% increase in sales, how will it affect the net operating income and the degree of operating leverage? Exercise 1.10: Multiple products break-even analysis A company has multiple products, X & Y. The overall contribution margin (CM) ratio is usually used in breakeven analysis: Product X Sales .............................................. $100,000 100% Variable expenses .........................70,000 70% Contribution margin ....................... $ 30,000 30% Fixed expenses.............................. Net operating income..................... Product Y $300,000 100% 120,000 40% $180,000 60% Total $400,000 100.0% 190,000 47.5% 210,000 52.5% 141,750 $ 68,250 Required: 1. Compute the overall contribution margin ratio and the break-even in $ sales. 2. Assume that total sales remain unchanged at $400,000. However, the sales mix shifts so that more of Product X ($300,000) is sold than of Product Y ($100,000). Compute the new overall contribution margin ratio and the new break-even in $ sales. Exercise 1.11: Fixed vs. variable cost of production The Saari Dress Co. has the following behaviour patterns: Production range in units Fixed costs (in €) 0 – 5,000 150,000 5,001 – 10,000 220,000 10,001 – 15,000 250,000 15,001 – 20,000 270,000 Maximum production capacity is 20,000 dresses per year. Variable costs per unit are 30€ at all production levels. Required: Each situation described below is to be considered independently. a. Production and sales are expected to be 11,000 dresses for the year. The sales price is 50€ per dress. How many additional dresses need to be sold, in an unrelated market, at 40€ per dress to show a total overall operating income of 9,000€ for the year? b. The company has orders for 23,000 dresses at 50€. It desires to make a minimum overall operating income of 145,000€ on these 23,000 dresses. What unit purchase price is the company willing to pay a subcontractor for the 3,000 dresses it cannot manufacture itself? Assume that the subcontractor would bear all costs: manufacturing, delivery, etc. However, the customers would pay Saari directly. (Hint: compute first the operating income for the 20,000 dresses Saari manufactures itself). SKM_CPM (Sessions 1+2) – QUESTIONS of Exercises & Problems (Winter 2023) 40 sur 59 4 of 11 SECTION II: Cost Analysis and Decision Making Exercise 2.1: Product and Customer Profitability Analysis Updraft Systems, Inc. makes paragliders for sale through specialty sporting goods stores. The company has a standard paraglider model, but also makes custom-designed paragliders. Management has designed an activity-based costing system with the following activity cost pools and activity rates: Management would like an analysis of the profitability of a particular customer, Eagle Wings, which has ordered the following products over the last 12 months: The company's direct labor rate is $19 per hour. Required: Using the company's activity-based costing system, compute the customer margin of Eagle Wings. MCFM_FC&PM (Sessions 2+3) – QUESTIONS of Exercises & Problems (W2024) 41 sur 59 5 - 11 Exercise 2.2: Product profitability using traditional vs. ABC costing method Islands Industries Ltd makes three products: Mykos, Kanos and Helios. The budget prepared for the next year includes the following information: Table 1: Budget information Mykos 50,000 45 32 2 7 Sales and production (units) Selling price (€ per unit) Direct labour and materials (€ per unit) Machine hours per unit in machining dept Direct labour hours per unit in assembly dept Kanos 40,000 95 84 5 3 Helios 30,000 73 65 4 2 Overheads allocated and apportioned to production departments (including service cost centres) were to be recovered in product costs as follows: Machining department at €1.20 per machine hour, Assembly department at €0.825 direct labour hour. However, you have determined that the overheads could be reanalyzed into cost pools, as in Table 2. Table 2: Activity cost pools and drivers Cost Pools Machining services Assembly services Set-up costs Order processing Purchasing € Cost 357,000 318,000 26,000 156,000 84,000 Cost Drivers Machine hours Direct labour hours Set-ups Customer orders Supplier orders Quantity 420,000 530,000 520 32,000 11,200 You have also been provided with the estimates for the period, as in the following Table 3. Table 3: Estimates Number of set-ups Customers orders Supplier orders Mykos 120 8,000 3,000 Kanos 200 8,000 4,000 Helios 200 16,000 4,200 Required: 1. Prepare and present a profit calculation showing the profitability of each product using traditional absorption costing, 2. Prepare and present a profit calculation showing the profitability of each product using activity-based costing, 3. Explain the differences between the product profitability using absorption and activity-based costing. MCFM_FC&PM (Sessions 2+3) – QUESTIONS of Exercises & Problems (W2024) 42 sur 59 6 - 11 Exercise 2.3: Customer profitability distribution “Figure Four Ltd” is a distributor of pharmaceutical products. Its ABC system has five activities: 1 2 3 4 5 Activity Area Cost Driver Rate in 2012 Order processing Line-item ordering Store deliveries Carton deliveries Shelf-stocking $40 per order $3 per line item $50 per store delivery $1 per carton $16 per stocking-hour Rick Flair, the controller of Figure Four, wants to use this ABC system to examine individual customer profitability within each distribution market. He focuses first on the Ma-and-Pa single-store distribution market. Two customers are used to exemplify the insights available with the ABC approach. Data pertaining to these two customers in August 2012 are as follows: Total orders Average line items per order Total store deliveries Average cartons shipped per store delivery Average hours of shelf-stoking per store delivery Average revenue per delivery Average cost of goods sold per delivery Charleston Pharmacy 13 9 7 22 0 $2,400 $2,100 Chapel Hill Pharmacy 10 18 10 20 0.5 $1,800 $1,650 Required: 1. Use the ABC information to compute the operating income of each customer in August 2012. Comment on the results and what, if anything, Flair should do. 2. Flair ranks the individual customers in the Ma-and-Pa single-store distribution market on the basis of monthly operating income. The cumulative operating income of the top 20% of customers is $55,650. Figure Four reports operating losses of $21,247 for the bottom 40% of its customers. Make four recommendations that you think Figure Four should consider in light of this new customer profitability information. MCFM_FC&PM (Sessions 2+3) – QUESTIONS of Exercises & Problems (W2024) 43 sur 59 7 - 11 Part II: Planning & Budgeting EXERCISE 1: Sales Budget In 2022, Rouse & Sons, a small environmental-testing firm, performed 12,200 radon tests for $290 each and 16,400 lead tests for $240 each. Because newer homes are being built with lead-free pipes, lead-testing volume is expected to decrease by 10% next year. However, awareness of radon-related health hazards is expected to result in a 6% increase in radon-test volume each year in the near future. Jim Rouse feels that if he lowers his price for lead testing to $230 per test, he will have to face only a 7% decline in lead-test sales in 2023. Required: 1. Prepare a 2023 sales budget for Rouse & Sons assuming that Rouse holds prices at 2022 levels. 2. Prepare a 2023 sales budget for Rouse & Sons assuming that Rouse lowers the price of a lead test to $230. Should Rouse lower the price of a lead test in 2023 if the company’s goal is to maximize sales revenue? EXERCISE 2: Budget of Production The Howell Company has prepared a sales budget of 43,000 finished units for a 3-month period. The company has an inventory of 11,000 units of finished goods on hand at December 31 and has a target finished goods inventory of 19,000 units at the end of the succeeding quarter. It takes 4 gallons of direct materials to make one unit of finished product. The company has an inventory of 66,000 gallons of direct materials at December 31 and has a target ending inventory of 56,000 gallons at the end of the succeeding quarter. How many gallons of direct materials should Howell Company purchase during the 3 months ending March 31? Exercise 3: Job Costing & budgeted manufacturing overhead The Dougherty Furniture Company manufactures tables. In March, the two production departments had budgeted allocation bases of 4,000 machine-hours in Department 100 and 8,000 direct manufacturing laborhours in Department 200. The budgeted manufacturing overheads for the month were €57,500 and €62,500, respectively. An excerpt from the accounting records for the month of March shows the following actual costs incurred in the two departments: Department 100 Direct materials purchased on account €110,000 Direct materials used for Job A 32,500 Direct manufacturing labor used for Job A 52,500 Indirect manufacturing labor 11,000 Indirect materials used 7,500 Lease on equipment 16,250 Utilities 1,000 Department 200 € 177,500 13,500 53,500 9,000 4,750 3,750 1,250 Job A incurred 800 machine-hours in Department 100 and 300 manufacturing labor-hours in Department 200. The company uses a budgeted overhead rate for applying overhead to production. Required: MCFM_FC&PM (Sessions 2+3) – QUESTIONS of Exercises & Problems (W2024) 44 sur 59 8 - 11 a. Determine the budgeted manufacturing overhead rate for each department. b. Provide possible reasons why Hill Manufacturing uses two different cost allocation rates. c. What is the total cost of Job A? EXERCISE 4: Cash Budget Forecast Oxbridge Corporation’s forecast for the next few months shows: Month February March April May June Sales revenues ($000) 500 600 400 200 200 Operating expenses ($000) 400 300 600 500 200 You are advised that operating expenses include $ 8,000 of depreciation every month. 30 % of sales are for cash. Of the credit sales, 75 % are collected in the month following sale and the remaining 25 % are collected 2 months after the sale. Operating expenses are paid in the month they are incurred. The firm wishes to maintain a minimum ending cash balance of $ 25,000. Any deficit would be financed through short-term bank borrowing. Required: a- Prepare a cash budget for April, May and June, assuming opening cash balance of $ 115,000 on 1st April (Ignore interest and taxation). b- What is the minimum financing needed, if any, during this period? c- If a pro-forma balance sheet were produced for the end of June, what would be the amounts for: Cash, Notes payable (short term borrowings) and Accounts receivable? EXERCISE 5: Master Budget The Kitchen Marvel Company (KMC) is a local retailer of a wide variety of kitchen and dining room items. The company rents a retail store in a midsized community near a large metropolitan area. KMC’s management prepares a continuous budget to aid financial and operating decisions. For simplicity in this illustration, the planning horizon is only 4 months, April through July. In the past, sales have increased during this season. Collections lag behind sales, and cash is needed for purchases, wages, and other operating outlays. In the past, the company has met this cash squeeze with the help of short-term loans from a local bank, and will continue to do so, repaying these loans as cash is available. Below is the closing balance sheet for the year just ending: KMC Balance Sheet - March 31, 2016 Fixed Assets Equipment, Fixtures, and other $ 37,000 Accumulated Depreciation Net Fixed Assets (12,800) $ 24,200 MCFM_FC&PM (Sessions 2+3) – QUESTIONS of Exercises & Problems (W2024) 45 sur 59 9 - 11 Current Assets Cash 10,000 Accounts Receivable 16,000 Merchandise Inventory 48,000 Prepaid Insurance 1,800 Total Current Assets Current Liabilities Accounts Payable (1/2 x March purchases of $ 33,600) Accrued wages & commissions payable ($ 1,250 + $ 3,000) Total Current Liabilities 75,800 16,800 4,250 (21,050) Net Assets $78,950 Financed by: Owners’ Equity $78,950 Sales in March were $ 40,000. Monthly sales are forecasted as follows: April May June $ 50,000 80,000 60,000 July $ 50,000 August 40,000 Management expects future sales collection to follow past experience: 60% of the sales should be in cash and 40% on credit. All credit accounts are collected in the month following the sales. The $ 16,000 of accounts receivable on March 31st represent credit sales made in March (40% of $ 40,000). Uncollectible accounts are negligible and are to be ignored. Also ignore all local, state and federal taxes. Because deliveries from suppliers and customer demands are uncertain, at the end of each month KMC wants to have on hand a basic inventory of items valued at $ 20,000 plus 80% of the expected cost of goods sold for the following month. The cost of merchandise sold averages 70% sales. The purchase terms available to KMC are net 30 days. It pays for each month’s purchases as follows: 50% during that month and 50% during the next month. Therefore, the accounts payable balance on March 31 is 50% of March’s purchases, or $ 33,600 x .5 = $ 16,800. KMC pays wages and commissions semi-monthly, half a month after they are earned. They are divided into two portions: monthly fixed wages of $ 2,500 and commissions equal to 15% of sales, which we will assume are uniform throughout each month. Therefore, the March 31 balance of accrued wages and commissions payable is (0.5 x $ 2,500) + 0.5 (0.15 x $ 40,000) = $ 1,250 + $ 3,000 = $ 4,250. KMC will pay this $ 4,250 on April 15. Other KMC’s monthly expenses are: Miscellaneous expenses Rent Insurance Depreciation 5% of sales, paid as incurred $ 2,000, paid as incurred $ 200 expiration per month $ 500 per month MCFM_FC&PM (Sessions 2+3) – QUESTIONS of Exercises & Problems (W2024) 46 sur 59 10 - 11 KMC bought new fixtures for $ 3,000 cash in April. The depreciation for these fixtures is included in the $500 monthly depreciation. The company wants a minimum of $ 10,000 as a cash balance at the end of each month. Management plans to borrow no more than necessary and to repay as promptly as possible. Borrowings and repayments occur at the end of the month. Interest is paid, under the term of the credit arrangement, every quarter in March, June, September and December. The interest rate is 12% per year. Required Using the data given, prepare the following detailed schedules for each of the months of the planning horizon (step 1), then use these schedules to prepare a budgeted income statement for the 3 months ending July 31st 2016. Use the previous schedules and the provided additional data to prepare the forecasted financial statements (step 2) Step 1 - Operating budget a) Sales budget b) Cash collection from customers c) Purchases budget d) Disbursements for purchases budget e) Operating expenses budget f) Disbursement for operating expenses budget Ä Prepare the budgeted income statement Step 2 – Financial budget g) Cash budget including details of borrowings, repayments, and interest for each month of the planning horizon h) Budgeted balance sheet as of July 31st 2016. MCFM_FC&PM (Sessions 2+3) – QUESTIONS of Exercises & Problems (W2024) 47 sur 59 11 - 11 48 sur 59 Global Advanced Research Journal of Management and Business Studies Vol. 1(4) pp. 115-125, May, 2012 Available online http://garj.org/garjmbs/index.htm Copyright © 2012 Global Advanced Research Journals Full Length Research Paper Management Accounting Change in the Portuguese Telecommunications Industry Maria João Martins Ferreira Major Associate professor Maria Major at ISCTE – Lisbon University Institute and BRU/UNIDE researcher, Avenida das Forças Armadas, 1649-026 Lisbon, Portugal, Europe. Email: maria.joao.major@iscte.pt; Phone number: +351/217903495 Accepted 014 April, 2012 This paper sought to study the reasons that explain why has a telecommunications operator (called Marconi) changed its traditional management accounting systems (MAS) and replaced it with activity-based costing (ABC). The paper relied on qualitative data collected through a longitudinal and in-depth case study in the telecommunications sector. The investigation was informed by new institutional sociology (NIS) insights. The study evidenced that Marconi adopted ABC in order to fulfil its constituencies’ expectations of efficiency created with the reorganisation of the Portuguese telecommunications sector and the introduction of competition in the market. Furthermore, the paper contests the managerial emphasis that ABC has been subject to and claims that social accounting theories, such as institutionalism, should be adopted by management accounting researchers in order to achieve a deeper understanding of the ‘ABC phenomenon’. Keywords: Management accounting change, liberalisation, New Institutional Sociology. Activity-Based Costing, Portuguese telecommunications INTRODUCTION This paper reports a case study conducted in a Portuguese telecommunications company (called Marconi) providing long telecommunications services that has adopted an activity based approach. Especially since the publication of diverse case studies by Cooper and Abbreviations ABC: Activity-based Costing; EC: European Commission; EU: European Union; ICP: Portuguese Communications Institute; MA: Management Accounting; MAS: Management Accounting Systems; NIE: New Institutional Economics; NIS: New Institutional Sociology; OIE: Old Institutional Economics; TDP: Teledifusora de Portugal; TLP: Telefones de Lisboa e Porto; TP: Telecom Portugal. Kaplan through the Harvard Business School in the 1980’s, Activity Based Costing (ABC) began to attract a widespread interest both amongst researchers and practitioners. It is said that ABC emerged in response to the recognition that traditional management accounting system (henceforth designated by MAS) were generating misleading costing data and that were not providing useful information to support managers decision-making within the new business environment (Johnson and Kaplan, 1991; author, 2007). The relevance of ABC was particularly emphasised when in 1987, Johnson and Kaplan published “Relevance Lost – The Rise and Fall of Management Accounting”, in which it was claimed that traditional MA (herein used to denominate management accounting) information is “too late, too aggregated, and too distorted to be relevant for managers’ planning and 49 sur 59 116 Glo. Adv. Res. J. Manag. Bus. Stud. control decisions” (1991, p. 1). After some years of enthusiasm towards this approach, several case studies of ABC implementation, documenting difficulty and failure have been reported (see for example, Malmi, 1997; Major and Hopper, 2005; Bhimani and Pigott, 1992; Cooper et al., 1992; Anderson, 1995; Friedman and Lyne, 1999) and some reservations about its effective value have been pointed out by a certain number of management accounting researchers (Baird et al., 2004; Armstrong, 2002; Hopper, 1994; Jones and Dugdale, 2002; Soin et al., 2002). Those reservations concern basically three types of issues (Innes et al., 2000; Major and Hopper, 2005): firstly, whether ABC is more than just a fad or fashion and whether it represents real technical enhancement rather than a bandwagon effect (Gosselin, 1997; Malmi, 1997; Jones and Dugdale, 2002); secondly, the recognition that ABC only generates relevant costing information in supporting decision making when applying certain restrictive conditions (Noreen, 1991; Datar and Gupta, 1994) and thirdly, that its implementation is costly and behavioural factors are determinant to its success (Shields, 1995; Englund and Gerdin, 2008; Shields and Young, 1989; author, 2007; Baird et al., 2004). This paper contests the managerial emphasis that ABC has been subject to, which the researcher believes is too restrictive and insufficient to address effectively all the complexities of the ‘ABC phenomenon’. Instead, the researcher claims that institutional theory might contribute to obtaining a more fundamental theoretical and concrete analysis than is being offered by mainstream accounting about ABC. Studies to date suggest that ABC in practice might differ from the way is portrayed in textbooks and that it is likely that after being implemented to threaten “existing managerial structures of power and control and possibly threaten managerial livelihoods” (Hopper, 1994, p. 487). Also, there has been a call for more intensive case study research, supported by the use of social theory accounting in order that ABC’s contextual and intrinsic complexities may be addressed effectively (Hopper, 1994; Armstrong, 2002; Soin et al., 2002; Lukka and Granlund, 2002; Baird et al., 2004). This paper is an attempt to address such calls and aims to contribute to increase understanding of the motivations that drive companies to begin organisational change and in particular to adopt activity based techniques. A discussion of the basic assumptions of new institutional sociology (NIS) follows, which is the branch of institutional theory adopted to explain why Marconi has adopted ABC. The main reservations towards ABC relevance will likewise be presented. The paper continues with the description of the research method followed in this investigation and with the presentation of the company. It then moves to the discussion of the case study conducted in Marconi informed by NIS perspective. The paper concludes with the presentation of conclusions. New Institutional Analysis and ABC Sociology in Organisational Conventional accounting wisdom is grounded on the assumptions of the neoclassical economics theory of the firm, which assumes that firms seek to maximise their profit and that organisational actors operate with perfect knowledge of reality (Baxter and Chua, 2003; Wickramasinghe and Alawattage, 2007). For a long time, management accounting research was more concerned with what economically-rational managers should do, rather than what managers were observed to do (Scapens, 1994; Ryan et al., 2002). This technical and prescriptive perspective of accounting had identified research before its actual emphasis on behavioural, social and political issues (Hopper and Major, 2007; Roberts and Scapens, 1985; Carruthers, 1995; Wickramasinghe and Alawattage, 2007). Nowadays, it is commonly accepted by researchers that accounting “is not a neutral device that merely documents and reports the ‘facts’ of economic activity” (Miller, 1994, p. 1). In opposition accounting has come to be considered as a social and institutional practice (Miller, 1994; Carruthers, 1995; Wickramasinghe and Alawattage, 2007) and, therefore, sociological / organisational theories are being used to help the researcher to make sense of management accounting practice (Baxter and Chua, 2003; Berry and Otley, 2004). Management accounting researchers have been adopting the institutional theory to explain and make sense of accounting practice, especially during the last three decades (Moll et al., 2006). Different branches of institutional theory have been used in accounting research, namely the new institutional economics (NIE), new institutional sociology (NIS) and the old institutional economics (OIE) (Dillard et al., 2004; Moll et al., 2006). These approaches are substantially different both in their intellectual roots and methodological issues, and their choice should depend of the ‘research purpose at hand’ (Moll et al., 2006). NIS applied to organisational analysis is a relatively recent phenomenon. It was only in the 1970’s that new conceptions focused on the cultural and social aspects of organisations and on their institutional environments emerged (Scott and Meyer, 1991; Scott, 2008; Greenwood et al., 2008). Since then NIS has been used repeatedly in empirical investigations (see for instance, Galaskiewicz, 1991; Flingstein, 1991; Dacin and Dacin, 2008; Davis and Anderson, 2008). Neoinstitutionalists are unanimous in their belief that the structure and behaviour of an organisation depend on the characteristics of the environment in which it operates. Scott and Meyer (1991) pointed out that “organizations are embedded in larger systems of relations” (p. 120) that they denominated by ‘societal sector’. They define societal sector as the group of organisations providing similar services, products or functions, including its major suppliers, customers, 50 sur 59 Major 117 owners, regulators, competitors, etc. This concept was termed by DiMaggio and Powell (1991b) as ‘organizational field’. It is said that these systems are organised at broader and wider levels and that organisations are connected into nonlocal and vertical hierarchies. The way this sector is structured significantly affects organisational features (Scott and Meyer, 1991; Scott, 2008). In sum, NIS is based on the belief that organisational structures are shaped by their social environment and that environments made organisations in their own image. However, this similarity between the inside and outside of organisations denominated by ‘isomorphism’ is not determined by technical criteria. Instead, formal organisational structures arise as reflections of rationalised rules that function as myths and give legitimacy and stability to organisational projects (Meyer and Rowan, 1991). As Carruthers (1995) pointed out, the process of isomorphism “is a cultural and political one that concerns legitimacy and power much more than efficiency alone” (p. 315). This often means that political and cultural issues are hidden under a technical surface. Four types of isomorphism can be distinguished (DiMaggio and Powell, 1991b): competitive, coercive, mimetic and normative. Competitive isomorphism occurs when the forces of competition will eventually impose upon organizations one single best way of doing things (Carruthers, 1995). This type of isomorphism, according to DiMaggio and Powell (1991b) gives only a partial picture of the modern world of organisations and, hence, should be complemented by an institutional view of isomorphism. Coercive, mimetic and normative isomorphisms were developed under this institutional view and stress cultural and political issues as the drivers of change. The former type of institutional isomorphism is the result of organisational external pressure on dependent organisations and of general expectations developed in the environment in which organisations develop their activities. Scott (1991) suggested that two types of impositions should be distinguished under this category: imposition by means of authority and imposition by means of coercive power. Accordingly, changes imposed by authority are met with less resistance and faster than those imposed by force. Moreover, structural changes associated with authority are expected to achieve higher levels of compliance and stability since these changes are less superficial than change imposed using coercion. If coercive isomorphism derives from coercive authority, mimetic isomorphism on the other hand, is driven by uncertainty and imitation processes. Accordingly, uncertainty about organisational technologies, goals and environment’s expectations often leads to the modelling of organisations on other kindred organisations. It seems that organisational fads and fashions are likely to spread through this particular type of isomorphism (Carruthers, 1995). Organisations tend to copy models of operation from successful companies and to be receptive to fashionable business techniques, as might be the case with ABC, to protect them from uncertainty (Granlund and Lukka, 1998; Abrahamson, 1991, 1996). Finally, normative isomorphism is based on the recognition that professions play an important role in the diffusion of similar orientations and dispositions in shaping organisational behaviour. This process takes place through the legitimacy that formal education confers and through the development of professional networks that span organisations. Hence, organisational change in NIS occurs as result of the organisation’s conformation to its institutional external environment in order to increase the organisations’ chances of survival. Scott and Meyer (1991) alleged that when occurring structural change is often very difficult to distinguish from technical and institutional drivers since those who formulate institutional rules strive to make them appear technical. To the extent that rules are considered proper, adequate and rational, organizations must incorporate them to avoid illegitimacy. As Carruthers (1995) claimed “being technically efficient is not the only path to organizational survival. Achieving legitimacy in the eyes of the world, state, powerful professions, or society at large, is another effective survival strategy” (p. 317). The incorporation of legitimised elements increases the commitment of internal participants and external constituents to organisational actions and protects organisations from having their conduct questioned. Nevertheless, because inadequacies often arise between organisational efficiency demands and prescriptions of generalised myths, formal organisational structures are decoupled from actual organisational practices and a logic of confidence and good faith is displayed, internally and externally (Meyer and Rowan, 1991). This organisational formal structure was described as “mythical and ceremonial, a kind of symbolic windowdressing” (Carruthers, 1995, p. 315). In summing up, traditionally neoinstitutionalists affirm that organisations are a reflection of their environments and external institutional demands and that when organisations do not accommodate the environment’s expectations they would not survive. This convergence between organisations and their environments emerged from the search for legitimacy. The constituents that exert such isomorphic pressure are vast and include such institutions as shareholders, regulator, state, public opinion and capital markets (Granlund and Lukka, 1998; Hopper and Major, 2007; Wickramasinghe and Alawattage, 2007). In this sense, the adoption of ABC or of any other managerial technique, which have gained the image of boosting organisational performance would legitimise organisations’ activities within their operating environments (Soin et al., 2002; Hopper and Major, 2007). Although activity costing was earlier referred to by Staubus (1971) its popularity was due mainly to its application in a few US companies in mid 1980’s and to the publicity of these experiences through the publication 51 sur 59 118 Glo. Adv. Res. J. Manag. Bus. Stud. of several cases studies by Cooper and Kaplan (Jones and Dugdale, 2002). ABC emerged as a result of the recognition that traditional MA was inappropriate in the current business environment and that often decisionmakers were provided with inaccurate cost information (Johnson and Kaplan, 1991; author, 2007). It has been alleged that conventional MAS lagged behind manufacturing technology changes and that management accounting was no longer providing relevant information for supporting managers in their decision-making task (ibid). It was argued that the cost accounting systems in use had lost their former relevance by the 1980’s (Johnson and Kaplan, 1991) and that management accounting should return to basics, “working closely with design and process engineers, operations managers, and product and business managers” (Jonhson and Kaplan, 1991, p. 261). After that first stage of huge excitement towards the potential of the approach where success cases were widely publicised and emphasised, several case studies reporting ABC implementation difficulty and failure have begun to appear (Major and Hopper, 2005; Malmi, 1997; Anderson, 1995; Bhimani and Pigott, 1992; Soin et al., 2002; Friedman and Lyne, 1999; Baird et al., 2004). If ABC literature until two decades ago was replete with methodological and operational issues (Cooper, 1988a, 1988b, 1989a, 1989b, 1990) it is now concerned with the study of organisational and behavioural topics both associated with the process of ABC implementation and with its impact on organisations and individuals (Major and Hopper, 2007; Soin et al., 2002; Baird et al., 2004; Gosselin, 1997; Wickramasinghe and Alawattage, 2007; Armstrong, 2002; Lukka and Granlund, 2002; Englund and Gerdin, 2008). ABC cannot be therefore understood as a panacea that solves all costing problems. Today, there is some evidence from empirical studies that ABC can generate dysfunctional consequences within organisations, perhaps because as Hopper argued (1994, p. 487) “systems perceived by managers to be potentially threatening can be rendered unworkable through managerial biasing and manipulation of data”. Furthermore, some researchers have questioned whether ABC is anything more than a fashion or fad (Innes et al., 2000; Jones and Dugdale, 2002; author, 2007). Often, the managerial techniques proposed by management fashion setters even if they look like innovations and improvements relative to the state of the art they are only old business practices reinvented (“old wine in new bottles”). This might be the case of ABC considering Johnson and Kaplan’s (1991) historical account of MA development. They claimed that in the beginning of the twentieth century the engineers and managers of big US manufacturing companies were using similar managerial techniques to ABC to allocate costs to products. ABC rhetoric aims to convince fashion followers that they must pursue efficiency goals and that the right means to attain those goals is through the adoption of activity based techniques (Wickramasinghe and Alawattage, 2007; Jones and Dugdale, 2002; author, 2007). Despite studies on ABC adoption in firms (e.g. Soin et al., 2002; Major and Hopper, 2005; Baird et al., 2004; Hopper and Major, 2007) further research is needed for researchers to comprehend whether ABC is merely a management fashion or if, on the contrary, it constitutes a true alternative to traditional costing systems offering real benefits to managers. RESEARCH METHODS This paper is supported by a case study conducted over 12 months in a Portuguese telecommunications company, which has followed the six steps of case study design suggested by Ryan et al. (2002): preparation, collecting evidence, assessing evidence, identifying and explaining patterns, theory development and report writing. The case study here reported followed an explanatory research model since theory was used to help the researcher make sense of the observed accounting practices. Thus, was not intended through this case study generate theory. This research format seems to be the most appropriate when research questions are focused mainly on “why” questions, as is the situation in this particular case study (Yin, 2009; Berry and Otley, 2004). The research questions posed by the researcher were the following: firstly, why Marconi has changed its MAS and secondly, why ABC was adopted. Different sources of information were used, including interviews, observations and documentary analysis, in order to facilitate triangulation (Yin, 2009; Ryan et al., 2002). Both in the pilot and main study a semi-structured format was adopted to conduct interviews. Nevertheless, every time the researcher felt that something not covered in the previous plan was worth exploring, alterations to the guide were made Also, interviewees were encouraged to speak freely their feelings and thoughts about the changes that had occurred in both Marconi and the Portuguese telecommunications market. About 52 interviews (20 interviews in the pilot study plus 32 in the main study) were conducted over a 71 hour period. Indepth and face to face interviews were carried out with several managers from the operational departments of Marconi with different interests and involvements with its MAS. In total 20 of Marconi’s managers and employees were interviewed. Also, the Portuguese telecommunications regulator, the consulting firm that was responsible for ABC implementation in both Marconi and its parent company, and some managers from Marconi’s parent company were interviewed. Apart from the interviews conducted in these organisations, documentary evidence was collected, namely Portugal Telecom’s and the Portuguese telecommunications regulator annual reports; Likewise several laws about telecommunications regulations were gathered. All the 52 sur 59 Major 119 interviews were tape recorded and then, fully transcribed, excluding the following ones: the two first in the pilot study where matters concerning access to data were discussed with Marconi’s managers, and two interviews conducted in the main study on two of its engineers, who refused to be tape-recorded. Marconi’s departments in which managers and employees were interviewed were the following: the two commercial divisions (Consumer Markets department and Carrier Services and Network Planning department), the production division (Telecommunications Infrastructure department), the Planning and Control department and the Finance and Administration department. Because the Telecommunications Infrastructure department has an important role in periodically feeding the ABC system, its operational centres of satellites (in Sintra), submarine cables (in Sesimbra), and Commutation (in Linda-aVelha) all situated in the outskirts of Lisbon, were visited, and interviews were conducted with several of its employees and managers. In Marconi several documents were obtained, namely its annual reports from 1990 till its fully integration in Portugal Telecom in 2002, financial reports, telecommunications market analysis, dictionary of activities, notes from the consultants and other similar data. Besides this, the researcher gathered newspapers’ interviews with the actual and previous board of directors from Marconi and Portugal Telecom and other articles about the telecommunications market both in Portugal and worldwide. Marconi Marconi was a Portuguese telecommunications company operating in the long distance telecommunications business and founded in 1925. Until the end of the 1990s this company was operating in a monopoly regime and, hence, was not facing true market competition. This fact, associated with the nature of its business, has contributed to turn Marconi in one of the most healthy and profitable Portuguese companies. Also, Marconi has acquired an engineering prestigious image both in Portugal and overseas by the expertise of its activity. Until 1974 This was the year of the ‘Revolution of April’, which led to the end of the 13 year colonial war between Portugal and the African colonies and to the independence of those countries. The activity of the company was mainly supported by the telecommunications traffic between the Portuguese ex-colonies in Africa, namely Angola, Mozambique, Guinea-Bissau, Cape Verde and S. Tome and the ‘mainland’. After the revolution, Marconi’s strategy was based on its internationalisation through the development of programmes worldwide, which was supported by its technological modernisation in satellite and submarine cables. At the end of 1980’s Marconi decided to move into new businesses, which encompassed not only telecommunications services but also the following new business areas: information systems; the electronics industry; financial services and property. At the same time, Marconi sought to enlarge its activities in the telecommunications business. Hence, inroads were made to new telecommunications areas, namely into the public telecommunications (both local and international) outside Portugal, maritime mobile services, telecommunications engineering, telephone and business directories, TV broadcasting, corporate communications, value added services and research and development. As result, Marconi became an important national economic group in the Portuguese economy at the end of 1980’s and in the early years of 1990’s. From the beginning of the 1990’s, the Portuguese government started a reorganisation programme of the whole telecommunications sector following the decision of the European Community to liberalise the telecommunications market in its member states. This decision was a result of the worldwide trend of fully deregulating telecommunications markets. The aims of the reorganisation of the Portuguese telecommunications sector were threefold: (1) First, it intended to create adequate conditions for the introduction of full competition; (2) Second, it sought to prepare the market to the installation of new operators; (3) Finally, it aimed to restructure the ‘old’ public operators. Until this reorganisation, the Portuguese telecommunications market comprised several public concessionaires of medium size with mixed capital, each of those companies focusing on a particular core business. These public concessionaires were the following: Telecom Portugal (TP), which was created in 1992 after having been separated from CTT (a company that was providing both mail and national telecommunications services); Telefones de Lisboa e Porto (TLP), whose business was to provide local and regional fixed telephone services in the areas of Lisbon and Oporto; Marconi, whose core business was the intercontinental telecommunications services; Telepac, whose business was switching data transmission and Teledifusora de Portugal (TDP), which was accountable for managing the network and broadcasting TV signals. These companies were under the jurisdiction of the Portuguese government, specifically the Ministry of Public Works, Transportation and Communication, and supervised by the Portuguese Communications Institute (ICP) These days the regulator is called ‘ANACOM’ Despite the fact that ICP’s origins are traced to the 1980’s, its role as a telecommunications regulator was mainly felt by operators after the Portuguese telecommunications sector was reorganised in the mid 1990’s. Throughout the 1990’s several changes were 53 sur 59 120 Glo. Adv. Res. J. Manag. Bus. Stud. introduced in the Portuguese telecommunications market, which have drastically affected Marconi’s business activity. Firstly, in 1994, Portugal Telecom (PT) was created as result of the merger between the public operators TP, TLP and TDP. Secondly, in 1995, Portugal st Telecom was privatised (1 phase) with the aims of both restructuring the Portuguese telecommunications market, opening it up to private both national and international investors and of increasing its internationalisation and competitiveness. Thirdly, in 1995 Marconi was integrated in PT, which was constituted as an economic group encompassing several businesses all related with telecommunications services. In consequence of Marconi’s integration in the Portugal Telecom Group, this company transferred all its non-core businesses and financial investments abroad to the parent company. On the other hand, PT transferred to Marconi the telecommunications traffic business with Europe and North Africa. Therefore, in this way Marconi became the single public provider of international telecommunications services, but ‘in compensation’ lost all its other businesses, including its physical and human resources to the parent company. The political idea underneath to the integration of Marconi in PT was that Portugal should be provided with a strong telecommunications group, in order to compete successfully with both internal and external telecommunications operators as happened in other European countries. Marconi kept its autonomy from PT, but its integration had affected its daily life in multiple ways. With the reorganisation of the Portuguese telecommunications sector, both PT and Marconi began a full programme of organisational change. External consultants were called in and several managerial projects were launched. In concrete, Marconi had implemented the following projects, which mainly affected its MA and informational systems: (1) Revision of its strategic plan; (2) Implementation of a new career evaluation system, including the preparation of a scheme to periodically assess employees’ motivation and work satisfaction; (3) Adoption of strategic control benchmarks; (4) Development of programmes to create staff awareness about the competitiveness of the business environment surrounding Marconi; (5) Implementation of EIS – Executive Information System, which aimed to provide senior managers with a set of operational and strategic information; and (6) Adoption of ABC. From all the projects introduced in the company the adoption of ABC was the major one, not only judging by the human and financial resources allocated but also by the time and importance allocated by Marconi’s top managers to this project. In 1997 Marconi, with the help of external consultants, began the implementation of ABC throughout the whole company and in March 1998 the first results were obtained and discussed amongst the managers. In mid 2000 ABC was fully implemented and data was being regularly provided to both Marconi’s managers and Portugal Telecom. Why has Marconi Changed its MAS? This section aims to explain the reasons that led Marconi to change its MAS supported by NIS theory. Neoinstitutionalists claim that organisations are shaped by their environments and that in order to survive they are forced to follow the expectations of their constituencies (DiMaggio and Powell, 1991a, 1991b; Scott and Meyer, 1991; Scott, 2008; Greenwood et al., 2008). It is argued here that Marconi has changed its MAS in order to accommodate internal and external expectations about its role within the new business environment characterised by tough competition. Changing its MAS was one of the means that the company has found to legitimise its actions to its shareholders, managers, regulator, parent company and the public, and a means to guarantee its survival. Yet competition was fully introduced in the Portuguese telecommunications market from 1st January 2000, according to EC decision of liberalising European telecommunications sector, until 2003. Already at the beginning of the 1990’s deregulation was publicly discussed and operators were perfectly aware of the huge challenges that they were soon going to face. On the other hand, Marconi’s managers were not satisfied with the MAS that the company had adopted in 1992, since the system was providing managers with costing data too late and in order to be feed overburdened them with informational demands. 1992’s cost accounting system was adopted by the initiative of Marconi’s finance general director in order to support managers in both pricing and cost control strategies. Marconi’s top managers were aware that the company would soon be losing its monopoly and facing tough competition and that it could not continue charging such high prices as in the past. Hence, during 1992 the first rationalisation of activities and cost control occurred. A policy of reducing telecommunications prices was introduced by Marconi since 1992 in order to improve its competitiveness within the telecommunications market. Considerable reductions, in some cases of more than 50%, have occurred in the price of Marconi’s calls. Therefore, it is contended here that the information demands of Marconi’s managers were one of the drivers that led the company to change its previous MAS and to replace it with a more ‘sophisticated system’ in 1997. If Marconi did not change its MAS, managers would tend to withdraw their involvement and motivation from company’s strategies, and would allege that without an adequate MAS they could not follow satisfactory pricing and cost control strategies, and hence, that they were not responsible for Marconi’s failure within the new business context. In this sense, it can be argued that MAS may be seen more as a ‘hygienic factor’ than a source of strategic or competitive advantage (Granlund and Lukka, 1998). However, besides managers there were other constituencies that led Marconi to change its MAS. One 54 sur 59 Major 121 of the most important constituencies that have pressed Marconi to change its MAS was the Portuguese telecommunications regulator, through Marconi’s parent company (PT - Portugal Telecom). Because Marconi was integrated within Portugal Telecom it did not maintain a direct relationship with the regulator. As a PT manager explained: “Marconi doesn’t have direct relations with the Portuguese regulator. Marconi has signed with PT a subconcession contract to explore the international telecommunications business. The concession contract is between the state and PT. This way, Marconi only has to send cost information to PT, which is consolidated with those of PT and than sent to the regulator…” Therefore, Marconi’s information systems needed to be integrated with those of PT, in order to allow PT to periodically send the regulator the costing data imposed by, as will be explained below, both its concession contract and PT’s ‘status’ of operator with ‘significant market power’ Those operators who hold a share equal to, or more than 25% of the market in relation to circuit leasing, fixed telephone service and fixed telephone networks. The Portuguese telecommunications regulator acquired substantial importance during the process of introduction of competition into the market. Its functions encompassed a wide range of activities, which might be summarised in three major tasks: (1) government advisement, (2) market regulation, and (3) technical assignment. In order to create conditions for true competition between the new operators and the established operators, legislation was laid down, pertaining especially to the ‘operators with significant market power’, with specific information obligations. In general, this legislation followed European Community directives, laid down by the commission with the aim of creating the conditions for the establishment of real competition within the European telecommunications market. The law-decree 290-A/99 dated 30 July pointed out that operators considered to have significant market power were obliged to: “a) Guarantee to all users, unrestricted access to the leased circuits, in conditions of equality, transparency and impartiality; b) Provide information on the provision and utilisation of the leased circuits, whenever requested by ICP [the Portuguese telecommunications regulator]; (…) d) Possess separate accounting for the activities of establishment or provision of public telecommunications networks, on one hand and the other activities on the other. The latter shall include the services provided to the body itself and those provided to other bodies; e) Implement a system of cost accounting in accordance with the provisions in the present Regulation; f) Observe the quality levels established for them by ICP.” Thus, the operators with significant market power, as is the case of Portugal Telecom, were obliged amongst other requirements to implement a system of cost accounting appropriate to provide the information demands of the regulator. Moreover, law-decree 474/99 of 8 November fixed that the operators of fixed telephone networks, and fixed telephone services providers, which had significant market power, should implement an analytical cost accounting system. This served the application of the tariff principles of equality, transparency and non-discrimination. It was aimed that PT, which has been the concessionaire of public telecommunications services for 15 years, based its price system on the services provided, exclusively in the context of the concession, following the principles described in article 30 of law-decree 40/95 of 15 February, which were: “a) Cost orientation for the service provision, duly justified by an analytical accounting system; b) Non-discrimination in its application, ensuring that all users in equal circumstances are conferred an equal treatment; c) Uniformity in the application of the tariff regime in force for the services object of concession.” In 1995, as result of all these regulations PT changed its previous cost model and adopted a more sophisticated cost accounting system, which would provided the regulator with more detailed and accurate cost data. The costing information demands of the regulator, mediated by its parent company determined Marconi’s resolution to (1) change its MAS and (2) to replace its ‘old’ MAS with a similar system to that adopted by Portugal Telecom. In other words, coercive isomorphism, as result of Portugal Telecom and the Portuguese telecommunications regulator’s pressure was one, of the most important reasons to explain why Marconi decided to change its MAS. However, this pressure, combined with Marconi’s information demands and expectations of change associated with the reorganisation of the company, explained partially the reasons that motivated Marconi’s top managers to adopt a new MAS. Pressures from other external constituencies, such as Marconi / PT’s shareholders and the capital markets, have also contributed to cause such a change. Coercive isomorphism, in this case generated by the creation of expectations within public opinion towards the improvement of Marconi and Portugal Telecom’s competitiveness in the telecommunications market, has induced Marconi / PT to alter their MAS. PT’s privatisation and the necessity of creating good public image, especially to potential shareholders, of a successful and dynamic company might have also influenced its top managers to adopt new managerial tools, believed by constituencies as progressive, rational and leading to success. PT was privatised in five phases, which had occurred after 1995. The goal of this privatisation was to get the participation in PT’s share capital of a global strategic partner, and of several other strategic partners within specific business areas, along 55 sur 59 122 Glo. Adv. Res. J. Manag. Bus. Stud. with the general objective of dispersing the company’s capital amongst private investors. This ‘public exposure’, as a PT’s manager called it, has pressured PT and Marconi to assure the public that they were making substantial efforts to become more ‘modern’ and efficient. Providing its shareholders with a better quality of information through the improvement of its informational systems was one of the means found to express such efforts of ‘modernisation’ and to attract new shareholders to the company. As Meyer and Rowan (1991) argued if managers do not seem to use techniques that conform to the norms of rationality it is likely that stakeholders’ expectations that companies are being well managed will tend to be disappointed. As a consequence of their disappointment their support will tend to be withdrawn from organisations, augmenting the likelihood of organisational failure. To conclude, with the deregulation and introduction of competition into Portuguese telecommunications market, Marconi was expected by its constituencies to improve its efficiency and performance. Additionally, the regulator in order to assure the market that true competition was introduced it was pressing those operators with ‘significant market power’ to provide it with detailed cost data and hence, to up date their MAS. Marconi’s MAS changes were then the result of such pressures and expectations. Why has Marconi Adopted ABC? As was previously pointed out, neo institutionalists assert that organisational constituencies expect managers to use the most efficient means to achieve important ends. Nevertheless, it is often ambiguous what constitutes the right ends to be achieved and the means considered most efficient (Abrahamson, 1991, 1996). It has been argued that in such situations of uncertainty managers legitimise their actions and decisions creating the appearance that they are conforming to norms of rationality (Meyer and Rowan, 1991; Scott, 2008; Greenwood et al., 2008). Thus, frequently in such cases, organisations tend to create the appearance of rationality by adopting management techniques that are generally believed by organisational stakeholders and other constituencies to be rational and efficient means to enhance organisational goals. In this paper it is argued that Marconi / PT have adopted ABC in order to obtain legitimisation from its constituencies, namely from the regulator and shareholders. Since ABC has gained the image of being up-to-date and the reputation of being a strategic tool to any successful company (Granlund and Lukka, 1998; Jones and Dugdale, 2002; author, 2007) its adoption would guarantee its constituencies that Marconi / PT’s goals were being pursued efficiently. In July 1997 Marconi, together with external consultants began the ABC implementation process throughout the company. As has been pointed out, the previous Marconi’s MAS was not providing all the detailed and accurate cost data its managers and the regulator were demanding. Marconi’s decision to adopt ABC was conditioned by PT’s decision of choosing ABC as the cost model which could satisfy the Portuguese telecommunications regulator’s cost information requirements. Therefore, to understand Marconi’s adoption of ABC, we need to understand why PT had taken the decision of implementing ABC and hence, it is needed to move backwards to 1994 when PT was created. PT was the result of joining TDP, TLP and TP, companies that were descended from a clear ‘state ownership mind set’. These companies did not have any proper cost systems, mostly because they were monopolistic companies that were not facing competition, and hence, did not felt pressured to use costing data to support investment decisions, to control costs and to follow pricing policies, amongst other decisions. Budgets were made annually, but with a ceremonial character, which means that they were not prepared to be used as a true management tool but to justify costs. Thus, when all these companies were merged, and PT was formed, top managers felt the need to develop more ‘sophisticated’ information systems, that would protect PT from being criticised either from its regulator, managers, competitors or other constituencies for not having a ‘proper’ MAS as all ‘large and successful’ companies have. A manager from the Portuguese telecommunications regulator assessed PT’s (and TP’s) information system in this way: “Even though PT, and TP, were very profitable companies they had very weak informational systems. Probably because these companies were very wealthy, they did not need to be concerned with finding market segments which were profitable… (…) They were earning so much money that they did not need to control theirs costs…” At the same time, as was discussed before, the regulator concerned in guarantee that the Portuguese telecommunications market become an arena of genuine competition, required that operators with significant market power should follow cost orientation in their pricing practices and that they should justify their costs, providing the regulator periodically with detailed cost data. PT, without any particular experience in cost issues, and considering the complexity of its business, decided to hire a specialised cost consultant by contacting one of the largest international consultant firms, which has had considerable experience in implementing ABC in US telecommunications companies. As has been argued, consultants have been contributing through mimetic processes to the diffusion of the same solutions for current managerial problems leading, to what Granlund and Lukka (1998) described as “a small world of management accounting practices” and “McDonaldism”. As they contended (p. 167): “Though the advice of consultants within the same 56 sur 59 Major 123 consulting firms may differ in different countries according to the operational context, they nevertheless seem to promote the same ‘standard solutions’ globally”. ABC was, therefore, the approach that these consultants advised PT’s top managers to implement in order to get all the cost data required. A PT’s manager explained how ABC was considered the right cost approach to provide the regulator and its managers with relevant cost data: “I think that the people who decided to adopt ABC had a relatively consensual opinion of the appropriateness of this approach in supporting PT’s informational needs. The problem it was facing was that ABC was a recent approach… PT’s ABC implementation was the first one in Portugal… Because ABC is compatible with traditional information systems, we decided as a first stage to develop it autonomously and laterally with the systems we had here before” Accordingly, ABC has been adopted by several other telecommunications operators in Europe, especially by incumbent operators, namely British Telecom in some of its areas. ABC seems to be ‘institutionalised’ as the appropriate cost approach to provide national regulators with cost data in the telecommunications sector through European Community legislation. In fact, the European Commission laid down a recommendation on ‘Interconnection in a Liberalised Telecommunications Market’ on the 15th October 1997. The preface pointed out the importance of operators following the cost oriented principle and hence, to implement separate cost accounting systems in order to adequately price telecommunications’ interconnections: “(…)Recognising the bottleneck nature of the incumbent’s fixed network and the lack of incentive to provide efficient interconnection, the European Parliament and Council Directive on Interconnection in Telecommunications imposes cost-oriented interconnect pricing, together with requirements for appropriate accounting separation. (…)” This recommendation alleged that the cost accounting systems which the operators need to adopt in order to satisfy the telecommunications regulators should be based ‘on current costs and activity-based accounts’, as is transcribed below: “The Interconnection Directive requires that organisations with obligations for cost-oriented interconnection charges must implement cost accounting systems which are capable of demonstrating that interconnection charges do indeed follow the principles of cost orientation and transparency. (…) The commission is therefore recommending that NRAs [national regulatory authorities for telecommunications] should set deadlines for implementation by incumbent operators of new cost accounting systems based on current costs and activitybased accounts.” Thus, the European Commission clearly indicated that ABC is the approach to be used, especially by the telecommunications incumbents, to allocate the joint and common costs to the cost objects. If at the beginning of such a trend telecommunications operators were experiencing uncertainty about the best MA they should adopt and were, hence, recurring often to consultants to support their decision, after 1997 with EC recommendation mimetic isomorphism was replaced by coercive isomorphic practices (DiMaggio and Powell, 1991b). Moreover, the researcher contends that EC and national regulatory entities have identified and recommended ABC combined with Long Run Incremental Cost (LRIC) as the best accounting practices to the operators with significant market power in the determination of interconnection pricing because they were expected to behave rationally in ‘solving the problem’ of guaranteeing operators that true competition was introduced into the market. However, this does not mean that operators in fact have fixed the right prices of interconnection services. Choosing ABC as the ‘right’ costing approach to support operators in their interconnection prices strategies was the means found by the regulator to legitimise its role in the sector as grantor of competition. As Meyer and Rowan (1991) suggested, the appearance of rationality is pursued through the use of management techniques that are believed and accepted by constituencies to be rational ways of pursuing goals in order to avoid constituencies’ sanctions and to get their support. ABC fulfilled all these demands of rationality and progress within telecommunications industry constituencies (Hopper and Major, 2007). CONCLUSIONS Since Harvard Business School published ABC case studies in the 1980’s, Activity Based techniques have been propagated by business mass media, management gurus, consultants and business schools as a means to enhance organisational efficiency and as an alternative system to cover the limitations and pitfalls of conventional management accounting (Jones and Dugdale, 2002). ABC’s advocates have been emphasising how traditional MAS are lagging behind the technological environment advances and how its cost information has been distorted to support their argument that ABC constitutes an efficient managerial tool to support managers’ decisions within the new business environment (ibid). The line of reasoning that supports the alleged superiority of ABC over the traditional MAS is based on the following two prepositions: (1) firstly, that ABC enhances the accuracy of product costing through the use of non-volume related allocation basis; and (2) secondly, that it enables managers to have a better understanding of the drivers of costs. In a world marked by a strong emphasis on efficiency and technique ABC, has easily gained the status of superior management technique proper of ‘dynamic and successful’ organisations, even though until 57 sur 59 124 Glo. Adv. Res. J. Manag. Bus. Stud. recently not much was known about its practicalities. It may be argued that ABC incorporates institutional myths, namely the myth of rationality, and hence it adoption may be understood socially as providing legitimacy, resources and stability to organisations and hence, enhancing organisations’ survival prospects (Meyer and Rowan, 1991; Scott, 2008). To this regard DiMaggio and Powell (1991b, p. 65) claimed that “as an innovation spreads, a threshold is reached beyond which adoption provides legitimacy rather than improves performance”. Nonetheless, after the first phase of huge enthusiasm towards ABC, some reservations about its effective value in practice have been noted by some researchers. This resulted from accounts of ABC failure throughout the 1990’s and 2000’s (e.g. Major and Hopper, 2005; Baird et al., 2004; Malmi, 1997; Friedman and Lyne, 1999). This paper is an attempt to address some of the claims pointed out by ABC’s critics and to contribute to a better and more integrated comprehension of the role of ABC within the management accounting field. The managerial emphasis that ABC has been subject to has been shown and it has been argued that new institutional sociology might contribute substantially to understanding the causes that lead companies to adopt the activity based approach. Furthermore, the researcher argued that one needs to encompass more than technical issues to comprehend the reasons that motive organisations to change their MAS and to replace them with activity based techniques. As has been pointed out the real drivers of organisational change are often political or cultural issues, which are covered by technical issues (Scott, 2008; DiMaggio and Powell, 1991a; Meyer and Rowan, 1991). Moreover, the incorporation of managerial techniques, which have become institutionalised within business audiences as bringing efficiency into organisations, as is the case of ABC, “quite apart from their possible efficiency (…) establish an organisation as appropriate, rational and modern” and “their use displays responsibility and avoids claims of negligence” (Meyer and Rowan, 1991, p. 53). These arguments were used in this paper to explain why Marconi and its parent company have substituted their previously MAS with an ABC model. Within the reorganisation of the Portuguese telecommunications sector these companies were expected to ‘modernise’ themselves in order to successfully face the challenges of liberalisation in both the Portuguese and European telecommunications markets. Such pressures of ‘modernisation’ came from several of their constituencies, such as telecommunications competitors, capital market and the Portuguese telecommunications regulator. In particular the pressure posed by the regulator was determinant in the change of Marconi and Portugal Telecom’s MAS. The change imposed by the regulator was in consonance with the change expected by other constituencies, which have contributed to a faster replacement of Marconi and Portugal Telecom’s ‘old’ MAS for a more ‘ up dated’ system. Finally, the researcher suggests that as result of the regulator’s coercive pressure, isomorphic MA practices might have spread among European telecommunications operators, especially those with ‘significant market power’ in which the determination of pricing interconnection was an important issue. Calls are also made for a further investigation into whether the European telecommunications MA practices have became isomorphic. REFERENCES Abrahamson (1991). “Managerial Fads and Fashions: The Diffusion and Rejection of Innovations”, Acad. Manag. Rev. 16(3): 586-612; Abrahmson (1996). “Management Fashion”, Acad. Manag. Rev. 21(1): 254-285; Anderson SW (1995). “A Framework for Assessing Cost Management System Changes: The Case of Activity Based Costing Implementation at General Motors, 1986-1993”, Journal of Management Accounting Research, Vol. 7, Fall, pp. 1-51; Armstrong P (2002). The costs of activity-based management, Accounting, Organizations and Society, Vol. 27: 99-120; Baird KM, Harrison GL, Reeve, RC (2004). Adoption of activity management practices: A note on the extent of adoption and the influence of organizational and cultural factors, Management Accounting Research, Vol. 15: 383-399; Baxter J, Chua WF (2003). Alternative management accounting research – ‘whence and whither’, Accounting, Organizations and Society, Vol. 28(2/3): pp. 97-126; Berry AJ, Otley DT (2004). Case-based research in accounting, Humphrey, C. and Lee, B. (Eds) The Real Life Guide to Accounting Research, Oxford: Elsevier, pp. 231-255; Bhimani A, Pigott D (1992). “Implementing ABC: A Case Study of Organizational and Behavioural Consequences”, Management Accounting Research, 3: 119-132; Bromwich M, Hong C (2000). “Costs and Regulation in the UK Telecommunications Industry”, Management Accounting Research, Volume 11(1): 137-165; Burns J, Scapens RW (2000). “Conceptualizing Management Accounting Change: An Institutional Framework”, Management Accounting Research, Vol. 11: 3-25; Carruthers BG (1995). “Accounting, Ambiguity, and the New Institutionalism”, Accounting, Organizations and Society, 20(4): 313328; Cooper R (1988a). “The Rise of Activity-Based Costing – Part One: What is an Activity-Based Cost System?”, Journal of Cost Management for the Manufacturing Industry, Summer, pp. 45-54; Cooper R (1988b). “The Rise of Activity-Based Costing – Part Two: When do I need an Activity-Based Cost System?”, Journal of Cost Management for the Manufacturing Industry, Fall, pp. 41-48; Cooper R (1989a). “The Rise of Activity-Based Costing – Part Tree: How many cost drivers do you need, and how do you select them?”, Journal of Cost Management for the Manufacturing Industry, Winter, pp. 34-36; Cooper R (1989b). “The Rise of Activity-Based Costing – Part Four: What do Activity-Based Cost System do like?”, J. Cost Manag. for the Manufacturing Industry, Spring, pp. 38-49; Cooper R (1990). “Cost Classification in Unit-Based and Activity-Based Manufacturing Cost Systems”, J. Cost Manag. 4(3): 4-14; Cooper R, Kaplan RS, Maisel LS, Morrissey E, Oehm RM (1992). Implementing Activity-Based Cost Management: Moving From Analysis to Action, Institute of Management Accountants, Montvale, NJ; Dacin MT, Dacin PA (2008). Traditions as institutionalized practice: implications for deinstitutionalization, Greenwood, R., Oliver, C., Suddaby, R. and Sahlin, K. (Eds) The Sage Handbook of 58 sur 59 Major 125 Organizational Institutionalism, Sage Publications, Thousand Oaks, CA, pp. 327-351; Datar S, Gupta M (1994). “Aggregation, Specification and Measurement Errors in Product Costing”, The Accounting Review, 69(4): 567-591; Davis GF, Anderson PJJ (2008). Social movements and failed institutionalization: corporate (non) response to the AIDS epidemic, Greenwood, R., Oliver C, Suddaby R, Sahlin K (Eds) (Provide other year) The Sage Handbook of Organizational Institutionalism, Sage Publications, Thousand Oaks, CA, pp. 371-388; Dillard JF, Rigsby JT, Goodman C (2004). The making and remaking of organization context – duality and the institutionalization process, Accounting, Auditing and Accountability Journal, 17(4): 506-542; DiMaggio PJ, Powell WW (1991a). “Introduction”, Powell, W. W. and DiMaggio, P. J. (Eds) The New Institutionalism in Organizational Analysis, The University of Chicago Press, Chicago, pp. 1-38; DiMaggio PJ, Powell WW (1991b). “The Iron Cage Revisited: Institutional Isomorphism and Collective Rationality in Organizational Fields”, Powell, W. W. and DiMaggio, P. J. (Eds) The New Institutionalism in Organizational Analysis, The University of Chicago Press, Chicago, pp. 63-82; Englund H, Gerdin J (2008). Transferring knowledge across sub-genres of the ABC implementation literature, Management Accounting Research, 19: 149-162; Fligstein N (1991). “The Structural Transformation of American Industry: An Institutional Account of the Causes of Diversification in the Largest Firms, 1919-1979”, Powell, W. W. and DiMaggio, P. J. (Eds) The New Institutionalism in Organizational Analysis, The University of Chicago Press, Chicago, pp. 311-336; Friedman AL, Lyne SR (1995). Activity Based Techniques: The Real Life Consequences, CIMA, London; Friedman AL, Lyne SR (1999). Success and Failure of Activity-Based Techniques: A Long Term Perspective, CIMA, London; Galaskiewicz J (1991). “Making Corporate Actors Accountable: Institution-Building in Minneapolis-St. Paul”, Powell, W. W. and DiMaggio, P. J. (Eds) The New Institutionalism in Organizational Analysis, The University of Chicago Press, Chicago, pp. 293-310; Gosselin M (1997). “The effect of Strategy and Organisational Structure on the Adoption and Implementation of Activity-Based Costing”, Accounting, Organisations and Society, 22(2): 105-122; Granlund M, Lukka K (1998). “It’s a Small World of Management Accounting Practices”, J. Manag. Account. Res. 10: 153-179; Greenwood R, Oliver C, Sahlin K, Suddaby R (2008). Introduction, Greenwood, R., Oliver, C., Sahlin, K. and Suddaby, R. (Eds) The Sage Handbook of Organizational Institutionalism, Sage Publication, Thousand Oaks, CA, pp. 1-46; Hopper T (1994). “Activity Based Costing: A Critical Commentary”, Fukuoka University Review of Commercial Sciences, 39(1-2): 135136, 479-511; Hopper T, Major M (2007). Extending institutional analysis through theoretical triangulation: regulation and activity-based costing in Portuguese telecommunications. European Accounting Review, 16(1): 59-97; Innes J, Mitchell F, Sinclair D (2000). “Activity-Based Costing in the UK’s Largest Companies: A Comparison of 1994 and 1999 Survey Results”, Management Accounting Research, Vol. 11: 349-362; Johnson HT, Kaplan RS (1991). Relevance Lost: The Rise and Fall of Management Accounting, 2nd ed., Harvard Business School Press, Boston; Jones TC, Dugdale D (2002). The ABC bandwagon and the juggernaut of modernity, Accounting, Organizations and Society, 27: 121-163. Lukka, L. and Granlund, M. (2002) The fragmented communication structure within the accounting academia: the case of activity-based costing research genres, Accounting, Organizations and Society, 27(1/2): 165-190; Major M, Hopper T (2005). Managers divided: Implementing ABC in a Portuguese telecommunications company, Management Accounting Research, 16: 205-229; Malmi T (1997). “Towards Explaining Activity-Based Costing Failure: Accounting and Control in a Decentralized Organisation”, Manag. Account. Res. Vol. 8, pp. 459-480; Meyer JW, Rowan B (1991). “Institutionalised Organisations: Formal Structures as Myth and Ceremony”, Powell, W. W. and DiMaggio, P. J. (Eds) The New Institutionalism in Organizational Analysis, The University of Chicago Press, Chicago, pp. 41-62; Miller JG, Vollmann TE (1985). “The Hidden Factory”, Harvard Business Review, September-October, pp. 142-150; Miller P (1994). “Accounting as Social and Institutional Practice: an Introduction”, Hopwood, A. G. and Miller, P. (Eds) Accounting as Social and Institutional Practice, Cambridge University Press; Moll J, Burns J, Major M (2006). Institutional Theory, Hoque, Z. (Ed.) Methodological Issues in Accounting Research: Theories and Methods, Spiramus, London, pp. 183-205; Noreen E (1991). “Conditions Under Which Activity-Based Cost Systems Provide Relevant Costs”, J. Manag. Account. Res. Volume Three, Fall, pp. 159-168; Roberts J, Scapens R (1985) “Accounting Systems and Systems of Accountability – Understanding Accounting Practices in their Organisational Contexts”, Accounting, Organisations and Society, 10(4): 443-456; Ryan B, Scapens RW, Theobald M (2002) Research Method and Methodology in Finance and Accounting, Thomson, London; Scapens RW (1994) “Never Mind the Gap: Towards an Institutional Perspective on Management Accounting Practice”, Management Accounting Research, Vol. 5, pp. 301-321; Scott WR (1991). “Unpacking Institutional Arguments”, Powell, W. W. and DiMaggio, P. J. (Eds) The New Institutionalism in Organizational Analysis, The University of Chicago Press, Chicago, pp. 164-182; Scott WR (2008). Institutions and Organizations. 3rd Edition, Sage Publications, Thousand Oaks, CA. Scott WR, Meyer JW (1991). “The Organization of Societal Sectors: Propositions and Early Evidence”, Powell, W. W. and DiMaggio, P. J. (Eds) The New Institutionalism in Organizational Analysis, The University of Chicago Press, Chicago, pp. 108-140; Shields MD (1995). “An Empirical Analysis of Firms’ Implementation Experiences with Activity-Based Costing”, Journal of Management Accounting Research, Fall, pp. 148-165; Shields MD, Young SM (1989). “A Behavioral Model for Implementing Cost Management Systems”, J. Cost Manag. Winter, pp. 17-27; Soin K, Seal W, Cullen J (2002). ABC and organizational change: an institutional perspective, Management Accounting Research, Vol.13(2), pp. 249-271; Staubus G (1971). Activity Costing and Input-Output Accounting, Richard D. Irwin Inc.; Wickramasinghe D, Alawattage C (2007). Management Accounting Change: Approaches and Perspectives, Routledge, Oxon; Yin RK (2009). Case Study Research: Design and Methods, 4th edition, Sage Publications, Thousand Oaks, CA; 59 sur 59